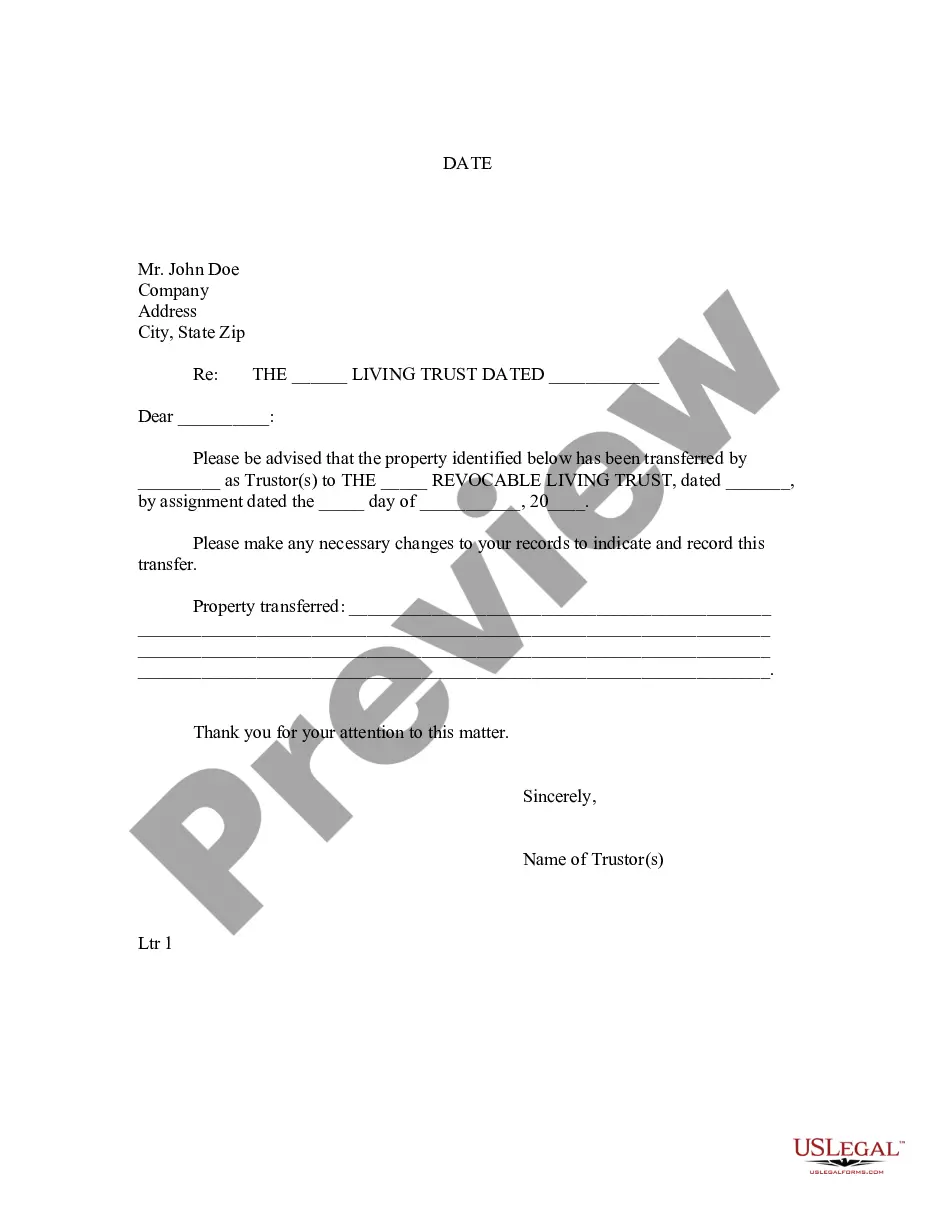

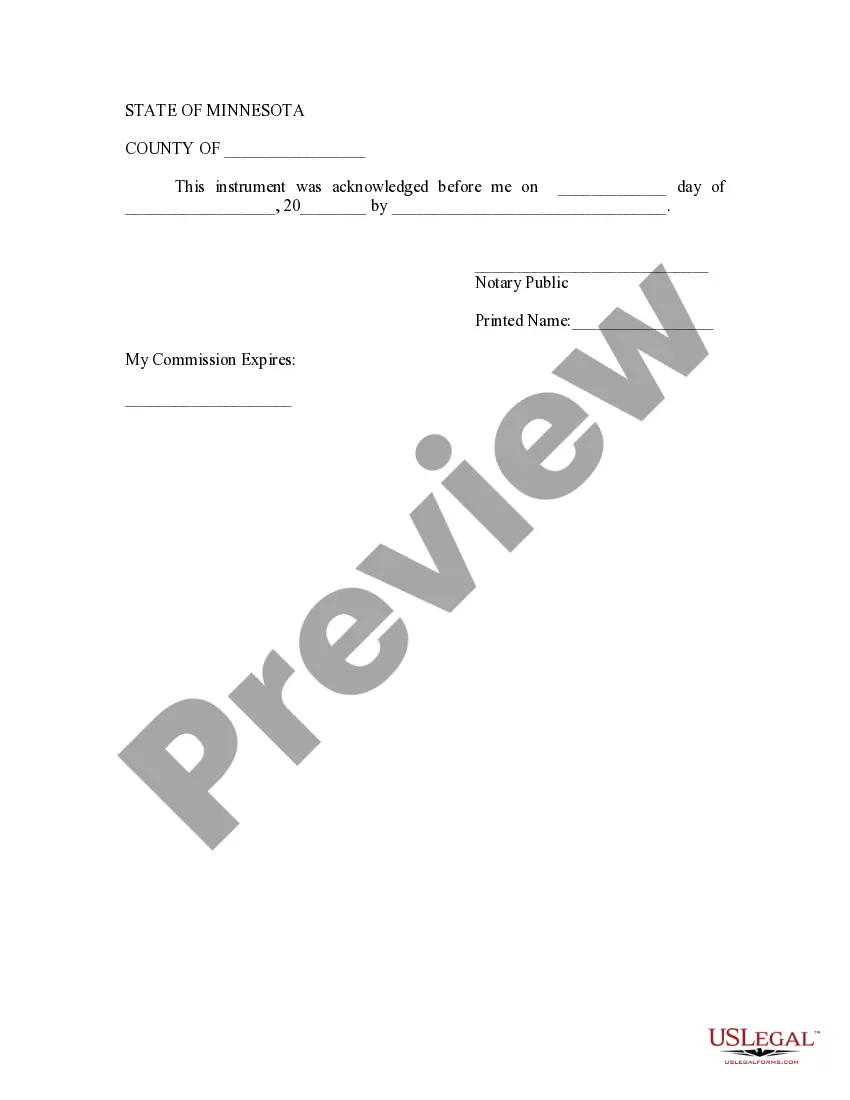

A Detailed Description of Hennepin Minnesota Letter to Lien holder to Notify of Trust In Hennepin County, Minnesota, when establishing a trust, it is essential to notify the lien holder to ensure a proper and legal transfer of assets. This process involves sending a formal letter to the lien holder, informing them of the trust and any necessary changes regarding the ownership of the property or assets in question. Hennepin County provides specific guidelines and templates for crafting such a letter, ensuring that all relevant information is accurately conveyed to the lien holder. The Hennepin Minnesota Letter to Lien holder to Notify of Trust serves as a legally binding document, establishing the trust's existence and the intended transfer of assets from the individual or entity to the trust. By promptly notifying the lien holder, the trust's legitimacy and lawful ownership of the assets can be established and protected. Several types of Hennepin Minnesota Letters to Lien holder to Notify of Trust can be named based on the specific purpose or circumstances. These may include: 1. Hennepin Minnesota Letter to Lien holder for Real Estate Trust: This type of letter focuses on notifying the lien holder about the transfer of a property into a trust. It will typically include details about the property, such as the address, legal description, and any associated mortgage or lien information. 2. Hennepin Minnesota Letter to Lien holder for Financial Trust: This type of letter is used in situations where financial accounts or investments are being transferred to a trust. It will include information about the specific accounts, their financial institutions, and any necessary instructions for the lien holder to update their records accordingly. 3. Hennepin Minnesota Letter to Lien holder for Vehicle Trust: In cases where vehicles are being transferred into a trust, this type of letter is used to inform the lien holder, typically an auto lender, about the change in ownership. It will include details about the vehicle, such as the make, model, year, and any pertinent loan or lien information. Regardless of the type of trust being established, the letter should include specific keywords and information relevant to the situation at hand. These may include: — Trust Name: Clearly mention the name of the trust to avoid confusion and ensure accurate record-keeping by the lien holder. — Trustee Details: Provide the complete name, address, and contact information of the trustee(s) responsible for managing the trust's assets. Lien holderer Information: Include the lienholder's name, address, and any account or reference numbers associated with the loan or lien being addressed. — Asset Details: Describe the assets being transferred into the trust, such as property address, financial