This is a Last Will and Testament Form for Married Person with Adult and Minor Children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse and children. It also establishes a trust and provides for the appointment of a trustee for the estate of the minor children.

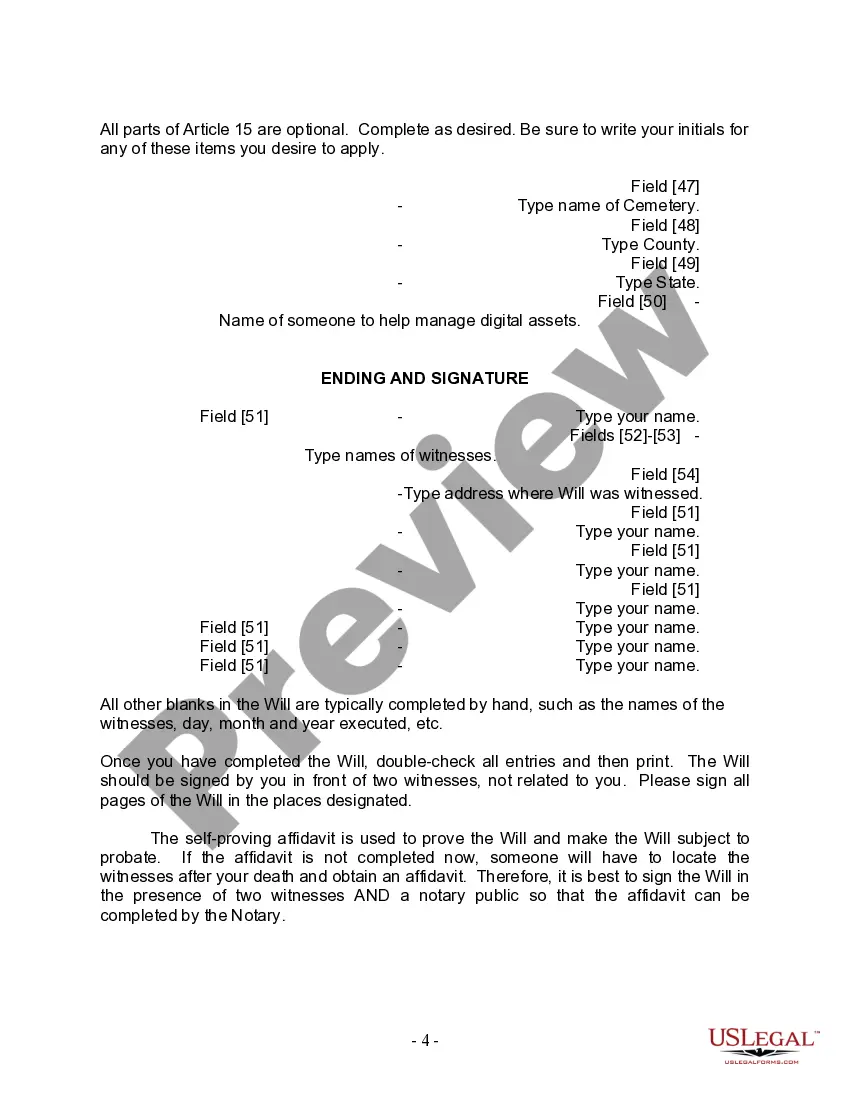

This will must be signed in the presence of two witnesses, not related to you or named in your will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the will.

