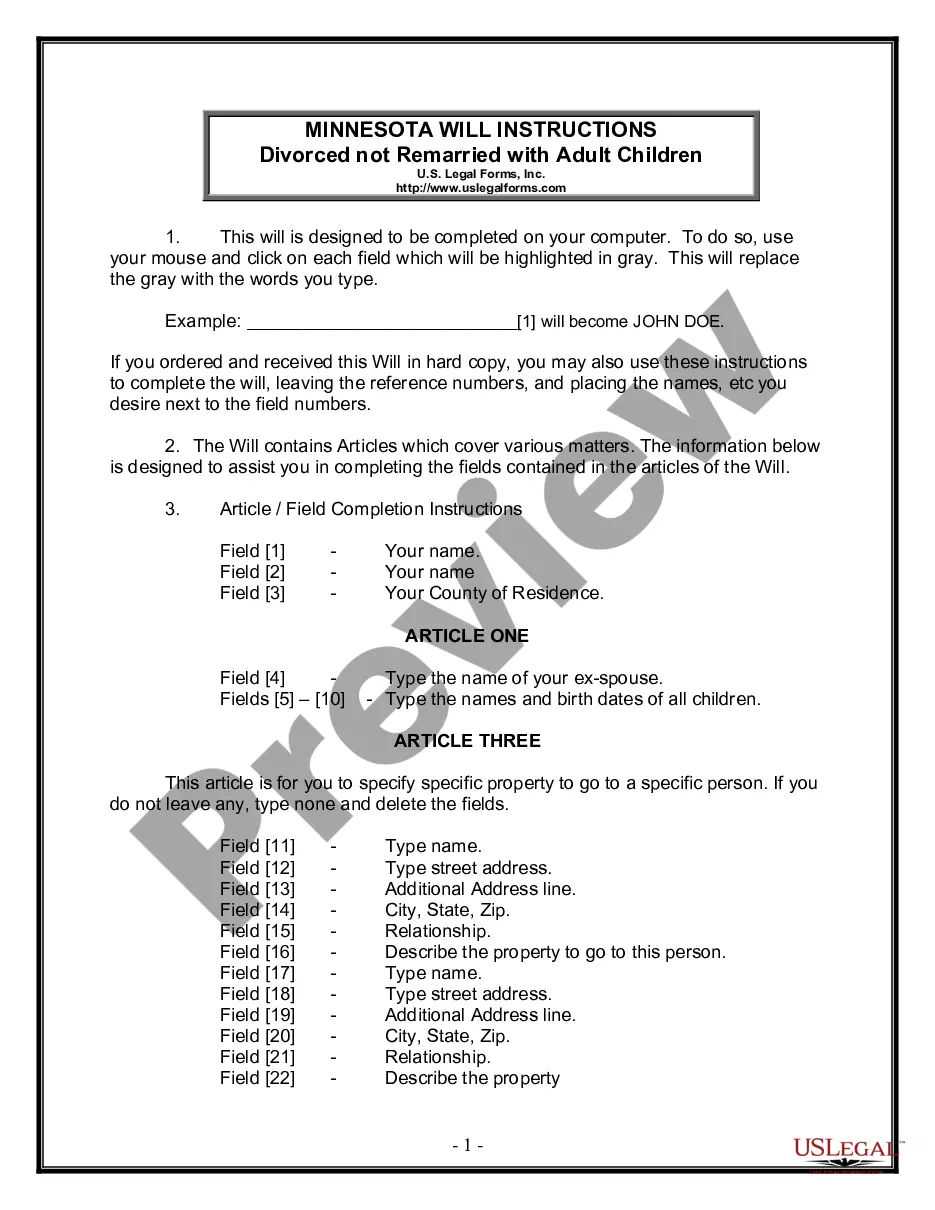

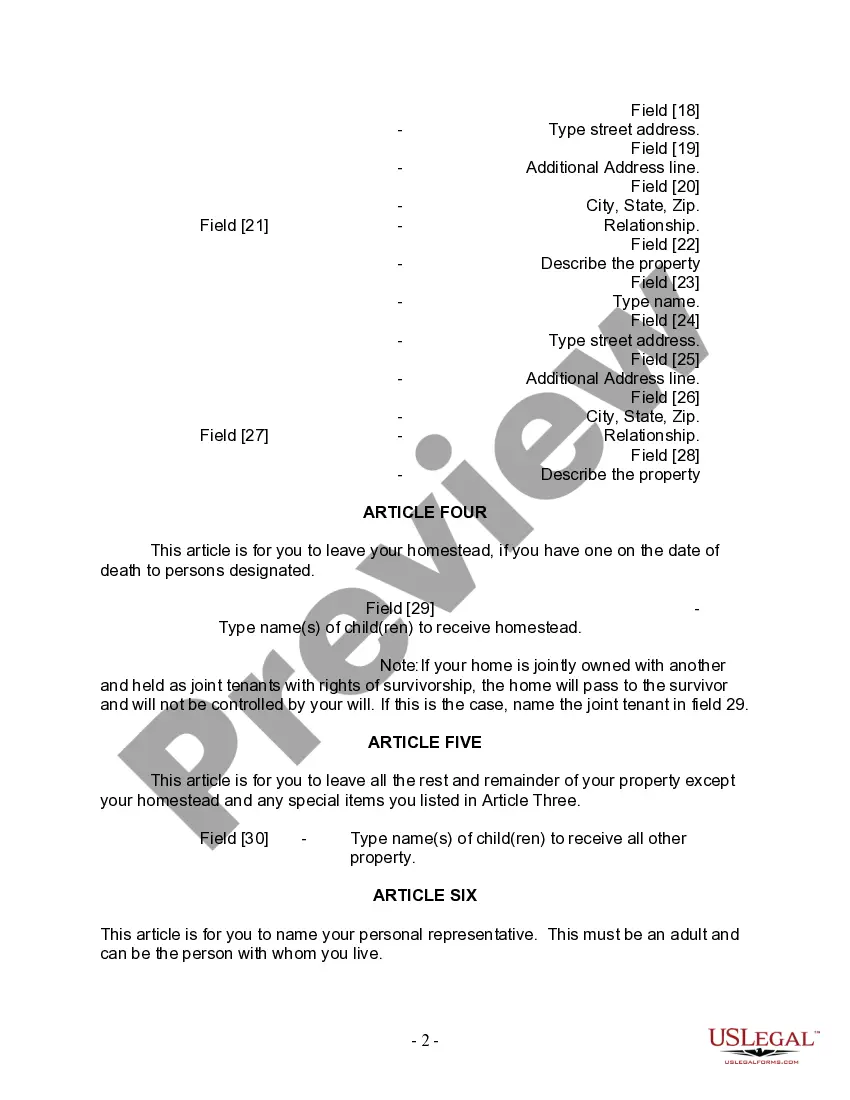

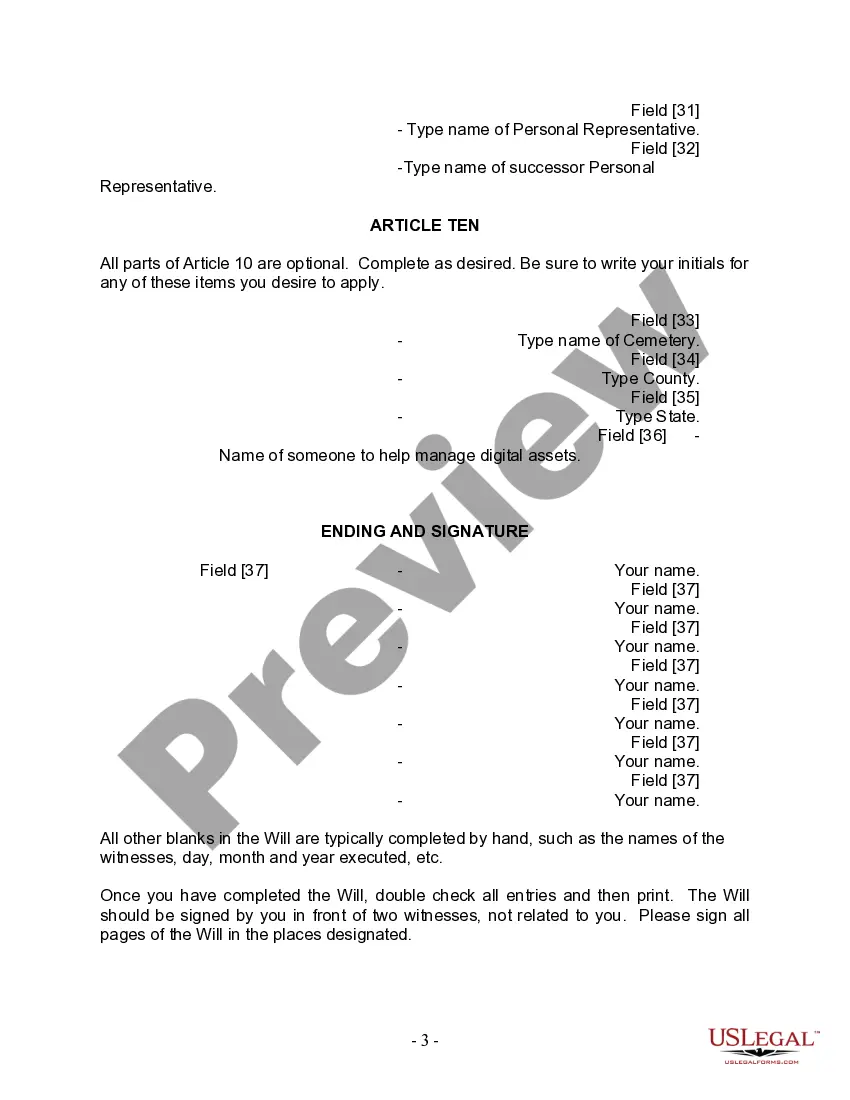

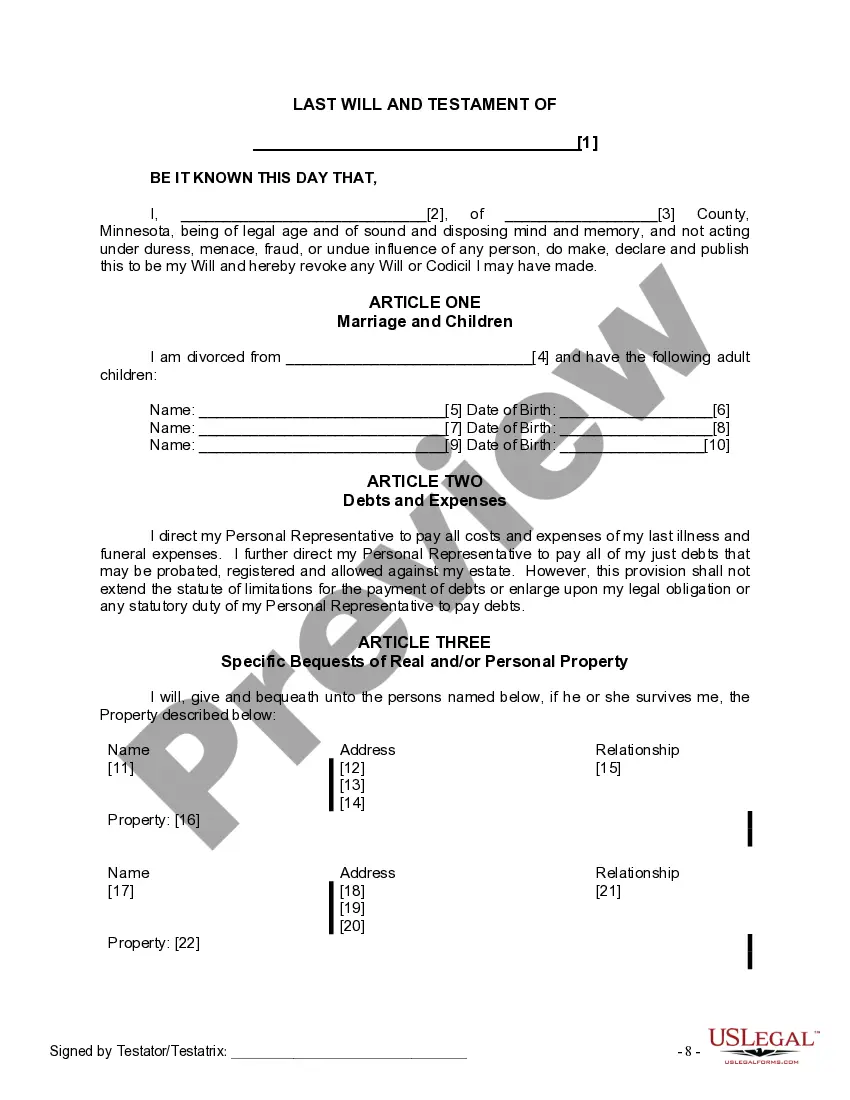

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Hennepin Minnesota Legal Last Will and Testament Form for a Divorced person not Remarried with Adult Children is a legally binding document that allows individuals in Hennepin County, Minnesota, who have gone through a divorce and have adult children, to outline their final wishes and distribute their assets upon their passing. This specific form is tailored to meet the unique needs of divorced individuals who have not remarried and have adult children. By completing this form, individuals can ensure that their assets are distributed according to their desires and that their adult children and other beneficiaries are provided for after their death. It is crucial for divorced individuals without a current spouse to have a valid Last Will and Testament to control the fate of their assets. The Hennepin Minnesota Legal Last Will and Testament Form for a Divorced person not Remarried with Adult Children covers various important points: 1. Executor Appointment: This form allows individuals to designate an executor, who will be responsible for managing the distribution of assets and fulfilling the instructions outlined in the will. 2. Asset Distribution: The form enables the individual to specify how their assets, including property, bank accounts, investments, and personal belongings, will be distributed among their adult children and other beneficiaries upon their passing. 