The Saint Paul Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the city of Saint Paul, Minnesota. This document serves as a written agreement and provides protection for both parties involved in the loan transaction. Keywords: Saint Paul Minnesota, Unsecured Installment Payment, Promissory Note, Fixed Rate, loan agreement, lender, borrower There are several types of Saint Paul Minnesota Unsecured Installment Payment Promissory Notes for Fixed Rate, each catering to specific loan scenarios. These variations may include: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for personal loans where an individual borrows money from another individual or entity for various purposes such as debt consolidation, home improvements, or educational expenses. The note specifies the loan amount, interest rate, repayment terms, and consequences for non-payment. 2. Business Loan Promissory Note: This promissory note is used when a business entity borrows money from a lender to fund its operations, expansion, or other business-related needs. It includes relevant details about the loan, such as the loan amount, interest rate, repayment schedule, and any collateral or guarantees provided by the business. 3. Student Loan Promissory Note: Specifically designed for educational purposes, this promissory note is used by students who require financial assistance to fund their college or university education. It specifies the loan amount, interest rate, repayment options, and any deferment or forgiveness provisions that may apply. 4. Real Estate Promissory Note: This type of promissory note is utilized in real estate transactions where a party borrows money to purchase or refinance a property. It outlines the terms of the loan, including the loan amount, fixed interest rate, repayment schedule, and any stipulations related to the property, such as liens or other encumbrances. Regardless of the specific type, a Saint Paul Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate provides legal protection for both the lender and the borrower by clearly defining the repayment terms, interest rates, penalties for late payments or default, and any conditions associated with the loan. It helps establish trust and transparency in the borrowing process while ensuring compliance with the laws and regulations of Saint Paul, Minnesota.

Saint Paul Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate

Category:

State:

Minnesota

City:

Saint Paul

Control #:

MN-NOTE-2

Format:

Word;

