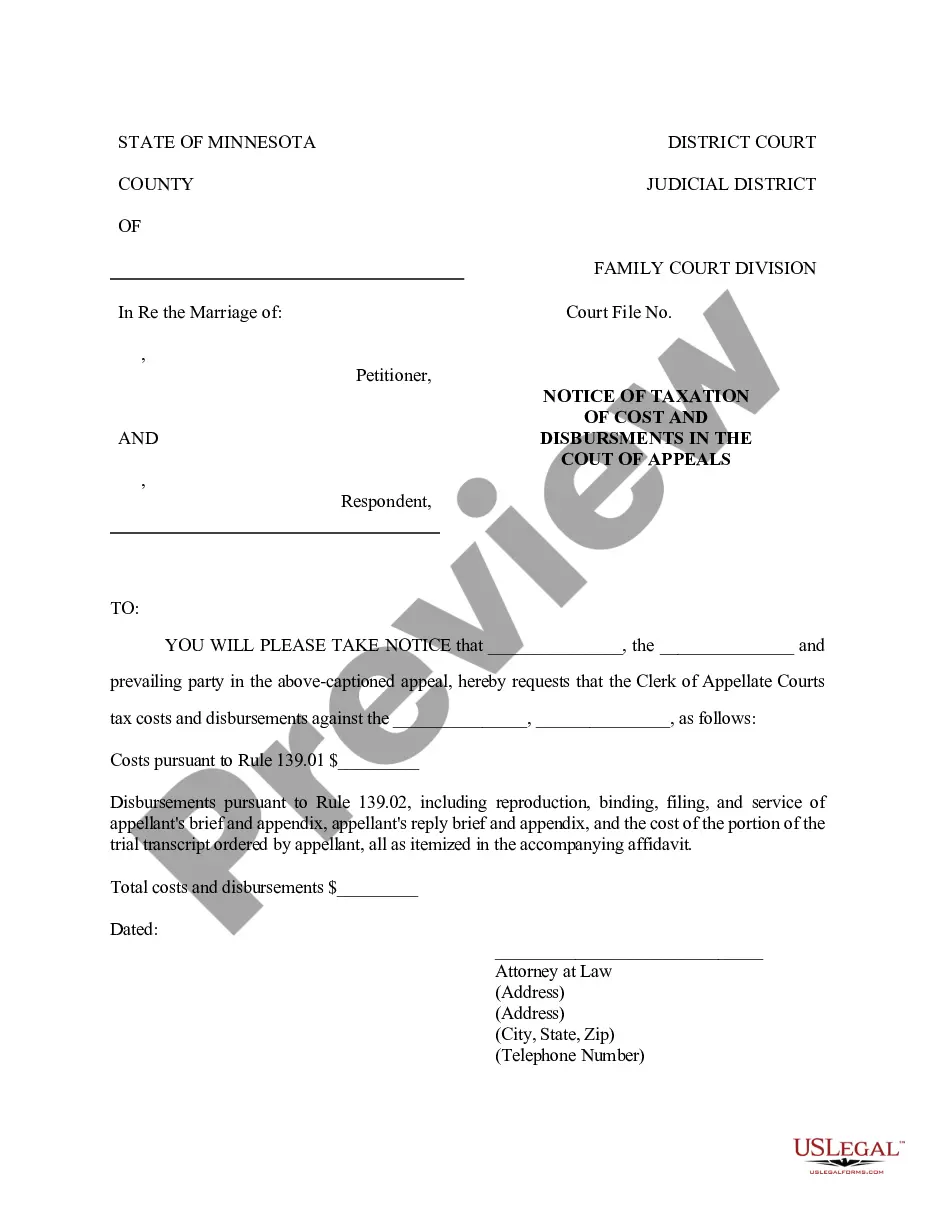

The Saint Paul Minnesota Notice of Taxation of Costs and Disbursements on Appeal is a legal document that outlines the expenses and fees associated with an appeal process in the city of Saint Paul, Minnesota. This notice serves to inform the parties involved in the appeal about the costs they are responsible for and the disbursements that have been claimed. When an appeal is filed in a court, there are several costs and disbursements involved throughout the process. These costs can include filing fees, document copying fees, postage fees, and other expenses that may have been incurred during the appeal. The Notice of Taxation of Costs and Disbursements on Appeal is an important document that strictly defines these costs and ensures transparency in the legal proceedings. In Saint Paul, Minnesota, there may be different types of Notice of Taxation of Costs and Disbursements on Appeal depending on the nature of the case. Some common variations include: 1. Civil Appeals: This type of notice is used for appeals related to civil cases, such as personal injury claims, contract disputes, or property disputes. It outlines the costs and disbursements specific to civil appeals. 2. Criminal Appeals: In instances where a criminal case is being appealed, a separate notice is generated to detail the costs and disbursements associated with criminal appeals. This may include fees related to obtaining transcripts, expert witnesses, or any other necessary expenses for the appeal process. 3. Family Law Appeals: When appeals are made in family law cases, such as divorce or child custody disputes, another category of the Notice of Taxation of Costs and Disbursements on Appeal is implemented. It breaks down the costs and disbursements specifically related to family law appeals. Regardless of the type of appeal, the notice is essential for both the appellant and the opposing party to understand the financial implications of the appeal. It ensures that each party is aware of their obligations and can take appropriate action. In conclusion, the Saint Paul Minnesota Notice of Taxation of Costs and Disbursements on Appeal is a critical document that outlines the expenses and fees involved in the appeal process in the city of Saint Paul, Minnesota. It ensures transparency and clarity regarding the financial aspects of the appeal, and there can be different types of notices depending on the nature of the case, including civil appeals, criminal appeals, and family law appeals.

Saint Paul Minnesota Notice of Taxation of Costs and Disbursements on Appeal

Description

How to fill out Saint Paul Minnesota Notice Of Taxation Of Costs And Disbursements On Appeal?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we apply for attorney solutions that, as a rule, are very costly. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Saint Paul Minnesota Notice of Taxation of Costs and Disbursements on Appeal or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Saint Paul Minnesota Notice of Taxation of Costs and Disbursements on Appeal adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Saint Paul Minnesota Notice of Taxation of Costs and Disbursements on Appeal is proper for you, you can select the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!