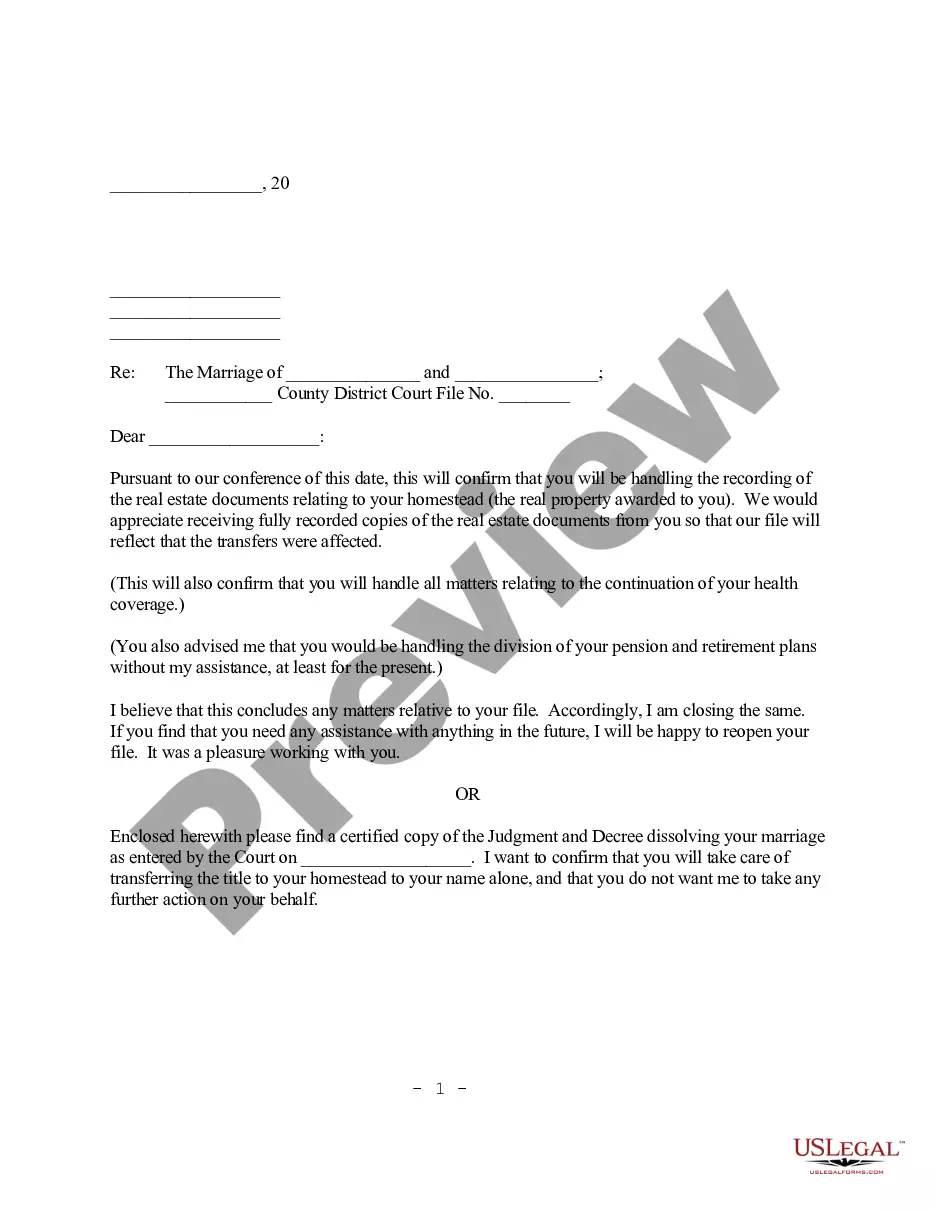

Title: Comprehensive Guide to Saint Paul Minnesota Letter to Client regarding Real Estate Documents related to Homestead Introduction: In the world of real estate transactions, understanding the intricacies of various legal documents is crucial. This detailed description aims to provide a comprehensive guide on the different types of Saint Paul Minnesota Letter to Client regarding Real Estate Documents related to Homestead. Whether you are a homeowner, buyer, seller, or a real estate agent, this article will equip you with the necessary knowledge to navigate through the process confidently. 1. Homestead Declaration Letter: One of the most important pieces of paperwork involved in real estate transactions within Saint Paul, Minnesota, is the Homestead Declaration Letter. This document signifies that a particular property is the primary residence of the homeowner and thus qualifies for certain benefits, such as property tax reductions and protection from creditors. 2. Mortgage Lender Letter: A crucial component of the real estate transaction process revolves around securing a mortgage. In Saint Paul, Minnesota, a Mortgage Lender Letter is often required to demonstrate to the lender that the property being purchased qualifies for homestead benefits. This letter usually confirms the homeowner's intent to make the property their primary residence. 3. Homestead Exclusion Letter: The Homestead Exclusion Letter is another document that clients might encounter during their real estate journey. This letter pertains to the exclusion of certain debts from the value of the homestead. Typically, it addresses cases where the property owner seeks to protect the property from judgment creditors to maintain its homestead status. 4. Transfer on Death Deed Letter: A Transfer on Death Deed Letter is essential in Saint Paul, Minnesota, when a homeowner wishes to designate beneficiaries who will inherit their property upon their passing. This letter informs the client about the necessary documentation and procedures to ensure a smooth transfer of the property's title after death without the need for probate or other lengthy legal processes. 5. Homestead Affidavit Letter: For clients who are selling a property they previously declared as their homestead, a Homestead Affidavit Letter may be required. This letter confirms the termination of the homestead declaration, allowing the client to regain the full range of flexibility for using their property as a primary residence or for other purposes. Conclusion: Navigating through the real estate documents related to homestead in Saint Paul, Minnesota, can be complex and overwhelming. However, armed with the knowledge of the different types of letters involved, clients can confidently handle any real estate transaction. Always consult with legal professionals or real estate agents to ensure accuracy and adherence to local laws and regulations.

Saint Paul Minnesota Letter to Client regarding Real Estate Documents related to Homestead

Description

How to fill out Saint Paul Minnesota Letter To Client Regarding Real Estate Documents Related To Homestead?