account numbers, or vehicle information, ensuring accuracy and minimizing potential errors. — Effective Date: Clearly state the date when the transfer of assets to the trust will take effect or when the lien holder should update their records. — Signature: The letter should be signed by the trustee(s) and notarized to add authenticity and credibility. Crafting a Hennepin Minnesota Letter to Lien holder to Notify of Trust requires attention to detail and adherence to the established guidelines provided by Hennepin County. By accurately conveying the necessary information, this letter ensures a smooth transition of assets into the trust and protects the trust's legitimate ownership rights.

Hennepin Minnesota Letter to Lienholder to Notify of Trust

Description

How to fill out Hennepin Minnesota Letter To Lienholder To Notify Of Trust?

If you are looking for a valid form, it’s difficult to choose a better place than the US Legal Forms website – one of the most considerable libraries on the internet. Here you can get a huge number of templates for business and individual purposes by types and regions, or key phrases. With our high-quality search feature, discovering the most recent Hennepin Minnesota Letter to Lienholder to Notify of Trust is as elementary as 1-2-3. Furthermore, the relevance of each and every record is verified by a team of skilled attorneys that regularly check the templates on our website and update them according to the newest state and county demands.

If you already know about our system and have a registered account, all you should do to get the Hennepin Minnesota Letter to Lienholder to Notify of Trust is to log in to your account and click the Download button.

If you use US Legal Forms the very first time, just follow the instructions below:

- Make sure you have opened the sample you want. Look at its explanation and use the Preview feature (if available) to explore its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to discover the needed record.

- Affirm your decision. Choose the Buy now button. After that, select your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Use your bank card or PayPal account to finish the registration procedure.

- Get the form. Pick the file format and download it on your device.

- Make changes. Fill out, modify, print, and sign the acquired Hennepin Minnesota Letter to Lienholder to Notify of Trust.

Every single form you save in your account has no expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you need to get an additional copy for editing or printing, feel free to return and download it once again whenever you want.

Make use of the US Legal Forms professional library to get access to the Hennepin Minnesota Letter to Lienholder to Notify of Trust you were seeking and a huge number of other professional and state-specific samples on one platform!