A Minneapolis Minnesota living trust for husband and wife with one child is a legal document that is designed to protect and manage the assets and properties owned by the couple for the benefit of their child. By creating this type of trust, parents can have peace of mind knowing that their child's financial future and well-being are secured. Keywords: Minneapolis Minnesota living trust, husband and wife, one child, legal document, protect assets, manage properties, financial future, well-being. There are several types of Minneapolis Minnesota living trusts for husband and wife with one child that can be established based on specific needs and goals: 1. Revocable Living Trust: A revocable living trust allows the granters (husband and wife) to maintain control over their assets during their lifetime. They have the flexibility to manage, modify, or revoke the trust as they see fit. This type of trust also avoids the probate process, which can save both time and costs for the family. 2. Irrevocable Living Trust: An irrevocable living trust, as the name suggests, cannot be modified or revoked without the consent of the beneficiaries. This type of trust offers added asset protection and can be beneficial for individuals seeking to minimize estate taxes. Once assets are transferred into the trust, they are no longer considered part of the granters' estates. 3. Testamentary Living Trust: A testamentary living trust is created through a will and only comes into effect upon the death of the granters. This type of trust can be useful for couples who wish to leave assets to their child in a structured manner, providing guidance on when and how the assets are distributed. 4. Special Needs Trust: A special needs trust is designed for parents with a child who has special needs or disabilities. This trust ensures that the child's eligibility for government benefits is not compromised by inheritance. It provides for their supplemental needs without affecting their access to programs such as Medicaid or Social Security. 5. Educational Trust: An educational trust is a type of trust that specifically focuses on financing the child's education. Parents can set up this trust to cover tuition fees, books, housing, and other educational expenses. By creating an educational trust, parents can support their child's academic journey and provide them with the resources necessary for a successful future. In summary, a Minneapolis Minnesota living trust for husband and wife with one child is a valuable legal tool that allows couples to protect and manage their assets for the benefit of their child. By understanding the different types of living trusts available, couples can choose the one that best suits their objectives and ensures a secure future for their child.

Minneapolis Minnesota Living Trust for Husband and Wife with One Child

Description

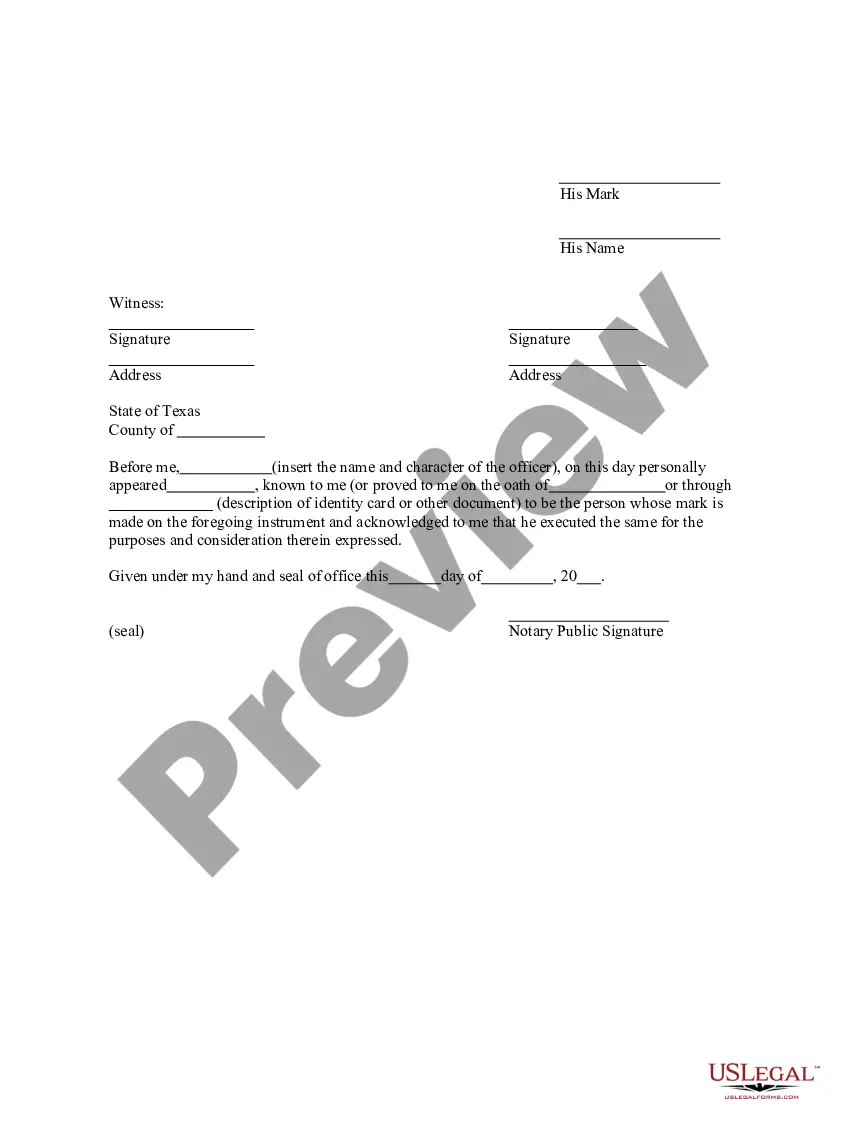

How to fill out Minneapolis Minnesota Living Trust For Husband And Wife With One Child?

Are you looking for a reliable and affordable legal forms provider to buy the Minneapolis Minnesota Living Trust for Husband and Wife with One Child? US Legal Forms is your go-to choice.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked based on the requirements of separate state and area.

To download the form, you need to log in account, find the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Minneapolis Minnesota Living Trust for Husband and Wife with One Child conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the form is good for.

- Restart the search in case the form isn’t suitable for your legal situation.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Minneapolis Minnesota Living Trust for Husband and Wife with One Child in any available file format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending hours learning about legal paperwork online once and for all.