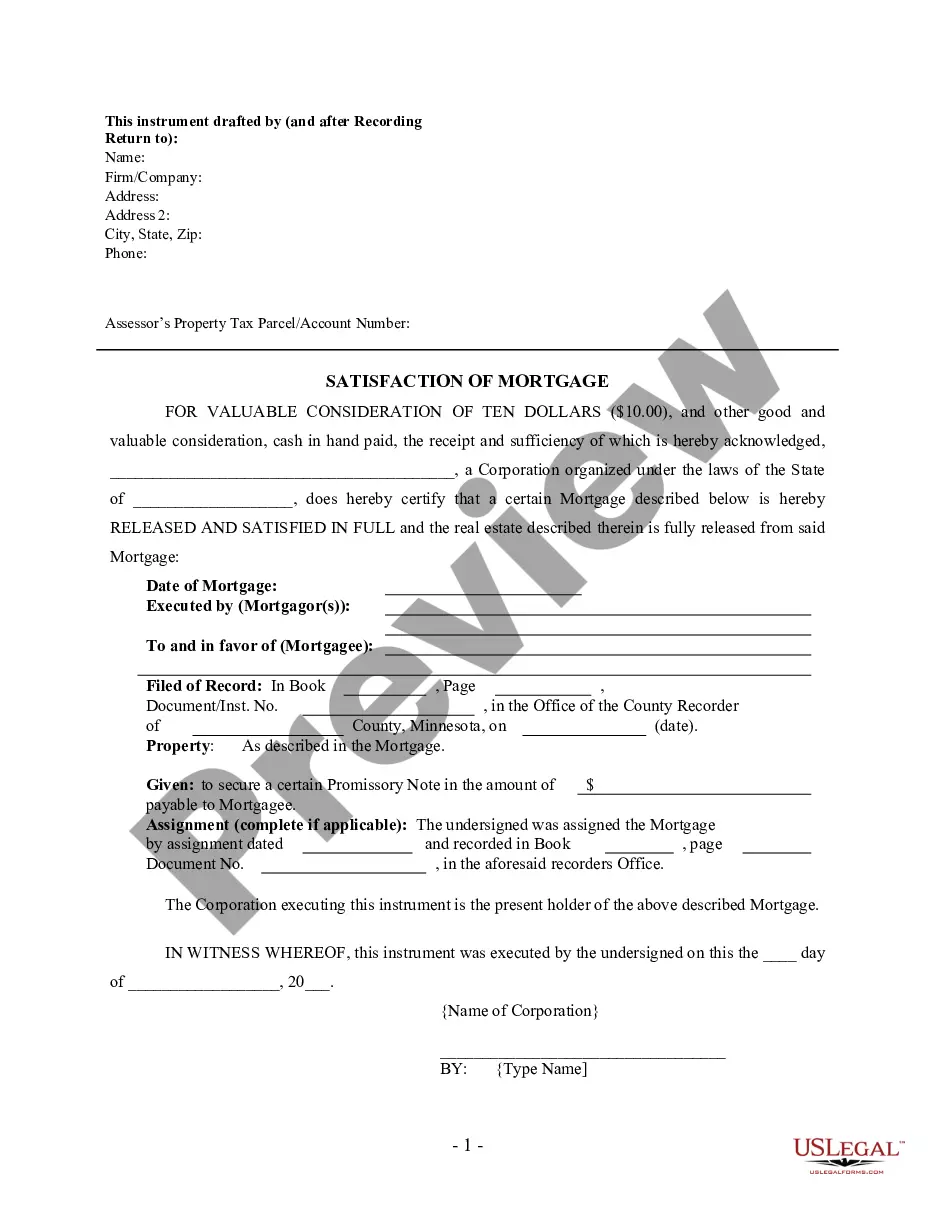

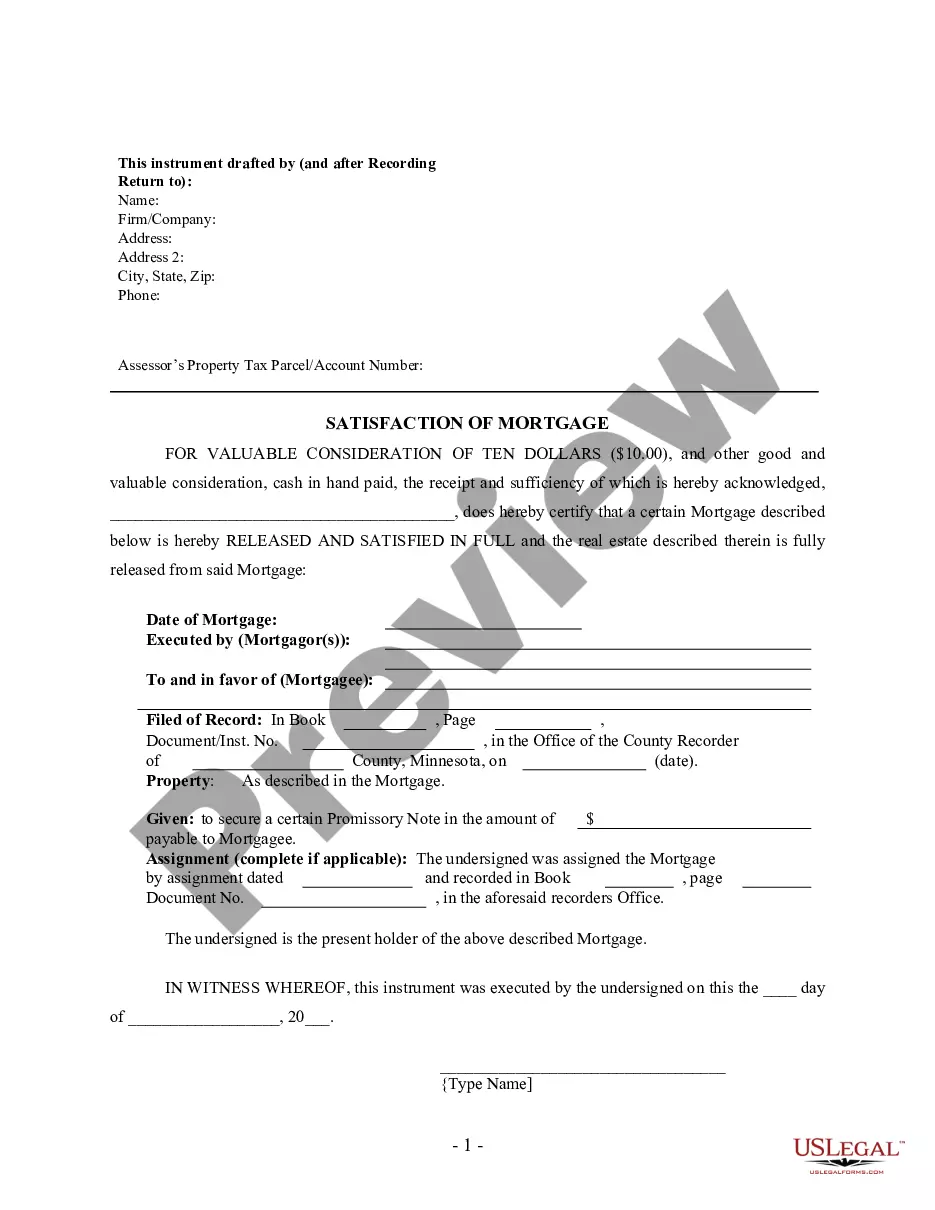

Minneapolis Minnesota Satisfaction, Release, or Cancellation of Mortgage by Corporation is a legally-binding document that signifies the complete discharge or cancellation of a mortgage agreement by a corporation based in Minneapolis, Minnesota. This document ensures that all obligations and responsibilities associated with the mortgage agreement have been fulfilled, giving the property owner complete ownership and freedom from any encumbrances. An effective Minneapolis Minnesota Satisfaction, Release, or Cancellation of Mortgage by Corporation document includes several key elements. Firstly, it should state the names of both the mortgagee (the corporation) and the mortgagor (the property owner) involved in the agreement. Additionally, it should clearly describe the property by providing details such as its legal description, address, and any other identifying information. The specific terms and conditions of the original mortgage agreement need to be stated in the document, such as the loan amount, interest rate, and repayment terms. By clearly mentioning these details, the Satisfaction, Release, or Cancellation of Mortgage by Corporation establishes a reference to the original contract and ensures that the mortgage is entirely fulfilled. In Minneapolis, Minnesota, there are several types of Satisfaction, Release, or Cancellation of Mortgage by Corporation documents that can be used, depending on the specific circumstances. Some of these variations include: 1. Voluntary Satisfaction: This type of document is used when the property owner has completely repaid the mortgage, according to the terms of the original agreement, and requests the corporation to release the lien on the property. The corporation, in this case, confirms the debt's satisfaction and relinquishes any claims on the property. 