The Last Will and Testament Form with Instructions you have found is for a single person with adult and minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

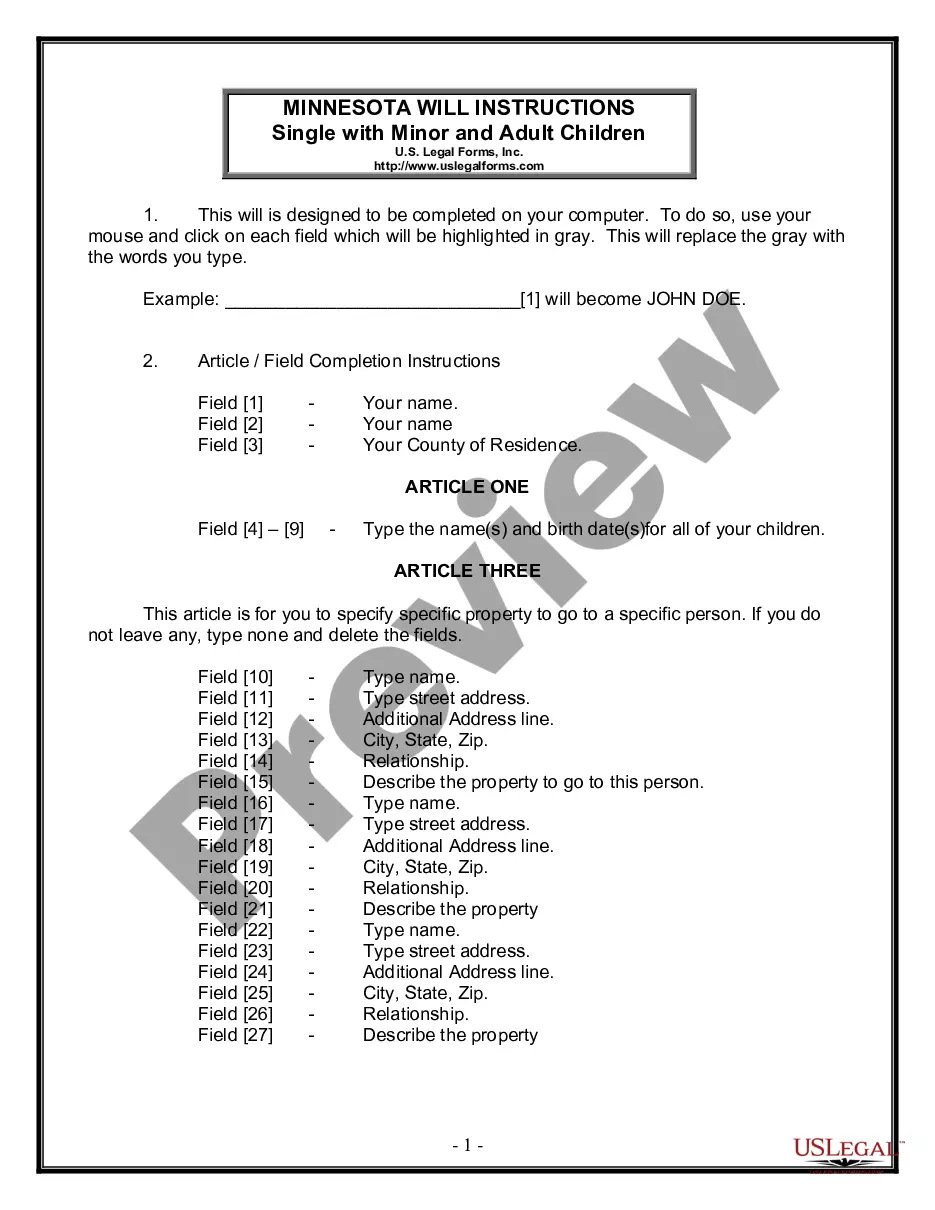

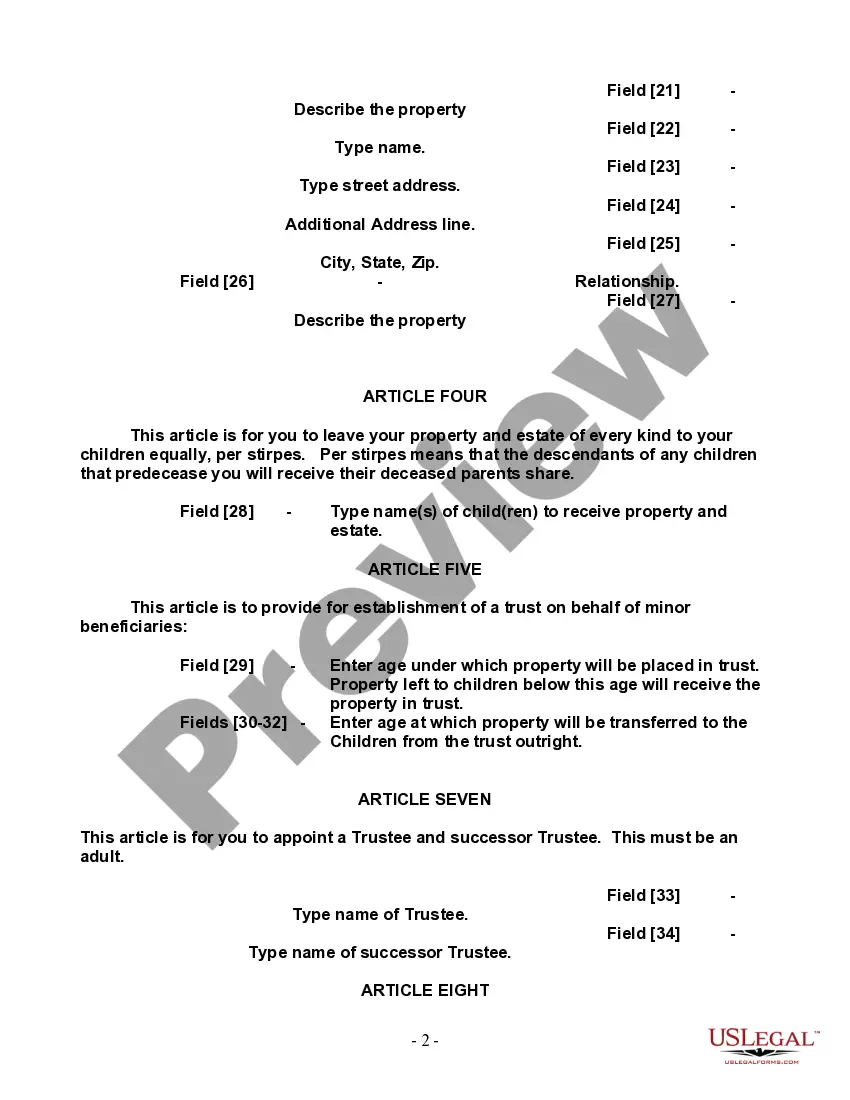

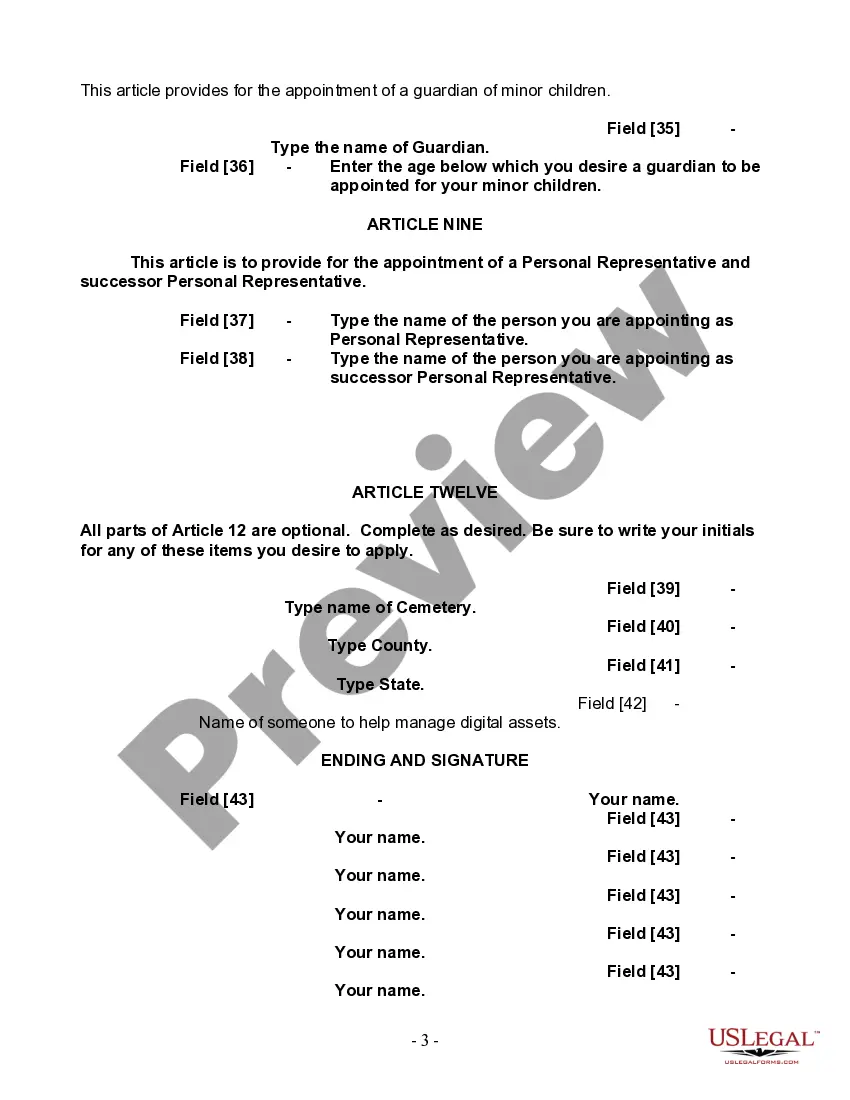

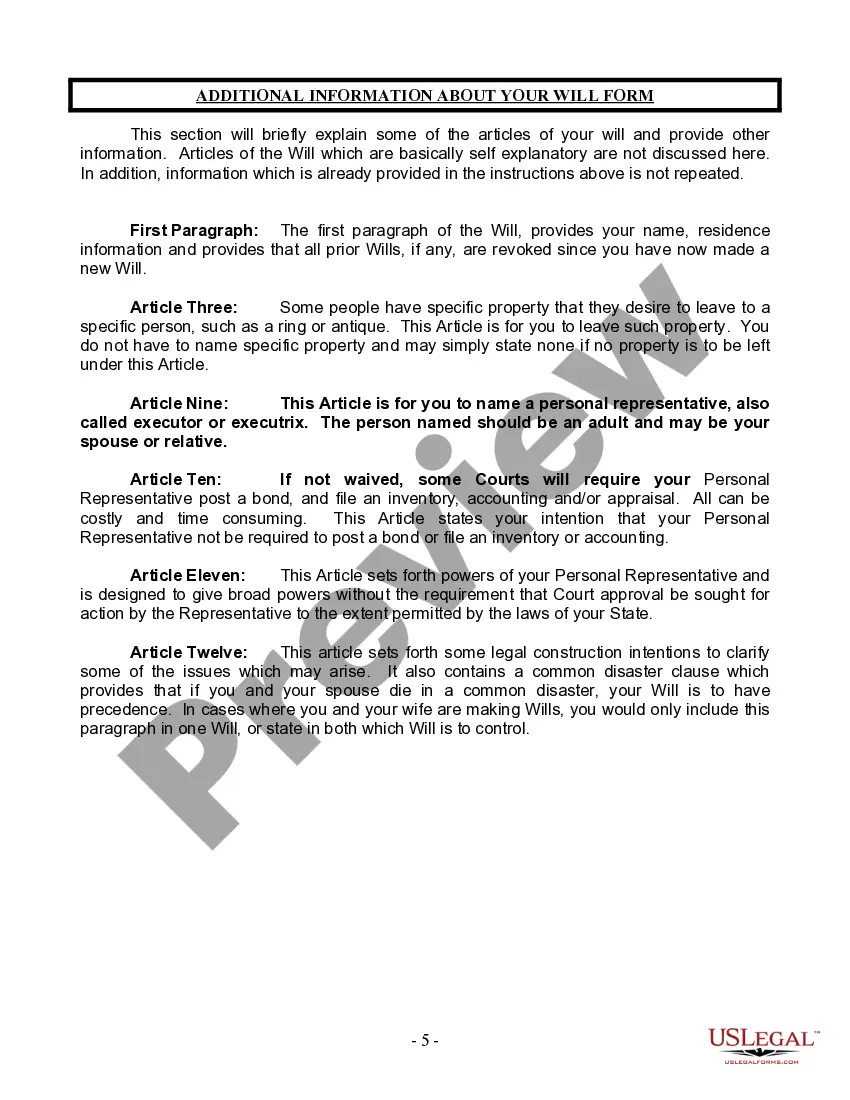

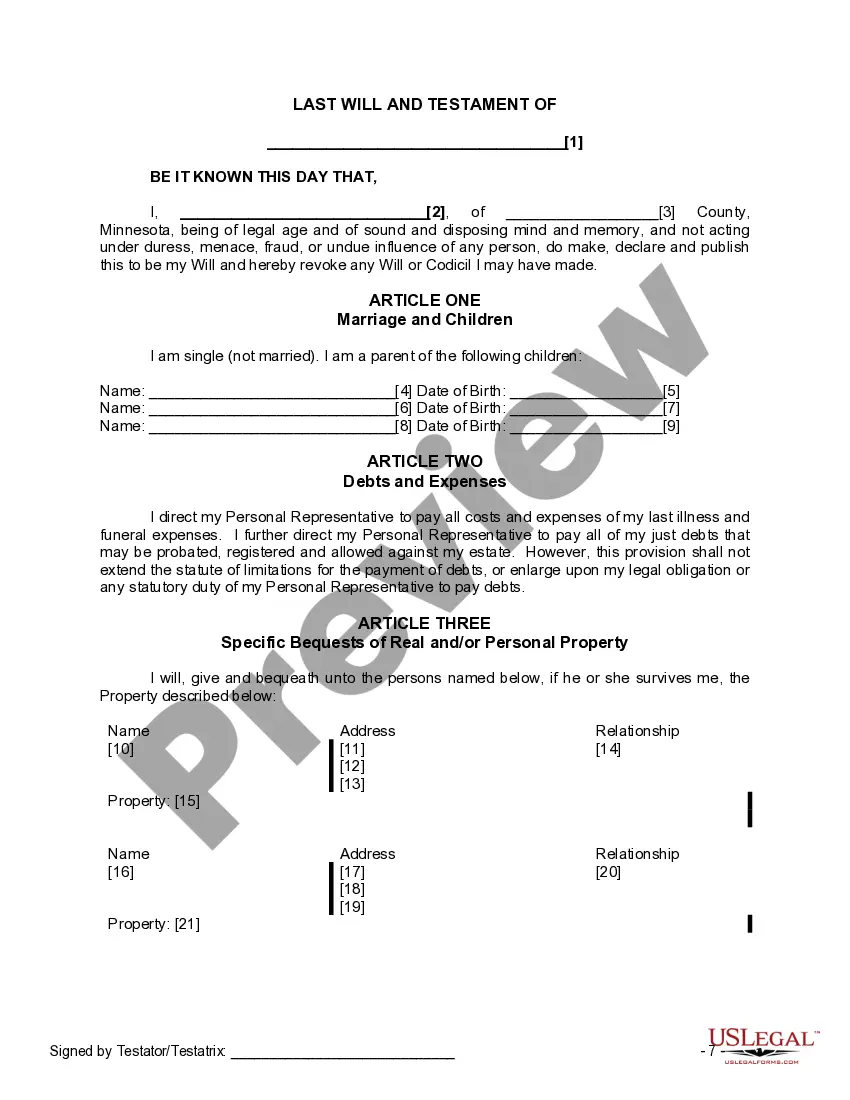

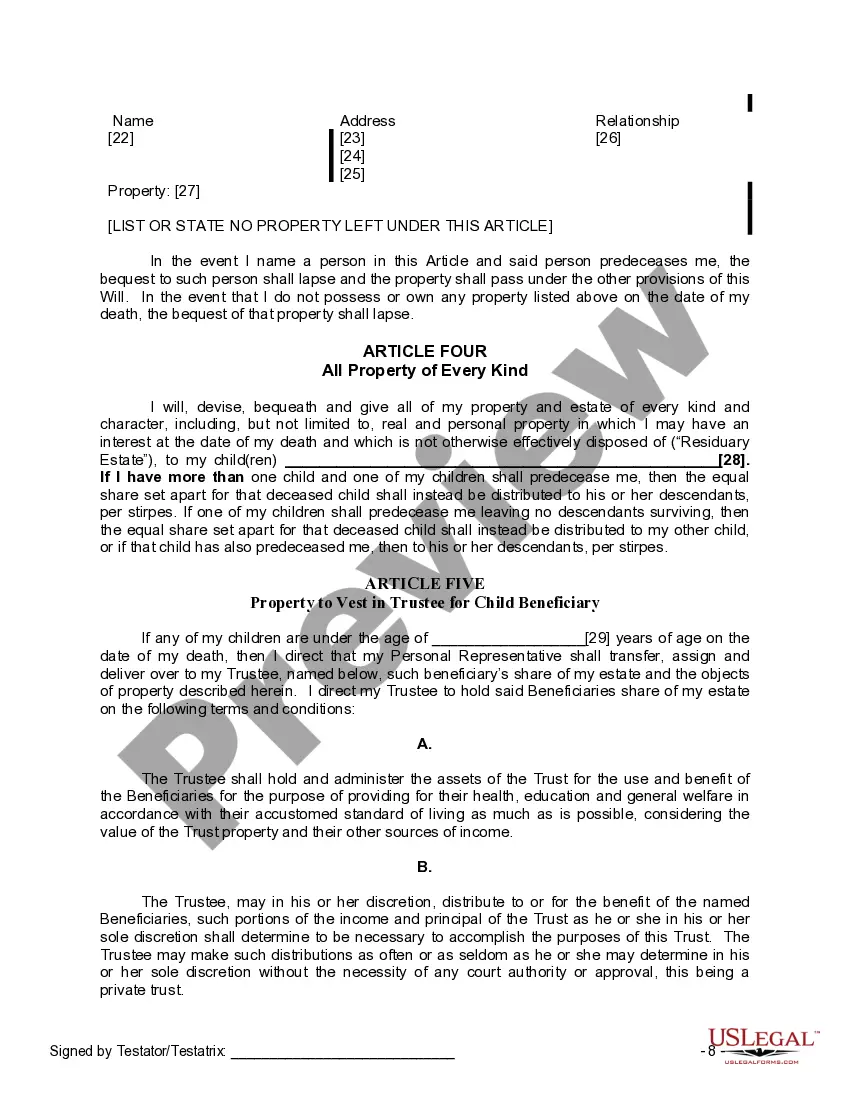

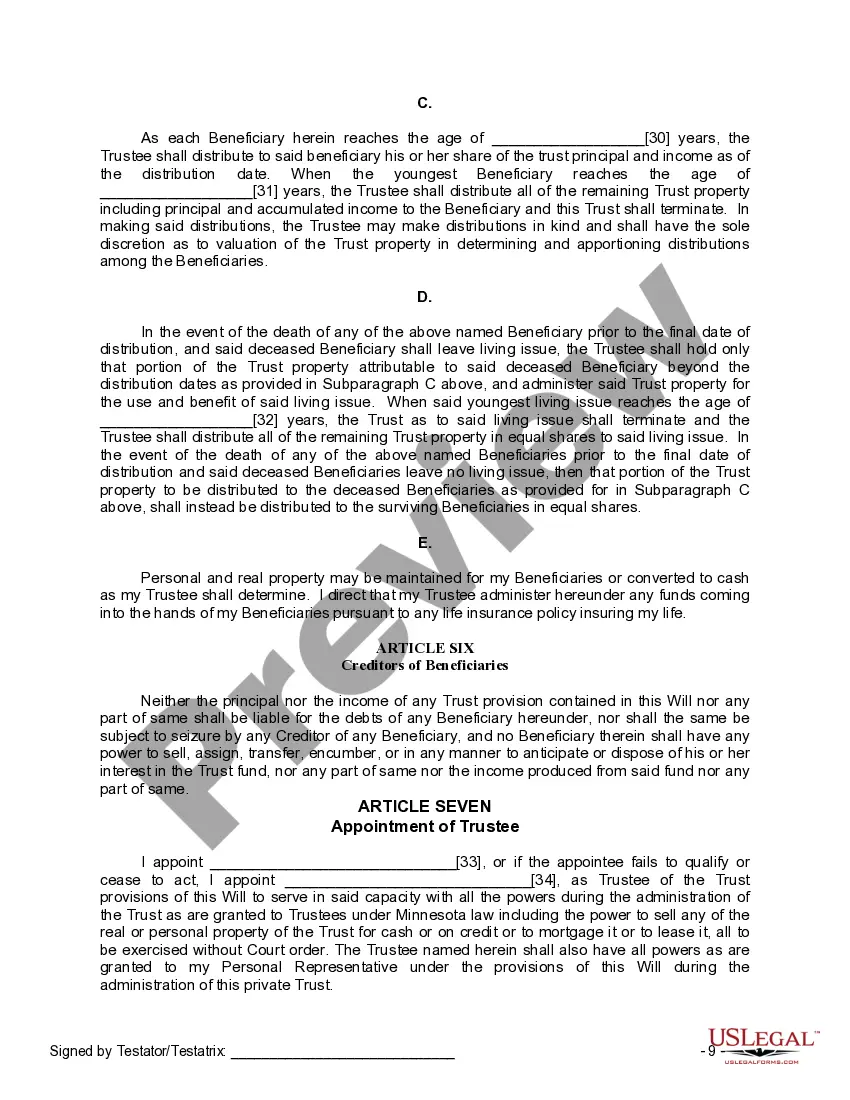

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. Minneapolis Minnesota Legal Last Will and Testament Form for Single Person with Adult and Minor Children is a legally-binding document that allows individuals in Minneapolis, Minnesota to outline their final wishes regarding the distribution of assets and the guardianship of their children in the event of their death. This form is specifically designed for single individuals who have both adult children and minor children. It is essential for single parents with adult and minor children to create a comprehensive Last Will and Testament to ensure that