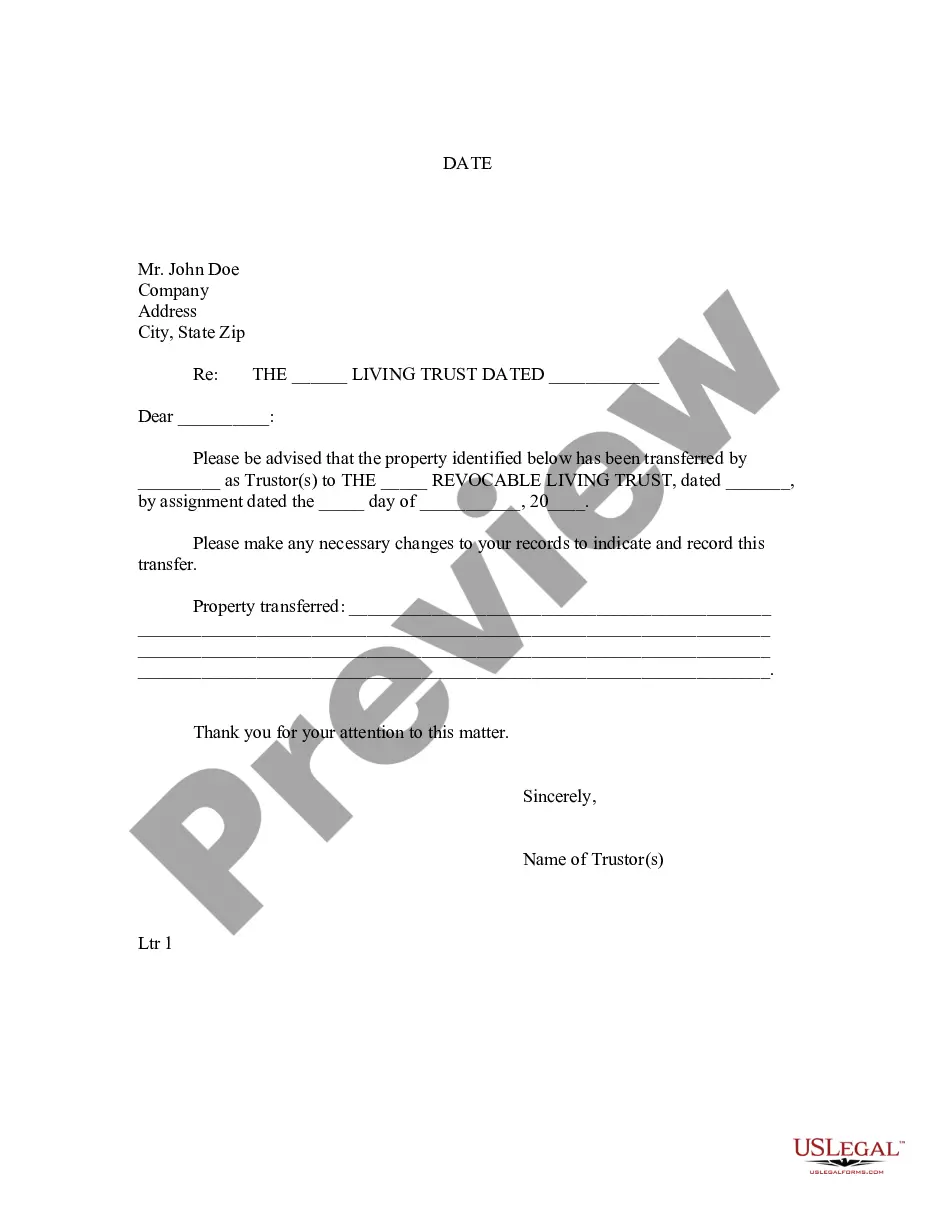

Title: Understanding the Saint Paul Minnesota Letter to Lien holder to Notify of Trust Description: When it comes to notifying lien holders of trusts established in Saint Paul, Minnesota, it is crucial to understand the necessary steps involved. In this article, we will provide a detailed description of the essential components of a Saint Paul Minnesota Letter to Lien holder to Notify of Trust and explain its importance. We will also explore any potential variations or types of such letters that may exist within the context of Saint Paul, Minnesota. Keywords: Saint Paul Minnesota, Lien holder, Trust, Letter, Notify, Components, Importance, Variations, Types. 1. Introduction to the Saint Paul Minnesota Letter to Lien holder to Notify of Trust: The Saint Paul Minnesota Letter to Lien holder to Notify of Trust is a document that serves as an official communication channel between a trust or (the creator of the trust) and a lien holder (a party with a legal claim or interest in the trust assets). This formal letter aims to inform the lien holder about the existence of a trust and the impact it may have on their rights or interests. 2. Components of the Saint Paul Minnesota Letter to Lien holder to Notify of Trust: — Identification of Parties: The letter should include detailed information about the trust or, lien holder, and any other relevant parties involved, such as attorneys or trustees. — Trust Details: Precise and accurate information about the trust, including the trust name, date of establishment, and a brief description of its purpose or objectives. — Trust Terms and Conditions: If applicable, the letter should outline specific provisions within the trust that may directly affect the lien holder's rights or claims. — Contact Information: Clear contact details for both the trust or and the lien holder, including addresses, phone numbers, and email addresses, to ensure open lines of communication. 3. Importance of the Saint Paul Minnesota Letter to Lien holder to Notify of Trust: — Legal Requirement: In Saint Paul, Minnesota, providing written notice to lien holders about the existence of a trust may be a legal obligation, ensuring transparency and fairness in any potential debt or property disputes. — Protection of Parties' Rights: The letter serves as a means to protect the rights and interests of both the trust or and the lien holder, clarifying their respective positions concerning the trust assets. — Avoidance of Future Disputes: By notifying the lien holder in a timely manner, potential conflicts and misunderstandings regarding the trust's impact can be minimized or resolved before they escalate. Types of Saint Paul Minnesota Letters to Lien holder to Notify of Trust (If Applicable): — Initial Notice: The first communication sent to the lien holder, informing them about the trust and its implications. — Follow-up Notice: A subsequent letter sent to reinforce the initial notice or provide additional details requested by the lien holder regarding the trust. Overall, understanding the Saint Paul Minnesota Letter to Lien holder to Notify of Trust is crucial for both trustees and lien holders. By following the required steps and ensuring effective communication, a harmonious relationship can be maintained, protecting the rights and interests of all parties involved in the trust.

Saint Paul Minnesota Letter to Lienholder to Notify of Trust

Description

How to fill out Saint Paul Minnesota Letter To Lienholder To Notify Of Trust?

