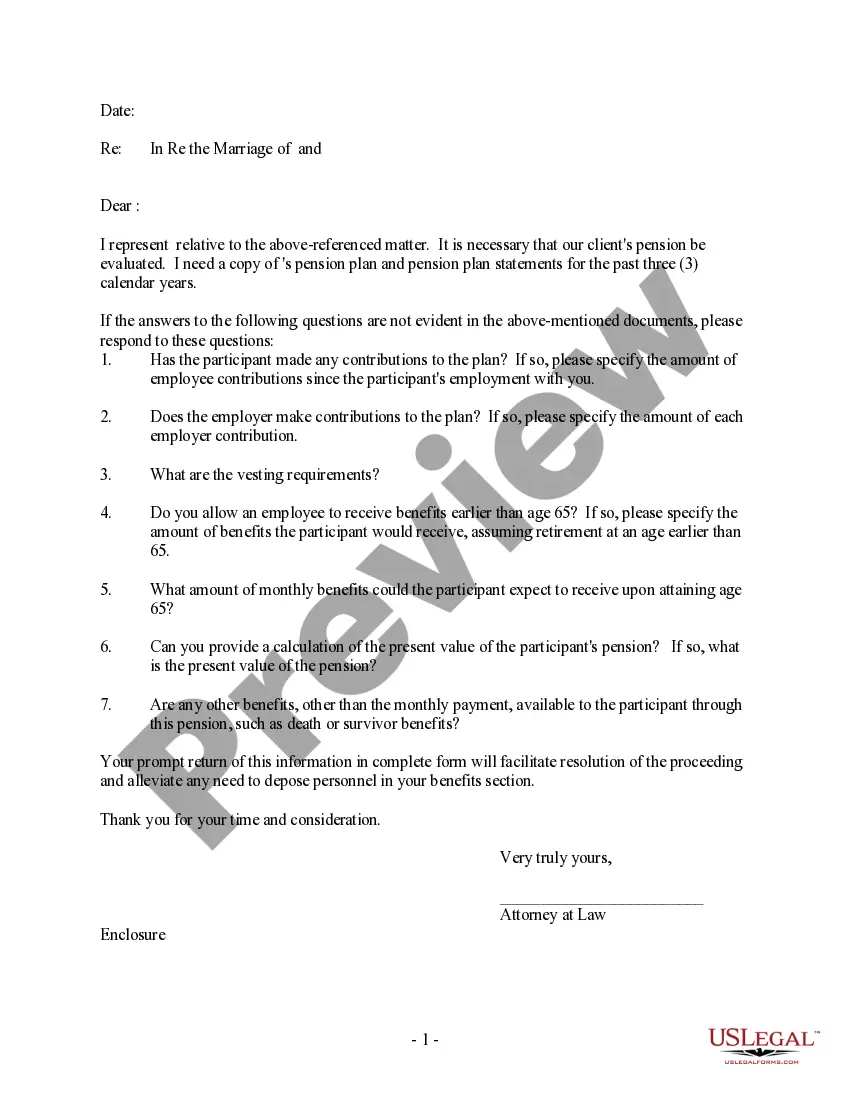

Title: Hennepin Minnesota Letter Requesting Client Pension Plan Account Statements: A Comprehensive Guide Introduction: In Hennepin, Minnesota, individuals looking to access their pension plan account statements can do so by following a straightforward process. This article aims to provide a detailed description of the steps involved in requesting and obtaining client pension plan account statements, along with relevant keywords that are vital to this process. 1. Understanding the Importance of Client Pension Plan Account Statements: Client pension plan account statements play a crucial role in facilitating retirement planning and financial management. These statements provide clients with vital information such as investment performance, contribution history, plan details, and projected retirement benefits. 2. Steps to Request Client Pension Plan Account Statements: To obtain the necessary pension plan account statements, clients in Hennepin, Minnesota should follow these steps: a. Drafting the Letter: — Begin the letter by addressing the appropriate pension plan administrator or company responsible for managing the client's retirement account. Examples include private financial institutions, pension funds, or government bodies. — State the purpose of the letter clearly: requesting client pension plan account statements. — Provide the necessary personal information, including the client's full name, contact details, Social Security number, and account number. b. Key Information and Statement Types: — Mention the specific type of pension plan account statements required. Common statement types include annual statements, quarterly statements, periodic performance reports, or benefit projections. — If there are different types of pension plans the client is enrolled in, specify them individually and request separate statements for each plan. c. Detailed Statement Information: — Ask for specific details to be included in the pension plan account statements, such as investment holdings, transaction history, fees, fund performance, contributions made, and employer/employee match information. — If additional information is needed, such as details on loans, withdrawals, or other plan-specific information, clearly state the requirements. d. Reason for Request: — Provide a brief explanation or justification for the request, such as retirement planning, tax purposes, investment analysis, or reviewing account accuracy. — If the client requires special accommodations due to a disability or language preference, specify the necessary arrangements. e. Contact and Delivery Details: — Clearly state the preferred method of notification (mail, email) and the desired format of the statements (digital, hard copy). — Include the current residential or email address for mailing or electronic delivery. — Provide an updated phone number for contact, if necessary. Conclusion: By following these steps and ensuring the inclusion of vital information, clients in Hennepin, Minnesota can successfully request their pension plan account statements. Regularly reviewing these statements is essential for effective retirement planning and financial management. Stay proactive and stay informed! Keywords: Hennepin, Minnesota, letter, requesting, client, pension plan, account statements, annual statements, quarterly statements, periodic performance reports, benefit projections, investment holdings, transaction history, fees, fund performance, contributions, employer, employee match, retirement planning, tax purposes, investment analysis, contact details, delivery details.

Hennepin Minnesota Letter Requesting Client Pension Plan Account Statements

Description

How to fill out Hennepin Minnesota Letter Requesting Client Pension Plan Account Statements?

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for attorney solutions that, as a rule, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Hennepin Minnesota Letter Requesting Client Pension Plan Account Statements or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Hennepin Minnesota Letter Requesting Client Pension Plan Account Statements adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Hennepin Minnesota Letter Requesting Client Pension Plan Account Statements is proper for your case, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!