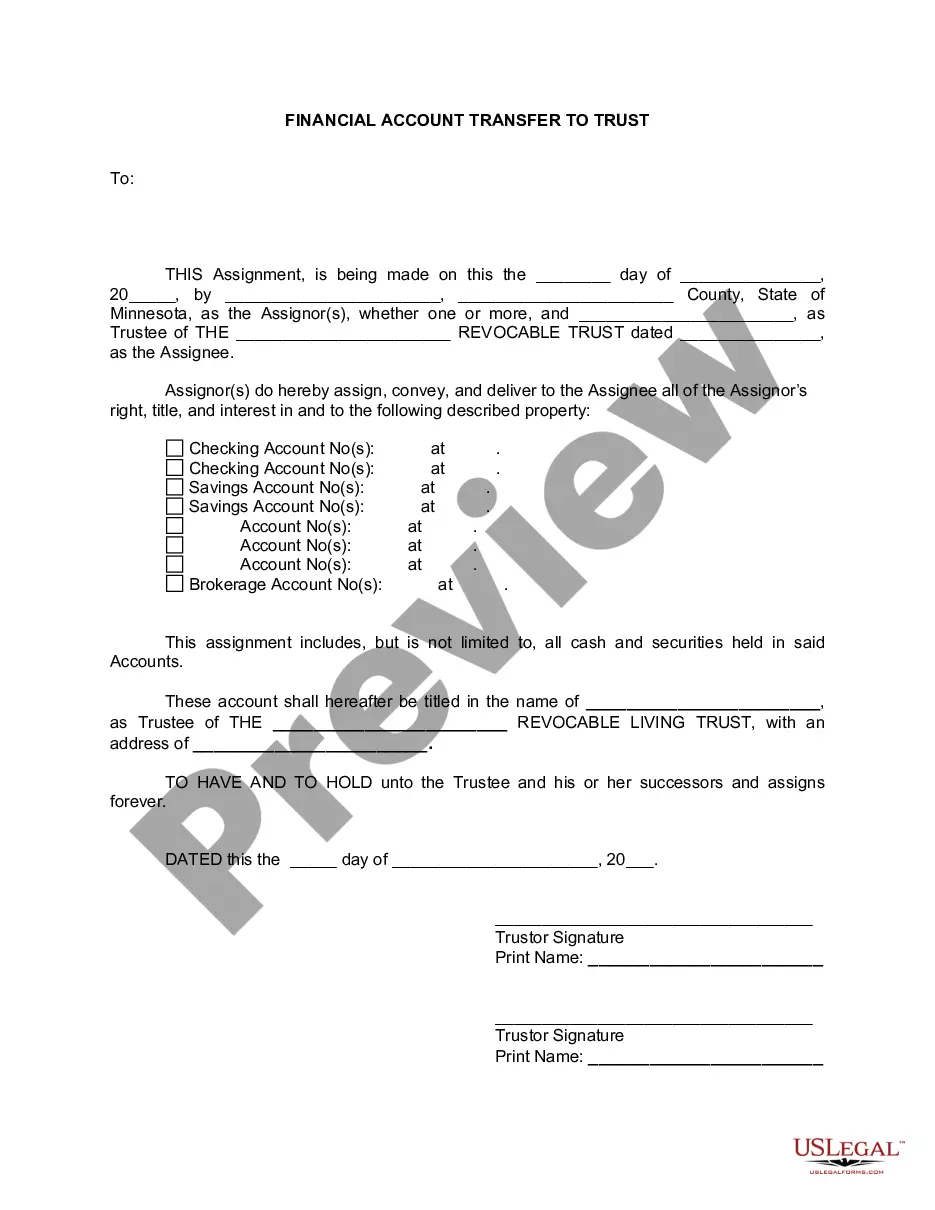

Saint Paul Minnesota Financial Account Transfer to Living Trust In Saint Paul, Minnesota, a financial account transfer to a living trust is a method of streamlining and safeguarding one's financial assets for the future. By establishing a living trust, individuals can ensure that their financial accounts are transferred smoothly, avoiding probate and ensuring an efficient distribution of their assets upon their passing. Living trusts offer several benefits, including privacy, flexibility, and control over the distribution of assets. Unlike a will, which becomes a matter of public record upon probate, a living trust allows for the private transfer of financial accounts, protecting sensitive information from prying eyes. Various types of financial accounts can be transferred to a living trust in Saint Paul, Minnesota, including: 1. Bank Accounts: Savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs) can all be transferred to a living trust. This ensures that the account holder's funds are managed according to their wishes, even if they become incapacitated or pass away. 2. Investment Accounts: Stocks, bonds, mutual funds, and other investment accounts can be transferred to a living trust. This enables better management and control over these assets, ensuring they are distributed to designated beneficiaries efficiently. 3. Retirement Accounts: IRA accounts, 401(k)s, and other retirement accounts can also be transferred to a living trust. Care must be taken with this type of transfer, as there are specific rules and considerations involved. 4. Life Insurance Policies: In certain cases, individuals may choose to transfer ownership of life insurance policies to a living trust. This ensures that the proceeds from the policy are distributed according to the trust's guidelines rather than going through probate. To initiate a financial account transfer to a living trust in Saint Paul, Minnesota, individuals must follow a series of steps. These typically include: 1. Creating a Living Trust: Seek advice from an experienced estate planning attorney in Saint Paul to establish a living trust. This involves naming a trustee, beneficiaries, and specifying the terms and conditions under which the financial accounts should be managed and distributed. 2. Updating Account Registrations: Contact financial institutions where the accounts are held and provide them with the necessary documentation to transfer ownership to the living trust. This may involve completing forms and providing a copy of the trust agreement. 3. Working with Professionals: Collaborate with professionals such as lawyers, financial advisors, and accountants to ensure the proper transfer of accounts and adherence to legal requirements. 4. Maintaining Records: Keep meticulous records of all financial account transfers to the living trust. These records will be invaluable when it comes time to distribute assets or update the trust in the future. By engaging in a financial account transfer to a living trust, residents of Saint Paul, Minnesota can secure their financial future and establish an efficient estate plan. With the proper guidance and understanding of the various account types that can be transferred, individuals can ensure the protection and successful distribution of their assets, bringing peace of mind to themselves and their loved ones.

Saint Paul Minnesota Financial Account Transfer to Living Trust

Description

How to fill out Saint Paul Minnesota Financial Account Transfer To Living Trust?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for legal services that, as a rule, are extremely expensive. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of an attorney. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Saint Paul Minnesota Financial Account Transfer to Living Trust or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Saint Paul Minnesota Financial Account Transfer to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Saint Paul Minnesota Financial Account Transfer to Living Trust would work for your case, you can select the subscription option and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!