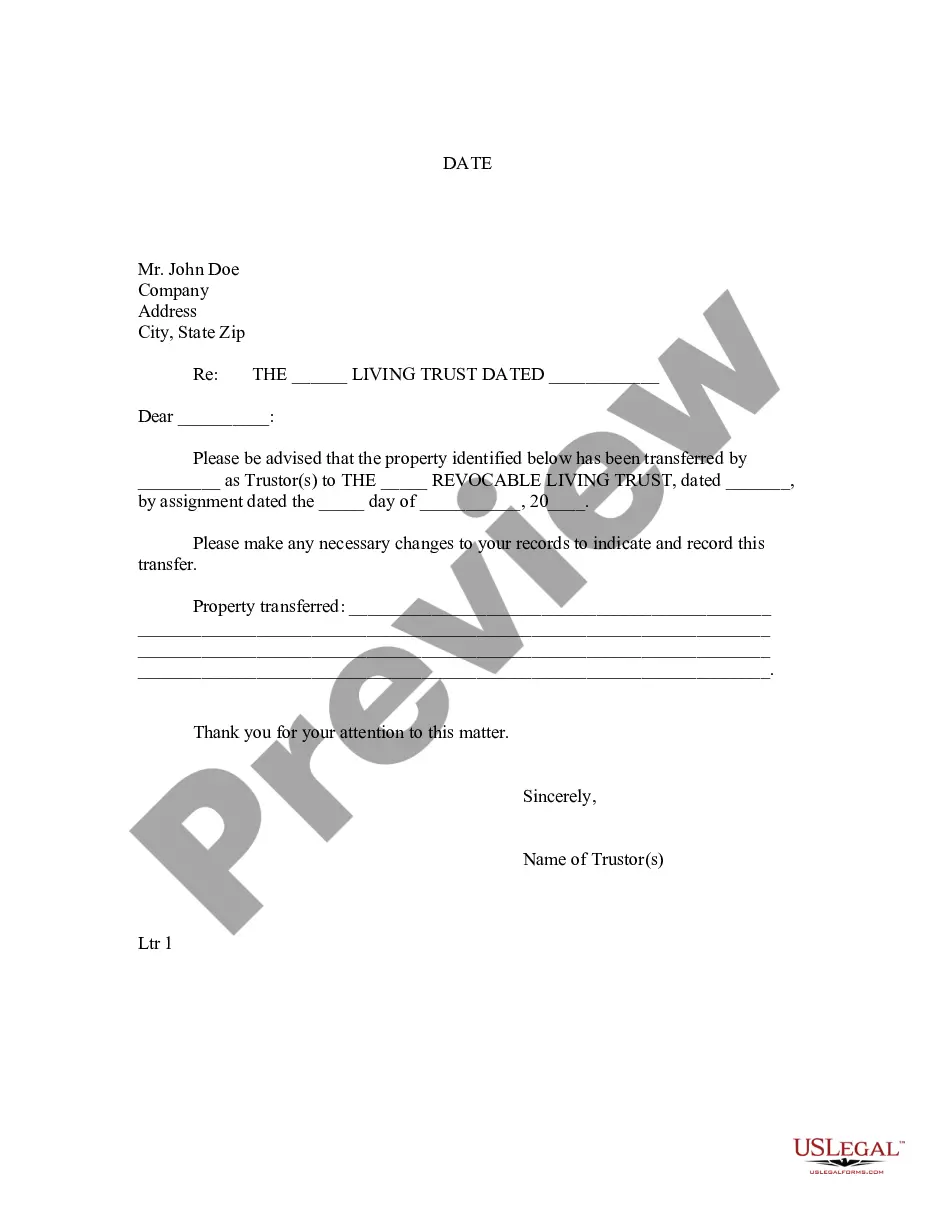

A Minneapolis Minnesota Letter to Lien holder to Notify of Trust is a document that serves as a formal communication to inform a lien holder about the establishment of a trust in relation to a particular property. This letter is crucial for ensuring accurate records and protecting the interests of all parties involved in the transaction. Keywords: Minneapolis Minnesota, letter, lien holder, trust, notify, property Types of Minneapolis Minnesota Letter to Lien holder to Notify of Trust: 1. Revocable Trust Letter: This type of letter is used when a property owner establishes a revocable trust and wishes to notify the lien holder about the change in ownership structure. The key objective is to update the lien holder's records and provide necessary information regarding the trustee's role and contact details. 2. Irrevocable Trust Letter: When a property owner creates an irrevocable trust, this letter is sent to notify the lien holder of the new trust arrangement. It clarifies the restriction on the owner's ability to alter the trust and provides relevant details of the trustee responsible for managing the property. 3. Testamentary Trust Letter: This letter is employed when a trust is established through a will and becomes effective upon the property owner's death. It informs the lien holder of the trust's existence, provides the necessary legal documentation, and outlines the trustee's responsibilities in relation to the property. 4. Living Trust Letter: In the case of a living trust, this letter is sent to the lien holder to notify them of the property owner's decision to transfer ownership to the trust while maintaining control of the property during their lifetime. It includes the relevant trust details and provides the lien holder with the trustee's contact information. Regardless of the specific type of Minneapolis Minnesota Letter to Lien holder to Notify of Trust, the content should include important details, such as: — The property owner's full name and contact information. Th lienen holderer's name, address, and contact details. — Clear and concise information on the establishment of the trust. — The type of trust (revocable, irrevocable, testamentary, living, etc.). — The date when the trust was created or became effective. — Details of the appointed trustee, including their name, address, and contact information. — Any additional instructions, requirements, or documents that the lien holder may need to update their records. It is essential to adopt a professional tone and format the letter appropriately to convey the necessary information effectively. Ensuring the accuracy and completeness of the letter will facilitate a smooth transition for all parties involved in the trust arrangement.

Minneapolis Minnesota Letter to Lienholder to Notify of Trust

Description

How to fill out Minneapolis Minnesota Letter To Lienholder To Notify Of Trust?

We always want to reduce or prevent legal issues when dealing with nuanced legal or financial matters. To do so, we apply for attorney solutions that, as a rule, are very costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Minneapolis Minnesota Letter to Lienholder to Notify of Trust or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Minneapolis Minnesota Letter to Lienholder to Notify of Trust adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Minneapolis Minnesota Letter to Lienholder to Notify of Trust is proper for your case, you can select the subscription option and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!