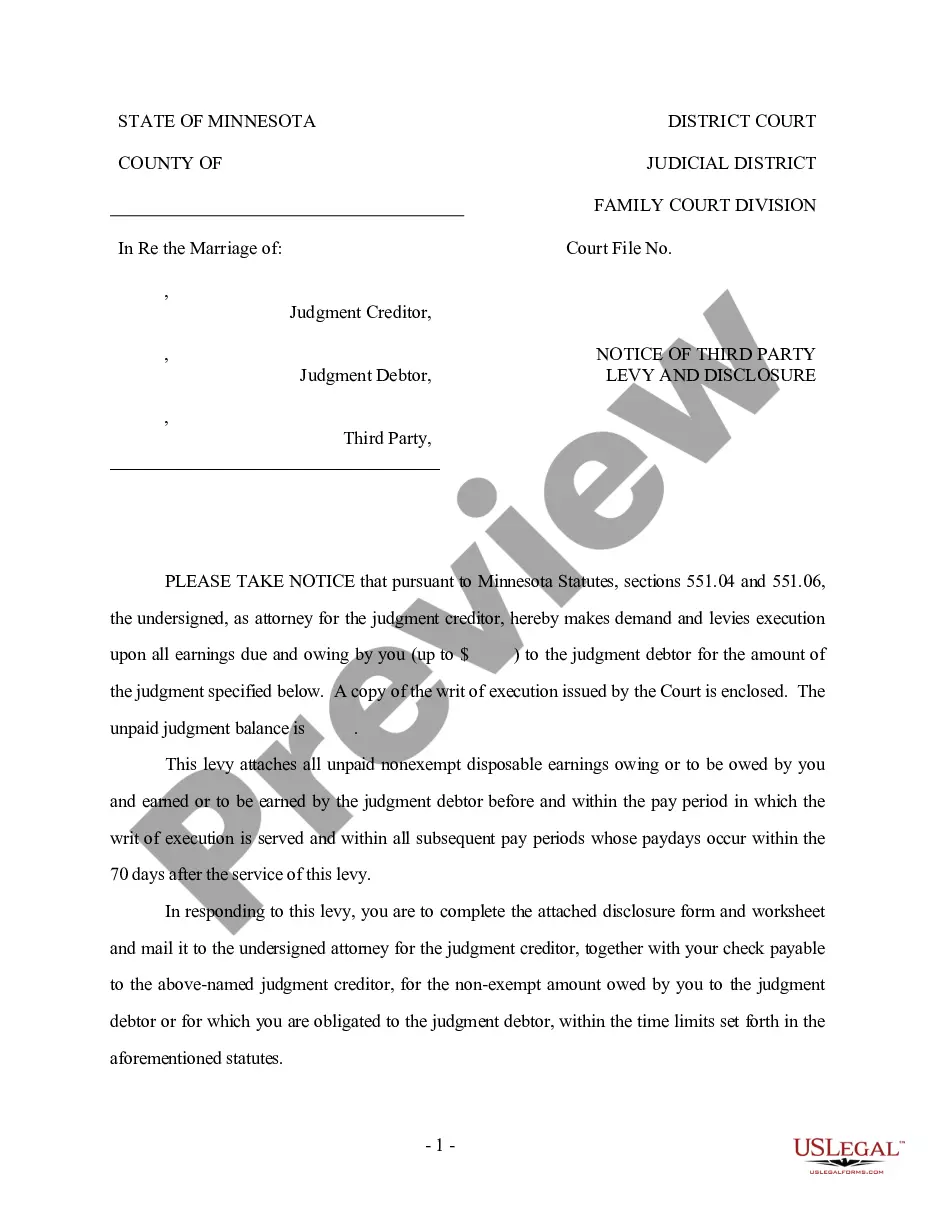

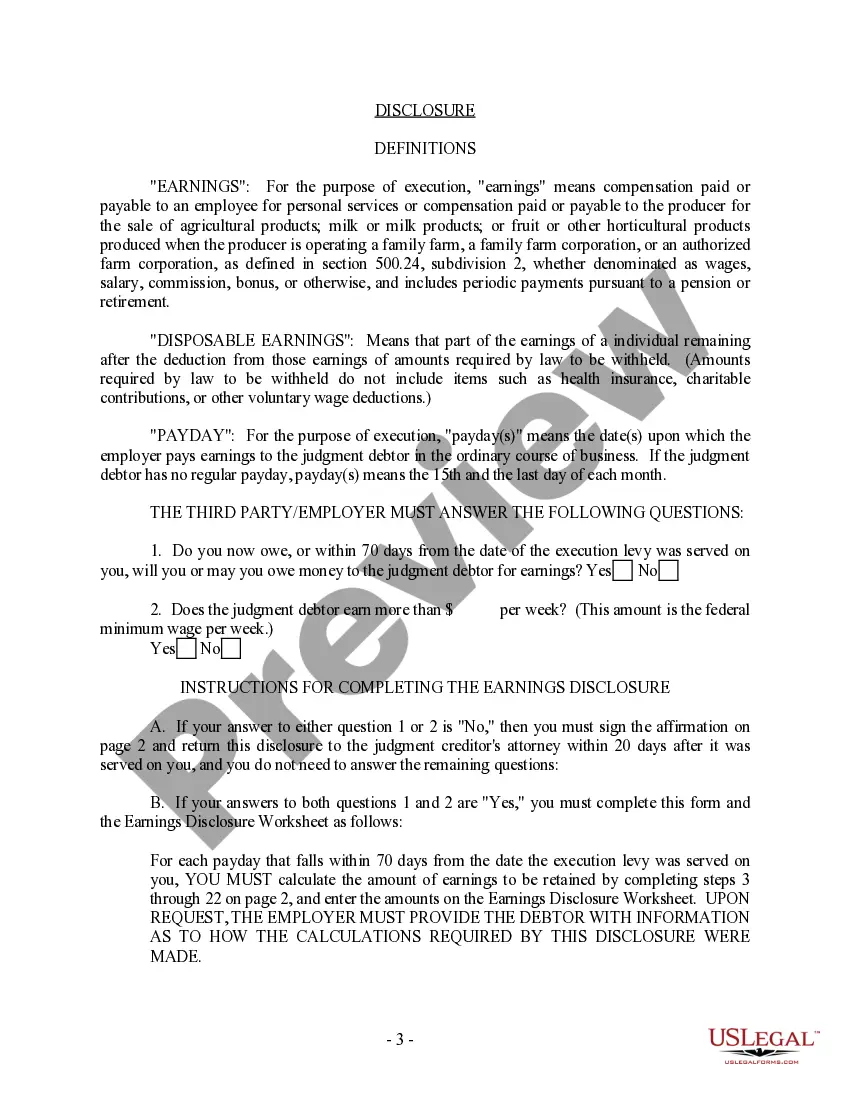

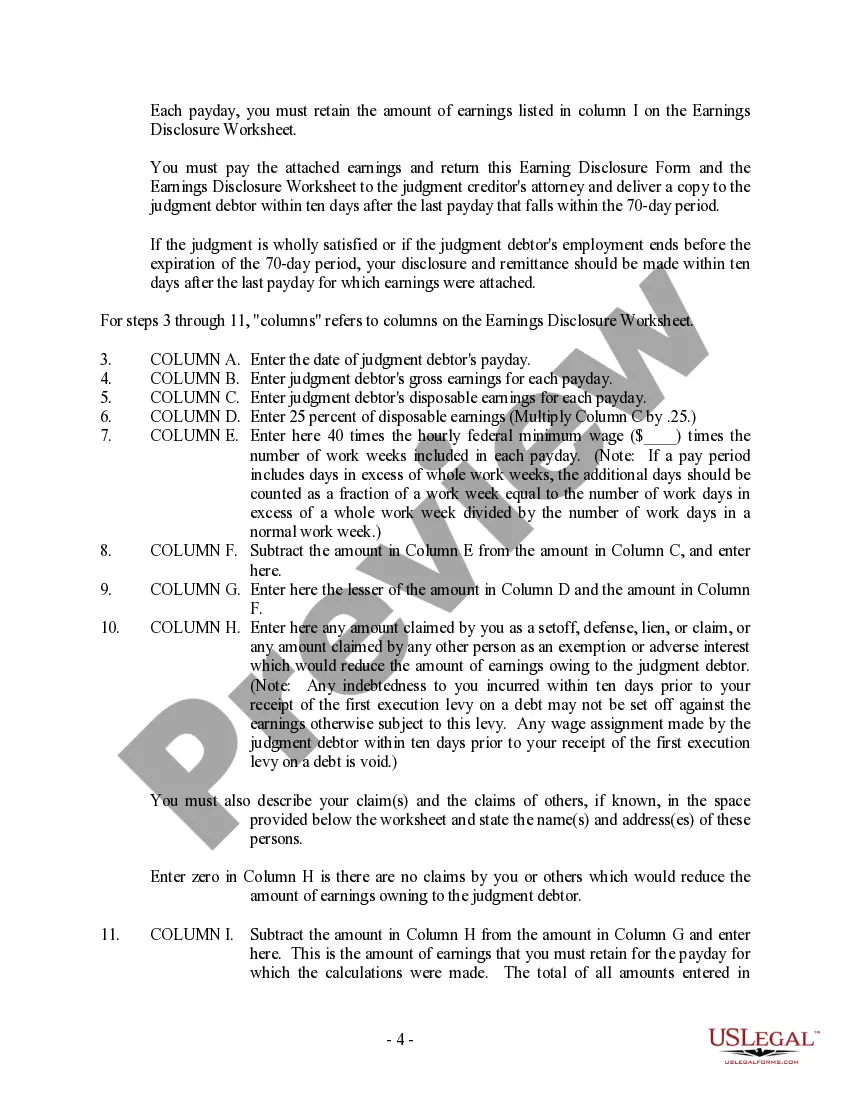

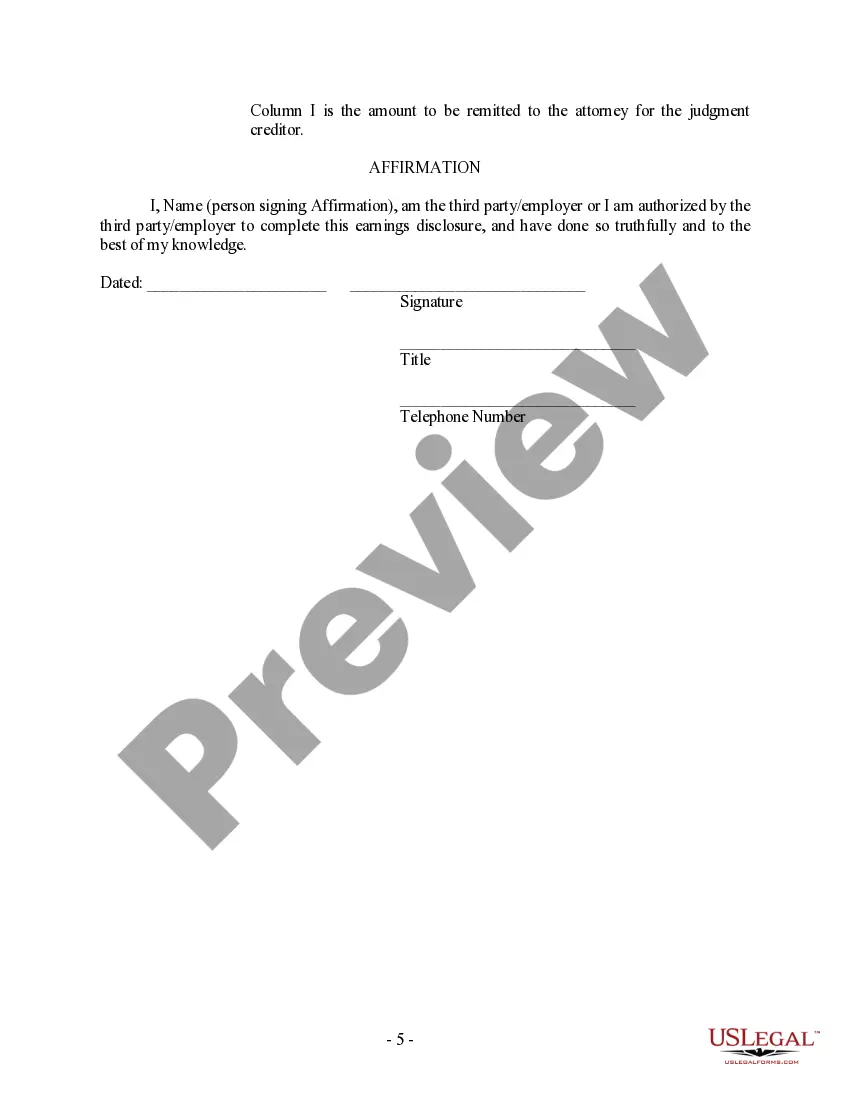

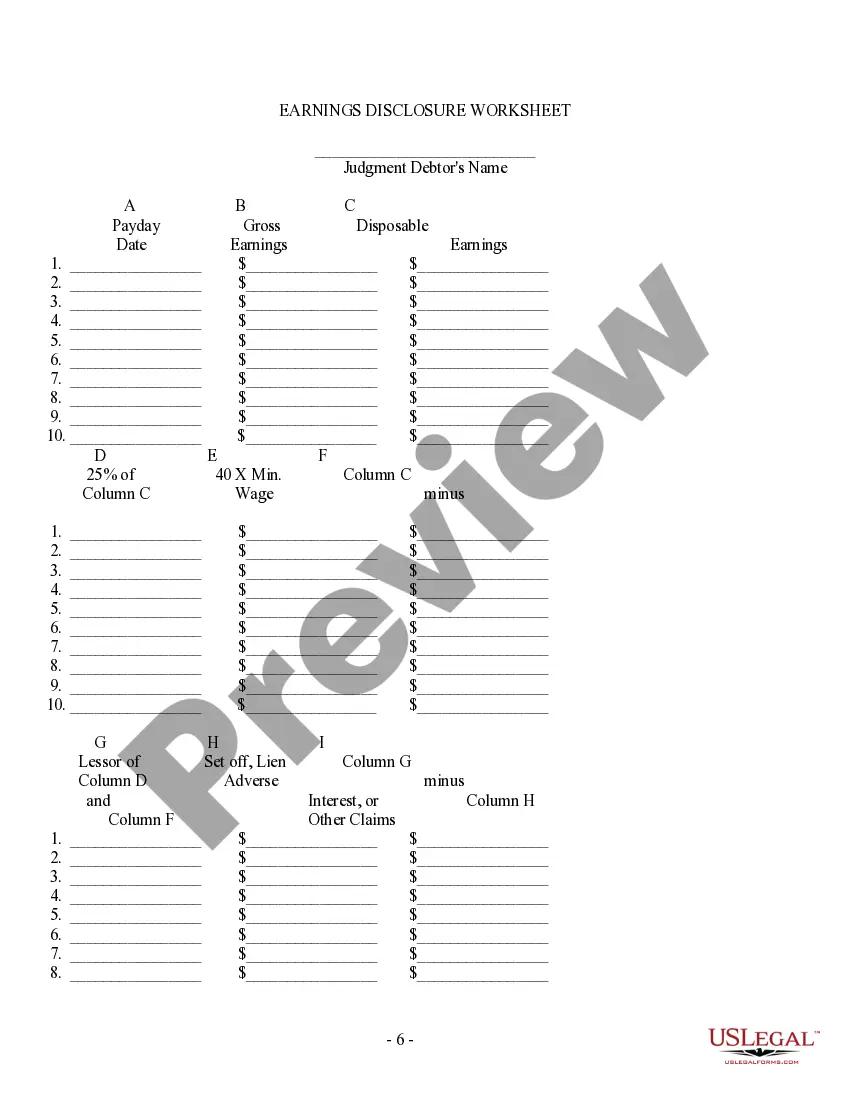

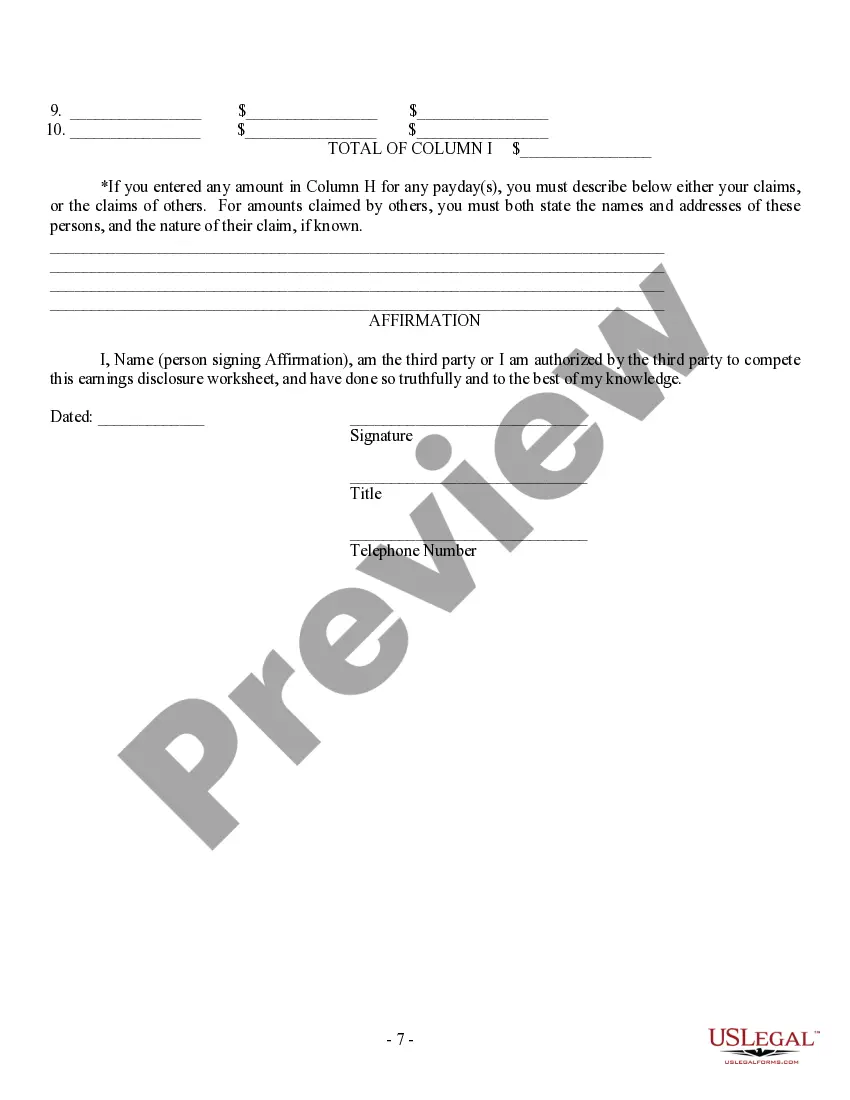

Minneapolis, Minnesota Notice of Third Party Levy and Disclosure — Garnishment: A Comprehensive Guide In Minneapolis, Minnesota, a Notice of Third Party Levy and Disclosure — Garnishment is a legal document that initiates the process of seizing funds from a third party to satisfy a debt owed by an individual. This notice is typically issued by a creditor and served to a financial institution or any other party that holds assets belonging to the debtor. This legal procedure is designed to collect outstanding debts and ensure that the creditors receive the payment they are entitled to. The garnishment process involves the following key steps: 1. Filing the Notice of Third Party Levy and Disclosure: A