Acquiring validated templates tailored to your local laws can be difficult unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents catering to both personal and professional requirements for various real-life scenarios.

All forms are appropriately categorized by application area and jurisdiction, making it straightforward and effortless to find the Saint Paul Minnesota Letter to Client concerning Real Estate Documents related to Homestead.

Maintaining documentation organized and compliant with legal mandates holds substantial value.

- Review the Preview mode and document synopsis.

- Ensure you've chosen the correct document that satisfies your requirements and aligns with your regional legal standards.

- Look for alternative templates if necessary.

- Upon discovering any discrepancies, utilize the Search tab at the top to locate the appropriate document.

- If it meets your needs, proceed to the next stage.

Form popularity

FAQ

To qualify for a homestead, you must: Own a property. Occupy the property as your sole or primary residence. Be a Minnesota resident....Qualifying property includes all property used as a residence, including: Gardens. Garages. Outbuildings.

To qualify for a homestead, you must: Own a property. Occupy the property as your sole or primary residence. Be a Minnesota resident.

General rule. (a) Residential real estate that is occupied and used for the purposes of a homestead by its owner, who must be a Minnesota resident, is a residential homestead.

Classification as a homestead may qualify a property for a reduced classification rate, a reduced taxable market value, a property tax refund, and/or other special programs. This exclusion reduces the taxable market value of qualifying homestead properties with at least $20,000 in mold repair costs.

If you own real estate property and you or a qualifying relative occupies the property by December 31, you may apply for homestead status by December 31. You can only homestead one residential parcel in the State of MN.

The Market Value Exclusion reduces the taxable market value for property classified as homestead if it is valued below $413,800. By decreasing the taxable market value, net property taxes are also decreased. How the Exclusion Works + The exclusion reduces the taxable market value of qualifying homestead properties.

To qualify for homestead: You must own the property, or be a relative or in-law of the owner (son, daughter, parent, grandchild, grandparent, brother, sister, aunt, uncle, niece or nephew). You or your relative must occupy the property as the primary place of residence. You must be a Minnesota resident.

The homestead estate is designed to protect home ownership from execution and forced sale, so long as the owner or covered family member occupies or intends to occupy the property as his or her principal place of residence.

Per Minnesota state statute, you can only homestead one residential parcel in the State of MN.

A homestead exemption protects home equity from a homeowner's creditors, up to a certain dollar amount. Collectors cannot acquire any funds within this amount to settle past-due debt. This applies if you file for bankruptcy or you experience financial difficulties after a divorce or your spouse passes away.