Rich Text

Instant download

Description

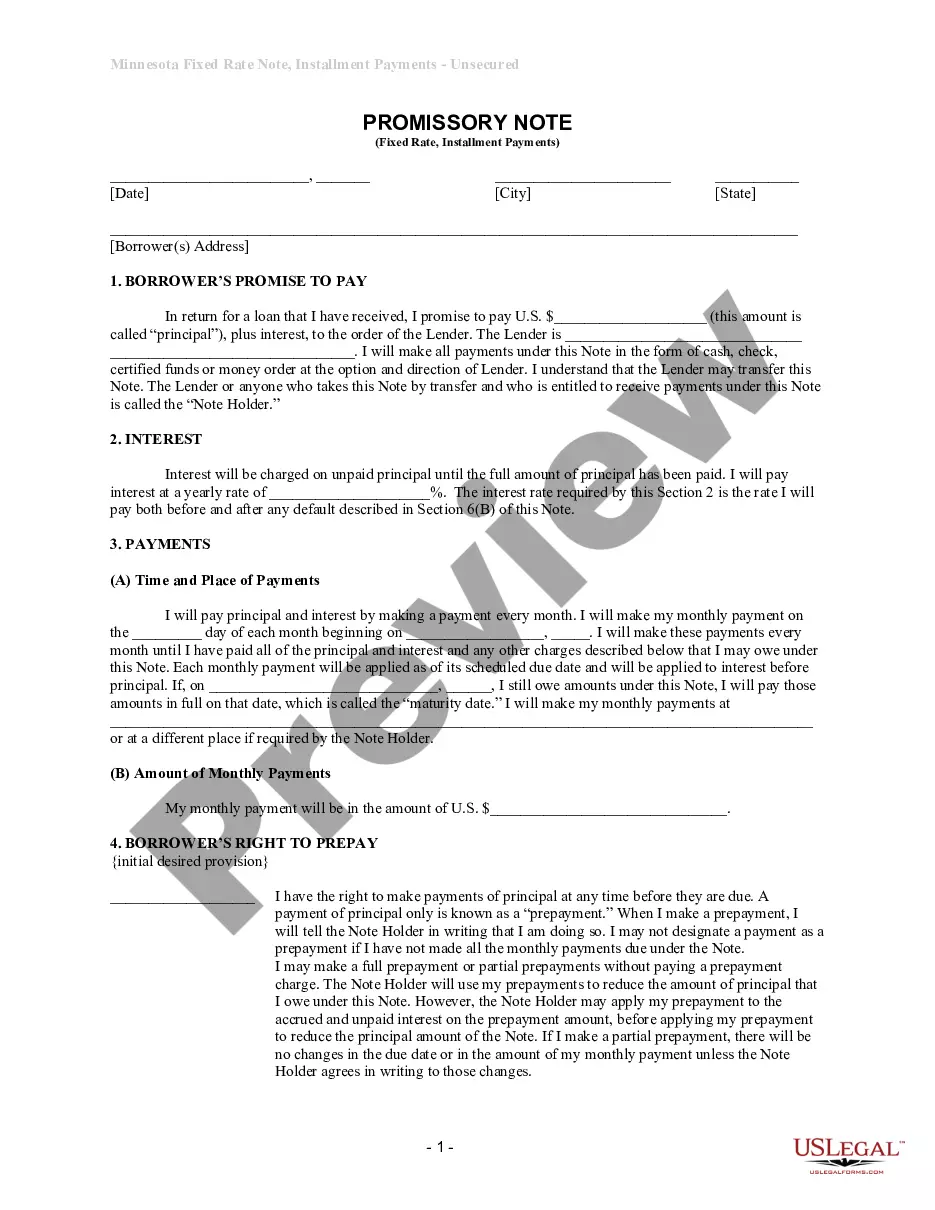

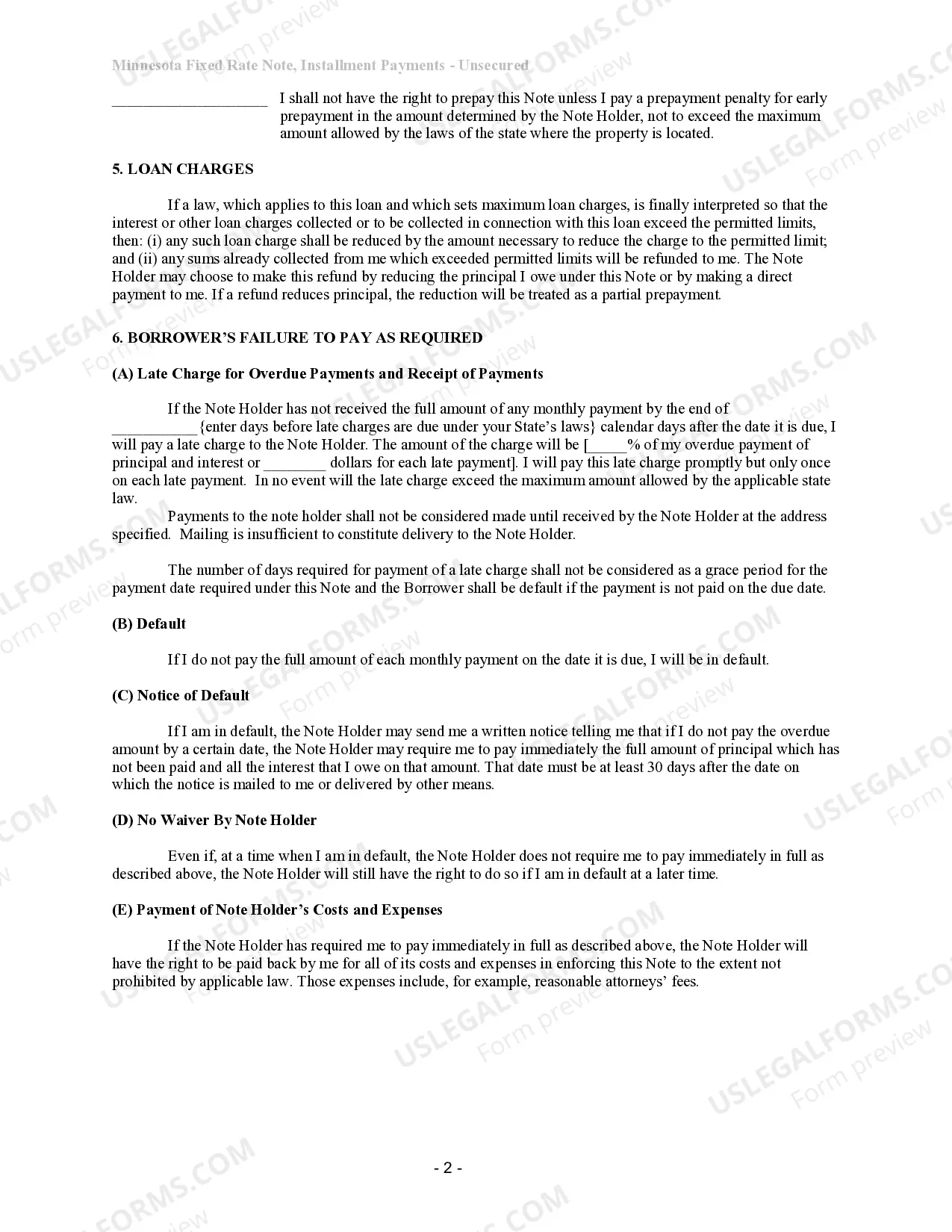

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

The Saint Paul Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the city of Saint Paul, Minnesota. This document serves as a written agreement and provides protection for both parties involved in the loan transaction. Keywords: Saint Paul Minnesota, Unsecured Installment Payment, Promissory Note, Fixed Rate, loan agreement, lender, borrower There are several types of Saint Paul Minnesota Unsecured Installment Payment Promissory Notes for Fixed Rate, each catering to specific loan scenarios. These variations may include: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for personal loans where an individual borrows money from another individual or entity for various purposes such as debt consolidation, home improvements, or educational expenses. The note specifies the loan amount, interest rate, repayment terms, and consequences for non-payment. 2. Business Loan Promissory Note: This promissory note is used when a business entity borrows money from a lender to fund its operations, expansion, or other business-related needs. It includes relevant details about the loan, such as the loan amount, interest rate, repayment schedule, and any collateral or guarantees provided by the business. 3. Student Loan Promissory Note: Specifically designed for educational purposes, this promissory note is used by students who require financial assistance to fund their college or university education. It specifies the loan amount, interest rate, repayment options, and any deferment or forgiveness provisions that may apply. 4. Real Estate Promissory Note: This type of promissory note is utilized in real estate transactions where a party borrows money to purchase or refinance a property. It outlines the terms of the loan, including the loan amount, fixed interest rate, repayment schedule, and any stipulations related to the property, such as liens or other encumbrances. Regardless of the specific type, a Saint Paul Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate provides legal protection for both the lender and the borrower by clearly defining the repayment terms, interest rates, penalties for late payments or default, and any conditions associated with the loan. It helps establish trust and transparency in the borrowing process while ensuring compliance with the laws and regulations of Saint Paul, Minnesota.

Free preview

How to fill out Saint Paul Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate?

If you’ve already utilized our service before, log in to your account and download the Saint Paul Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Saint Paul Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!