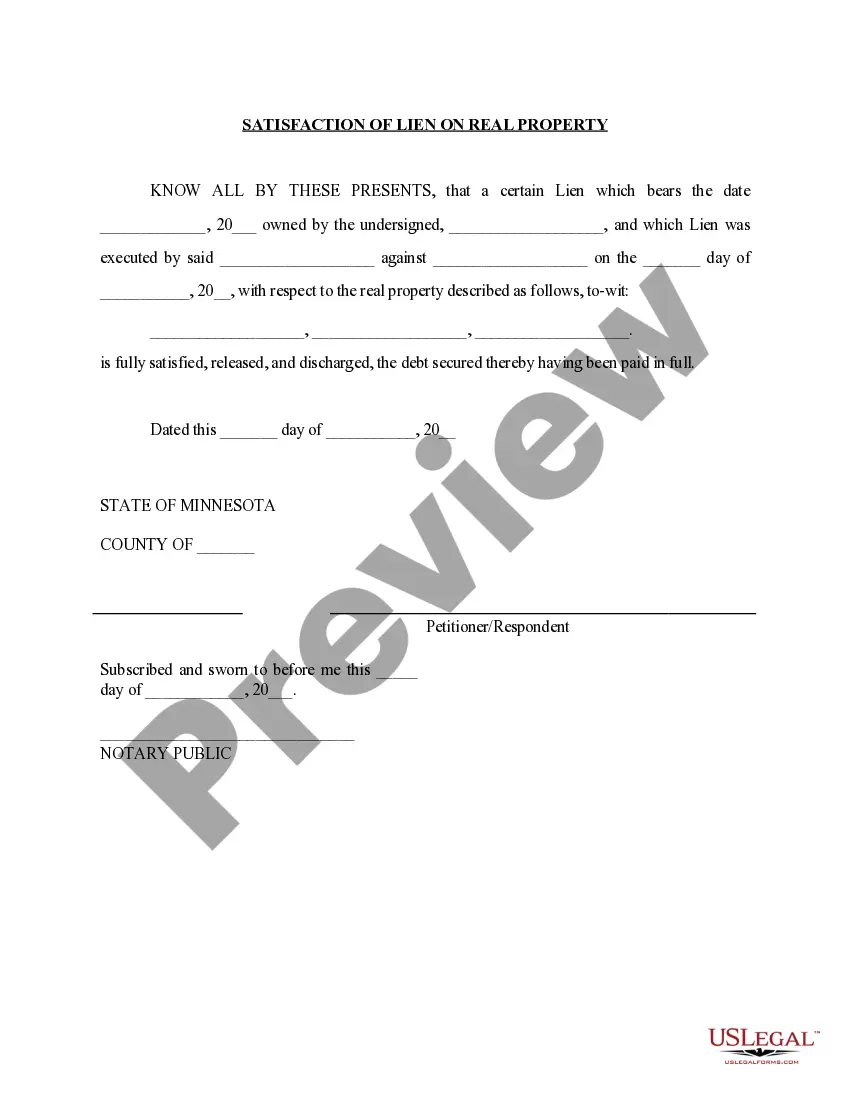

Saint Paul, Minnesota Satisfaction of Lien on Real Property is a legal process that allows for the removal of a lien on a property once the lien has been satisfied. A lien is a legal claim or right against a property owner's assets, usually used as security for the settlement of a debt. When a debt is fully paid, the lien holder must provide a satisfaction of lien to acknowledge that the debt has been fulfilled. In Saint Paul, Minnesota, this satisfaction of lien is an important document that ensures a clean title for the property. The Satisfaction of Lien on Real Property in Saint Paul, Minnesota is crucial for both the property owner and the lien holder. By obtaining this document, property owners can ensure that all liens associated with their property have been released, preventing any encumbrances or disputes over ownership. On the other hand, lien holders can protect their interests by using the satisfaction of lien as evidence that the debt has been settled and that they no longer have any rights or claims on the property. In Saint Paul, Minnesota, there are different types of Satisfaction of Lien on Real Property, including: 1. Mortgage Lien Satisfaction: This type of satisfaction of lien is issued by the mortgage lender once the homeowner has completely paid off their mortgage debt. It releases the lien on the property and confirms that the mortgage has been satisfied. 2. Mechanics Lien Satisfaction: This satisfaction of lien is commonly used in the construction industry. Contractors, subcontractors, or suppliers can file a mechanics lien against a property if they are not paid for their work or materials used. A mechanics lien satisfaction is obtained when the debt is paid off, allowing for the release of the lien on the property. 3. Judgment Lien Satisfaction: If a creditor successfully obtains a judgment against a property owner, they can file a judgment lien. Once the judgment debt is paid, the creditor issues a satisfaction of lien, releasing the lien on the property. 4. Tax Lien Satisfaction: When property owners fail to pay their property taxes, the local government can place a tax lien on the property. After the tax debt is cleared, the government issues a satisfaction of lien, removing the encumbrance from the property. It is important to note that the specific requirements and procedures for obtaining a Satisfaction of Lien on Real Property in Saint Paul, Minnesota may vary depending on the type of lien. Property owners seeking to obtain this document should consult with a qualified attorney or contact the appropriate government agency to ensure compliance with all legal requirements. In conclusion, the Saint Paul, Minnesota Satisfaction of Lien on Real Property is a vital document that allows property owners to clear any outstanding liens on their property. Different types of liens, such as mortgage liens, mechanics liens, judgment liens, and tax liens, require specific satisfaction procedures. By obtaining the appropriate satisfaction of lien, property owners can ensure a clean title and protect their property rights.

Saint Paul Minnesota Satisfaction of Lien on Real Property

Description

How to fill out Saint Paul Minnesota Satisfaction Of Lien On Real Property?

If you are searching for a valid form template, it’s difficult to find a better platform than the US Legal Forms site – one of the most extensive libraries on the internet. Here you can get a huge number of form samples for organization and personal purposes by types and states, or keywords. Using our advanced search feature, finding the latest Saint Paul Minnesota Satisfaction of Lien on Real Property is as easy as 1-2-3. Moreover, the relevance of each and every document is verified by a team of expert lawyers that regularly review the templates on our platform and update them in accordance with the most recent state and county regulations.

If you already know about our platform and have an account, all you should do to get the Saint Paul Minnesota Satisfaction of Lien on Real Property is to log in to your user profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have opened the sample you require. Check its description and utilize the Preview option (if available) to see its content. If it doesn’t meet your needs, use the Search option near the top of the screen to discover the needed record.

- Confirm your choice. Click the Buy now button. Next, pick the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the form. Choose the file format and download it on your device.

- Make modifications. Fill out, modify, print, and sign the received Saint Paul Minnesota Satisfaction of Lien on Real Property.

Each and every form you add to your user profile does not have an expiry date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you need to have an extra version for modifying or printing, you can return and export it once again anytime.

Make use of the US Legal Forms extensive catalogue to get access to the Saint Paul Minnesota Satisfaction of Lien on Real Property you were seeking and a huge number of other professional and state-specific templates on one website!