- US Legal Forms

- Localized Forms

- Minnesota

- Saint Paul

-

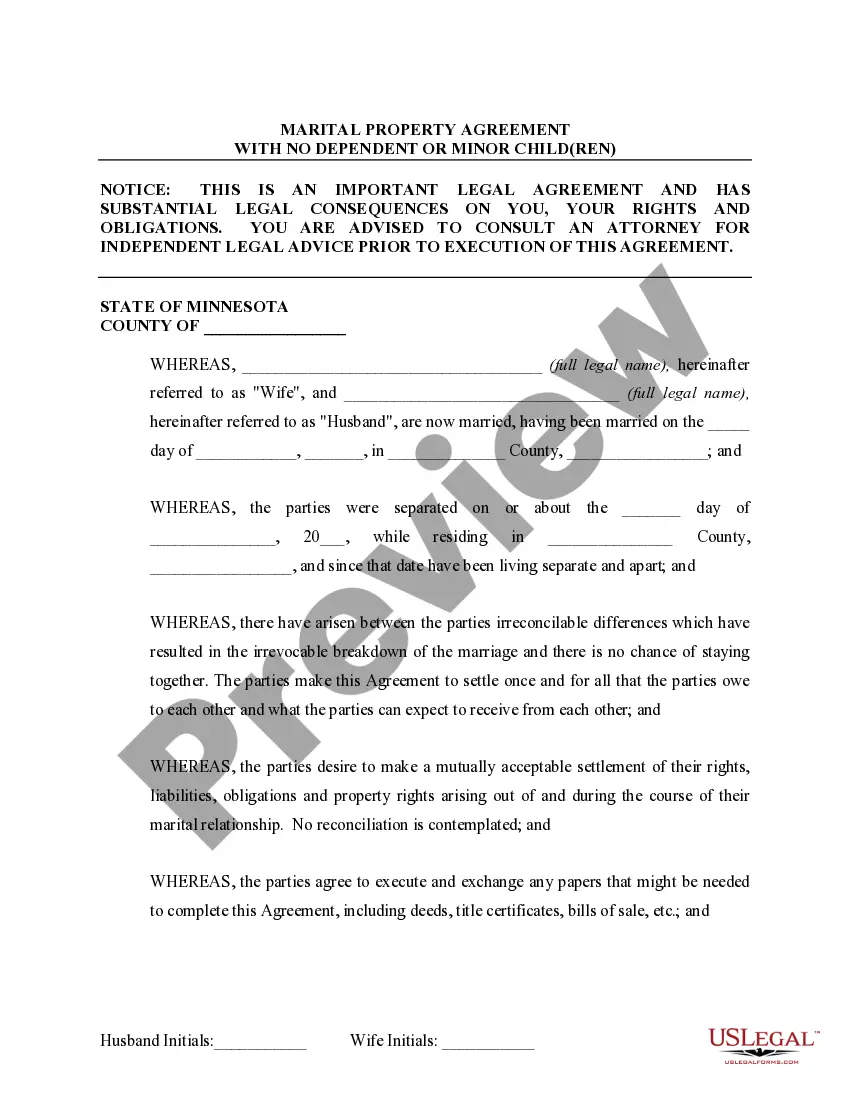

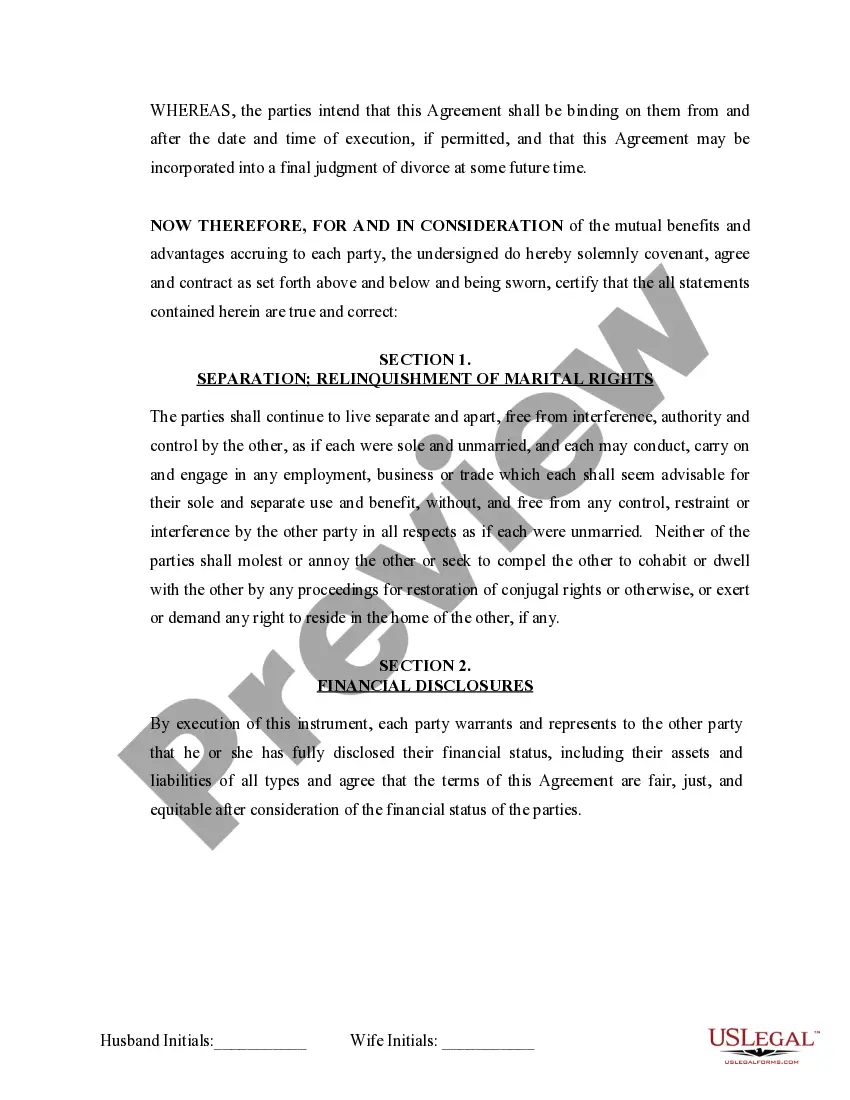

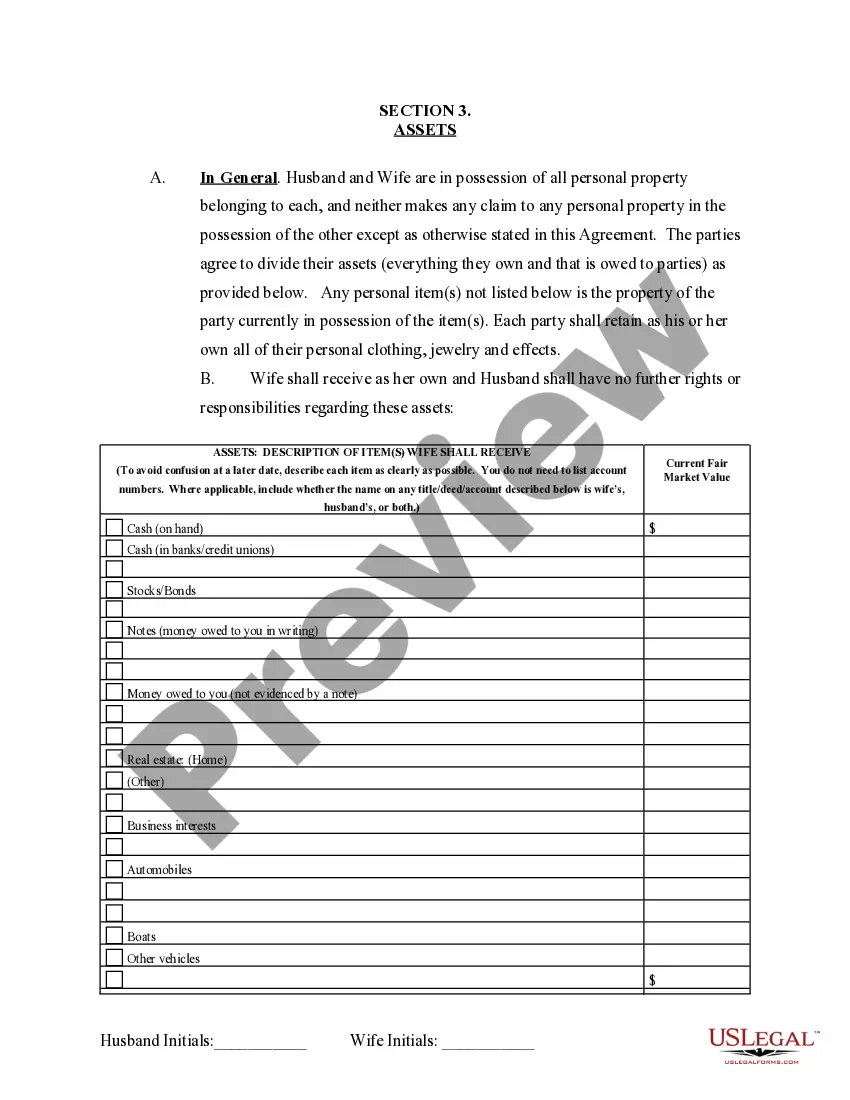

Minnesota Marital Domestic Separation and Property Settlement...

Saint Paul Minnesota Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts Effective Immediately

Description

Related forms

Related legal definitions

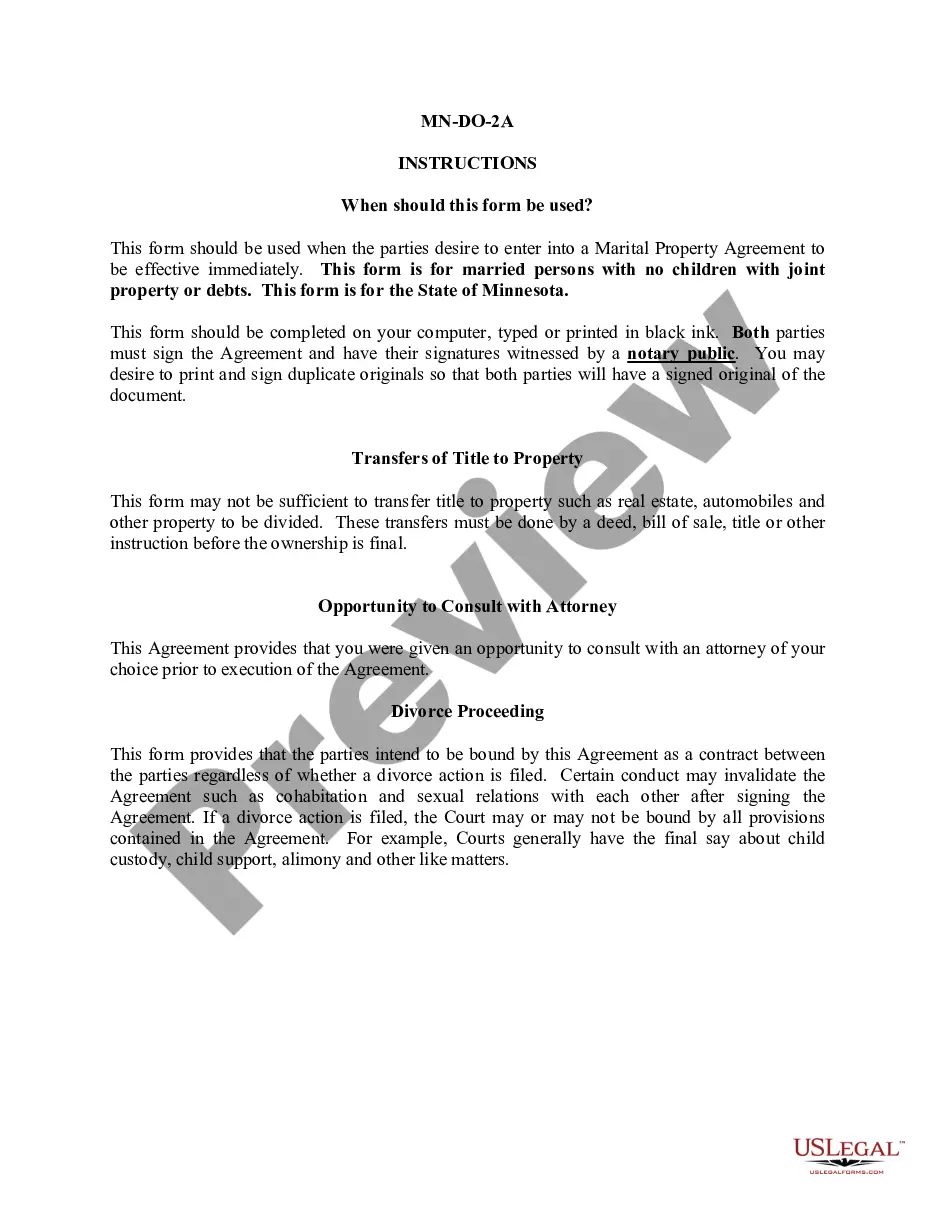

How to fill out Saint Paul Minnesota Marital Domestic Separation And Property Settlement Agreement No Children Parties May Have Joint Property Or Debts Effective Immediately?

If you are searching for a relevant form, it’s impossible to find a better place than the US Legal Forms site – one of the most extensive libraries on the web. With this library, you can get thousands of form samples for business and personal purposes by types and states, or keywords. With the advanced search feature, discovering the most up-to-date Saint Paul Minnesota Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts Effective Immediately is as elementary as 1-2-3. In addition, the relevance of each file is verified by a group of professional lawyers that regularly review the templates on our website and revise them according to the latest state and county requirements.

