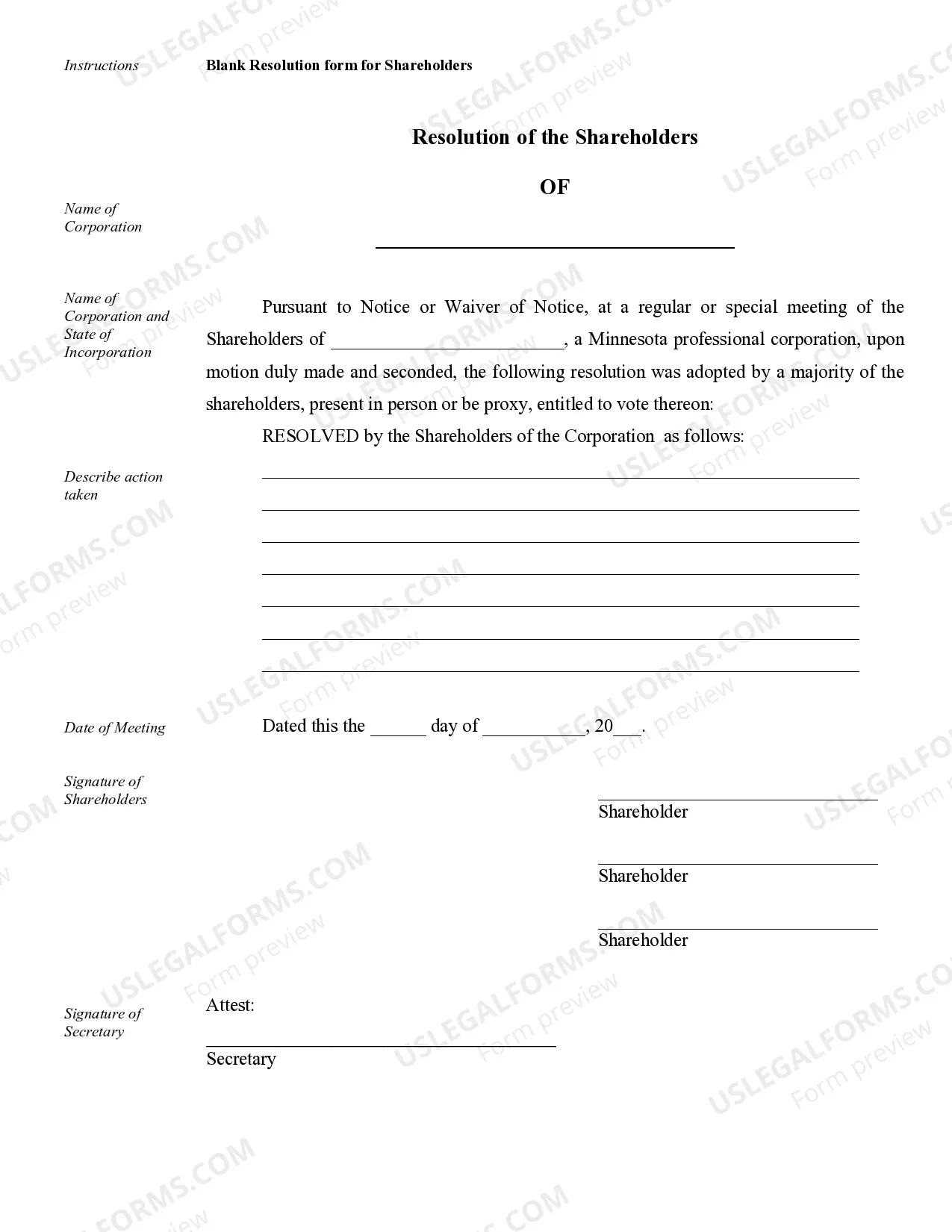

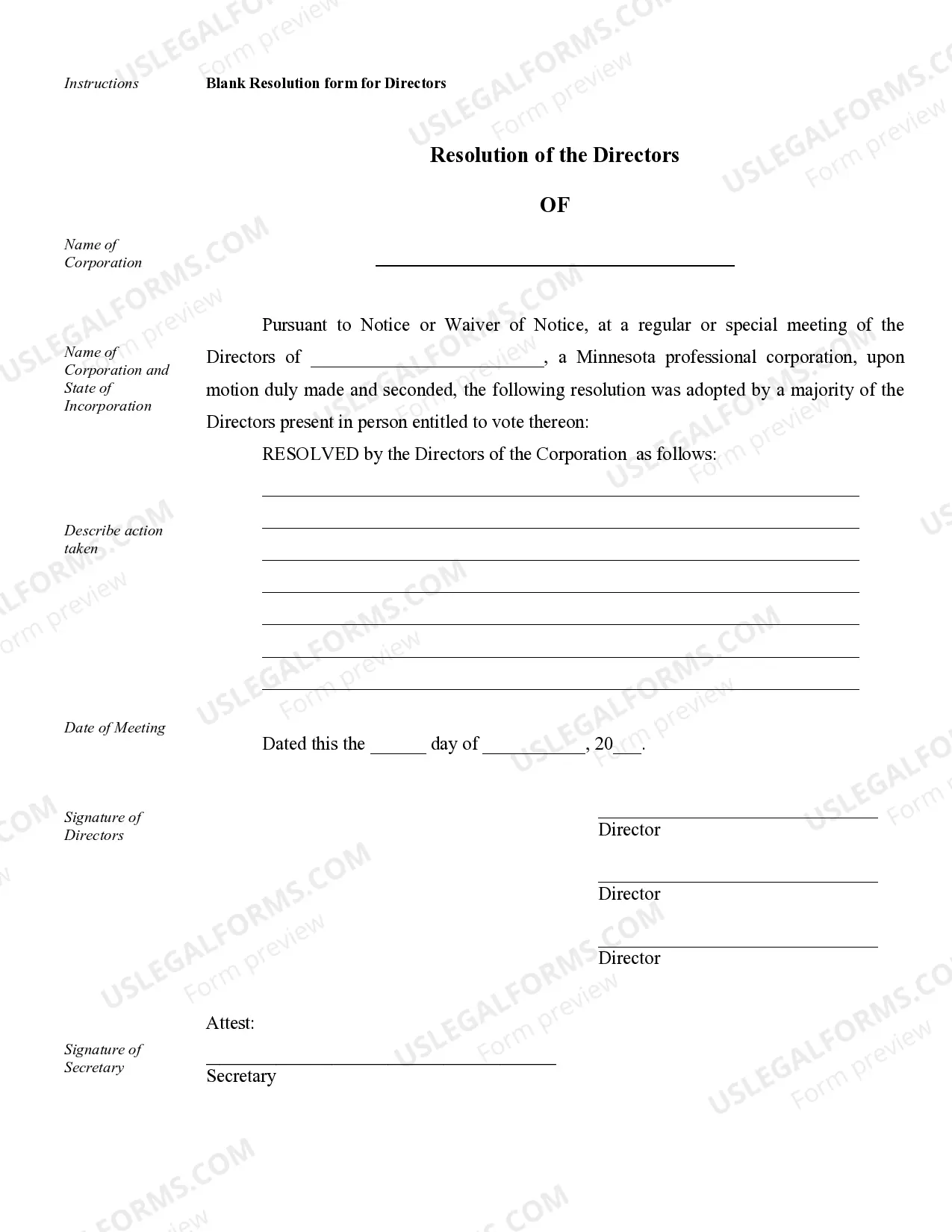

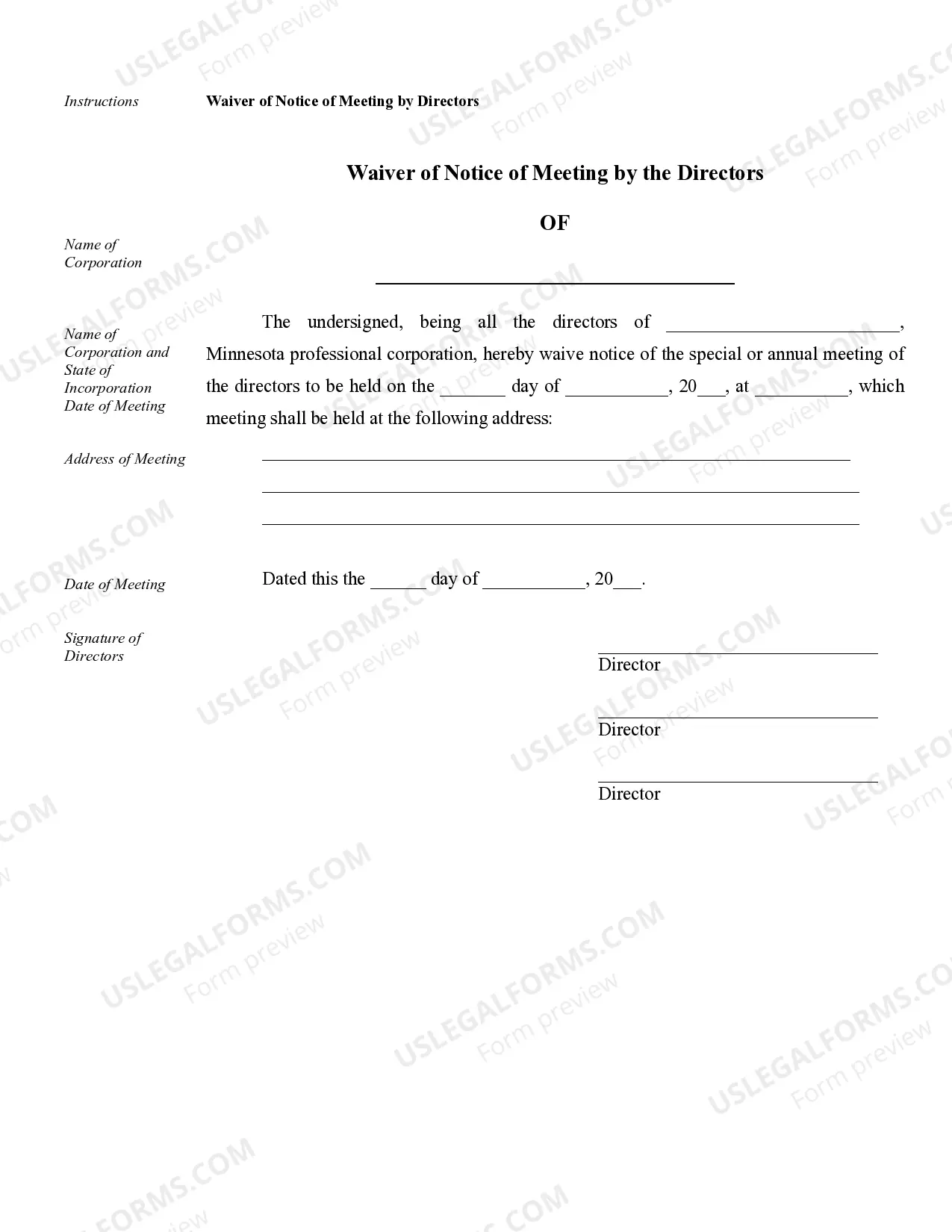

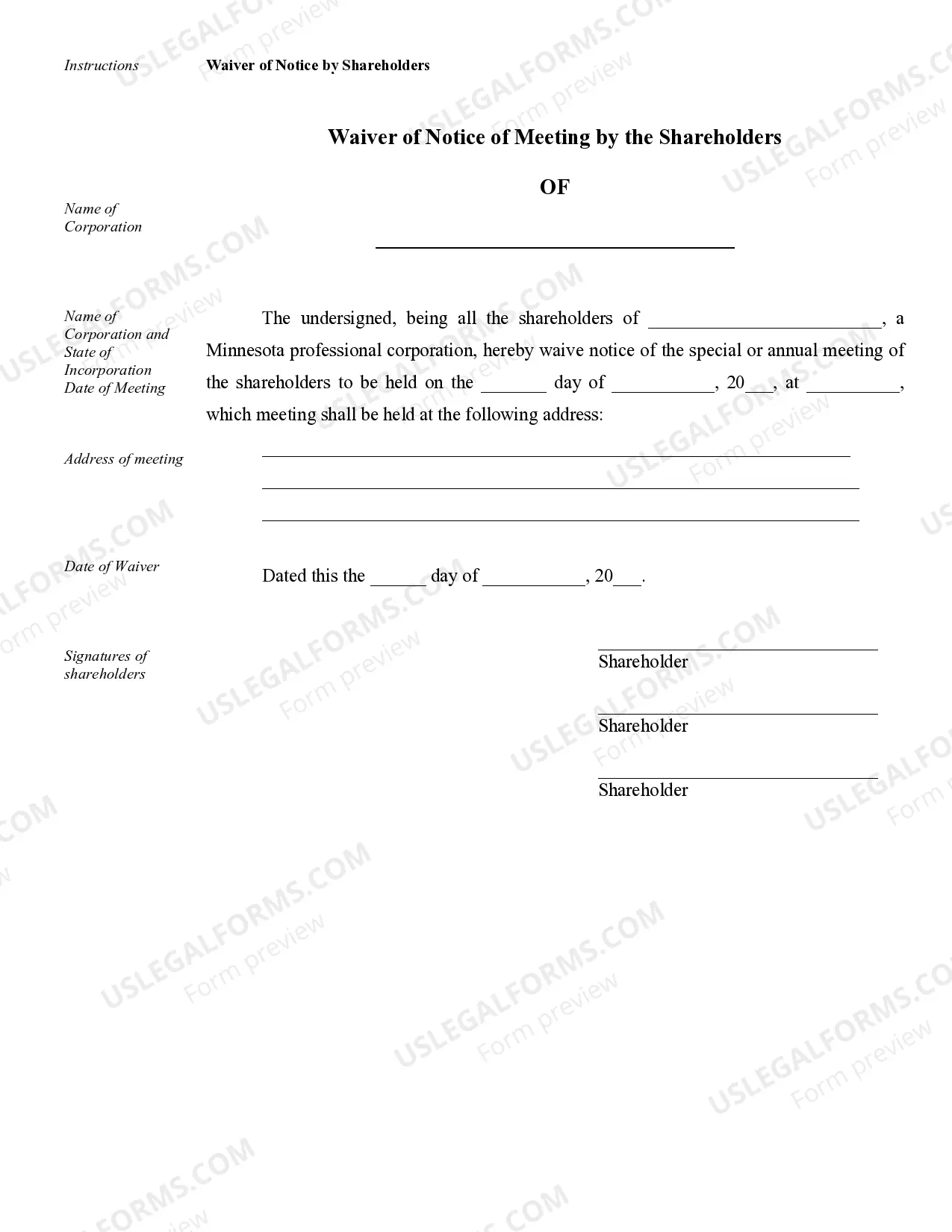

Minneapolis Annual Minutes for a Minnesota Professional Corporation serve as a written record of the proceedings that took place during the annual meeting of the corporation's directors or shareholders. These minutes are an important legal document that outlines the decisions, discussions, and actions undertaken during the meeting. Keywords: Minneapolis, Annual Minutes, Minnesota Professional Corporation, record, proceedings, annual meeting, directors, shareholders, decisions, discussions, actions, legal document. There are two types of Minneapolis Annual Minutes for a Minnesota Professional Corporation — one for the annual meeting of directors and another for the annual meeting of shareholders. 1. Minutes for Annual Directors' Meeting: The annual directors' meeting is typically held to discuss and decide on matters related to the corporation's management and operations. The minutes for the annual directors' meeting document various aspects, including: a. Meeting Date and Time: The specific date, time, and location of the meeting are noted. b. Attendance: The names of the directors