Hennepin Minnesota Limited Power of Attorney, also known as a specific power of attorney, is a legal document granting an individual, called the agent or attorney-in-fact, the authority to act on behalf of another person, referred to as the principal. This legal arrangement allows the agent to make decisions and perform specific tasks outlined in the document while the principal is incapacitated, unavailable, or unable to handle specific matters on their own. In Hennepin County, Minnesota, the powers conferred under a limited power of attorney can vary depending on the specific needs and preferences of the principal. These powers can be customized and tailored to address different scenarios and situations. Below are some sample powers that can be included in a Hennepin Minnesota Limited Power of Attorney document: 1. Real Estate Transactions: Granting the agent the authority to buy, sell, or manage the principal's real estate properties, including the ability to sign contracts, negotiate terms, and handle related financial transactions. 2. Financial Matters: Authorizing the agent to handle banking and financial affairs, such as accessing bank accounts, paying bills, managing investments, and filing tax returns. 3. Legal Matters: Allowing the agent to hire attorneys, represent the principal in legal proceedings, settle claims or lawsuits, and make legal decisions on the principal's behalf. 4. Business Transactions: Empowering the agent to conduct business activities on behalf of the principal, including signing contracts, entering into agreements, and managing business operations. 5. Health Care Decisions: Granting the agent the power to make medical decisions for the principal in case of incapacitation, including consenting to medical treatments, discussing medical conditions with healthcare providers, and accessing medical records. 6. Governmental Matters: Enabling the agent to act on behalf of the principal with government agencies, such as filing applications, receiving benefits, and interacting with Social Security or the Department of Motor Vehicles. It is important to note that a Hennepin Minnesota Limited Power of Attorney can have various forms or types depending on the specific powers granted. One common distinction is the financial power of attorney, which focuses primarily on financial matters, such as banking, investments, and managing assets. Another category is a healthcare power of attorney, which grants the agent powers related to medical decisions and healthcare matters. When creating a Hennepin Minnesota Limited Power of Attorney, it is advisable to consult with an attorney to ensure that the document meets all legal requirements and accurately reflects the principal's intentions and desired powers. It is also crucial to review and update the power of attorney periodically to address any changes in circumstances or preferences.

Hennepin Minnesota Limited Power of Attorney where you Specify Powers with Sample Powers Included

Category:

State:

Minnesota

County:

Hennepin

Control #:

MN-P099D

Format:

Word;

