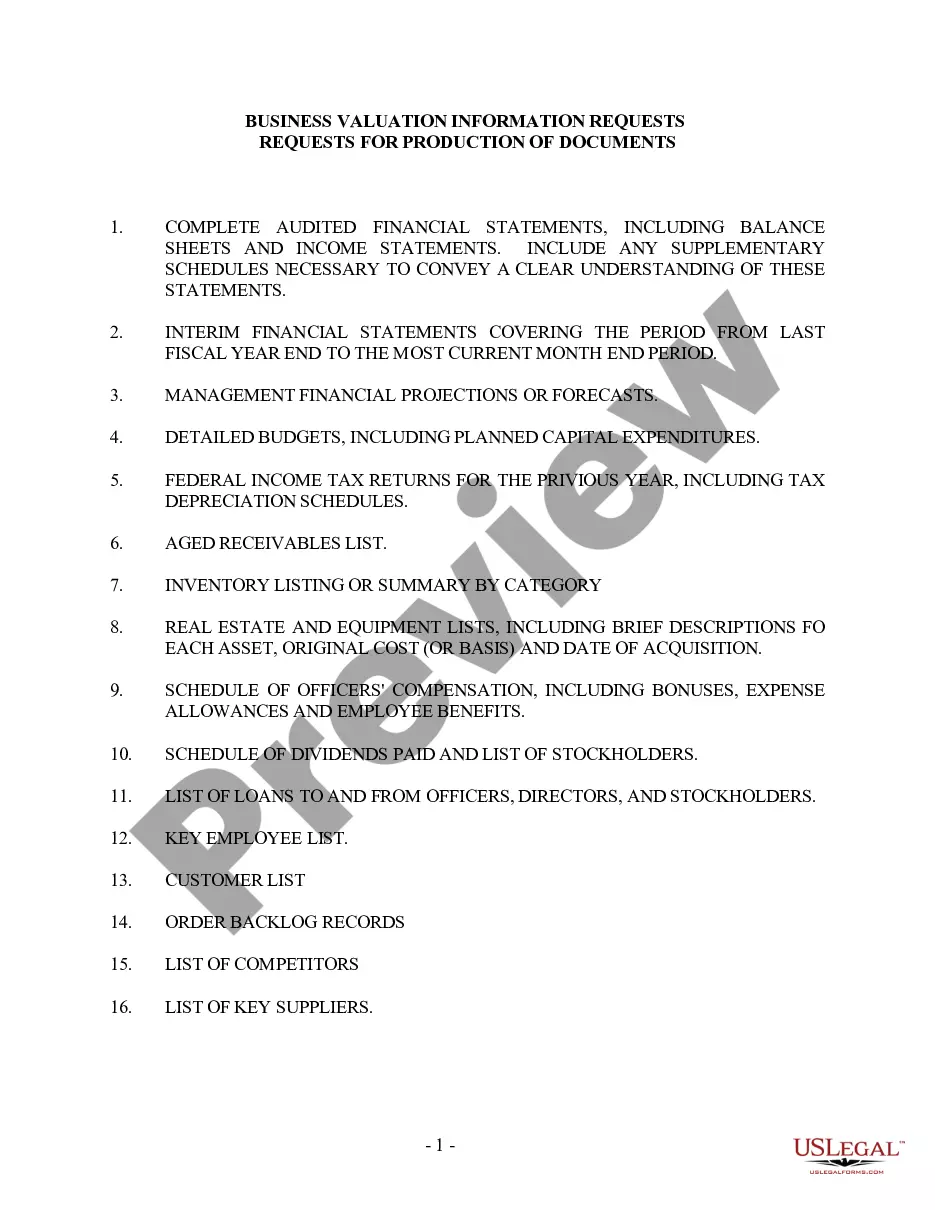

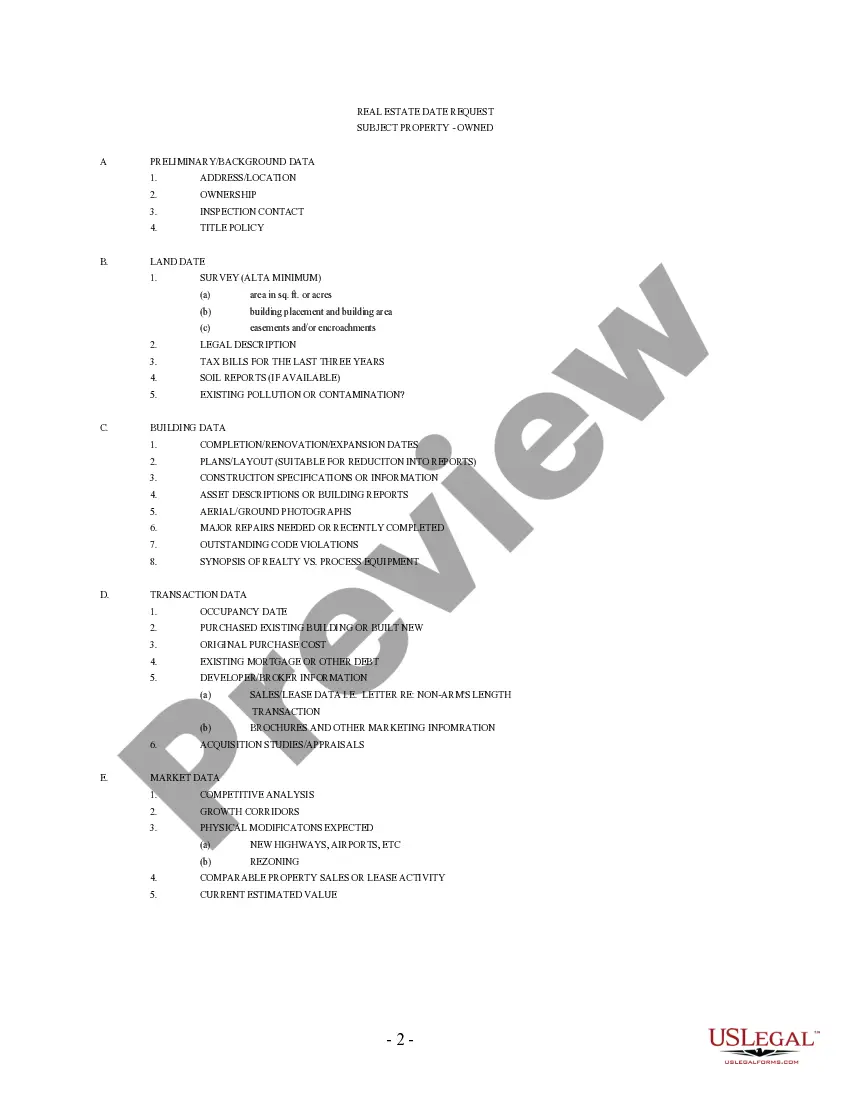

Minneapolis Minnesota Discovery — Requests for Business Valuation Information: A Comprehensive Guide Minneapolis, Minnesota is a bustling city that serves as a hub for various industries and businesses. If you are a business owner or investor in the Minneapolis area, it is crucial to have accurate and up-to-date information regarding the valuation of businesses in the region. This detailed description aims to provide valuable insights into Minneapolis Minnesota Discovery — Requests for Business Valuation Information, outlining its importance, processes involved, and different types. What is Minneapolis Minnesota Discovery — Requests for Business Valuation Information? Minneapolis Minnesota Discovery — Requests for Business Valuation Information refers to the process of obtaining detailed data and analysis on the value of businesses operating within the Minneapolis, Minnesota area. This information is crucial for a wide range of purposes, such as buying or selling a business, raising capital, mergers and acquisitions, tax planning, financial reporting, and litigation support. Importance of Minneapolis Minnesota Discovery — Requests for Business Valuation Information: Accurate business valuation information is essential for making informed decisions. Whether you are an investor looking to evaluate the worth of a potential investment or a business owner planning an exit strategy, understanding the true value of a business is crucial. Minneapolis Minnesota Discovery provides the necessary framework to gather and evaluate the relevant information needed for business valuations accurately. Processes Involved in Minneapolis Minnesota Discovery — Requests for Business Valuation Information: 1. Gathering Information: The discovery process begins with amassing a comprehensive set of data about the business under evaluation. This includes financial statements, tax returns, market analysis, industry trends, competitor analysis, customer base, and potential risks. 2. Analyzing Financials: Once the necessary information is collected, financial statements are carefully reviewed, and financial ratios are computed to assess profitability, liquidity, and solvency. This step also involves evaluating revenue streams, capital structure, overhead expenses, and potential future earnings. 3. Assessing Market Factors: Market analysis plays a crucial role in business valuations. This includes examining the target market, competition, customer preferences, economic indicators, and other external factors that may impact the business's value. 