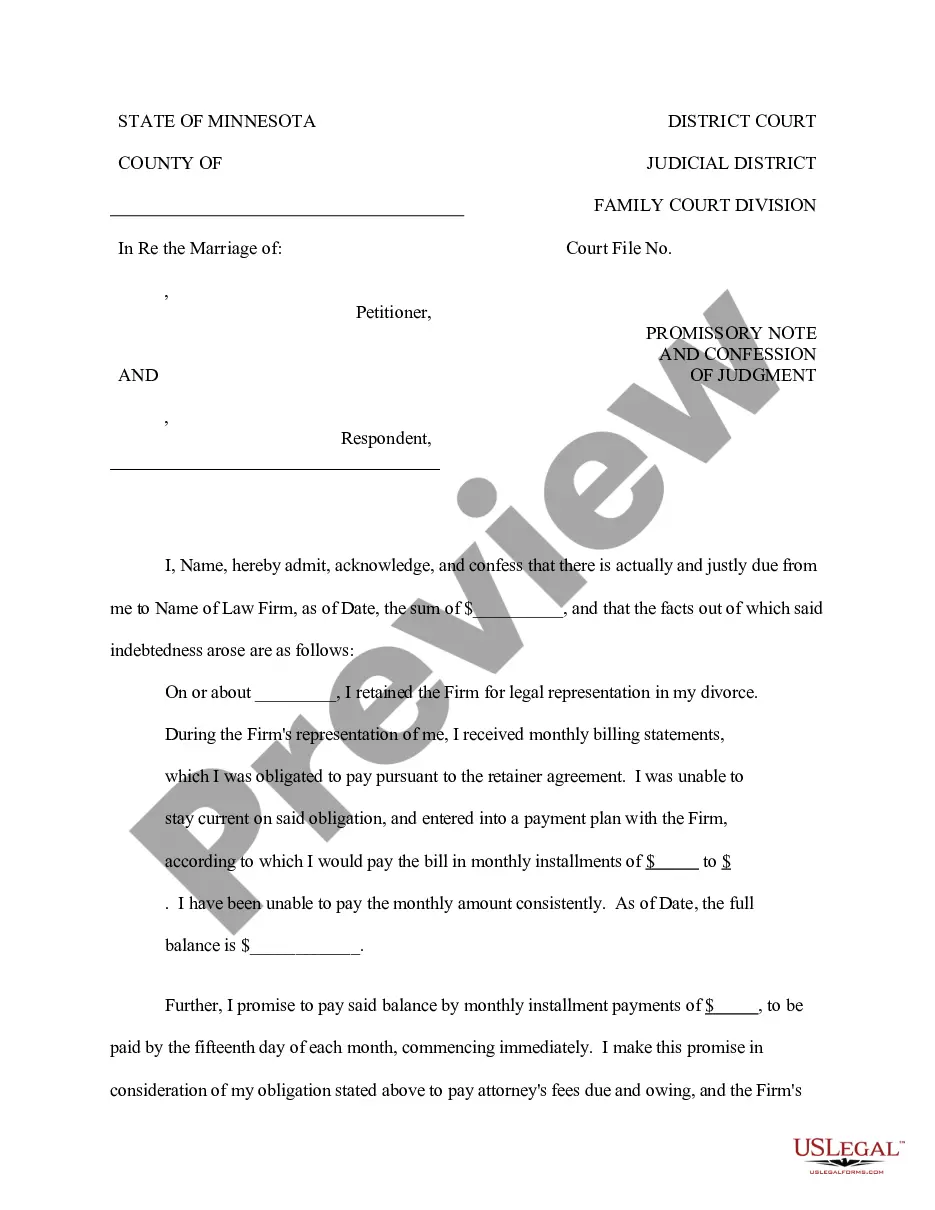

Saint Paul, Minnesota Promissory Note and Confession of Judgment for Legal Fees: A Comprehensive Guide In Saint Paul, Minnesota, a Promissory Note and Confession of Judgment for Legal Fees is a legal agreement that outlines the terms and conditions of a loan or debt incurred for legal services. This document is crucial for maintaining a transparent and legally binding relationship between a client and their attorney, ensuring repayment for the legal fees. A Promissory Note is a legally enforceable agreement that states the borrower's promise to repay the lender a specific amount of money within a pre-defined period. It specifies the loan principal, interest rate, repayment terms, late payment consequences, and any applicable fees. This document plays a vital role in setting clear expectations and establishing the financial obligations of the borrower. Confession of Judgment, on the other hand, is a powerful legal instrument that allows the lender (in this case, the attorney) to obtain a judgment against the borrower without going through a formal trial. By signing this document, the borrower agrees to the entry of judgment against them and waives their right to contest the debt. It expedites the legal process, allowing the attorney to proceed directly to seizing assets or garnishing wages to satisfy the outstanding legal fees. Types of Saint Paul, Minnesota Promissory Note and Confession of Judgment for Legal Fees: 1. Simple Promissory Note: This type of promissory note contains basic terms and conditions of the loan, such as the principal amount borrowed, repayment schedule, interest rate, and any late payment penalties or fees. 2. Secured Promissory Note: If the borrower provides collateral (e.g., property, vehicle) to secure the loan, a secured promissory note is utilized. It includes provisions related to the collateral, such as the borrower's duty to maintain insurance on the collateral and the lender's right to seize the collateral in the event of default. 3. Confession of Judgment Promissory Note: This document combines the elements of both a promissory note and a confession of judgment. It includes not only the repayment terms but also provisions that enable the attorney to obtain a judgment in case of non-payment. This helps expedite the legal process if the borrower defaults on their obligations. 4. Acceleration Clause Promissory Note: An acceleration clause states that the entire outstanding loan amount becomes due immediately if the borrower fails to make timely payments or breaches the terms and conditions of the promissory note. This clause provides additional protection and incentives for the borrower to fulfill their repayment obligations promptly. 