their assets are distributed according to their wishes and that their minor children are taken care of by a selected guardian. This legal document provides clear instructions on how the testator's (the person creating the will) property, possessions, and financial assets should be distributed among their beneficiaries, including their adult children and minor children. The Minneapolis Minnesota Legal Last Will and Testament Form for Single Person with Adult and Minor Children includes various sections that need to be completed. These sections may cover: 1. Testator's Personal Information: This section requires the testator's full name, address, date of birth, and other identifying details. 2. Appointment of Executor: The testator can name an individual who will be responsible for executing the terms of the will and managing the estate after their death. 3. Guardianship of Minor Children: This section allows the testator to name a guardian who will assume responsibility for their minor children's upbringing if both parents have passed away. 4. Asset Distribution: The testator can clearly specify how they want their assets, including money, properties, investments, and personal belongings, to be divided among their adult and minor children. 5. Alternate Beneficiaries: In case any of the named beneficiaries predecease the testator or are unable to inherit, this section allows for the designation of alternate beneficiaries. 6. Residual Estate Clause: This clause involves the distribution of any remaining assets that are not specifically mentioned in the will. 7. Witnesses and Signature: The testator must sign the will in the presence of two witnesses who are not beneficiaries. It's important to note that there might be different versions or templates of the Minneapolis Minnesota Legal Last Will and Testament Form for Single Person with Adult and Minor Children available, as they can be tailored to meet specific needs or comply with changes in local laws. These variants might include slight modifications or additional sections to address particular circumstances, such as special bequests or the