If you already know about our platform and have a registered account, all you need to receive the Saint Paul Minnesota Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts Effective Immediately is to log in to your profile and click the Download button.

If you make use of US Legal Forms the very first time, just follow the instructions below:

- Make sure you have found the form you require. Look at its information and utilize the Preview function to see its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to discover the appropriate record.

- Affirm your decision. Choose the Buy now button. Next, choose the preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Indicate the format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the acquired Saint Paul Minnesota Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts Effective Immediately.

Every template you save in your profile does not have an expiration date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to get an additional copy for modifying or creating a hard copy, feel free to come back and save it again whenever you want.

Take advantage of the US Legal Forms professional catalogue to get access to the Saint Paul Minnesota Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts Effective Immediately you were looking for and thousands of other professional and state-specific samples on one platform!

Form Rating

Form popularity

FAQ

The short answer is, probably not. In Minnesota, non-marital property is generally not subject to division. In other words, if the inheritance is non-marital property, you would not be entitled to a share of your spouse's inheritance as part of the divorce proceeding, even if it was received during the marriage.

Minnesota is an equitable distribution state. This does not necessarily mean a 50-50 settlement of everything. But the law presumes that all assets and debts acquired during the marriage will be divided equitably, including: Your house and other real estate.

In California, it is legal for one spouse to force the other to move out for a set time period. This is accomplished through a court order, but the individual must be able to provide evidence of threats of assault or assault attempts if the case is an emergency.

The short answer is, probably not. In Minnesota, non-marital property is generally not subject to division. In other words, if the inheritance is non-marital property, you would not be entitled to a share of your spouse's inheritance as part of the divorce proceeding, even if it was received during the marriage.

In most cases, a person who receives an inheritance is under no obligations to share it with his or her spouse. However, there are some instances in which the inheritance must be shared. Primarily, the inheritance must be kept separate from the couple's shared bank accounts.

If there are minor children involved in a divorce and both parties desire the home and one party is determined by the court to be the primary care provider for the children and will be moving forward, the home is likely to be awarded to that person so as to cause as little disruption in the children's life as possible.

While you generally cannot force your spouse to leave the home, there may be an exception in cases where physical abuse is occurring. If you have credible evidence that your spouse has been abusive or threatening to you or to your children, you may be able to get a court order to force your spouse to leave the house.

To legally kick your husband out of the house, California law has certain requirements. It requires a showing of assault or threatened assault if the request is made on an emergency basis. It also requires potential for physical or emotional harm if the request is made on a non-emergency basis.

ANSWER: Though you are the sole legal owner of your home, your husband has a right to live in the house because of your marriage, and so you cannot just change the locks. However, a court can remove that right, depending on how seriously harmful his behaviour is.

Minnesota is an equitable distribution state. This does not necessarily mean a 50-50 settlement of everything. But the law presumes that all assets and debts acquired during the marriage will be divided equitably, including: Your house and other real estate.

The short answer is, probably not. In Minnesota, non-marital property is generally not subject to division. In other words, if the inheritance is non-marital property, you would not be entitled to a share of your spouse's inheritance as part of the divorce proceeding, even if it was received during the marriage.

Minnesota is an equitable distribution state. This does not necessarily mean a 50-50 settlement of everything. But the law presumes that all assets and debts acquired during the marriage will be divided equitably, including: Your house and other real estate.

In California, it is legal for one spouse to force the other to move out for a set time period. This is accomplished through a court order, but the individual must be able to provide evidence of threats of assault or assault attempts if the case is an emergency.

The short answer is, probably not. In Minnesota, non-marital property is generally not subject to division. In other words, if the inheritance is non-marital property, you would not be entitled to a share of your spouse's inheritance as part of the divorce proceeding, even if it was received during the marriage.

In most cases, a person who receives an inheritance is under no obligations to share it with his or her spouse. However, there are some instances in which the inheritance must be shared. Primarily, the inheritance must be kept separate from the couple's shared bank accounts.

If there are minor children involved in a divorce and both parties desire the home and one party is determined by the court to be the primary care provider for the children and will be moving forward, the home is likely to be awarded to that person so as to cause as little disruption in the children's life as possible.

While you generally cannot force your spouse to leave the home, there may be an exception in cases where physical abuse is occurring. If you have credible evidence that your spouse has been abusive or threatening to you or to your children, you may be able to get a court order to force your spouse to leave the house.

To legally kick your husband out of the house, California law has certain requirements. It requires a showing of assault or threatened assault if the request is made on an emergency basis. It also requires potential for physical or emotional harm if the request is made on a non-emergency basis.

ANSWER: Though you are the sole legal owner of your home, your husband has a right to live in the house because of your marriage, and so you cannot just change the locks. However, a court can remove that right, depending on how seriously harmful his behaviour is.

Minnesota is an equitable distribution state. This does not necessarily mean a 50-50 settlement of everything. But the law presumes that all assets and debts acquired during the marriage will be divided equitably, including: Your house and other real estate.

The short answer is, probably not. In Minnesota, non-marital property is generally not subject to division. In other words, if the inheritance is non-marital property, you would not be entitled to a share of your spouse's inheritance as part of the divorce proceeding, even if it was received during the marriage.

Minnesota is an equitable distribution state. This does not necessarily mean a 50-50 settlement of everything. But the law presumes that all assets and debts acquired during the marriage will be divided equitably, including: Your house and other real estate.

In California, it is legal for one spouse to force the other to move out for a set time period. This is accomplished through a court order, but the individual must be able to provide evidence of threats of assault or assault attempts if the case is an emergency.

The short answer is, probably not. In Minnesota, non-marital property is generally not subject to division. In other words, if the inheritance is non-marital property, you would not be entitled to a share of your spouse's inheritance as part of the divorce proceeding, even if it was received during the marriage.

In most cases, a person who receives an inheritance is under no obligations to share it with his or her spouse. However, there are some instances in which the inheritance must be shared. Primarily, the inheritance must be kept separate from the couple's shared bank accounts.

If there are minor children involved in a divorce and both parties desire the home and one party is determined by the court to be the primary care provider for the children and will be moving forward, the home is likely to be awarded to that person so as to cause as little disruption in the children's life as possible.

While you generally cannot force your spouse to leave the home, there may be an exception in cases where physical abuse is occurring. If you have credible evidence that your spouse has been abusive or threatening to you or to your children, you may be able to get a court order to force your spouse to leave the house.

To legally kick your husband out of the house, California law has certain requirements. It requires a showing of assault or threatened assault if the request is made on an emergency basis. It also requires potential for physical or emotional harm if the request is made on a non-emergency basis.

ANSWER: Though you are the sole legal owner of your home, your husband has a right to live in the house because of your marriage, and so you cannot just change the locks. However, a court can remove that right, depending on how seriously harmful his behaviour is.