5. Installment Promissory Note: This type of promissory note breaks the total repayment amount into regular installments, including principal and interest. It outlines the due dates for each payment, allowing the borrower to repay the loan over an extended period, helping manage their financial obligations more effectively. In conclusion, the Saint Paul, Minnesota Promissory Note and Confession of Judgment for Legal Fees serve as a critical legal document that protects the interests of both the client and attorney. It lays out the loan terms, repayment conditions, and provides an expedited legal procedure through confession of judgment in case of non-payment. Understanding the different types of promissory notes available ensures that parties involved can choose the most suitable one for their specific legal and financial needs.

Saint Paul Minnesota Promissory Note and Confession of Judgment for Legal Fees

Description

How to fill out Saint Paul Minnesota Promissory Note And Confession Of Judgment For Legal Fees?

Make use of the US Legal Forms and have immediate access to any form you want. Our beneficial website with a large number of document templates makes it easy to find and obtain virtually any document sample you need. It is possible to download, fill, and sign the Saint Paul Minnesota Promissory Note and Confession of Judgment for Legal Fees in just a couple of minutes instead of browsing the web for several hours attempting to find an appropriate template.

Using our library is a wonderful strategy to increase the safety of your form submissions. Our experienced lawyers on a regular basis check all the records to ensure that the forms are relevant for a particular region and compliant with new acts and regulations.

How can you obtain the Saint Paul Minnesota Promissory Note and Confession of Judgment for Legal Fees? If you have a subscription, just log in to the account. The Download button will appear on all the samples you look at. Additionally, you can find all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions listed below:

- Open the page with the template you require. Make sure that it is the form you were looking for: examine its headline and description, and use the Preview option if it is available. Otherwise, use the Search field to find the needed one.

- Start the saving process. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the document. Indicate the format to obtain the Saint Paul Minnesota Promissory Note and Confession of Judgment for Legal Fees and change and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and reliable form libraries on the internet. We are always happy to help you in virtually any legal procedure, even if it is just downloading the Saint Paul Minnesota Promissory Note and Confession of Judgment for Legal Fees.

Feel free to take full advantage of our form catalog and make your document experience as efficient as possible!