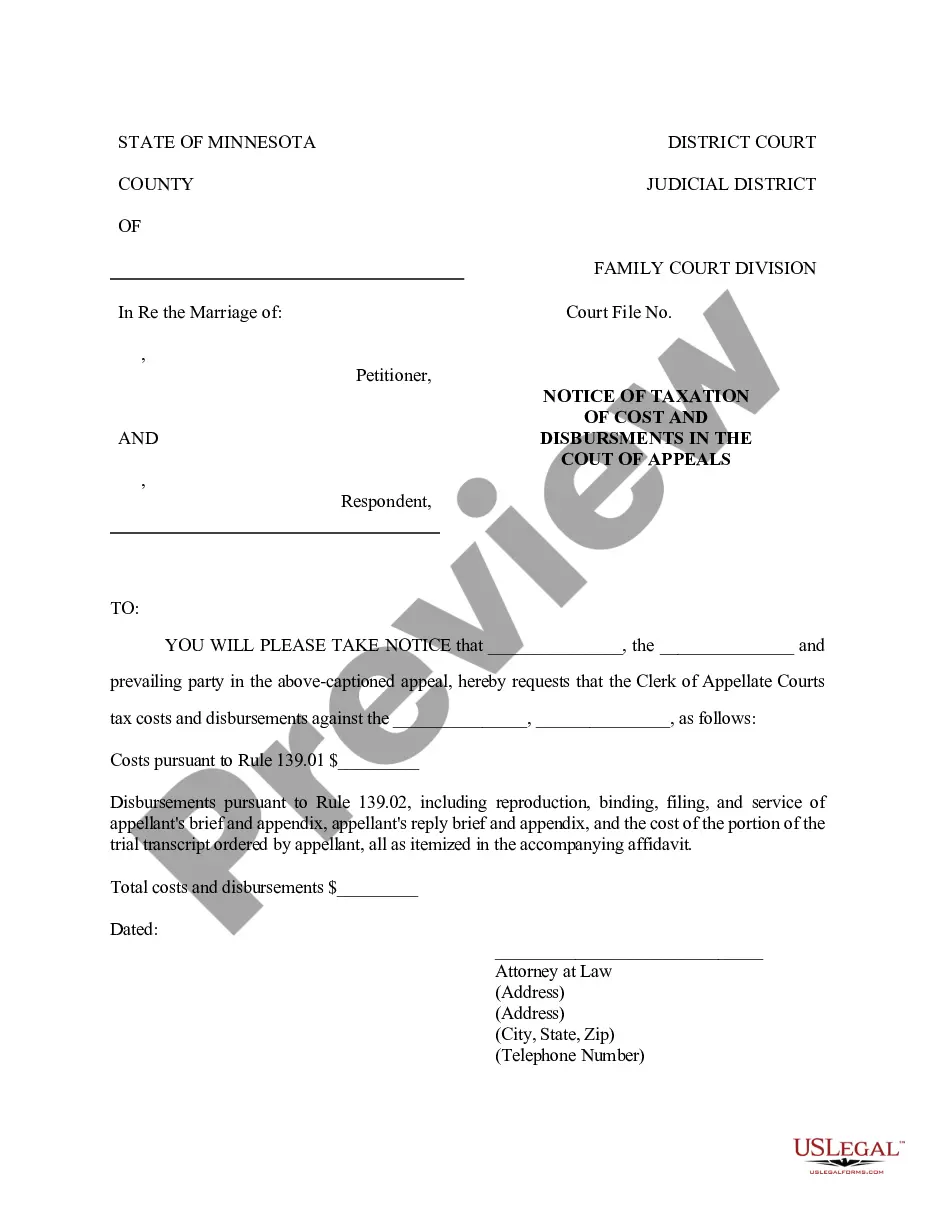

Title: Understanding the Minneapolis Minnesota Notice of Taxation of Costs and Disbursements on Appeal Description: The Minneapolis Minnesota Notice of Taxation of Costs and Disbursements on Appeal is a legal document that outlines the assessment of various costs and expenses associated with an appeal process in the city of Minneapolis, Minnesota. This detailed description aims to provide an overview of the notice and its significance when appealing a case. Keywords: — Minneapolis Minnesota Notice of Taxation of Costs and Disbursements on Appeal — tax assessment on appeal in Minneapolis — appeal costs and disbursements in Minnesota — legal expenses on appeal in Minneapolis — understanding appeal expenses in Minnesota Types of Minneapolis Minnesota Notices of Taxation of Costs and Disbursements on Appeal: 1. General Notice of Taxation of Costs and Disbursements on Appeal: This notice is issued by the concerned court in Minneapolis, Minnesota, following the completion of an appeal process. It includes a comprehensive breakdown of various expenses and costs incurred during the appeal, such as filing fees, transcript costs, attorney fees, and other related expenses. 2. Detailed Itemization of Costs and Disbursements on Appeal: In some cases, a more detailed breakdown of the costs and disbursements on appeal may be provided. This notice offers an itemized list of specific expenses and their corresponding amounts, allowing the appellant to review and potentially challenge any discrepancies. 3. Notice of Taxation of Costs and Disbursements on Successful Appeal: If the appeal is successful, this notice outlines the costs and disbursements that the appellant is entitled to recover from the opposing party. As per Minnesota law, the prevailing party is generally eligible to recover some or all of the incurred expenses. 4. Notice of Objection to Taxation of Costs and Disbursements on Appeal: In certain scenarios, a party may file an objection to the taxation of costs and disbursements on appeal, disputing the reasonableness or necessity of certain expenses. This notice serves as an opportunity for parties to present their arguments and potentially negotiate or seek resolution before any payments are made. Understanding the Minneapolis Minnesota Notice of Taxation of Costs and Disbursements on Appeal is crucial for individuals involved in the appeal process. It helps them comprehend the financial implications associated with their appeal and ensures transparency in the taxation of costs and disbursements. Familiarizing oneself with the notice can assist in making informed decisions and engaging in appropriate discussions with legal representatives or concerned parties.

Minneapolis Minnesota Notice of Taxation of Costs and Disbursements on Appeal

Description

How to fill out Minneapolis Minnesota Notice Of Taxation Of Costs And Disbursements On Appeal?

If you are searching for a valid form, it’s difficult to choose a more convenient platform than the US Legal Forms website – one of the most considerable libraries on the web. With this library, you can find a huge number of form samples for organization and personal purposes by categories and regions, or key phrases. Using our advanced search function, getting the most up-to-date Minneapolis Minnesota Notice of Taxation of Costs and Disbursements on Appeal is as elementary as 1-2-3. In addition, the relevance of each and every document is confirmed by a group of expert attorneys that on a regular basis check the templates on our platform and update them based on the newest state and county demands.

If you already know about our platform and have a registered account, all you should do to get the Minneapolis Minnesota Notice of Taxation of Costs and Disbursements on Appeal is to log in to your account and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have opened the sample you want. Read its explanation and make use of the Preview option (if available) to see its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to get the appropriate document.

- Confirm your choice. Choose the Buy now button. After that, select your preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Get the form. Choose the file format and download it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Minneapolis Minnesota Notice of Taxation of Costs and Disbursements on Appeal.

Each form you save in your account does not have an expiration date and is yours permanently. You can easily access them via the My Forms menu, so if you want to have an additional duplicate for enhancing or printing, feel free to return and save it again anytime.

Make use of the US Legal Forms extensive catalogue to get access to the Minneapolis Minnesota Notice of Taxation of Costs and Disbursements on Appeal you were looking for and a huge number of other professional and state-specific templates in one place!