4. Applying Valuation Approaches: Multiple valuation approaches are utilized to ensure the accuracy and reliability of the business valuation. These approaches may include the income approach, market approach, and asset-based approach. Each approach provides a different perspective on the business's value and helps establish a fair and reasonable valuation range. Different Types of Minneapolis Minnesota Discovery — Requests for Business Valuation Information: 1. Buy-Sell Agreement Valuations: These valuations are conducted when business owners are planning to sell their shares or buy out other shareholders. The valuation ensures a fair transaction and protects the interests of all parties involved. 2. Estate Planning Valuations: Estate planning often involves determining the value of a business for tax purposes and inheritance planning. Accurate business valuations aid in making informed decisions regarding asset distribution, taxes, and succession planning. 3. Litigation Support Valuations: In legal disputes such as divorce settlements, partnership disputes, or shareholder conflicts, business valuations play a critical role. Accurate valuations provide a basis for negotiation and court proceedings, ensuring a fair resolution. In conclusion, Minneapolis Minnesota Discovery — Requests for Business Valuation Information is a vital process for businesses and investors in the Minneapolis area. It involves gathering, analyzing, and applying various methods to determine the true value of a business. Whether for strategic planning, financial reporting, or legal purposes, accurate business valuations are indispensable. By understanding the processes involved and the different types of valuations available, businesses and investors can make informed decisions and navigate the Minneapolis business landscape with confidence.

Minneapolis Minnesota Discovery - Requests for Business Valuation Information

Description

How to fill out Minneapolis Minnesota Discovery - Requests For Business Valuation Information?

We always want to minimize or prevent legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for legal services that, usually, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of a lawyer. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Minneapolis Minnesota Discovery - Requests for Business Valuation Information or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Minneapolis Minnesota Discovery - Requests for Business Valuation Information complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Minneapolis Minnesota Discovery - Requests for Business Valuation Information would work for you, you can choose the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!