present, absent, and those participating remotely are recorded. c. Call to Order: The meeting is officially called to order by the chairperson or an appointed director, and it is mentioned in the minutes. d. Approval of Previous Minutes: The minutes from the previous annual directors' meeting are reviewed and approved. e. Reports: The minutes outline any reports presented during the meeting, such as financial, operations, or any other relevant reports. f. Old Business: Discussions or actions related to unresolved matters from previous meetings are detailed. g. New Business: Any new matters or proposals brought forth by directors for discussion and decision-making are documented. h. Resolutions and Voting: The minutes list the resolutions proposed, the discussions that took place, and the results of voting on each resolution. i. Election of Officers: If any officer positions need to be filled or changed, the minutes record the elections. j. Adjournment: The meeting is officially adjourned by the chairperson or an assigned director, and the time noted in the minutes. 2. Minutes for Annual Shareholders' Meeting: The annual shareholders' meeting focuses on matters directly affecting the ownership and governance of the corporation, including major decisions. The minutes for the annual shareholders' meeting encompass the following key details: a. Meeting Date and Time: The specific date, time, and location of the meeting are noted in the minutes. b. Attendance: The names of the shareholders present, absent, and those participating remotely are recorded. c. Call to Order: The chairman or an appointed shareholder officially calls the meeting to order, and it is mentioned in the minutes. d. Approval of Previous Minutes: The minutes from the previous annual shareholders' meeting are reviewed and approved. e. Reports: Noteworthy reports, such as financial statements, profit-sharing, dividends, and any other relevant information, are documented. f. Old Business: Any unresolved matters from previous meetings are discussed and decisions are recorded. g. New Business: Shareholders can propose new business items for discussion and potential voting, which are detailed in the minutes. h. Resolutions and Voting: The minutes outline resolutions proposed, the discussions held, and the voting results for each resolution. i. Election of Directors: If director positions need to be filled or changed, the minutes record the elections conducted by the shareholders. j. Adjournment: The meeting is officially adjourned by