Minnesota is an equitable distribution state. This does not necessarily mean a 50-50 settlement of everything. But the law presumes that all assets and debts acquired during the marriage will be divided equitably, including: Your house and other real estate.

Saint Paul Minnesota Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts Effective Immediately Related Searches

-

notice of entry of judgment dissolution minnesota

-

marriage dissolution mn

-

mn divorce forms

-

mn divorce decree sample

-

mn court forms divorce

-

minnesota default divorce

-

minnesota annulment forms

-

free printable divorce papers mn

-

what is an equitable distribution state

-

property acquired after separation but before divorce

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Minnesota

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Dakota

-

Tennessee

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Note: This summary is not intended to be an all-inclusive discussion of the law of separation agreements in Minnesota, but does include basic and other provisions.

General Summary: Marital Termination Agreements, as stipulations are a judicially-favored means of simplifying and expediting dissolution litigation and, for this reason, are accorded the sanctity of binding contracts. As "binding contracts," a party cannot repudiate or withdraw from a stipulation without the consent of the other party, except "by leave of the court for cause shown".

Property divisions are final and are not subject to modification except where they are the product of mistake or fraud. A precondition to this finality is the duty of the parties to a marital dissolution have a duty to make a full and accurate disclosure of all assets and liabilities to facilitate the trial court's property distribution.

Statutes: MINNESOTA STATUTES

CHAPTER 518 MARRIAGE DISSOLUTION

Division of marital property:

Subdivision 1. General. Upon a dissolution of a marriage, an annulment, or in a proceeding for disposition of property following a dissolution of marriage by a court which lacked personal jurisdiction over the absent spouse or lacked jurisdiction to dispose of the property and which has since acquired jurisdiction, the court shall make a just and equitable division of the marital property of the parties without regard to marital misconduct, after making findings regarding the division of the property. The court shall base its findings on all relevant factors including the length of the marriage, any prior marriage of a party, the age, health, station, occupation, amount and sources of income, vocational skills, employability, estate, liabilities, needs, opportunity for future acquisition of capital assets, and income of each party. The court shall also consider the contribution of each in the acquisition, preservation, depreciation or appreciation in the amount or value of the marital property, as well as the contribution of a spouse as a homemaker. It shall be conclusively presumed that each spouse made a substantial contribution to the acquisition of income and property while they were living together as husband and wife. The court may also award to either spouse the household goods and furniture of the parties, whether or not acquired during the marriage. The court shall value marital assets for purposes of division between the parties as of the day of the initially scheduled prehearing settlement conference, unless a different date is agreed upon by the parties, or unless the court makes specific findings that another date of valuation is fair and equitable. If there is a substantial change in value of an asset between the date of valuation and the final distribution, the court may adjust the valuation of that asset as necessary to effect an equitable distribution.

Subd. 1a. Transfer, encumbrance, concealment, or disposition of marital assets. During the pendency of a marriage dissolution, separation, or annulment proceeding, or in contemplation of commencing a marriage dissolution, separation, or annulment proceeding, each party owes a fiduciary duty to the other for any profit or loss derived by the party, without the consent of the other, from a transaction or from any use by the party of the marital assets. If the court finds that a party to a marriage, without consent of the other party, has in contemplation of commencing, or during the pendency of, the current dissolution, separation, or annulment proceeding, transferred, encumbered, concealed, or disposed of marital assets except in the usual course of business or for the necessities of life, the court shall compensate the other party by placing both parties in the same position that they would have been in had the transfer, encumbrance, concealment, or disposal not occurred. The burden of proof under this subdivision is on the party claiming that the other party transferred, encumbered, concealed, or disposed of marital assets in contemplation of commencing or during the pendency of the current dissolution, separation, or annulment proceeding, without consent of the claiming party, and that the transfer, encumbrance, concealment, or disposal was not in the usual course of business or for the necessities of life. In compensating a party under this section, the court, in dividing the marital property, may impute the entire value of an asset and a fair return on the asset to the party who transferred, encumbered, concealed, or disposed of it. Use of a power of attorney, or the absence of a restraining order against the transfer, encumbrance, concealment, or disposal of marital property is not available as a defense under this subdivision.

Subd. 2. Award of nonmarital property. If the court finds that either spouse's resources or property, including the spouse's portion of the marital property as defined in section 518.54, subdivision 5, are so inadequate as to work an unfair hardship, considering all relevant circumstances, the court may, in addition to the marital property, apportion up to one-half of the property otherwise excluded under section 518.54, subdivision 5, clauses (a) to (d), to prevent the unfair hardship. If the court apportions property other than marital property, it shall make findings in support of the apportionment. The findings shall be based on all relevant factors including the length of the marriage, any prior marriage of a party, the age, health, station, occupation, amount and sources of income, vocational skills, employability, estate, liabilities, needs, and opportunity for future acquisition of capital assets and income of each party.

Subd. 3. Sale or distribution while proceeding pending. (a) If the court finds that it is necessary to preserve the marital assets of the parties, the court may order the sale of the homestead of the parties or the sale of other marital assets, as the individual circumstances may require, during the pendency of a proceeding for a dissolution of marriage or an annulment. If the court orders a sale, it may further provide for the disposition of the funds received from the sale during the pendency of the proceeding. If liquid or readily liquidated marital property other than property representing vested pension benefits or rights is available, the court, so far as possible, shall divide the property representing vested pension benefits or rights by the disposition of an equivalent amount of the liquid or readily liquidated property.

(b) The court may order a partial distribution of marital assets during the pendency of a proceeding for a dissolution of marriage or an annulment for good cause shown or upon the request of both parties, provided that the court shall fully protect the interests of the other party.

Subd. 4. Pension plans. (a) The division of marital property that represents pension plan benefits or rights in the form of future pension plan payments:

(1) is payable only to the extent of the amount of the pension plan benefit payable under the terms of the plan;

(2) is not payable for a period that exceeds the time that pension plan benefits are payable to the pension plan benefit recipient;

(3) is not payable in a lump sum amount from pension plan assets attributable in any fashion to a spouse with the status of an active member, deferred retiree, or benefit recipient of a pension plan;

(4) if the former spouse to whom the payments are to be made dies prior to the end of the specified payment period with the right to any remaining payments accruing to an estate or to more than one survivor, is payable only to a trustee on behalf of the estate or the group of survivors for subsequent apportionment by the trustee; and

(5) in the case of public pension plan benefits or rights, may not commence until the public plan member submits a valid application for a public pension plan benefit and the benefit becomes payable. (b) The individual retirement account plans established under chapter 354B may provide in its plan document, if published and made generally available, for an alternative marital property division or distribution of individual retirement account plan assets. If an alternative division or distribution procedure is provided, it applies in place of paragraph (a), clause (5). Section 518.58.