3. Guardianship of Minor Children: If there are minor children involved, this form allows for the appointment of a legal guardian who will be responsible for the care and well-being of the children in the event of the individual's death. 4. Specific Bequests: The form accommodates specific instructions for leaving particular assets, such as sentimental items or family heirlooms, to specific individuals or organizations. 5. Debts and Taxes: The form addresses the distribution of assets and instructs the executor on how to handle any outstanding debts and taxes. 6. Successor Beneficiaries: In the event that a primary beneficiary predeceases the testator, the form provides the option to name successors to ensure assets are still distributed according to the individual's wishes. It is important to note that Hennepin County, Minnesota, may have specific legal requirements or forms for a last will and testament. Therefore, it is advisable to consult with an attorney or legal professional to ensure compliance with all local laws and regulations. Different variations or types of Hennepin County, Minnesota, legal last will and testament forms may exist based on specific circumstances or preferences. However, the main focus is typically on individuals who are divorced, not remarried, and have adult children. Specific names for these variations may not be available without consulting local legal resources or professionals.

The Hennepin Minnesota Legal Last Will and Testament Form for a Divorced person not Remarried with Adult Children is a legally binding document that allows individuals in Hennepin County, Minnesota, who have gone through a divorce and have adult children, to outline their final wishes and distribute their assets upon their passing. This specific form is tailored to meet the unique needs of divorced individuals who have not remarried and have adult children. By completing this form, individuals can ensure that their assets are distributed according to their desires and that their adult children and other beneficiaries are provided for after their death. It is crucial for divorced individuals without a current spouse to have a valid Last Will and Testament to control the fate of their assets. The Hennepin Minnesota Legal Last Will and Testament Form for a Divorced person not Remarried with Adult Children covers various important points: 1. Executor Appointment: This form allows individuals to designate an executor, who will be responsible for managing the distribution of assets and fulfilling the instructions outlined in the will. 2. Asset Distribution: The form enables the individual to specify how their assets, including property, bank accounts, investments, and personal belongings, will be distributed among their adult children and other beneficiaries upon their passing. 3. Guardianship of Minor Children: If there are minor children involved, this form allows for the appointment of a legal guardian who will be responsible for the care and well-being of the children in the event of the individual's death. 4. Specific Bequests: The form accommodates specific instructions for leaving particular assets, such as sentimental items or family heirlooms, to specific individuals or organizations. 5. Debts and Taxes: The form addresses the distribution of assets and instructs the executor on how to handle any outstanding debts and taxes. 6. Successor Beneficiaries: In the event that a primary beneficiary predeceases the testator, the form provides the option to name successors to ensure assets are still distributed according to the individual's wishes. It is important to note that Hennepin County, Minnesota, may have specific legal requirements or forms for a last will and testament. Therefore, it is advisable to consult with an attorney or legal professional to ensure compliance with all local laws and regulations. Different variations or types of Hennepin County, Minnesota, legal last will and testament forms may exist based on specific circumstances or preferences. However, the main focus is typically on individuals who are divorced, not remarried, and have adult children. Specific names for these variations may not be available without consulting local legal resources or professionals.