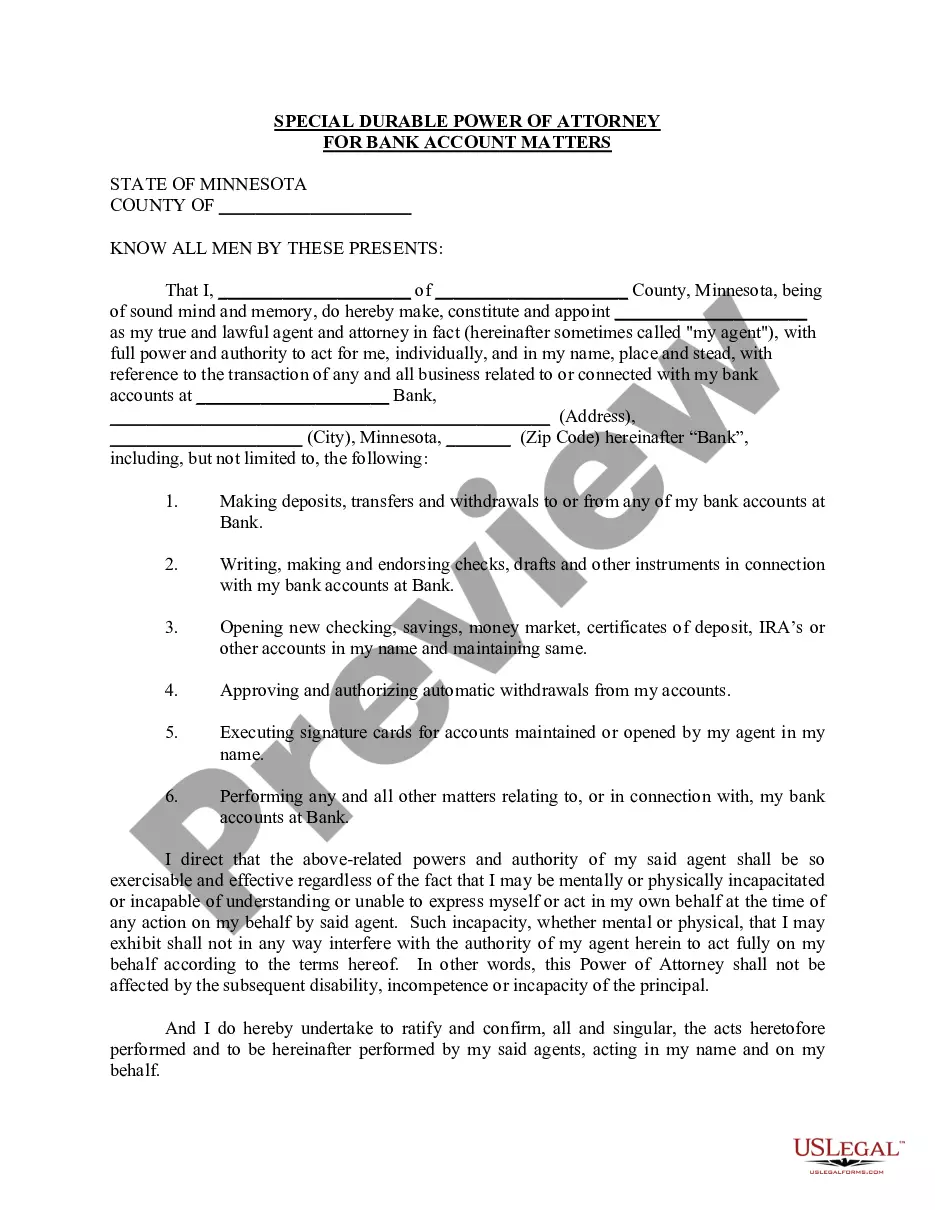

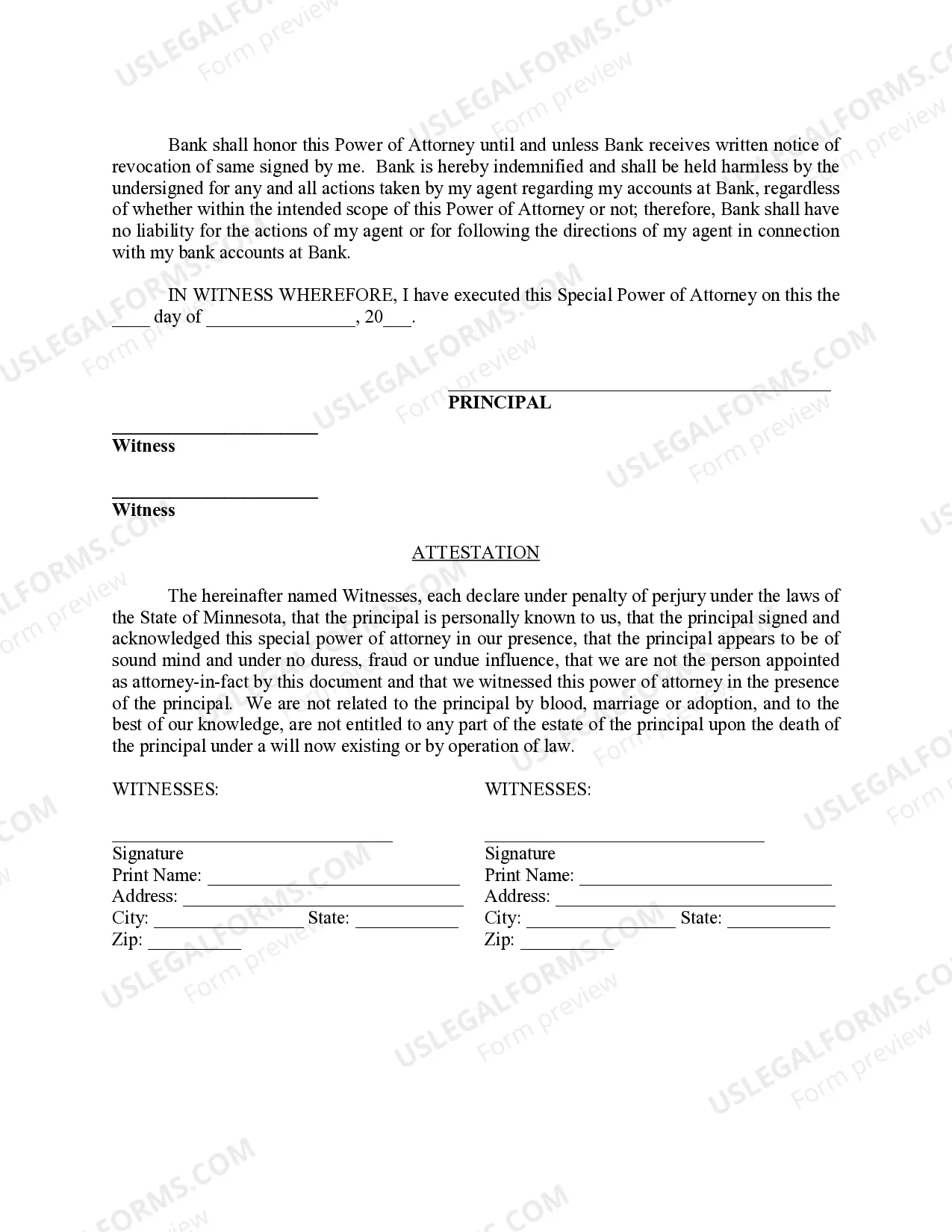

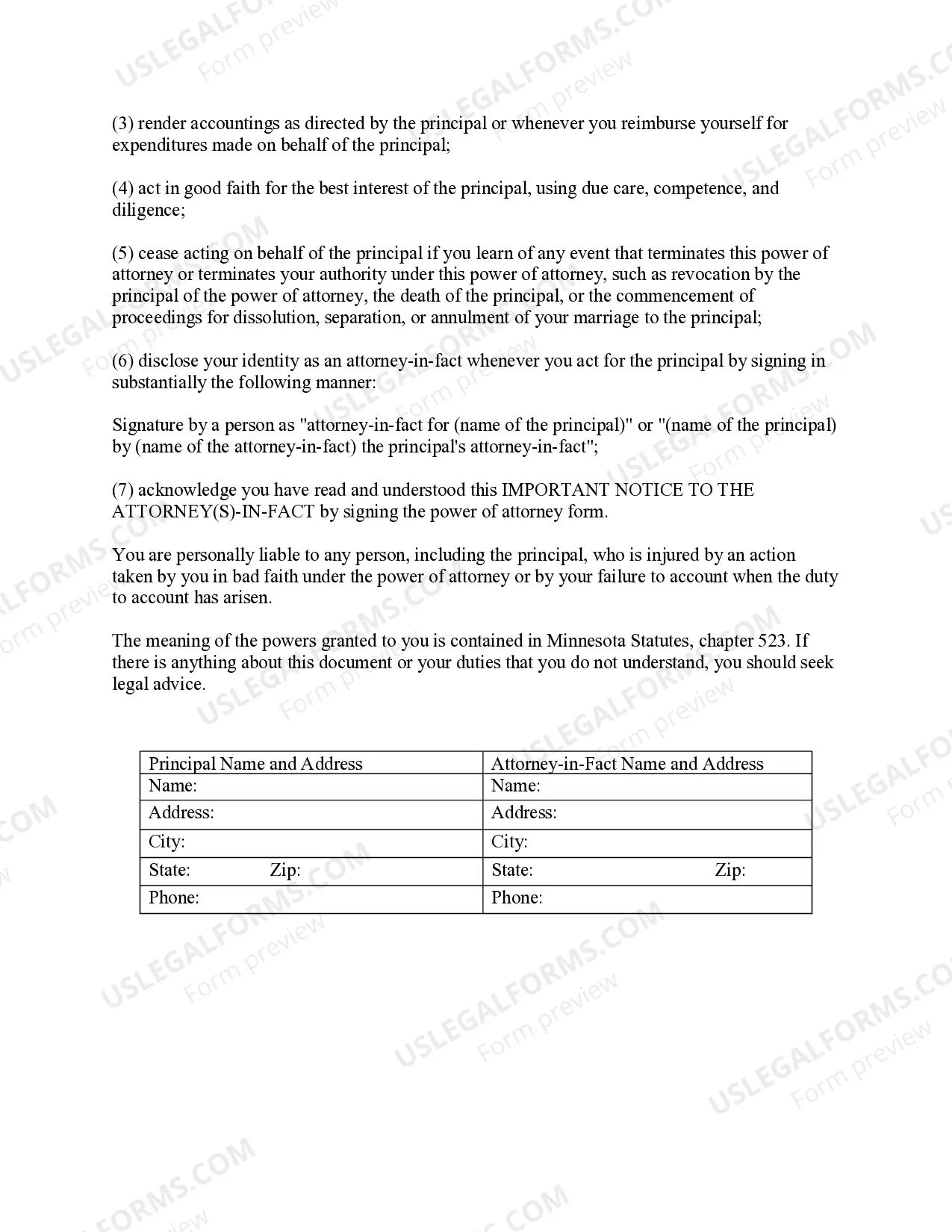

The Hennepin County in Minnesota provides residents with a legal document known as the Special Durable Power of Attorney for Bank Account Matters. This specialized power of attorney grants an individual, referred to as the "principal," the ability to select a trusted person, known as the "agent," to handle specific bank account matters on their behalf. This legal arrangement is designed to ensure that the principal's financial affairs are properly managed even if they become incapacitated or are unable to personally handle their bank account matters. The Hennepin Minnesota Special Durable Power of Attorney for Bank Account Matters allows the principal to specify the exact types of responsibilities and powers they want to grant to their agent regarding their bank accounts. This customization ensures that the principal only grants authority to the agent for specific bank account matters that they are comfortable with, while other matters remain under their direct control. Some common responsibilities and powers that can be included in the Hennepin Minnesota Special Durable Power of Attorney for Bank Account Matters are: 1. Deposit and withdrawal transactions: The principal can authorize the agent to initiate deposits or withdrawals from their bank accounts. This can include cashing checks, transferring funds between accounts, or making electronic payments. 