Modification of orders or decrees:

Subdivision 1. Authority. After an order for maintenance or support money, temporary or permanent, or for the appointment of trustees to receive property awarded as maintenance or support money, the court may from time to time, on motion of either of the parties, a copy of which is served on the public authority responsible for child support enforcement if payments are made through it, or on motion of the public authority responsible for support enforcement, modify the order respecting the amount of maintenance or support money, and the payment of it, and also respecting the appropriation and payment of the principal and income of property held in trust, and may make an order respecting these matters which it might have made in the original proceeding, except as herein otherwise provided. A party or the public authority also may bring a motion for contempt of court if the obligor is in arrears in support or maintenance payments.

Subd. 2. Modification.

(a) The terms of an order respecting maintenance or support may be modified upon a showing of one or more of the following:

(1) substantially increased or decreased earnings of a party;

(2) substantially increased or decreased need of a party or the child or children that are the subject of these proceedings;

(3) receipt of assistance under the AFDC program formerly codified under sections 256.72 to 256.87 or 256B.01 to 256B.40, or chapter 256J or 256K;

(4) a change in the cost of living for either party as measured by the federal bureau of statistics, any of which makes the terms unreasonable and unfair;

(5) extraordinary medical expenses of the child not provided for under section 518.171; or

(6) the addition of work-related or education-related child care expenses of the obligee or a substantial increase or decrease in existing work-related or education-related child care expenses. On a motion to modify support, the needs of any child the obligor has after the entry of the support order that is the subject of a modification motion shall be considered as provided by section 518.551, subdivision 5f.

(b) It is presumed that there has been a substantial change in circumstances under paragraph (a) and the terms of a current support order shall be rebuttably presumed to be unreasonable and unfair if:

(1) the application of the child support guidelines in section 518.551, subdivision 5, to the current circumstances of the parties results in a calculated court order that is at least 20 percent and at least $50 per month higher or lower than the current support order;

(2) the medical support provisions of the order established under section 518.171 are not enforceable by the public authority or the custodial parent;

(3) health coverage ordered under section 518.171 is not available to the child for whom the order is established by the parent ordered to provide; or

(4) the existing support obligation is in the form of a statement of percentage and not a specific dollar amount. (c) On a motion for modification of maintenance, including a motion for the extension of the duration of a maintenance award, the court shall apply, in addition to all other relevant factors, the factors for an award of maintenance under section 518.552 that exist at the time of the motion. On a motion for modification of support, the court:

(1) shall apply section 518.551, subdivision 5, and shall not consider the financial circumstances of each party's spouse, if any; and

(2) shall not consider compensation received by a party for employment in excess of a 40-hour work week, provided that the party demonstrates, and the court finds, that:

(i) the excess employment began after entry of the existing support order;

(ii) the excess employment is voluntary and not a condition of employment;

(iii) the excess employment is in the nature of additional, part-time employment, or overtime employment compensable by the hour or fractions of an hour;

(iv) the party's compensation structure has not been changed for the purpose of affecting a support or maintenance obligation;

(v) in the case of an obligor, current child support payments are at least equal to the guidelines amount based on income not excluded under this clause; and

(vi) in the case of an obligor who is in arrears in child support payments to the obligee, any net income from excess employment must be used to pay the arrearages until the arrearages are paid in full.

(d) A modification of support or maintenance, including interest that accrued pursuant to section 548.091, may be made retroactive only with respect to any period during which the petitioning party has pending a motion for modification but only from the date of service of notice of the motion on the responding party and on the public authority if public assistance is being furnished or the county attorney is the attorney of record.

However, modification may be applied to an earlier period if the court makes express findings that:

(1) the party seeking modification was precluded from serving a motion by reason of a significant physical or mental disability, a material misrepresentation of another party, or fraud upon the court and that the party seeking modification, when no longer precluded, promptly served a motion;

(2) the party seeking modification was a recipient of federal Supplemental Security Income (SSI), Title II Older Americans, Survivor's Disability Insurance (OASDI), other disability benefits, or public assistance based upon need during the period for which retroactive modification is sought; or

(3) the order for which the party seeks amendment was entered by default, the party shows good cause for not appearing, and the record contains no factual evidence, or clearly erroneous evidence regarding the individual obligor's ability to pay. The court may provide that a reduction in the amount allocated for child care expenses based on a substantial decrease in the expenses is effective as of the date the expenses decreased.

(e) Except for an award of the right of occupancy of the homestead, provided in section 518.63, all divisions of real and personal property provided by section 518.58 shall be final, and may be revoked or modified only where the court finds the existence of conditions that justify reopening a judgment under the laws of this state, including motions under section 518.145, subdivision 2. The court may impose a lien or charge on the divided property at any time while the property, or subsequently acquired property, is owned by the parties or either of them, for the payment of maintenance or support money, or may sequester the property as is provided by section 518.24.

(f) The court need not hold an evidentiary hearing on a motion for modification of maintenance or support.

(g) Section 518.14 shall govern the award of attorney fees for motions brought under this subdivision.

Subd. 3. Maintenance on death or remarriage. Unless otherwise agreed in writing or expressly provided in the decree, the obligation to pay future maintenance is terminated upon the death of either party or the remarriage of the party receiving maintenance.

Subd. 4. Child support on death of obligor. Unless otherwise agreed in writing or expressly provided in the order, provisions for the support of a child are not terminated by the death of a parent obligated to support the child. When a parent obligated to pay support dies, the amount of support may be modified, revoked, or commuted to a lump sum payment, to the extent just and appropriate in the circumstances.

Subd. 4a. Automatic termination of support.

(a) Unless a court order provides otherwise, a child support obligation in a specific amount per child terminates automatically and without any action by the obligor to reduce, modify, or terminate the order upon the emancipation of the child as provided under section 518.54, subdivision 2.

(b) A child support obligation for two or more children that is not a support obligation in a specific amount per child continues in the full amount until the emancipation of the last child for whose benefit the order was made, or until further order of the court.

(c) The obligor may request a modification of the obligor's child support order upon the emancipation of a child if there are still minor children under the order. The child support obligation shall be determined based on the income of the parties at the time the modification is sought.

Subd. 5. Form. The state court administrator's office shall prepare and make available to court administrators, obligors, and persons to whom child support is owed a form to be submitted by the obligor or the person to whom child support is owed in support of a motion for a modification of an order for support or maintenance or for contempt of court. Section 518.64.

Decree, finality and reopening:

Subdivision 1. Appeal. A decree of dissolution of marriage or of legal separation is final when entered, subject to the right of appeal. When entered, the findings of fact and conclusions of law may constitute the judgment and decree. An appeal from the decree of dissolution that does not challenge the finding that the marriage is irretrievably broken does not delay the finality of that provision of the decree which dissolves the marriage beyond the time for appealing from that provision. A party may remarry before the time for appeal has run if it is not contested that the marriage is irretrievably broken or if a stipulation that the marriage is irretrievably broken is incorporated in the decree of dissolution.

