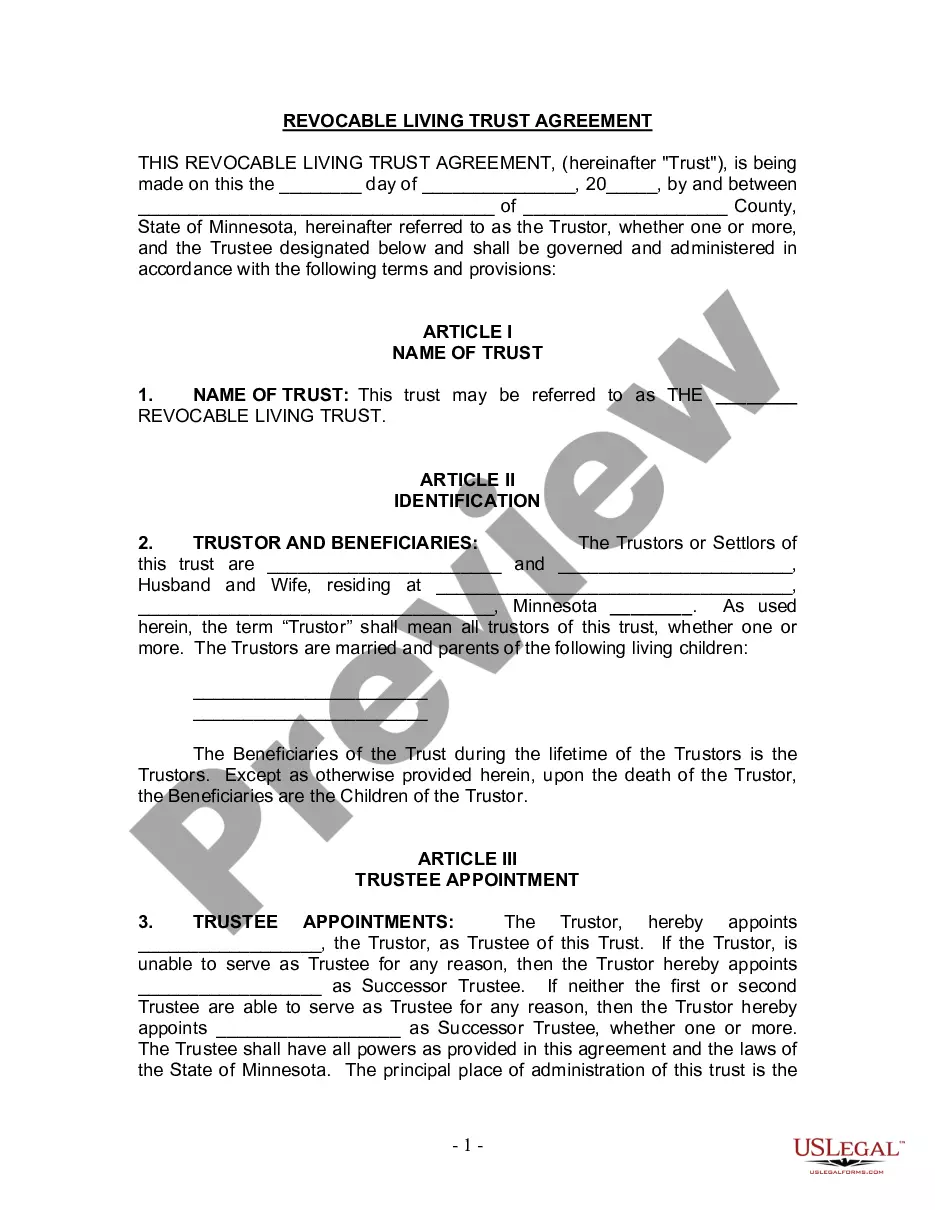

Hennepin Minnesota Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Minnesota Living Trust For Husband And Wife With Minor And Or Adult Children?

We consistently endeavor to minimize or avert legal complications when handling intricate legal or financial issues.

To achieve this, we engage in attorney services that are often quite costly.

