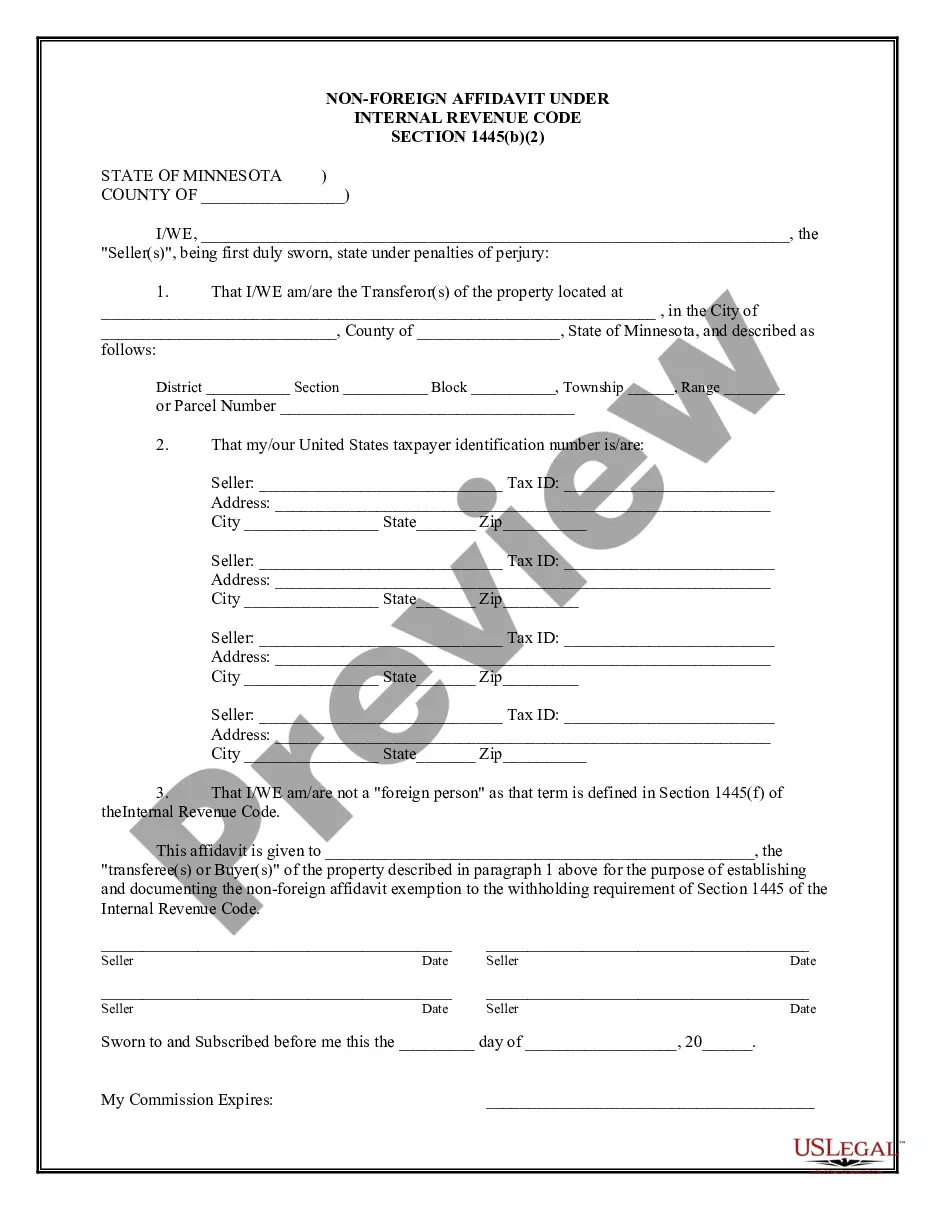

A non-foreign affidavit under IRC 1445 is a crucial legal document required during the sale of certain types of real estate properties in Saint Paul, Minnesota. This affidavit is intended to confirm that the seller is not a foreign person as defined by the Internal Revenue Code (IRC) and is subject to FIR PTA (Foreign Investment in Real Property Tax Act) withholding provisions. The Saint Paul Non-Foreign Affidavit Under IRC 1445 serves as an assurance to the buyer and the IRS that the seller is a U.S. citizen, resident alien, domestic corporation, or a domestic partnership. By signing this affidavit, the seller declares their status and confirms that they are not subject to FIR PTA withholding. Key elements of the Saint Paul Non-Foreign Affidavit Under IRC 1445 may include: 1. Seller Information: The affidavit would collect important details about the seller, such as their full legal name, address, taxpayer identification number, and proof of citizenship or residency. 2. Property Details: This section would involve a comprehensive description of the property being sold, including its address, legal description, and any relevant identification numbers, such as the parcel number or assessor's identification number. 3. FIR PTA Certification: The seller would certify their tax status, acknowledging whether they are a U.S. citizen, resident alien, domestic corporation, or domestic partnership, thus exempt from FIR PTA withholding. They might also affirm that they have not changed their status since signing the affidavit. 4. Signature and Date: To establish the authenticity of the affidavit, the seller would be required to sign and date the document, legally binding themselves to the information provided. Notarization may also be necessary for added validity. It is important to note that while the general structure of the Saint Paul Non-Foreign Affidavit Under IRC 1445 remains consistent, there might be slight variations based on specific state or local requirements. Additionally, there may be different versions of the affidavit tailored to individual scenarios, such as partnerships or corporations selling real estate. In conclusion, the Saint Paul Non-Foreign Affidavit Under IRC 1445 is a critical document used to establish the seller's tax status and exemption from FIR PTA withholding during real estate transactions in Saint Paul, Minnesota. By affirming their eligibility as a non-foreign entity, sellers fulfill their obligations under the IRC and provide assurance to both buyers and the IRS regarding their tax liability.

Saint Paul Minnesota Non-Foreign Affidavit Under IRC 1445

Category:

State:

Minnesota

City:

