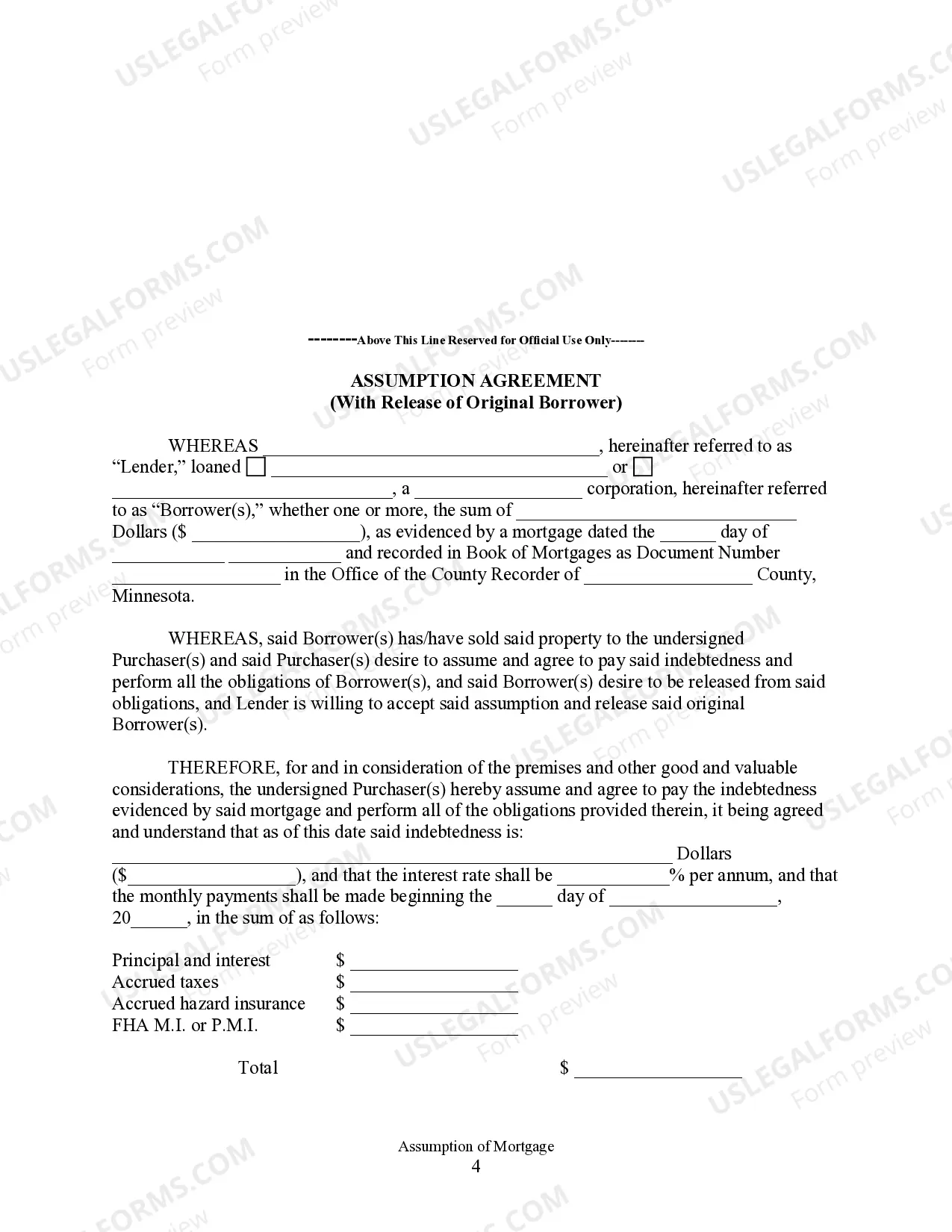

The Minneapolis Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the terms and conditions of transferring an existing mortgage from one party to another. This agreement is commonly used in real estate transactions when the original mortgagors (borrowers) decide to transfer the mortgage obligation to a new party, known as the assumption. Under the assumption agreement, the assumption takes over the responsibilities of the original mortgagors, including making regular mortgage payments, complying with the terms of the original mortgage, and assuming liability for any default or foreclosure proceedings. This agreement requires the consent and approval of the mortgage lender or financial institution and may involve certain administrative fees and legal procedures. There are different types of Minneapolis Minnesota Assumption Agreements of Mortgage and Release of Original Mortgagors, which may include: 1. Full Assumption Agreement: In this type of assumption agreement, the assumption assumes full responsibility for the mortgage, including both the principal balance and interest payments. The original mortgagors are completely released from their obligations, and the assumption becomes the new borrower under the same terms and conditions as the original mortgage. 2. Partial Assumption Agreement: In a partial assumption agreement, the assumption agrees to assume the mortgage but only takes on a portion of the outstanding balance. This type of agreement might occur when the original mortgagors want to transfer a portion of their mortgage to another party, such as a co-borrower or a relative. 3. Release of Original Mortgagors: The release of original mortgagors is an integral part of the assumption agreement. It involves the formal release and discharge of the original borrowers from their obligations under the original mortgage. This release is typically granted by the mortgage lender or financial institution upon successful completion of the assumption agreement, clearing the way for the assumption to take full responsibility for the mortgage. 4. Minnesota-specific Requirements: In Minneapolis, Minnesota, the assumption agreement of a mortgage may also need to comply with specific state laws and regulations governing real estate transactions. It is crucial to consult with an experienced real estate attorney or a mortgage specialist to ensure compliance with all legal requirements. Overall, the Minneapolis Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors facilitates the transfer of an existing mortgage obligation from the original mortgagors to the assumption. It enables individuals to transfer their mortgage responsibilities legally and efficiently, while providing a framework for ensuring the lender's consent and protection for all parties involved.

Minneapolis Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Minneapolis Minnesota Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

We always want to minimize or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney services that, as a rule, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Minneapolis Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Minneapolis Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Minneapolis Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors would work for you, you can choose the subscription option and make a payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!