Subject: Comprehensive Description of the Saint Paul Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act Keywords: Saint Paul Minnesota, Letter to Debt Collector, Fair Debt Collection and Practices Act, comprehensive description, relevant content, types Dear [Debt Collector's Name], I am writing this letter to you concerning the Fair Debt Collection and Practices Act (FD CPA), which plays a significant role in debt collection procedures in Saint Paul, Minnesota. It is important for debt collectors to operate within the boundaries set by this legislation to ensure the fair treatment of debtors and protect their rights. [Saint Paul Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act — General Explanation] The purpose of this letter is to bring your attention to the specific requirements outlined in the FD CPA when attempting to collect a debt. As a debt collector, you must familiarize yourself with these regulations and ensure compliance to prevent any legal implications. Ignorance of the provisions in this act could result in severe consequences. [Type 1: First Communication Letter] If this is our first communication regarding the debt in question, it is vital to understand that the FD CPA provides guidelines for initial communications with debtors. The letter should clearly identify the debtor, state the amount of debt owed, and the creditor to whom the debt is owed. Provide the debtor with a validation notice, informing them of their right to dispute the validity of the debt within 30 days. [Type 2: Validation Letter Request] In certain situations, debtors may request a validation letter to verify the legitimacy of the debt. When such a request is made, you are obligated by the FD CPA to provide detailed information about the debt, including the original creditor's name, the original amount owed, and any relevant documentation that supports the claim. This allows the debtor to confirm the accuracy of the debt before proceeding further. [Type 3: Cease and Desist Letter] Debtors have the right to request that you cease all communication with them regarding the debt. If a debtor sends you a cease and desist letter, you must comply with their request and only contact them again to inform them about legal actions being taken or to acknowledge receipt of the letter. [Type 4: Notice of Dispute] In instances where a debtor disputes the validity of a debt or a portion of it, the FD CPA provides provisions for a notice of dispute. Upon receiving such a notice, you are required to cease collection efforts or provide documentation that substantiates the debt's validity or the amount being disputed. [Brief Conclusion and Final Remarks] It is crucial for you as a debt collector to adhere to the Fair Debt Collection and Practices Act to ensure ethical debt collection practices. Failure to comply with the provisions mentioned could result in legal action, tarnish the reputation of your company, and lead to substantial penalties. It is highly recommended seeking legal advice or consult an attorney if you are uncertain about any aspect of the act or any specific letter requirements. Please take this letter as a reminder to familiarize yourself with the Fair Debt Collection and Practices Act to ensure your collection practices align with the legal obligations outlined in this legislation. Thank you for your attention to this matter. Sincerely, [Your Name]

Saint Paul Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act

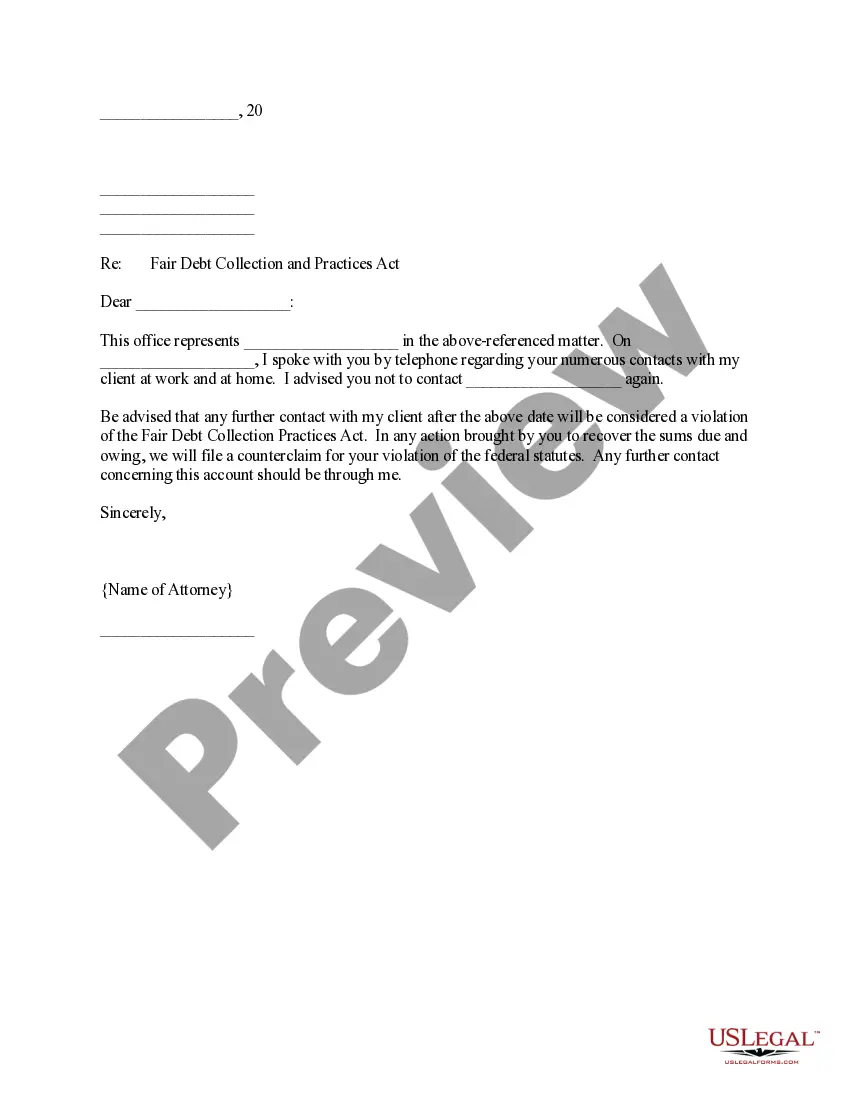

Description

How to fill out Saint Paul Minnesota Letter To Debt Collector Re Fair Debt Collection And Practices Act?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person with no law background to create this sort of paperwork cfrom the ground up, mostly due to the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our platform offers a huge library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Saint Paul Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Saint Paul Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act in minutes employing our trusted platform. In case you are already a subscriber, you can go on and log in to your account to get the appropriate form.

Nevertheless, in case you are a novice to our platform, make sure to follow these steps before obtaining the Saint Paul Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act:

- Ensure the template you have found is suitable for your area because the regulations of one state or county do not work for another state or county.

- Review the form and go through a short outline (if available) of cases the document can be used for.

- If the one you picked doesn’t meet your needs, you can start over and search for the needed form.

- Click Buy now and pick the subscription plan that suits you the best.

- Log in to your account credentials or create one from scratch.

- Choose the payment gateway and proceed to download the Saint Paul Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act once the payment is done.

You’re good to go! Now you can go on and print out the form or fill it out online. In case you have any issues getting your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.