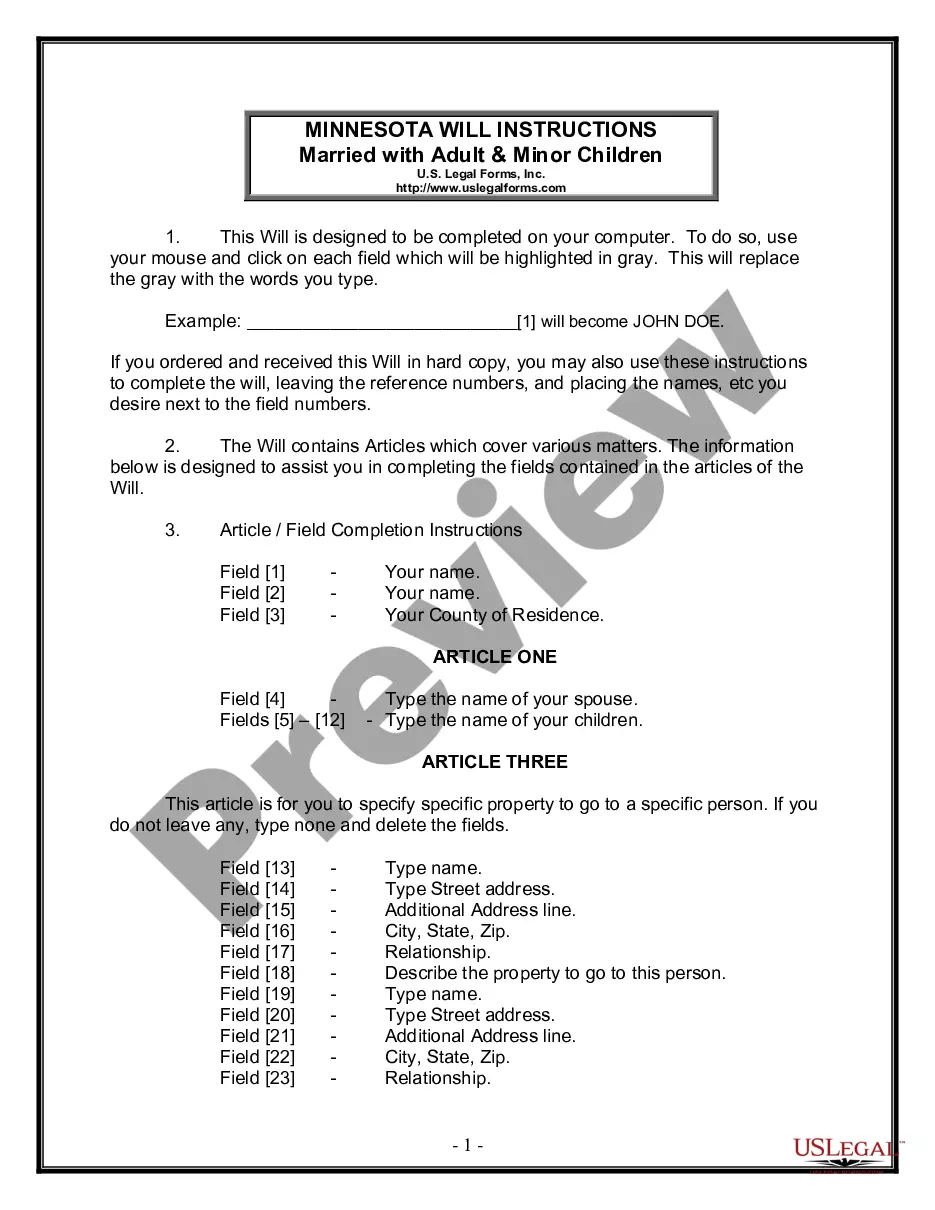

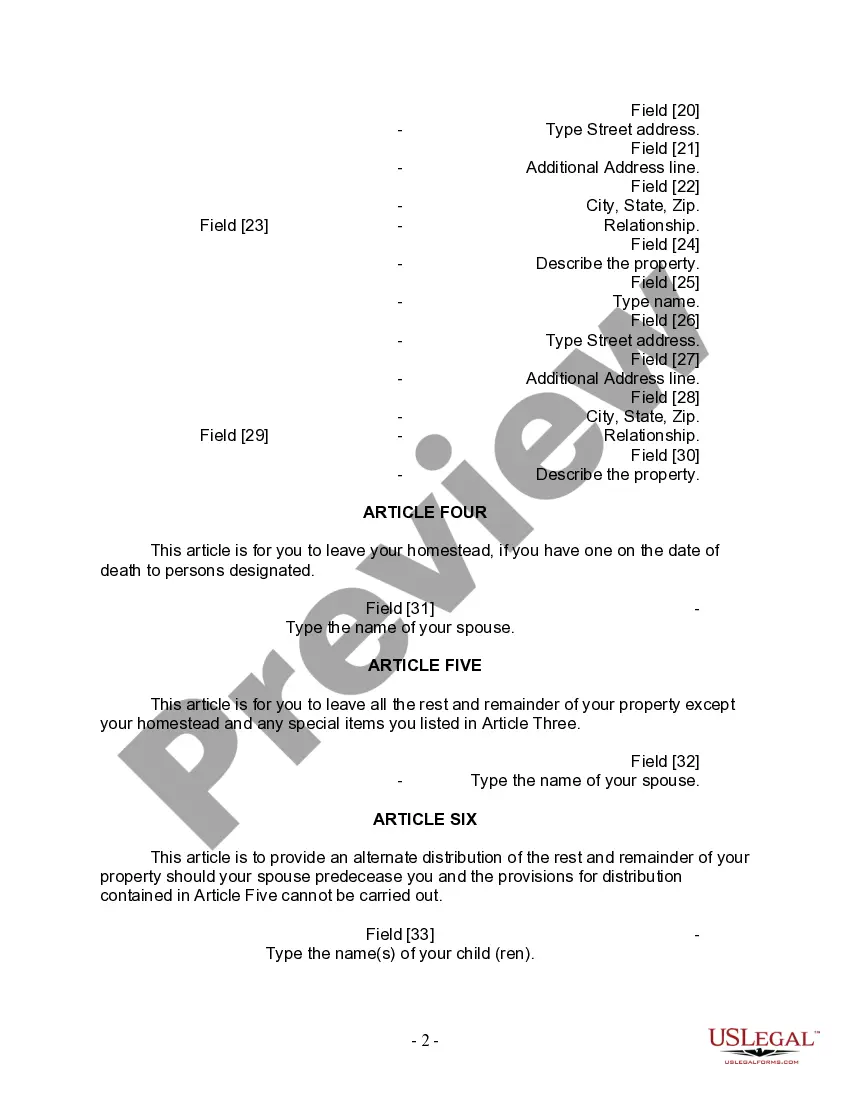

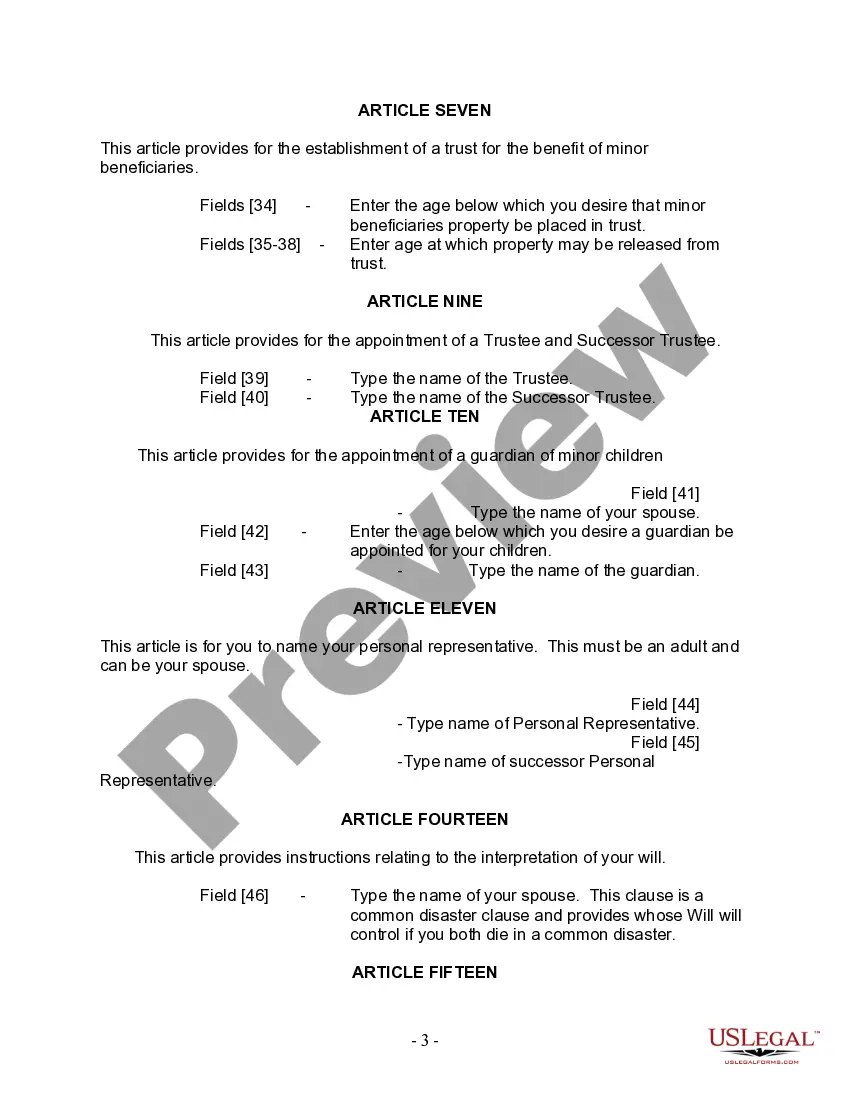

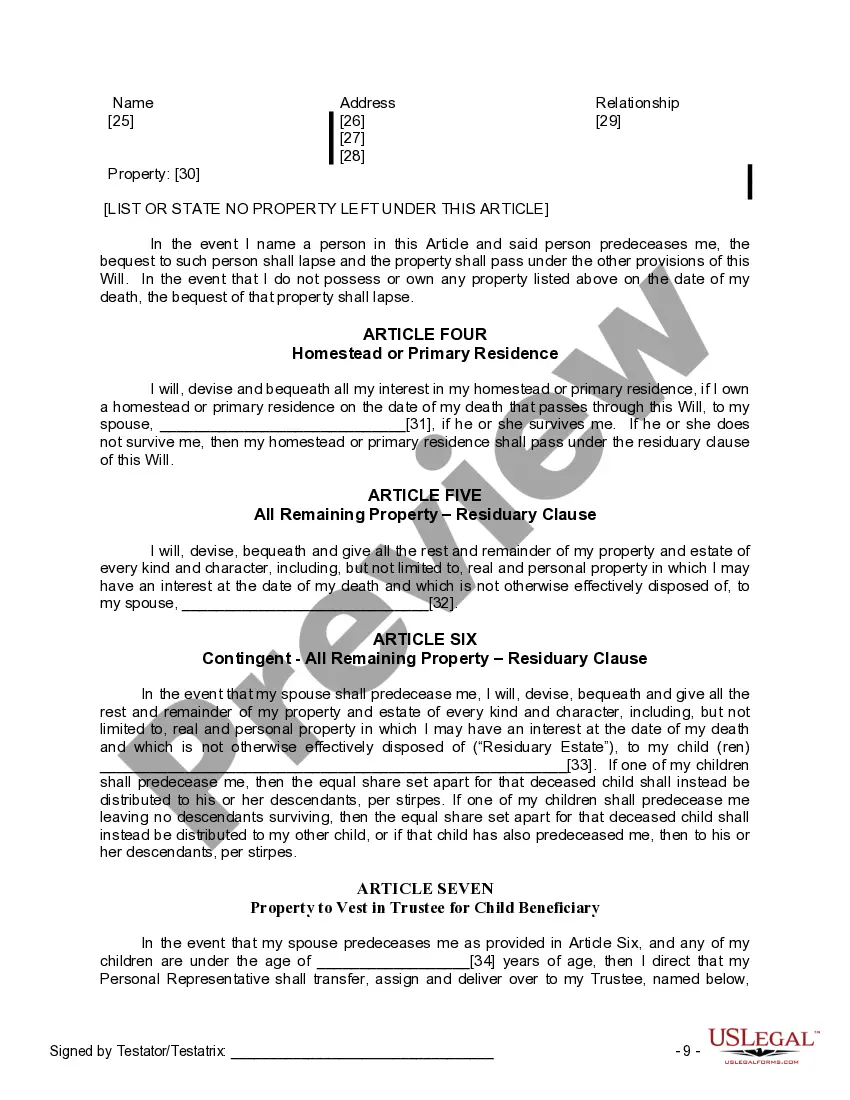

The Hennepin Minnesota Legal Last Will and Testament Form for Married Person with Adult and Minor Children is a legal document that allows married individuals residing in Hennepin County, Minnesota, to outline their final wishes regarding the distribution of their assets and the care of their children after their passing. This comprehensive form ensures that the individual's spouse, adult children, and minor children are adequately provided for in accordance with their wishes. This specific type of Last Will and Testament form is designed for married individuals who have both adult and minor children. It takes into consideration the unique legal considerations and responsibilities associated with the different age groups of children. With this form, married individuals can designate their spouse as the primary beneficiary and executor of their estate, ensuring that their partner has the authority to administer the estate and carry out their wishes. Here are different types of Hennepin Minnesota Legal Last Will and Testament Form for Married Person with Adult and Minor Children: 1. Standard Last Will and Testament: This form allows married individuals to distribute their assets as they see fit, providing detailed instructions on who will inherit