the chairperson or an assigned shareholder, with the time mentioned in the minutes. In conclusion, the Minneapolis Annual Minutes for a Minnesota Professional Corporation serve as comprehensive records of the annual meetings held by directors and shareholders. These minutes provide an accurate account of the discussions, decisions, and actions taken, ensuring transparency and legal compliance for the corporation.

Minneapolis Annual Minutes for a Minnesota Professional Corporation

Description

How to fill out Minneapolis Annual Minutes For A Minnesota Professional Corporation?

If you are looking for a valid form template, it’s difficult to find a better place than the US Legal Forms website – probably the most comprehensive online libraries. With this library, you can find a large number of templates for business and individual purposes by types and regions, or keywords. With the high-quality search option, finding the most recent Minneapolis Annual Minutes for a Minnesota Professional Corporation is as elementary as 1-2-3. In addition, the relevance of every file is confirmed by a group of expert lawyers that on a regular basis review the templates on our platform and revise them according to the latest state and county requirements.

If you already know about our system and have a registered account, all you need to receive the Minneapolis Annual Minutes for a Minnesota Professional Corporation is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have discovered the sample you want. Check its description and use the Preview feature to see its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to discover the appropriate record.

- Affirm your choice. Select the Buy now button. Following that, select the preferred subscription plan and provide credentials to register an account.

- Make the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the form. Pick the format and download it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Minneapolis Annual Minutes for a Minnesota Professional Corporation.

Each form you save in your profile does not have an expiry date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you want to receive an extra version for editing or creating a hard copy, you may come back and download it again whenever you want.

Make use of the US Legal Forms extensive library to gain access to the Minneapolis Annual Minutes for a Minnesota Professional Corporation you were seeking and a large number of other professional and state-specific templates in a single place!