Subd. 2. Reopening. On motion and upon terms as are just, the court may relieve a party from a judgment and decree, order, or proceeding under this chapter, except for provisions dissolving the bonds of marriage, annulling the marriage, or directing that the parties are legally separated, and may order a new trial or grant other relief as may be just for the following reasons:

(1) mistake, inadvertence, surprise, or excusable neglect;

(2) newly discovered evidence which by due diligence could not have been discovered in time to move for a new trial under the rules of civil

(3) fraud, whether denominated intrinsic or extrinsic, misrepresentation, or other misconduct of an adverse party;

(4) the judgment and decree or order is void; or

(5) the judgment has been satisfied, released, or discharged, or a prior judgment and decree or order upon which it is based has been reversed or otherwise vacated, or it is no longer equitable that the judgment and decree or order should have prospective application. The motion must be made within a reasonable time, and for a reason under clause (1), (2), or (3), not more than one year after the judgment and decree, order, or proceeding was entered or taken. A motion under this subdivision does not affect the finality of a judgment and decree or order or suspend its operation. This subdivision does not limit the power of a court to entertain an independent action to relieve a party from a judgment and decree, order, or proceeding or to grant relief to a party not actually personally notified as provided in the rules of civil procedure, or to set aside a judgment for fraud upon the court. Section 518.145.

Case Law:

Stipulations are a judicially-favored means of simplifying and expediting dissolution litigation and, for this reason, are "accorded the sanctity of binding contracts."

Shirk v. Shirk, 561 N.W.2d 519 (Minn. 1997). As "binding contracts," a party cannot repudiate or withdraw from a stipulation without the consent of the other party, except "by leave of the court for cause shown." Shirk v. Shirk, 561 N.W.2d 519 (Minn. 1997). Thus, even though the district court had yet to adopt the parties' stipulation or incorporate it into a dissolution judgment, appellant could not repudiate or withdraw from the stipulation absent respondent's consent or the court's permission. Toughill v. Toughill, 609 N.W.2d 634 (Minn.App. 2000).

The district court is a third party to dissolution proceedings and has the authority to refuse to accept the terms of a stipulation "in part or in toto." Karon v. Karon, 435 N.W.2d 501, 503 (Minn. 1989).

When a judgment and decree is entered based on a stipulation, the stipulation is merged into the judgment and cannot thereafter be attacked by a party seeking relief from the judgment and decree. Shirk v. Shirk, 561 N.W.2d 519, 522 (Minn. 1997). The sole relief from the judgment and decree lies in meeting the requirements of Minn.Stat. § 518.145, subd. 2. Shirk v. Shirk, 561 N.W.2d 519, 522 (Minn. 1997).

Property divisions are final and are not subject to modification except where they are the product of mistake or fraud. Kerr v. Kerr, 243 N.W.2d 313 (Minn. 1976); see Minn.Stat. § 518.64 (1984). Mere unforeseen circumstances will not permit a reopening of the judgment. Hestekin v. Hestekin, 587 N.W.2d 308, 310 (Minn.App. 1998).

The parties to a marital dissolution have a duty to make a full and accurate disclosure of all assets and liabilities to facilitate the trial court's property distribution. Fraud on the court must amount to an intentional course of material misrepresentation or non-disclosure, having the result of misleading the court and opposing counsel and making the property settlement grossly unfair. Ronnkvist v. Ronnkvist, 331 N.W.2d 764, 765-66 (Minn. 1983)

Custody provisions contained in a stipulated decree must be accorded a good deal of deference, in that they represent the terms specifically agreed to by the parties and adopted by the court. Where * * * the parties have agreed, by stipulated decree, to joint legal custody and joint physical custody, and the court has accepted that denomination, the parties will be bound by it. Ayers v. Ayers, 508 N.W.2d 515, 520 (Minn. 1993).

Note: This summary is not intended to be an all-inclusive discussion of the law of separation agreements in Minnesota, but does include basic and other provisions.

General Summary: Marital Termination Agreements, as stipulations are a judicially-favored means of simplifying and expediting dissolution litigation and, for this reason, are accorded the sanctity of binding contracts. As "binding contracts," a party cannot repudiate or withdraw from a stipulation without the consent of the other party, except "by leave of the court for cause shown".

Property divisions are final and are not subject to modification except where they are the product of mistake or fraud. A precondition to this finality is the duty of the parties to a marital dissolution have a duty to make a full and accurate disclosure of all assets and liabilities to facilitate the trial court's property distribution.

Statutes: MINNESOTA STATUTES

CHAPTER 518 MARRIAGE DISSOLUTION

Division of marital property:

Subdivision 1. General. Upon a dissolution of a marriage, an annulment, or in a proceeding for disposition of property following a dissolution of marriage by a court which lacked personal jurisdiction over the absent spouse or lacked jurisdiction to dispose of the property and which has since acquired jurisdiction, the court shall make a just and equitable division of the marital property of the parties without regard to marital misconduct, after making findings regarding the division of the property. The court shall base its findings on all relevant factors including the length of the marriage, any prior marriage of a party, the age, health, station, occupation, amount and sources of income, vocational skills, employability, estate, liabilities, needs, opportunity for future acquisition of capital assets, and income of each party. The court shall also consider the contribution of each in the acquisition, preservation, depreciation or appreciation in the amount or value of the marital property, as well as the contribution of a spouse as a homemaker. It shall be conclusively presumed that each spouse made a substantial contribution to the acquisition of income and property while they were living together as husband and wife. The court may also award to either spouse the household goods and furniture of the parties, whether or not acquired during the marriage. The court shall value marital assets for purposes of division between the parties as of the day of the initially scheduled prehearing settlement conference, unless a different date is agreed upon by the parties, or unless the court makes specific findings that another date of valuation is fair and equitable. If there is a substantial change in value of an asset between the date of valuation and the final distribution, the court may adjust the valuation of that asset as necessary to effect an equitable distribution.

Subd. 1a. Transfer, encumbrance, concealment, or disposition of marital assets. During the pendency of a marriage dissolution, separation, or annulment proceeding, or in contemplation of commencing a marriage dissolution, separation, or annulment proceeding, each party owes a fiduciary duty to the other for any profit or loss derived by the party, without the consent of the other, from a transaction or from any use by the party of the marital assets. If the court finds that a party to a marriage, without consent of the other party, has in contemplation of commencing, or during the pendency of, the current dissolution, separation, or annulment proceeding, transferred, encumbered, concealed, or disposed of marital assets except in the usual course of business or for the necessities of life, the court shall compensate the other party by placing both parties in the same position that they would have been in had the transfer, encumbrance, concealment, or disposal not occurred. The burden of proof under this subdivision is on the party claiming that the other party transferred, encumbered, concealed, or disposed of marital assets in contemplation of commencing or during the pendency of the current dissolution, separation, or annulment proceeding, without consent of the claiming party, and that the transfer, encumbrance, concealment, or disposal was not in the usual course of business or for the necessities of life. In compensating a party under this section, the court, in dividing the marital property, may impute the entire value of an asset and a fair return on the asset to the party who transferred, encumbered, concealed, or disposed of it. Use of a power of attorney, or the absence of a restraining order against the transfer, encumbrance, concealment, or disposal of marital property is not available as a defense under this subdivision.

