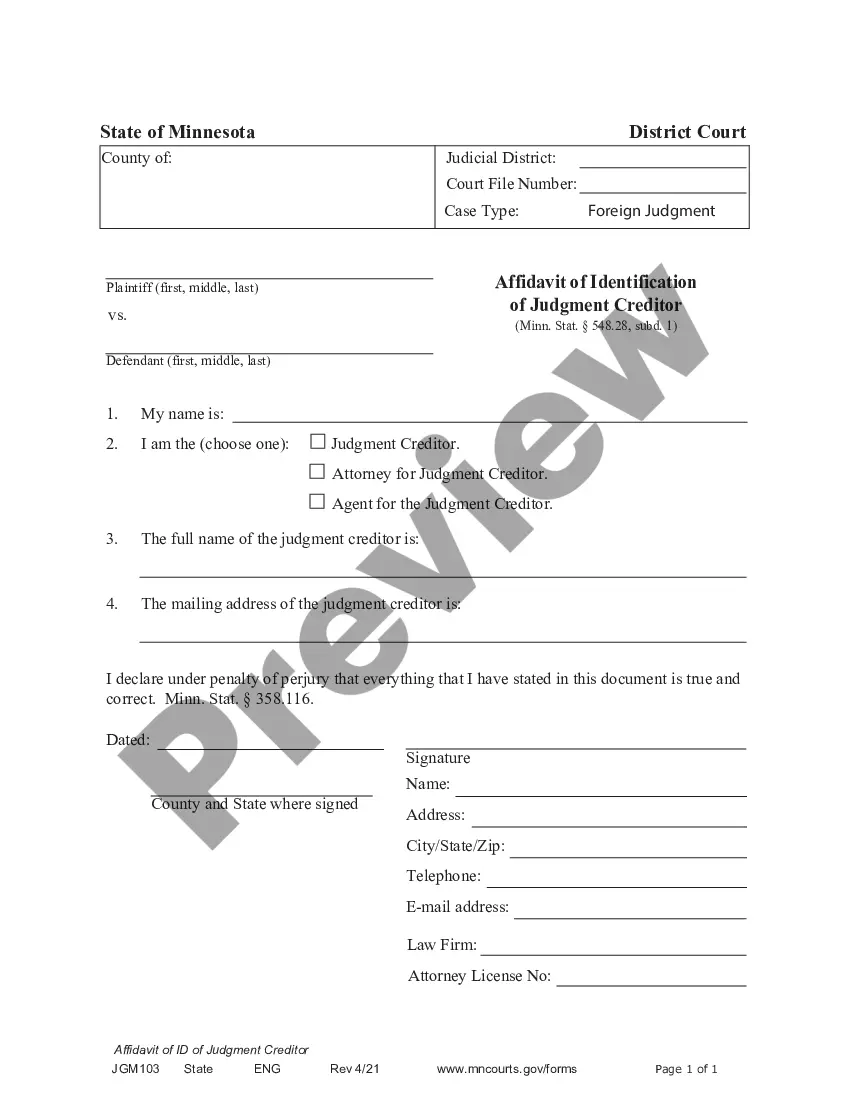

This is an official Minnesota court form for use in a civil case, an Affidavit of Identification of Judgment Debtor. USLF amends and updates these forms as is required by Minnesota Statutes and Law.

Minneapolis Minnesota Affidavit of Identification of Judgment Debtor

Description

How to fill out Minnesota Affidavit Of Identification Of Judgment Debtor?

If you have previously employed our service, Log In to your account and store the Minneapolis Minnesota Affidavit of Identification of Judgment Debtor on your device by clicking the Download button. Ensure that your subscription is still active. If not, renew it according to your payment plan.

If this is your initial engagement with our service, follow these straightforward steps to obtain your document.

You have lifelong access to every document you have acquired: you can find it in your profile under the My documents menu whenever you wish to use it again. Utilize the US Legal Forms service to quickly find and save any template for your personal or business requirements!

- Verify that you have located an appropriate document. Browse through the description and utilize the Preview option, if available, to confirm it meets your needs. If it is not suitable, use the Search tab above to find the right one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and make a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Minneapolis Minnesota Affidavit of Identification of Judgment Debtor. Select the file format for your document and save it to your device.

- Finalize your sample. Print it out or take advantage of online professional editors to complete and sign it electronically.

Form popularity

FAQ

Assuming the creditor gets the judgment within the first statute of limitations, then the creditor has 10 years from when they get a judgment to collect the money. (Minnesota Statutes 550.01, Enforcement of Judgments). A judgment can also be renewed for another ten years. (Minnesota Statutes 548.09).

Renew the judgment Money judgments automatically expire (run out) after 10 years. To prevent this from happening, the creditor must file a request for renewal of the judgment with the court BEFORE the 10 years run out.

Step 1: Docket the judgment.Step 2: Request an Order for Disclosure.Step 3: Request an Order to Show Cause.Step 4: Send the judgment debtor notice that you plan to start collecting.Step 5: Request a Writ of Execution from court administration.Step 6: Take the paperwork to the sheriff's office.

The most common ways you may find out that there are outstanding judgements against you are: Letter in the mail or phone call from the collection attorneys; Garnishee notice from your payroll department; Freeze on your bank account; or. Routine check of your credit report.

The easy definition is that a judgment is an official decision rendered by the court with regard to a civil matter. A judgment lien, sometimes referred to as an ?abstract of judgment,? is an involuntary lien that is filed to give constructive notice and is to attach to the Judgment Debtor's property and/or assets.

The Minnesota Court Payment Center (CPC) began operations that fall, starting with a small number of counties. Additional counties are being phased in, and based on experiences to date; CPC staff have identified and implemented process improvements which will benefit law enforcement, the courts and the public.

Once a judgment is docketed, a judgment lien in Minnesota generally lasts for 10 years.

A judgment in Minnesota is valid for 10 years. To renew a judgment in Minnesota for another ten year period, a creditor must start a new lawsuit against the debtor before the expiration of the initial ten year period.

The statute of limitations for most debts in Minnesota is six years, including open accounts and written contracts. Creditors and debt collectors can file a lawsuit for breach of contract under Minnesota law within this period to hold you legally responsible for an unpaid debt.

A judgment may be provided either in written or oral form depending on the circumstances. Oral judgments are often provided at the conclusion of a hearing and are frequently used by courts with heavier caseloads or where a judgment must be rendered quickly.