establishment of trusts for minor children. To ensure that the Last Will and Testament accurately reflects the testator's intentions and adheres to legal requirements, it is advisable to seek guidance from an attorney specializing in estate planning and wills.

Minneapolis Minnesota Legal Last Will and Testament Form for Single Person with Adult and Minor Children is a legally-binding document that allows individuals in Minneapolis, Minnesota to outline their final wishes regarding the distribution of assets and the guardianship of their children in the event of their death. This form is specifically designed for single individuals who have both adult children and minor children. It is essential for single parents with adult and minor children to create a comprehensive Last Will and Testament to ensure that their assets are distributed according to their wishes and that their minor children are taken care of by a selected guardian. This legal document provides clear instructions on how the testator's (the person creating the will) property, possessions, and financial assets should be distributed among their beneficiaries, including their adult children and minor children. The Minneapolis Minnesota Legal Last Will and Testament Form for Single Person with Adult and Minor Children includes various sections that need to be completed. These sections may cover: 1. Testator's Personal Information: This section requires the testator's full name, address, date of birth, and other identifying details. 2. Appointment of Executor: The testator can name an individual who will be responsible for executing the terms of the will and managing the estate after their death. 3. Guardianship of Minor Children: This section allows the testator to name a guardian who will assume responsibility for their minor children's upbringing if both parents have passed away. 4. Asset Distribution: The testator can clearly specify how they want their assets, including money, properties, investments, and personal belongings, to be divided among their adult and minor children. 5. Alternate Beneficiaries: In case any of the named beneficiaries predecease the testator or are unable to inherit, this section allows for the designation of alternate beneficiaries. 6. Residual Estate Clause: This clause involves the distribution of any remaining assets that are not specifically mentioned in the will. 7. Witnesses and Signature: The testator must sign the will in the presence of two witnesses who are not beneficiaries. It's important to note that there might be different versions or templates of the Minneapolis Minnesota Legal Last Will and Testament Form for Single Person with Adult and Minor Children available, as they can be tailored to meet specific needs or comply with changes in local laws. These variants might include slight modifications or additional sections to address particular circumstances, such as special bequests or the establishment of trusts for minor children. To ensure that the Last Will and Testament accurately reflects the testator's intentions and adheres to legal requirements, it is advisable to seek guidance from an attorney specializing in estate planning and wills.