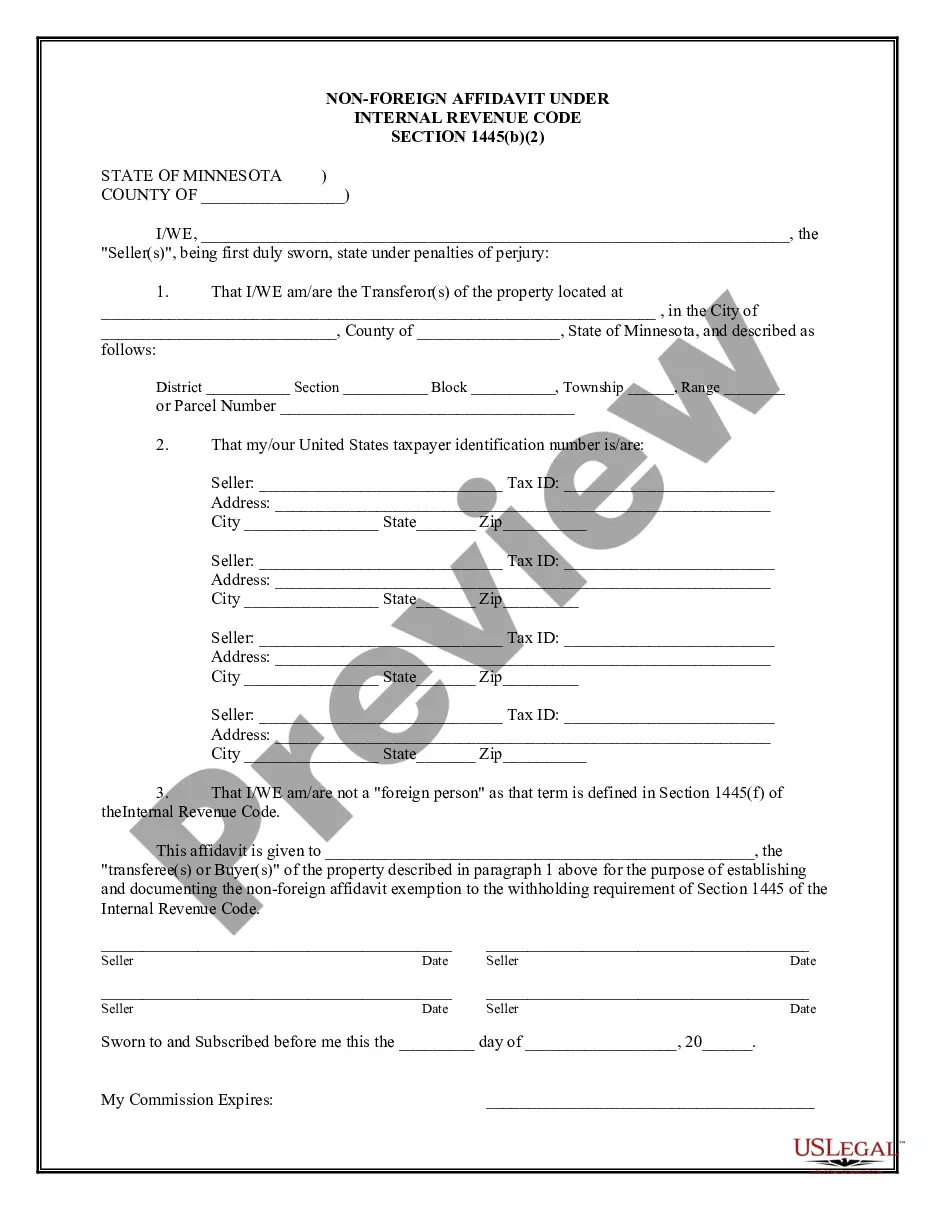

A Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445 is a legal document that is required in certain real estate transactions involving non-U.S. citizens or non-resident aliens. This affidavit is specifically mandated by the Internal Revenue Code (IRC) 1445, which imposes withholding tax obligations on the buyer or transferee of U.S. real property interests. The purpose of this affidavit is to certify the status of the transferor as a non-foreign person in regard to the transaction, thereby ensuring compliance with the IRC 1445 regulations. It is used to confirm that the seller or transferor is either a U.S. citizen, resident alien, domestic corporation, or a domestic partnership or trust. The Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445 must include various crucial details related to the transaction, such as the names and addresses of the buyer and seller, a description of the property being transferred, the sale price or transfer amount, and the date of transfer. Additionally, it typically requires the transferor to provide their U.S. taxpayer identification number (TIN) for proper tax reporting purposes. Different types of Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445 may vary based on the specific real estate transaction or property involved. For instance, there could be separate affidavits for residential properties, commercial properties, vacant land, or even for specific types of transactions like leasehold interests or easements. These variations are generally determined by the nature and complexity of the property transfer. In conclusion, a Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445 is a vital legal document necessary for real estate transactions involving non-U.S. citizens or non-resident aliens. It certifies that the transferor is not a foreign person as defined by the IRC 1445 regulations. By ensuring compliance with the tax withholding obligations, this affidavit facilitates transparent and legally compliant property transfers in Minneapolis, Minnesota.

Irc Tin 2 Form Pdf Download

Category:

State:

Minnesota

City:

Minneapolis

Control #:

MN-CLOSE7

Format:

Word;

Rich Text

Instant download

Description

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

A Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445 is a legal document that is required in certain real estate transactions involving non-U.S. citizens or non-resident aliens. This affidavit is specifically mandated by the Internal Revenue Code (IRC) 1445, which imposes withholding tax obligations on the buyer or transferee of U.S. real property interests. The purpose of this affidavit is to certify the status of the transferor as a non-foreign person in regard to the transaction, thereby ensuring compliance with the IRC 1445 regulations. It is used to confirm that the seller or transferor is either a U.S. citizen, resident alien, domestic corporation, or a domestic partnership or trust. The Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445 must include various crucial details related to the transaction, such as the names and addresses of the buyer and seller, a description of the property being transferred, the sale price or transfer amount, and the date of transfer. Additionally, it typically requires the transferor to provide their U.S. taxpayer identification number (TIN) for proper tax reporting purposes. Different types of Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445 may vary based on the specific real estate transaction or property involved. For instance, there could be separate affidavits for residential properties, commercial properties, vacant land, or even for specific types of transactions like leasehold interests or easements. These variations are generally determined by the nature and complexity of the property transfer. In conclusion, a Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445 is a vital legal document necessary for real estate transactions involving non-U.S. citizens or non-resident aliens. It certifies that the transferor is not a foreign person as defined by the IRC 1445 regulations. By ensuring compliance with the tax withholding obligations, this affidavit facilitates transparent and legally compliant property transfers in Minneapolis, Minnesota.

Free preview

How to fill out Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445?

If you’ve already utilized our service before, log in to your account and download the Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445 on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make sure you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!