creditor must first file the notice with the proper court, providing details about the debt, the debtor, and the third party who possesses the debtor's assets. This notice informs the third party about the garnishment and their legal obligations. 2. Service of the Notice: Once filed, the notice is served to the third party, typically by certified mail or personal delivery. The third party must be given the opportunity to respond to the notice within a specified time frame. 3. Response and Disclosure: When served with the notice, the third party must disclose any assets or property held for or belonging to the debtor. This includes bank accounts, wages, stocks, and other valuable assets that may be subject to seizure to satisfy the debt. The third party must provide a detailed account of these assets to the creditor or the court. Minneapolis Minnesota recognizes various types of Notice of Third Party Levy and Disclosure — Garnishment, each catering to specific circumstances. Some commonly encountered types include: 1. Wage Garnishment: In cases where the debtor is employed, the employer may be served with a wage garnishment notice, which requires them to withhold a portion of the debtor's wages to satisfy the debt. 2. Bank Account Garnishment: This type of garnishment is aimed at seizing funds directly from the debtor's bank account. The financial institution holding the account is served with the notice and required to freeze the funds to facilitate debt repayment. 3. Property or Asset Garnishment: In situations where the debtor possesses valuable assets or property, such as real estate, vehicles, or investments, a notice is served to the relevant third party, informing them of the pending garnishment and potential seizure of the debtor's assets. Regardless of the specific type of Notice of Third Party Levy and Disclosure — Garnishment, it is critical for all parties involved to adhere to the