Nonetheless, not every legal issue is equally intricate; many can be addressed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My documents tab. The process is equally simple if you’re new to the platform! You can create your account in just a few minutes. Ensure that the Hennepin Minnesota Living Trust for Husband and Wife with Minor and/or Adult Children conforms to the laws and regulations of your state and area. Additionally, it’s essential to review the form’s description (if provided), and if you find any inconsistencies with what you initially sought, look for a different form. Once you’ve confirmed that the Hennepin Minnesota Living Trust for Husband and Wife with Minor and/or Adult Children is appropriate for your situation, you can choose the subscription option and proceed to payment. Then you can download the document in any format available. For over 24 years, we’ve assisted millions by providing ready-to-customize, up-to-date legal documents. Take full advantage of US Legal Forms now to conserve time and resources!

- Our platform empowers you to manage your affairs without the need for a lawyer's services.

- We provide access to legal document templates that are not always readily accessible.

- Our templates are customized for specific states and regions, significantly easing the search process.

- Utilize US Legal Forms whenever you need to find and securely download the Hennepin Minnesota Living Trust for Husband and Wife with Minor and/or Adult Children or any other document swiftly.

Form popularity

FAQ

Whether a husband and wife should have separate living trusts largely depends on their financial situation and goals. A joint Hennepin Minnesota Living Trust for Husband and Wife with Minor and or Adult Children can simplify asset management and provide unified distribution. However, separate trusts may better serve couples with different financial interests or children from previous relationships. Consulting with a legal professional can clarify the best approach for your unique situation.

Yes, you can write your own trust in Minnesota, including a Hennepin Minnesota Living Trust for Husband and Wife with Minor and or Adult Children. However, it's crucial to ensure that your trust complies with state laws to avoid future issues. Utilizing a resource like USLegalForms can provide templates and legal guidance to help you create a valid, effective trust tailored to your needs.

A notable disadvantage of a family trust is the potential for family disagreements over the distribution of assets. With a Hennepin Minnesota Living Trust for Husband and Wife with Minor and or Adult Children, clear communication and documentation become essential to prevent conflicts. Moreover, setting up a trust can involve ongoing management and potential legal fees, which families should consider when evaluating this option.

One of the biggest mistakes parents make when establishing a Hennepin Minnesota Living Trust for Husband and Wife with Minor and or Adult Children is failing to fund the trust properly. If assets are not transferred into the trust, it cannot effectively manage those assets as intended. Additionally, neglecting to review and update the trust as family circumstances change can lead to outdated provisions that do not reflect current realities.

Deciding whether your parents should put their assets in a Hennepin Minnesota Living Trust for Husband and Wife with Minor and or Adult Children often depends on their unique financial situation. Trusts can provide more control over asset distribution and may help in avoiding probate. However, it's important for them to consult with a legal expert to evaluate their specific needs and goals before making this decision.

One downside of putting assets in a Hennepin Minnesota Living Trust for Husband and Wife with Minor and or Adult Children is the potential for complexities and fees. Setting up and maintaining a trust may require legal assistance, which can add costs. Additionally, if the trust is not managed properly, it may lead to unintended tax consequences. Understanding these factors is crucial for informed decision-making.

Deciding whether married couples should have separate living trusts can depend on various factors like financial goals and family structure. A Hennepin Minnesota Living Trust for Husband and Wife with Minor and or Adult Children can streamline joint asset management. However, separate trusts may be advantageous for addressing individual needs, especially if there are children from previous marriages. Seeking advice from professionals can help you evaluate the best option for both you and your spouse.

Yes, you can create a living trust independently, even without your husband. Establishing a Hennepin Minnesota Living Trust for Husband and Wife with Minor and or Adult Children allows for greater flexibility in managing your assets and planning for the future. This can be particularly beneficial if you want to ensure your wishes are honored without waiting for joint agreement. Be sure to consult legal resources to guide you through the process.

In many cases, husband and wife can create a joint living trust, which simplifies management and reduces paperwork. However, separate Hennepin Minnesota Living Trusts for Husband and Wife with Minor and or Adult Children may offer benefits like individualized control over assets. It ultimately depends on individual financial situations and family dynamics. Consulting with a legal expert can provide clarity based on your unique circumstances.