2. Partial Satisfaction or Release: In certain situations, the property owner may make partial payments towards the mortgage principal, resulting in a decreased outstanding balance. A Partial Satisfaction or Release of Mortgage document acknowledges that a portion of the debt has been satisfied and releases the corresponding portion of the property from the mortgage lien. 3. Release by Corporation: This document is used when the corporation itself decides to release the mortgage, typically due to repayment in full or as part of a refinancing arrangement. It signifies that the corporation acknowledges the fulfillment of all obligations and relinquishes its claim on the property. The Minneapolis Minnesota Satisfaction, Release, or Cancellation of Mortgage by Corporation document plays a crucial role in ensuring a clear title transfer and removing any encumbrances on the property. It provides legal evidence that the mortgage agreement has been satisfied, released, or canceled while protecting the rights and interests of both the corporation and the property owner. It is essential to consult with legal professionals to draft or review this document to ensure compliance with relevant Minnesota state laws and regulations and to accurately reflect the intentions of all parties involved.

Minneapolis Minnesota Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out Minneapolis Minnesota Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

If you have previously made use of our service, Log In to your account and download the Minneapolis Minnesota Satisfaction, Release or Cancellation of Mortgage by Corporation onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial engagement with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to quickly locate and download any template for your personal or professional purposes!

- Verify you’ve located the correct document. Browse through the description and utilize the Preview feature, if available, to determine if it fulfills your requirements. If it does not meet your needs, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Retrieve your Minneapolis Minnesota Satisfaction, Release or Cancellation of Mortgage by Corporation. Select the file format for your document and save it to your device.

- Finalize your sample. Print it out or leverage professional online editors to complete and sign it electronically.

Form popularity

FAQ

Borrowers who can no longer afford to stay in their home may consider a Mortgage Release?, also known as a deed-in-lieu of foreclosure, to avoid foreclosure. This is also a good alternative for homeowners who are unable to sell their property, whether for a full payoff or a short sale.

How long does it take to discharge a mortgage? Generally it takes between 14-21 business days to complete the discharge process. At one stage it took less time, around 10-14 business days, but these days more people are refinancing their home loan so there are more discharges taking place.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

Within 60 days after the date of receipt of the full payment of the mortgage, lien, or judgment, the person required to acknowledge satisfaction of the mortgage, lien, or judgment shall send or cause to be sent the recorded satisfaction to the person who has made the full payment.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

Upon receipt of the final payment, satisfying a mortgage, the mortgagee (lender) must execute and file a written document acknowledging that the mortgage has been satisfied (i.e., paid in full). This written document must be acknowledged, or proven (i.e., notarized).

A release assignment or satisfaction of mortgage form is a document stating that the lender has released the homeowner from all liability regarding her mortgage. The release assignment must be recorded at the local land office in order to be valid.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.