specific assets, including real estate, financial accounts, personal belongings, and investments. The form also includes provisions for the appointment of guardians for minor children, specifying who should take care of their physical, emotional, and financial needs in the event of both parents' passing. 2. Trust-Based Last Will and Testament: This variant of the form incorporates the creation of a trust to manage and distribute assets. A trust can provide various benefits, such as reducing estate taxes, protecting assets from creditors, ensuring the orderly transfer of assets, and safeguarding the financial security of minor children until they reach adulthood. 3. Living Will: While not directly related to the distribution of assets, a living will is an important document that can be included as part of the Last Will and Testament. This legal document allows individuals to express their preferences regarding end-of-life medical treatments in case they become unable to communicate their wishes due to incapacitation. By using the Hennepin Minnesota Legal Last Will and Testament Form for Married Person with Adult and Minor Children, individuals can ensure their spouse and children are protected and cared for according to their wishes, provide clear instructions regarding their estate, and establish a sense of security for the future. It is recommended to consult with an attorney specializing in estate planning to ensure the form is completed accurately and in compliance with Minnesota state laws.The Hennepin Minnesota Legal Last Will and Testament Form for Married Person with Adult and Minor Children is a legal document that allows married individuals residing in Hennepin County, Minnesota, to outline their final wishes regarding the distribution of their assets and the care of their children after their passing. This comprehensive form ensures that the individual's spouse, adult children, and minor children are adequately provided for in accordance with their wishes. This specific type of Last Will and Testament form is designed for married individuals who have both adult and minor children. It takes into consideration the unique legal considerations and responsibilities associated with the different age groups of children. With this form, married individuals can designate their spouse as the primary beneficiary and executor of their estate, ensuring that their partner has the authority to administer the estate and carry out their wishes. Here are different types of Hennepin Minnesota Legal Last Will and Testament Form for Married Person with Adult and Minor Children: 1. Standard Last Will and Testament: This form allows married individuals to distribute their assets as they see fit, providing detailed instructions on who will inherit specific assets, including real estate, financial accounts, personal belongings, and investments. The form also includes provisions for the appointment of guardians for minor children, specifying who should take care of their physical, emotional, and financial needs in the event of both parents' passing. 2. Trust-Based Last Will and Testament: This variant of the form incorporates the creation of a trust to manage and distribute assets. A trust can provide various benefits, such as reducing estate taxes, protecting assets from creditors, ensuring the orderly transfer of assets, and safeguarding the financial security of minor children until they reach adulthood. 3. Living Will: While not directly related to the distribution of assets, a living will is an important document that can be included as part of the Last Will and Testament. This legal document allows individuals to express their preferences regarding end-of-life medical treatments in case they become unable to communicate their wishes due to incapacitation. By using the Hennepin Minnesota Legal Last Will and Testament Form for Married Person with Adult and Minor Children, individuals can ensure their spouse and children are protected and cared for according to their wishes, provide clear instructions regarding their estate, and establish a sense of security for the future. It is recommended to consult with an attorney specializing in estate planning to ensure the form is completed accurately and in compliance with Minnesota state laws.