Saint Paul

Control #:

MN-CLOSE7

Format:

Word;

Rich Text

Instant download

Description

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

A non-foreign affidavit under IRC 1445 is a crucial legal document required during the sale of certain types of real estate properties in Saint Paul, Minnesota. This affidavit is intended to confirm that the seller is not a foreign person as defined by the Internal Revenue Code (IRC) and is subject to FIR PTA (Foreign Investment in Real Property Tax Act) withholding provisions. The Saint Paul Non-Foreign Affidavit Under IRC 1445 serves as an assurance to the buyer and the IRS that the seller is a U.S. citizen, resident alien, domestic corporation, or a domestic partnership. By signing this affidavit, the seller declares their status and confirms that they are not subject to FIR PTA withholding. Key elements of the Saint Paul Non-Foreign Affidavit Under IRC 1445 may include: 1. Seller Information: The affidavit would collect important details about the seller, such as their full legal name, address, taxpayer identification number, and proof of citizenship or residency. 2. Property Details: This section would involve a comprehensive description of the property being sold, including its address, legal description, and any relevant identification numbers, such as the parcel number or assessor's identification number. 3. FIR PTA Certification: The seller would certify their tax status, acknowledging whether they are a U.S. citizen, resident alien, domestic corporation, or domestic partnership, thus exempt from FIR PTA withholding. They might also affirm that they have not changed their status since signing the affidavit. 4. Signature and Date: To establish the authenticity of the affidavit, the seller would be required to sign and date the document, legally binding themselves to the information provided. Notarization may also be necessary for added validity. It is important to note that while the general structure of the Saint Paul Non-Foreign Affidavit Under IRC 1445 remains consistent, there might be slight variations based on specific state or local requirements. Additionally, there may be different versions of the affidavit tailored to individual scenarios, such as partnerships or corporations selling real estate. In conclusion, the Saint Paul Non-Foreign Affidavit Under IRC 1445 is a critical document used to establish the seller's tax status and exemption from FIR PTA withholding during real estate transactions in Saint Paul, Minnesota. By affirming their eligibility as a non-foreign entity, sellers fulfill their obligations under the IRC and provide assurance to both buyers and the IRS regarding their tax liability.