Rich Text

Instant download

Description

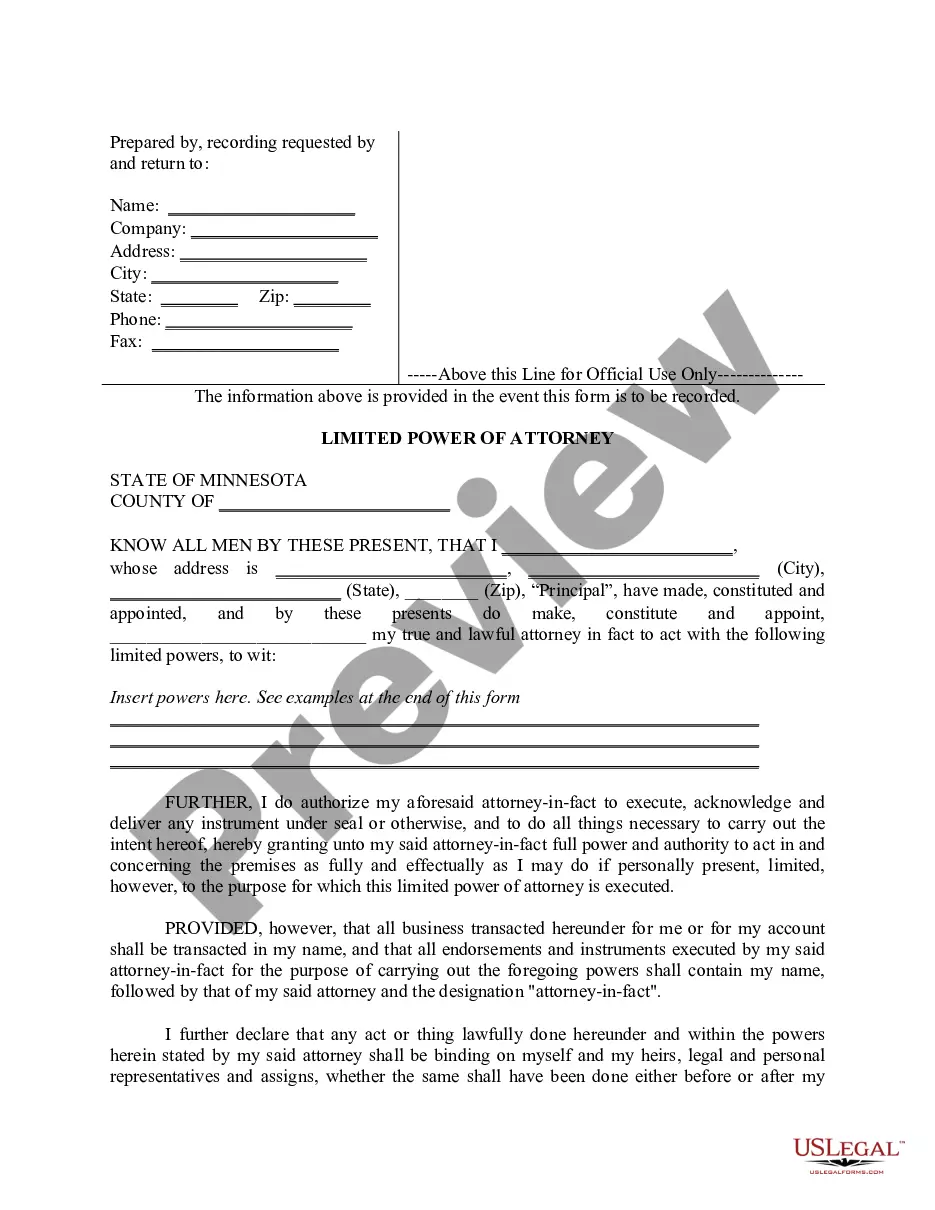

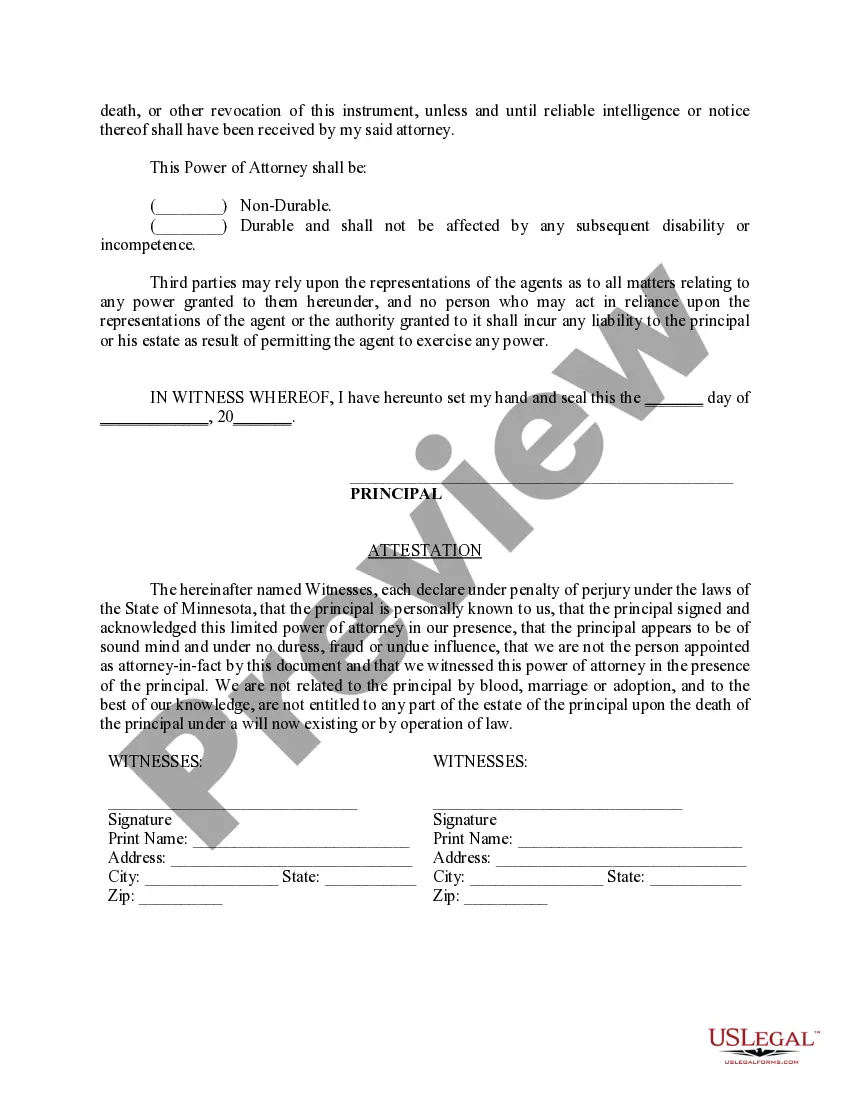

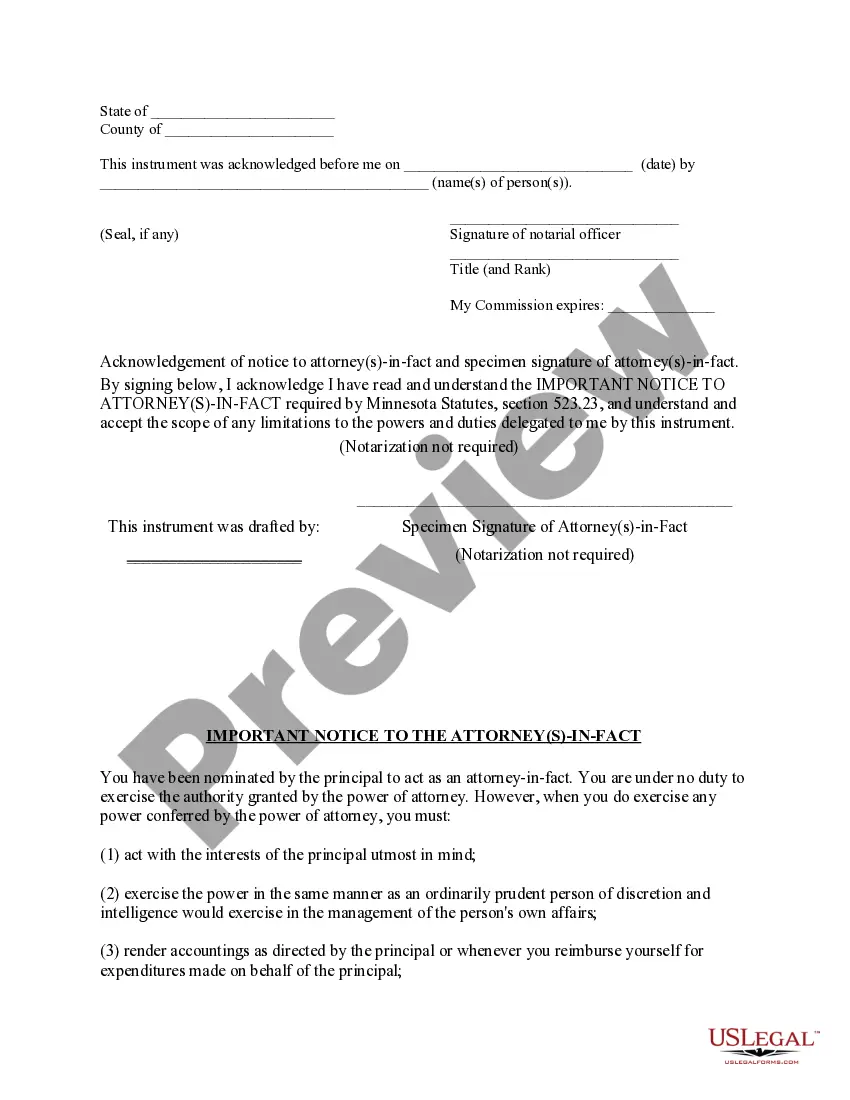

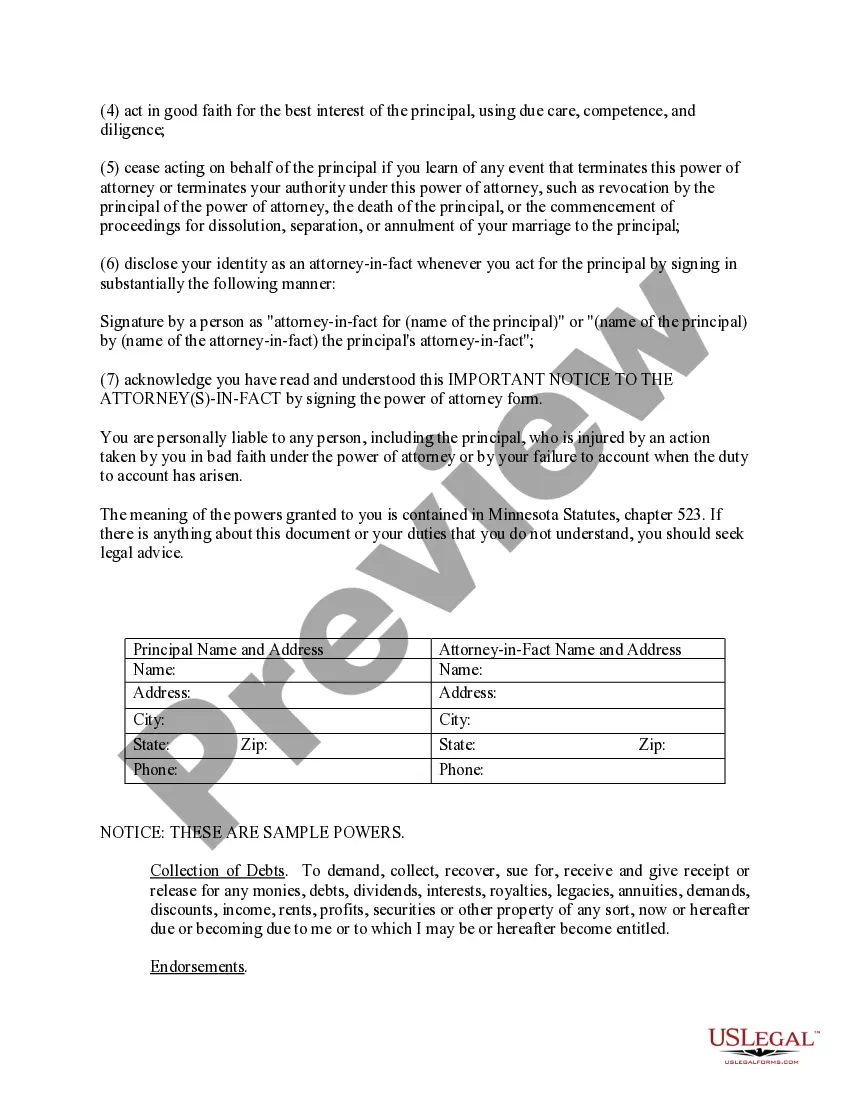

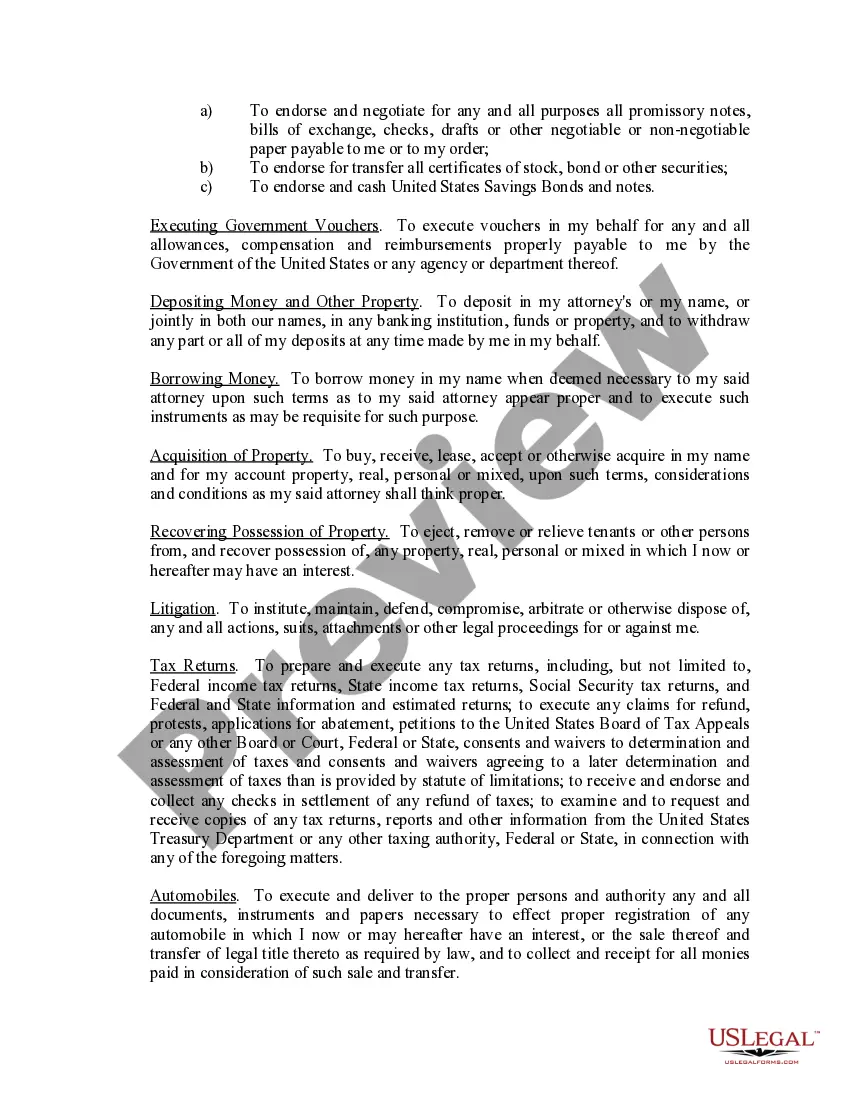

This is a limited power of attorney for the State of Minnesota. You specify the powers you desire to give to your agent. Sample powers are attached to the form for illustration only and should be deleted after you complete the form with the powers you desire. The form contains an acknowledgment in the event the form is to be recorded.

Hennepin Minnesota Limited Power of Attorney, also known as a specific power of attorney, is a legal document granting an individual, called the agent or attorney-in-fact, the authority to act on behalf of another person, referred to as the principal. This legal arrangement allows the agent to make decisions and perform specific tasks outlined in the document while the principal is incapacitated, unavailable, or