necessary legal procedures to ensure fairness and protection of rights. Failure to comply with the notice may result in severe penalties, including fines or contempt of court charges. Navigating the complexities of a Notice of Third Party Levy and Disclosure — Garnishment can be daunting, requiring the expertise of legal professionals well-versed in Minnesota's laws and regulations. Seeking legal advice and representation is highly recommended safeguarding the interests of all parties involved in the garnishment process.

Minneapolis Minnesota Notice of Third Party Levy and Disclosure - Garnishment

Description

How to fill out Minneapolis Minnesota Notice Of Third Party Levy And Disclosure - Garnishment?

If you are looking for a relevant form template, it’s extremely hard to choose a more convenient place than the US Legal Forms site – one of the most considerable libraries on the web. With this library, you can find thousands of document samples for business and personal purposes by categories and states, or key phrases. Using our high-quality search feature, discovering the most up-to-date Minneapolis Minnesota Notice of Third Party Levy and Disclosure - Garnishment is as elementary as 1-2-3. Moreover, the relevance of every record is verified by a group of professional lawyers that regularly check the templates on our platform and revise them in accordance with the most recent state and county requirements.

If you already know about our platform and have an account, all you need to get the Minneapolis Minnesota Notice of Third Party Levy and Disclosure - Garnishment is to log in to your account and click the Download button.

If you make use of US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have chosen the sample you need. Read its description and utilize the Preview option to explore its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to get the needed record.

- Affirm your choice. Choose the Buy now button. After that, choose the preferred subscription plan and provide credentials to register an account.

- Process the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Receive the form. Select the file format and save it to your system.

- Make changes. Fill out, modify, print, and sign the acquired Minneapolis Minnesota Notice of Third Party Levy and Disclosure - Garnishment.

Every single form you save in your account has no expiration date and is yours forever. You can easily access them via the My Forms menu, so if you want to have an additional copy for editing or creating a hard copy, feel free to come back and save it once more whenever you want.

Take advantage of the US Legal Forms extensive collection to gain access to the Minneapolis Minnesota Notice of Third Party Levy and Disclosure - Garnishment you were seeking and thousands of other professional and state-specific templates on a single platform!