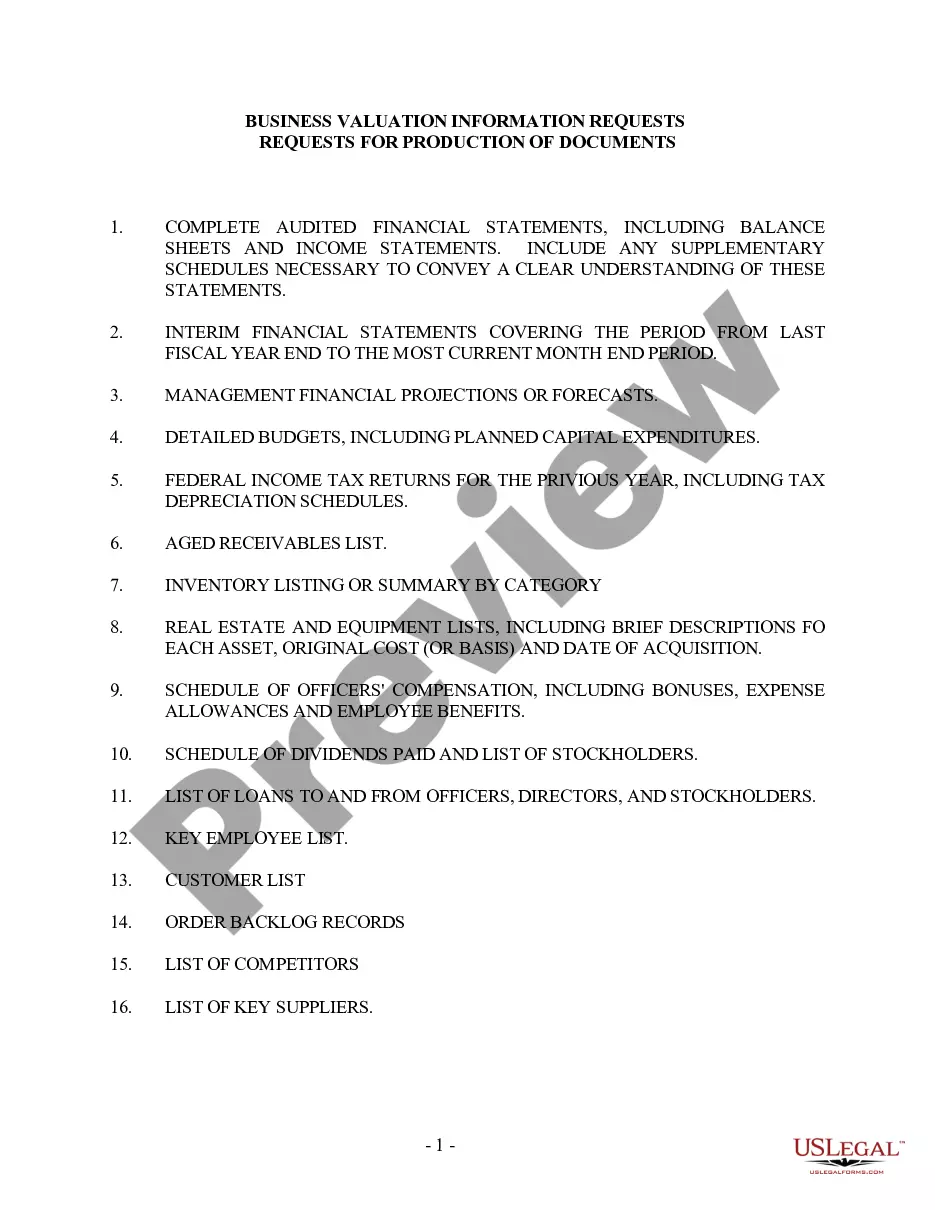

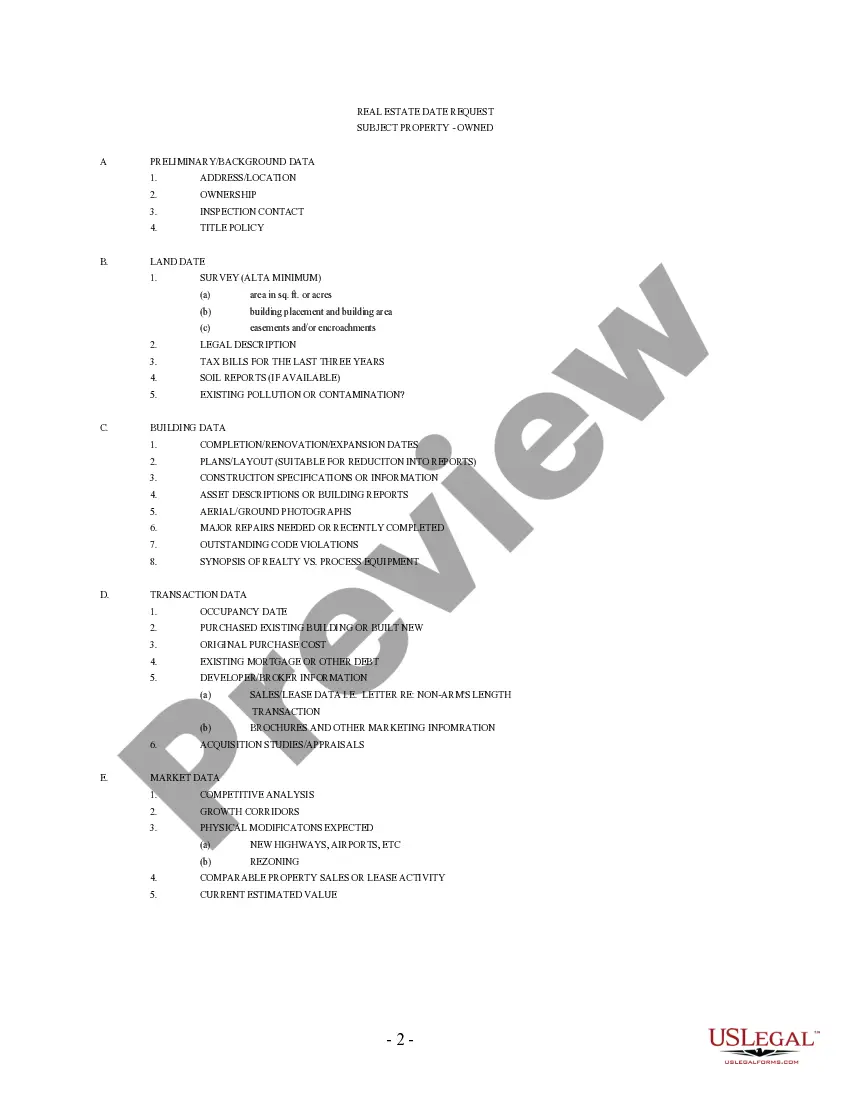

Hennepin Minnesota Discovery — Requests for Business Valuation Information is a process that involves obtaining detailed and accurate information about the valuation of businesses located in Hennepin County, Minnesota. This process is typically initiated by individuals or entities seeking to evaluate the worth of a business for various purposes, such as mergers and acquisitions, tax assessments, litigation, or strategic planning. In Hennepin County, there are several types of discovery requests for business valuation information available, each serving different purposes and requiring specific details to be provided. These types include but are not limited to: 1. Merger and Acquisition Valuation Requests: In these cases, individuals or companies interested in acquiring or merging with a business in Hennepin County request detailed valuation information to assess the fair market value of the target company. This information helps them determine the appropriate purchase price and negotiate the terms of the transaction. 2. Tax Assessment Valuation Requests: Hennepin County authorities may issue requests for business valuation information to ensure accurate property tax assessments. These requests require the business owner to provide comprehensive financial data, including revenue, assets, liabilities, and other relevant information to determine the fair market value for tax purposes. 3. Litigation Valuation Requests: In legal disputes that involve businesses, Hennepin Minnesota Discovery requests for business valuation information can be filed by one party to support or challenge the valuation presented by the opposing party. This type of request often includes a thorough examination of financial statements, market analysis, intellectual property value, and other relevant factors to determine an accurate estimate of the business's worth. 4. Strategic Planning Valuation Requests: Businesses themselves may initiate discovery requests for business valuation information when engaging in strategic planning activities. This information helps them assess their market position, identify potential growth opportunities, and make informed decisions regarding expansion, diversification, or investment in new ventures. Hennepin Minnesota Discovery — Requests for Business Valuation Information typically requires the submission of various financial documents, such as balance sheets, income statements, cash flow statements, tax returns, and any other relevant material that provides insights into the business's financial performance and overall value. Additionally, market research reports, industry analysis, and intellectual property evaluations may be required depending on the specific purpose of the request. It is essential for businesses in Hennepin County to comply with these discovery requests, as accurate business valuation information plays a crucial role in determining fair transactions, tax liabilities, legal outcomes, and strategic decisions. Failure to provide the requested information can result in legal penalties, disputes, or significant setbacks in various aspects of a business's operations.