unable to handle specific matters on their own. In Hennepin County, Minnesota, the powers conferred under a limited power of attorney can vary depending on the specific needs and preferences of the principal. These powers can be customized and tailored to address different scenarios and situations. Below are some sample powers that can be included in a Hennepin Minnesota Limited Power of Attorney document: 1. Real Estate Transactions: Granting the agent the authority to buy, sell, or manage the principal's real estate properties, including the ability to sign contracts, negotiate terms, and handle related financial transactions. 2. Financial Matters: Authorizing the agent to handle banking and financial affairs, such as accessing bank accounts, paying bills, managing investments, and filing tax returns. 3. Legal Matters: Allowing the agent to hire attorneys, represent the principal in legal proceedings, settle claims or lawsuits, and make legal decisions on the principal's behalf. 4. Business Transactions: Empowering the agent to conduct business activities on behalf of the principal, including signing contracts, entering into agreements, and managing business operations. 5. Health Care Decisions: Granting the agent the power to make medical decisions for the principal in case of incapacitation, including consenting to medical treatments, discussing medical conditions with healthcare providers, and accessing medical records. 6. Governmental Matters: Enabling the agent to act on behalf of the principal with government agencies, such as filing applications, receiving benefits, and interacting with Social Security or the Department of Motor Vehicles. It is important to note that a Hennepin Minnesota Limited Power of Attorney can have various forms or types depending on the specific powers granted. One common distinction is the financial power of attorney, which focuses primarily on financial matters, such as banking, investments, and managing assets. Another category is a healthcare power of attorney, which grants the agent powers related to medical decisions and healthcare matters. When creating a Hennepin Minnesota Limited Power of Attorney, it is advisable to consult with an attorney to ensure that the document meets all legal requirements and accurately reflects the principal's intentions and desired powers. It is also crucial to review and update the power of attorney periodically to address any changes in circumstances or preferences.

Free preview

How to fill out Hennepin Minnesota Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

If you’ve already utilized our service before, log in to your account and save the Hennepin Minnesota Limited Power of Attorney where you Specify Powers with Sample Powers Included on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Hennepin Minnesota Limited Power of Attorney where you Specify Powers with Sample Powers Included. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!