Subd. 2. Award of nonmarital property. If the court finds that either spouse's resources or property, including the spouse's portion of the marital property as defined in section 518.54, subdivision 5, are so inadequate as to work an unfair hardship, considering all relevant circumstances, the court may, in addition to the marital property, apportion up to one-half of the property otherwise excluded under section 518.54, subdivision 5, clauses (a) to (d), to prevent the unfair hardship. If the court apportions property other than marital property, it shall make findings in support of the apportionment. The findings shall be based on all relevant factors including the length of the marriage, any prior marriage of a party, the age, health, station, occupation, amount and sources of income, vocational skills, employability, estate, liabilities, needs, and opportunity for future acquisition of capital assets and income of each party.

Subd. 3. Sale or distribution while proceeding pending. (a) If the court finds that it is necessary to preserve the marital assets of the parties, the court may order the sale of the homestead of the parties or the sale of other marital assets, as the individual circumstances may require, during the pendency of a proceeding for a dissolution of marriage or an annulment. If the court orders a sale, it may further provide for the disposition of the funds received from the sale during the pendency of the proceeding. If liquid or readily liquidated marital property other than property representing vested pension benefits or rights is available, the court, so far as possible, shall divide the property representing vested pension benefits or rights by the disposition of an equivalent amount of the liquid or readily liquidated property.

(b) The court may order a partial distribution of marital assets during the pendency of a proceeding for a dissolution of marriage or an annulment for good cause shown or upon the request of both parties, provided that the court shall fully protect the interests of the other party.

Subd. 4. Pension plans. (a) The division of marital property that represents pension plan benefits or rights in the form of future pension plan payments:

(1) is payable only to the extent of the amount of the pension plan benefit payable under the terms of the plan;

(2) is not payable for a period that exceeds the time that pension plan benefits are payable to the pension plan benefit recipient;

(3) is not payable in a lump sum amount from pension plan assets attributable in any fashion to a spouse with the status of an active member, deferred retiree, or benefit recipient of a pension plan;

(4) if the former spouse to whom the payments are to be made dies prior to the end of the specified payment period with the right to any remaining payments accruing to an estate or to more than one survivor, is payable only to a trustee on behalf of the estate or the group of survivors for subsequent apportionment by the trustee; and

(5) in the case of public pension plan benefits or rights, may not commence until the public plan member submits a valid application for a public pension plan benefit and the benefit becomes payable. (b) The individual retirement account plans established under chapter 354B may provide in its plan document, if published and made generally available, for an alternative marital property division or distribution of individual retirement account plan assets. If an alternative division or distribution procedure is provided, it applies in place of paragraph (a), clause (5). Section 518.58.

Modification of orders or decrees:

Subdivision 1. Authority. After an order for maintenance or support money, temporary or permanent, or for the appointment of trustees to receive property awarded as maintenance or support money, the court may from time to time, on motion of either of the parties, a copy of which is served on the public authority responsible for child support enforcement if payments are made through it, or on motion of the public authority responsible for support enforcement, modify the order respecting the amount of maintenance or support money, and the payment of it, and also respecting the appropriation and payment of the principal and income of property held in trust, and may make an order respecting these matters which it might have made in the original proceeding, except as herein otherwise provided. A party or the public authority also may bring a motion for contempt of court if the obligor is in arrears in support or maintenance payments.

Subd. 2. Modification.

(a) The terms of an order respecting maintenance or support may be modified upon a showing of one or more of the following:

(1) substantially increased or decreased earnings of a party;

(2) substantially increased or decreased need of a party or the child or children that are the subject of these proceedings;

(3) receipt of assistance under the AFDC program formerly codified under sections 256.72 to 256.87 or 256B.01 to 256B.40, or chapter 256J or 256K;

(4) a change in the cost of living for either party as measured by the federal bureau of statistics, any of which makes the terms unreasonable and unfair;

(5) extraordinary medical expenses of the child not provided for under section 518.171; or

(6) the addition of work-related or education-related child care expenses of the obligee or a substantial increase or decrease in existing work-related or education-related child care expenses. On a motion to modify support, the needs of any child the obligor has after the entry of the support order that is the subject of a modification motion shall be considered as provided by section 518.551, subdivision 5f.

(b) It is presumed that there has been a substantial change in circumstances under paragraph (a) and the terms of a current support order shall be rebuttably presumed to be unreasonable and unfair if:

(1) the application of the child support guidelines in section 518.551, subdivision 5, to the current circumstances of the parties results in a calculated court order that is at least 20 percent and at least $50 per month higher or lower than the current support order;

(2) the medical support provisions of the order established under section 518.171 are not enforceable by the public authority or the custodial parent;

(3) health coverage ordered under section 518.171 is not available to the child for whom the order is established by the parent ordered to provide; or

(4) the existing support obligation is in the form of a statement of percentage and not a specific dollar amount. (c) On a motion for modification of maintenance, including a motion for the extension of the duration of a maintenance award, the court shall apply, in addition to all other relevant factors, the factors for an award of maintenance under section 518.552 that exist at the time of the motion. On a motion for modification of support, the court:

(1) shall apply section 518.551, subdivision 5, and shall not consider the financial circumstances of each party's spouse, if any; and

(2) shall not consider compensation received by a party for employment in excess of a 40-hour work week, provided that the party demonstrates, and the court finds, that:

(i) the excess employment began after entry of the existing support order;

(ii) the excess employment is voluntary and not a condition of employment;

(iii) the excess employment is in the nature of additional, part-time employment, or overtime employment compensable by the hour or fractions of an hour;

(iv) the party's compensation structure has not been changed for the purpose of affecting a support or maintenance obligation;

(v) in the case of an obligor, current child support payments are at least equal to the guidelines amount based on income not excluded under this clause; and

(vi) in the case of an obligor who is in arrears in child support payments to the obligee, any net income from excess employment must be used to pay the arrearages until the arrearages are paid in full.

(d) A modification of support or maintenance, including interest that accrued pursuant to section 548.091, may be made retroactive only with respect to any period during which the petitioning party has pending a motion for modification but only from the date of service of notice of the motion on the responding party and on the public authority if public assistance is being furnished or the county attorney is the attorney of record.