2. Bill payment: The power of attorney document can specify whether the agent is permitted to pay bills on behalf of the principal using their bank accounts. This can include utilities, mortgages, credit card bills, or any other regular payments. 3. Managing investments: If the principal has investment accounts, they can grant the agent the power to make investment decisions on their behalf. This may include buying or selling stocks, bonds, or other investment assets. 4. Accessing financial information: The principal can authorize the agent to access their bank account statements, balances, and other financial information. This allows the agent to monitor the principal's financial situation and make informed decisions. It is important to note that different types of Special Durable Power of Attorney for Bank Account Matters can exist based on the specific requirements of the principal. Some individuals may need a limited power of attorney that grants authority for a specific time period or for a specific bank account. Others may require a general power of attorney that provides broad authorization over all their bank accounts. The Hennepin County legal system allows for customization to address the diverse needs of its residents. In conclusion, the Hennepin Minnesota Special Durable Power of Attorney for Bank Account Matters is a legal document that empowers individuals to designate an agent to handle various bank account matters on their behalf. Through this document, the principal can customize the scope of authority granted to the agent based on their specific needs and preferences. By having such a power of attorney in place, residents of Hennepin County can ensure the smooth management of their financial affairs, even in challenging circumstances.

Hennepin Minnesota Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Hennepin Minnesota Special Durable Power Of Attorney For Bank Account Matters?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Hennepin Minnesota Special Durable Power of Attorney for Bank Account Matters becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Hennepin Minnesota Special Durable Power of Attorney for Bank Account Matters takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve chosen the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Hennepin Minnesota Special Durable Power of Attorney for Bank Account Matters. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!