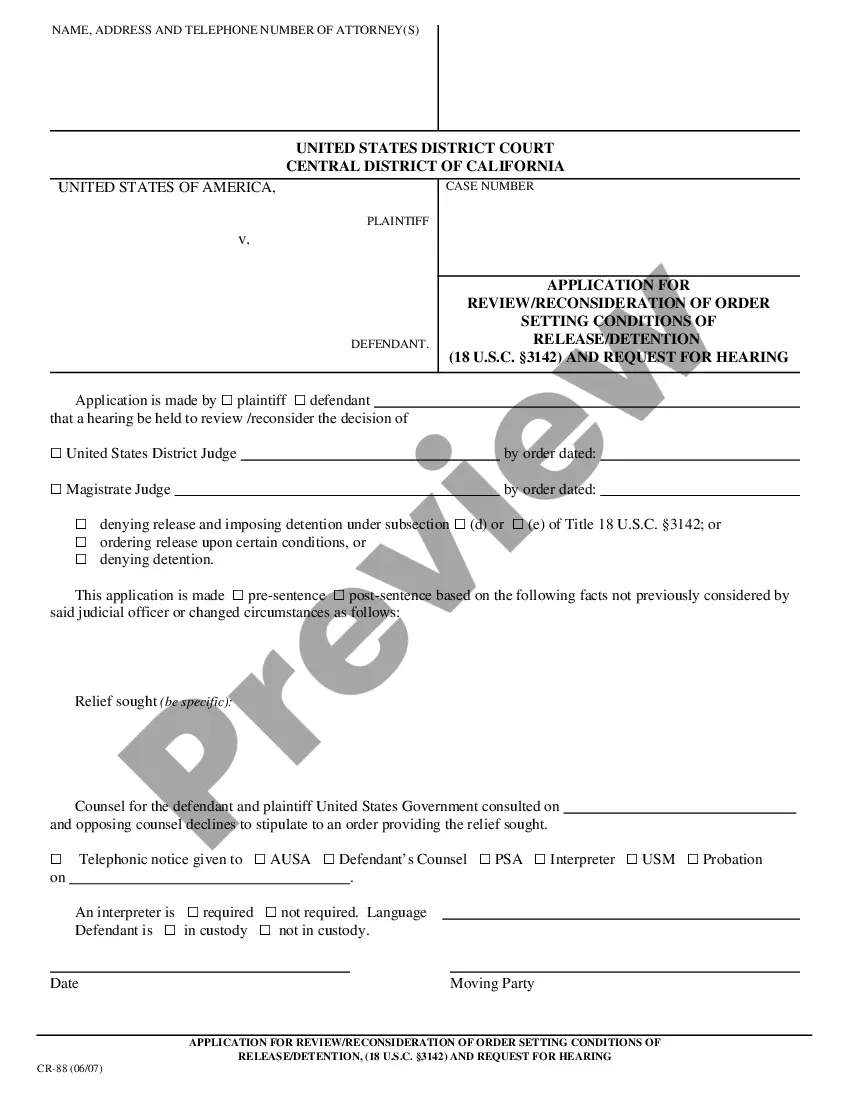

Free preview

How to fill out Saint Paul Minnesota Non-Foreign Affidavit Under IRC 1445?

If you’ve already used our service before, log in to your account and save the Saint Paul Minnesota Non-Foreign Affidavit Under IRC 1445 on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Saint Paul Minnesota Non-Foreign Affidavit Under IRC 1445. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!