However, modification may be applied to an earlier period if the court makes express findings that:

(1) the party seeking modification was precluded from serving a motion by reason of a significant physical or mental disability, a material misrepresentation of another party, or fraud upon the court and that the party seeking modification, when no longer precluded, promptly served a motion;

(2) the party seeking modification was a recipient of federal Supplemental Security Income (SSI), Title II Older Americans, Survivor's Disability Insurance (OASDI), other disability benefits, or public assistance based upon need during the period for which retroactive modification is sought; or

(3) the order for which the party seeks amendment was entered by default, the party shows good cause for not appearing, and the record contains no factual evidence, or clearly erroneous evidence regarding the individual obligor's ability to pay. The court may provide that a reduction in the amount allocated for child care expenses based on a substantial decrease in the expenses is effective as of the date the expenses decreased.

(e) Except for an award of the right of occupancy of the homestead, provided in section 518.63, all divisions of real and personal property provided by section 518.58 shall be final, and may be revoked or modified only where the court finds the existence of conditions that justify reopening a judgment under the laws of this state, including motions under section 518.145, subdivision 2. The court may impose a lien or charge on the divided property at any time while the property, or subsequently acquired property, is owned by the parties or either of them, for the payment of maintenance or support money, or may sequester the property as is provided by section 518.24.

(f) The court need not hold an evidentiary hearing on a motion for modification of maintenance or support.

(g) Section 518.14 shall govern the award of attorney fees for motions brought under this subdivision.

Subd. 3. Maintenance on death or remarriage. Unless otherwise agreed in writing or expressly provided in the decree, the obligation to pay future maintenance is terminated upon the death of either party or the remarriage of the party receiving maintenance.

Subd. 4. Child support on death of obligor. Unless otherwise agreed in writing or expressly provided in the order, provisions for the support of a child are not terminated by the death of a parent obligated to support the child. When a parent obligated to pay support dies, the amount of support may be modified, revoked, or commuted to a lump sum payment, to the extent just and appropriate in the circumstances.

Subd. 4a. Automatic termination of support.

(a) Unless a court order provides otherwise, a child support obligation in a specific amount per child terminates automatically and without any action by the obligor to reduce, modify, or terminate the order upon the emancipation of the child as provided under section 518.54, subdivision 2.

(b) A child support obligation for two or more children that is not a support obligation in a specific amount per child continues in the full amount until the emancipation of the last child for whose benefit the order was made, or until further order of the court.

(c) The obligor may request a modification of the obligor's child support order upon the emancipation of a child if there are still minor children under the order. The child support obligation shall be determined based on the income of the parties at the time the modification is sought.

Subd. 5. Form. The state court administrator's office shall prepare and make available to court administrators, obligors, and persons to whom child support is owed a form to be submitted by the obligor or the person to whom child support is owed in support of a motion for a modification of an order for support or maintenance or for contempt of court. Section 518.64.

Decree, finality and reopening:

Subdivision 1. Appeal. A decree of dissolution of marriage or of legal separation is final when entered, subject to the right of appeal. When entered, the findings of fact and conclusions of law may constitute the judgment and decree. An appeal from the decree of dissolution that does not challenge the finding that the marriage is irretrievably broken does not delay the finality of that provision of the decree which dissolves the marriage beyond the time for appealing from that provision. A party may remarry before the time for appeal has run if it is not contested that the marriage is irretrievably broken or if a stipulation that the marriage is irretrievably broken is incorporated in the decree of dissolution.

Subd. 2. Reopening. On motion and upon terms as are just, the court may relieve a party from a judgment and decree, order, or proceeding under this chapter, except for provisions dissolving the bonds of marriage, annulling the marriage, or directing that the parties are legally separated, and may order a new trial or grant other relief as may be just for the following reasons:

(1) mistake, inadvertence, surprise, or excusable neglect;

(2) newly discovered evidence which by due diligence could not have been discovered in time to move for a new trial under the rules of civil

(3) fraud, whether denominated intrinsic or extrinsic, misrepresentation, or other misconduct of an adverse party;

(4) the judgment and decree or order is void; or

(5) the judgment has been satisfied, released, or discharged, or a prior judgment and decree or order upon which it is based has been reversed or otherwise vacated, or it is no longer equitable that the judgment and decree or order should have prospective application. The motion must be made within a reasonable time, and for a reason under clause (1), (2), or (3), not more than one year after the judgment and decree, order, or proceeding was entered or taken. A motion under this subdivision does not affect the finality of a judgment and decree or order or suspend its operation. This subdivision does not limit the power of a court to entertain an independent action to relieve a party from a judgment and decree, order, or proceeding or to grant relief to a party not actually personally notified as provided in the rules of civil procedure, or to set aside a judgment for fraud upon the court. Section 518.145.

Case Law:

Stipulations are a judicially-favored means of simplifying and expediting dissolution litigation and, for this reason, are "accorded the sanctity of binding contracts."

Shirk v. Shirk, 561 N.W.2d 519 (Minn. 1997). As "binding contracts," a party cannot repudiate or withdraw from a stipulation without the consent of the other party, except "by leave of the court for cause shown." Shirk v. Shirk, 561 N.W.2d 519 (Minn. 1997). Thus, even though the district court had yet to adopt the parties' stipulation or incorporate it into a dissolution judgment, appellant could not repudiate or withdraw from the stipulation absent respondent's consent or the court's permission. Toughill v. Toughill, 609 N.W.2d 634 (Minn.App. 2000).

The district court is a third party to dissolution proceedings and has the authority to refuse to accept the terms of a stipulation "in part or in toto." Karon v. Karon, 435 N.W.2d 501, 503 (Minn. 1989).

When a judgment and decree is entered based on a stipulation, the stipulation is merged into the judgment and cannot thereafter be attacked by a party seeking relief from the judgment and decree. Shirk v. Shirk, 561 N.W.2d 519, 522 (Minn. 1997). The sole relief from the judgment and decree lies in meeting the requirements of Minn.Stat. § 518.145, subd. 2. Shirk v. Shirk, 561 N.W.2d 519, 522 (Minn. 1997).

Property divisions are final and are not subject to modification except where they are the product of mistake or fraud. Kerr v. Kerr, 243 N.W.2d 313 (Minn. 1976); see Minn.Stat. § 518.64 (1984). Mere unforeseen circumstances will not permit a reopening of the judgment. Hestekin v. Hestekin, 587 N.W.2d 308, 310 (Minn.App. 1998).

The parties to a marital dissolution have a duty to make a full and accurate disclosure of all assets and liabilities to facilitate the trial court's property distribution. Fraud on the court must amount to an intentional course of material misrepresentation or non-disclosure, having the result of misleading the court and opposing counsel and making the property settlement grossly unfair. Ronnkvist v. Ronnkvist, 331 N.W.2d 764, 765-66 (Minn. 1983)

Custody provisions contained in a stipulated decree must be accorded a good deal of deference, in that they represent the terms specifically agreed to by the parties and adopted by the court. Where * * * the parties have agreed, by stipulated decree, to joint legal custody and joint physical custody, and the court has accepted that denomination, the parties will be bound by it. Ayers v. Ayers, 508 N.W.2d 515, 520 (Minn. 1993).