Are you searching for a reliable and economical legal forms provider to purchase the Saint Paul Minnesota Letter to Lienholder to Notify of Trust? US Legal Forms is your top choice.

Whether you require a simple agreement to establish rules for cohabitating with your partner or a set of documents to facilitate your separation or divorce in court, we have you covered. Our website features over 85,000 current legal document templates for personal and commercial use. All templates we offer are not generic but tailored to meet the specifications of specific state and locality.

To acquire the form, you need to Log In to your account, locate the needed form, and click the Download button adjacent to it. Please remember that you can retrieve your previously bought document templates at any time from the My documents tab.

Is it your first time visiting our site? No problem. You can create an account in a few minutes, but before doing that, make sure to follow these steps.

Now you can set up your account. Then select the subscription plan and proceed to payment. As soon as the payment is completed, download the Saint Paul Minnesota Letter to Lienholder to Notify of Trust in any available file format. You can revisit the site at any time and re-download the form without any additional charges.

Finding current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time learning about legal documentation online.

- Check if the Saint Paul Minnesota Letter to Lienholder to Notify of Trust complies with the laws of your state and locality.

- Review the form's description (if available) to understand who and what the form is designed for.

- Reinitiate the search if the form does not suit your legal situation.

Form popularity

FAQ

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.

There are only nine title-holding states: Kentucky, Maryland, Michigan, Minnesota, Missouri, Montana, New York, Oklahoma, Wisconsin. In the other 41 states, titles are issued to the lien holder of your vehicle until the loan is fully paid off.

The nine non-title holding states are Michigan, Minnesota, New York, Arizona, Kentucky, Oklahoma, Wisconsin, Maryland, and South Dakota.

Whether you are an individual or a business, we may file a lien at any time and add a charge of $30 to file and release it. (See Minnesota Statutes, section 270C. 63 and section 16D. 08).

To remove a lien from a title, the vehicle title must be submitted with the Lien Notification card from the lien holder, properly signed by the lender or with a notarized Notification of Assignment ? Release or Grant of Secured Interest (PS2017) signed by the lender.

The Minnesota Department of Public Safety (DPS) is the state agency that administers vehicle titles and registration. DPS requires an original certificate of title and other original title documents when you apply for title and registration.

In Minnesota, all mechanics liens must be filed within 120 days from the claimant's last day providing materials or labor. In Minnesota, mechanics liens expire 1 year from the date of the lien claimant's last furnishing of labor or materials to the project.

Minnesota is a lien theory state, meaning the lender is considered the holder of only a security interest, and the mortgagor is the owner of the land and is entitled to possession, unless and until foreclosure of the mortgage is completed.

People who have sold a car titled in Minnesota but failed to transfer the title to the car may want to file a motion with a District Court in Minnesota to try to get a court order forcing the title of the vehicle to be transferred from the name of the seller to the name of the buyer.