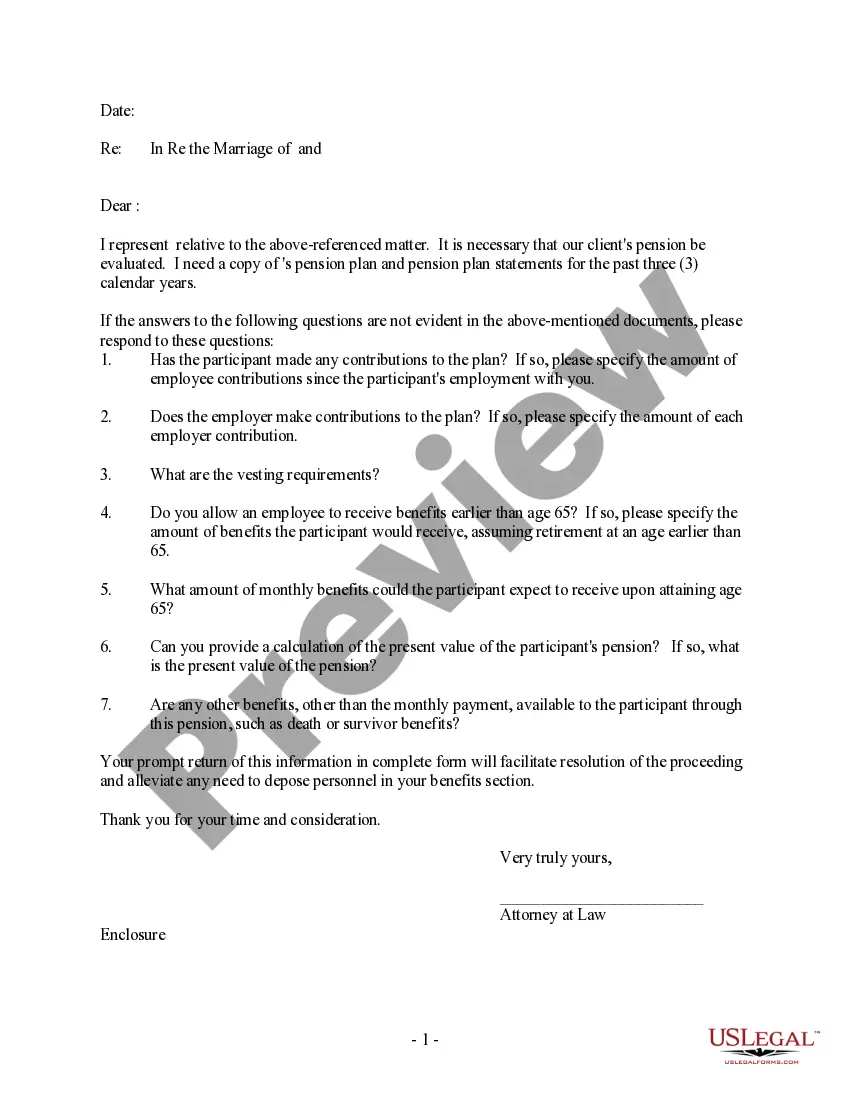

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Client Name] [Client Address] [City, State, ZIP] Subject: Request for Saint Paul Minnesota Letter Requesting Client Pension Plan Account Statements Dear [Client Name], I hope this letter finds you in good health and high spirits. I am writing to request the account statements for your pension plan held with [Name of the Pension Plan Provider]. As your trusted financial advisor, it is essential that we regularly review your pension plan to ensure its alignment with your financial goals. To accurately assess the performance and growth of your pension plan, it is crucial to obtain the most recent account statements. This information allows us to analyze the progress of your investments, evaluate your asset allocation, and make informed decisions regarding the management of your pension plan. Considering the importance of these statements, I kindly request you to provide the following account statements for the mentioned pension plan: 1. Statement of Account: This document provides an overview of your account's holdings and transactions during a specific reporting period. It includes details such as opening and closing balances, contributions made, withdrawals, dividends earned, and any associated fees or charges. 2. Performance Summary: This report summarizes the performance of your pension plan over a given period. It presents information on investment returns, benchmark comparisons, and growth indicators, enabling us to gauge the overall profitability of your portfolio. 3. Asset Allocation Report: This statement illustrates the distribution of your pension plan investments across various asset classes, such as stocks, bonds, and cash equivalents. It helps us assess the diversification of your portfolio and make necessary adjustments to optimize its risk and return profile. Additionally, please include any other relevant documents such as quarterly or annual reports, policy updates, or plan amendments to ensure a comprehensive review of your pension plan. Kindly send these requested statements in either hard copy format via mail to my office address mentioned above or electronically to my email address provided. If you have any questions or require assistance in gathering these statements, please feel free to contact me at [Your Phone Number] or via email at [Your Email Address]. Ensuring the accuracy and completeness of your pension plan account statements aids us in providing you with the highest level of financial advice and guidance. Your prompt attention to this matter is greatly appreciated. Thank you for your cooperation in this regard. Yours sincerely, [Your Name] [Your Designation] [Your Company Name] [Your Company Address] [City, State, ZIP]

Saint Paul Minnesota Letter Requesting Client Pension Plan Account Statements

Description

How to fill out Saint Paul Minnesota Letter Requesting Client Pension Plan Account Statements?

We always want to reduce or avoid legal issues when dealing with nuanced law-related or financial matters. To do so, we apply for attorney services that, as a rule, are very costly. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to legal counsel. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Saint Paul Minnesota Letter Requesting Client Pension Plan Account Statements or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Saint Paul Minnesota Letter Requesting Client Pension Plan Account Statements adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Saint Paul Minnesota Letter Requesting Client Pension Plan Account Statements would work for you, you can select the subscription plan and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!