Hennepin Minnesota Discovery - Requests for Business Valuation Information

Description

How to fill out Hennepin Minnesota Discovery - Requests For Business Valuation Information?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Hennepin Minnesota Discovery - Requests for Business Valuation Information becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Hennepin Minnesota Discovery - Requests for Business Valuation Information takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve chosen the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Hennepin Minnesota Discovery - Requests for Business Valuation Information. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

Federal Rule of Civil Procedure 11 provides that a district court may sanction attorneys or parties who submit pleadings for an improper purpose or that contain frivolous arguments or arguments that have no evidentiary support.

26(b)(4)(B). Therefore, attorney and expert notes in a draft report, in any form, are protected from disclosure. However, depending on the context, additional draft documents and notes prepared by the expert likely are discoverable.

In cases where a party has not propounded pattern interrogatories pursuant to LCR 33, a party may serve no more than 40 interrogatories, including all discrete subparts.

11.01Signature Except when otherwise specifically provided by rule or statute, pleadings need not be verified or accompanied by affidavit. An unsigned document shall be stricken unless omission of the signature is corrected promptly after being called to the attention of the attorney or party.

No party may serve more than a total of 50 interrogatories upon any other party unless permitted to do so by the court upon motion, notice and a showing of good cause.

Parties may obtain discovery regarding any nonprivileged matter that is relevant to any party's claim or defense and proportional to the needs of the case, considering the importance of the issues at stake in the action, the amount in controversy, the parties' relative access to relevant information, the parties'

Unless otherwise specified in the preliminary conference order, only 25 interrogatories may be served in any action, including consolidated actions.

Rule 11 does apply to search warrants and related documents filed by parties in a case. If any person filing a medical record in a civil commitment case fails to designate the medical record as non-public upon filing, the court administrator shall not reject the filing due to the failure to do so.