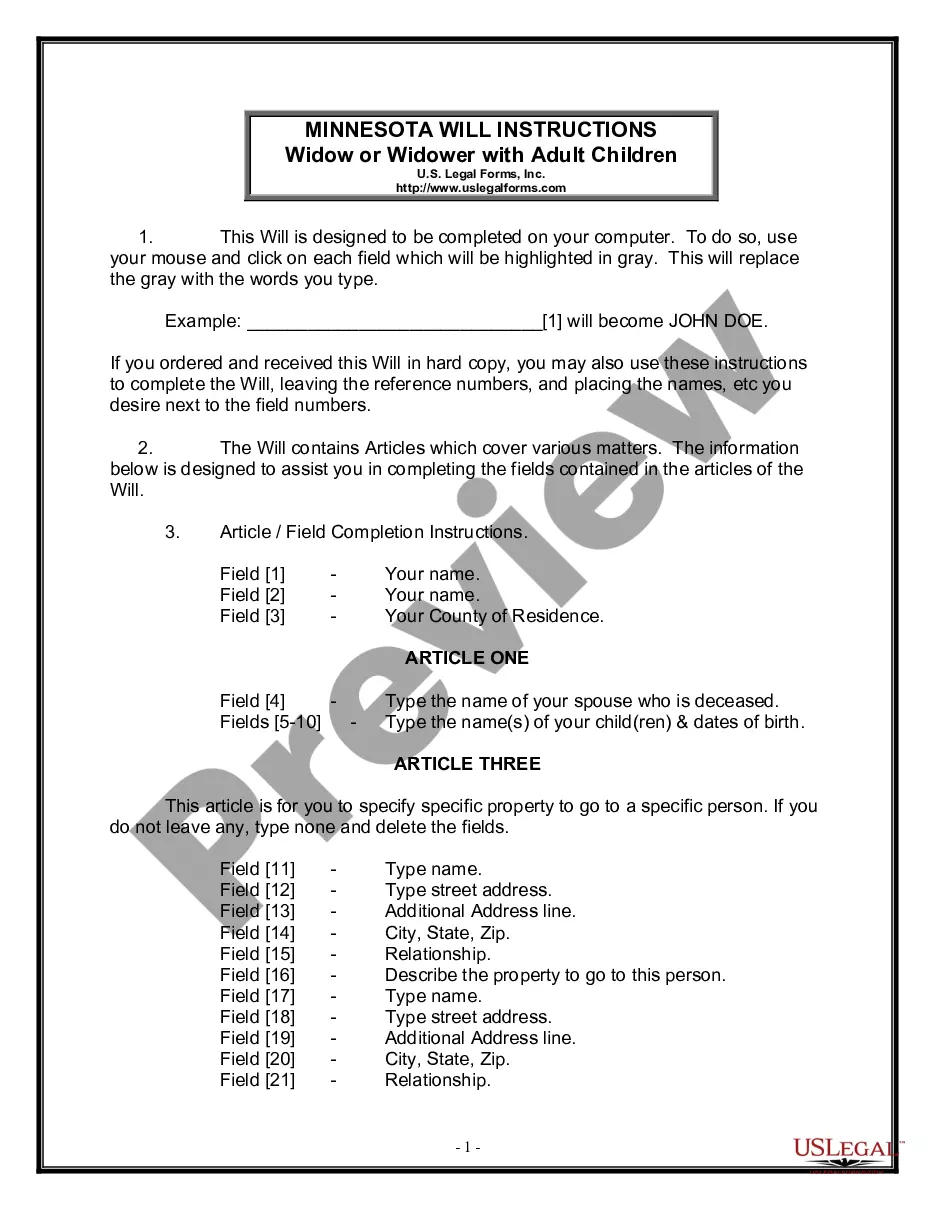

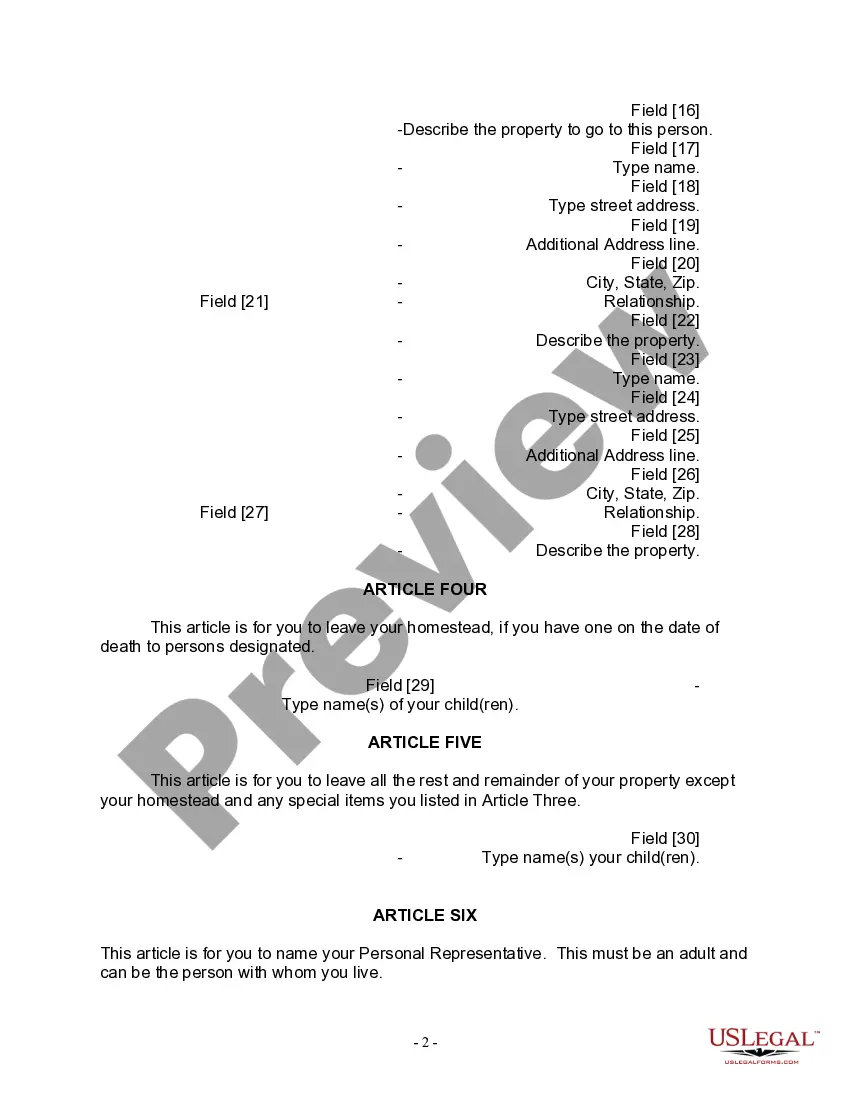

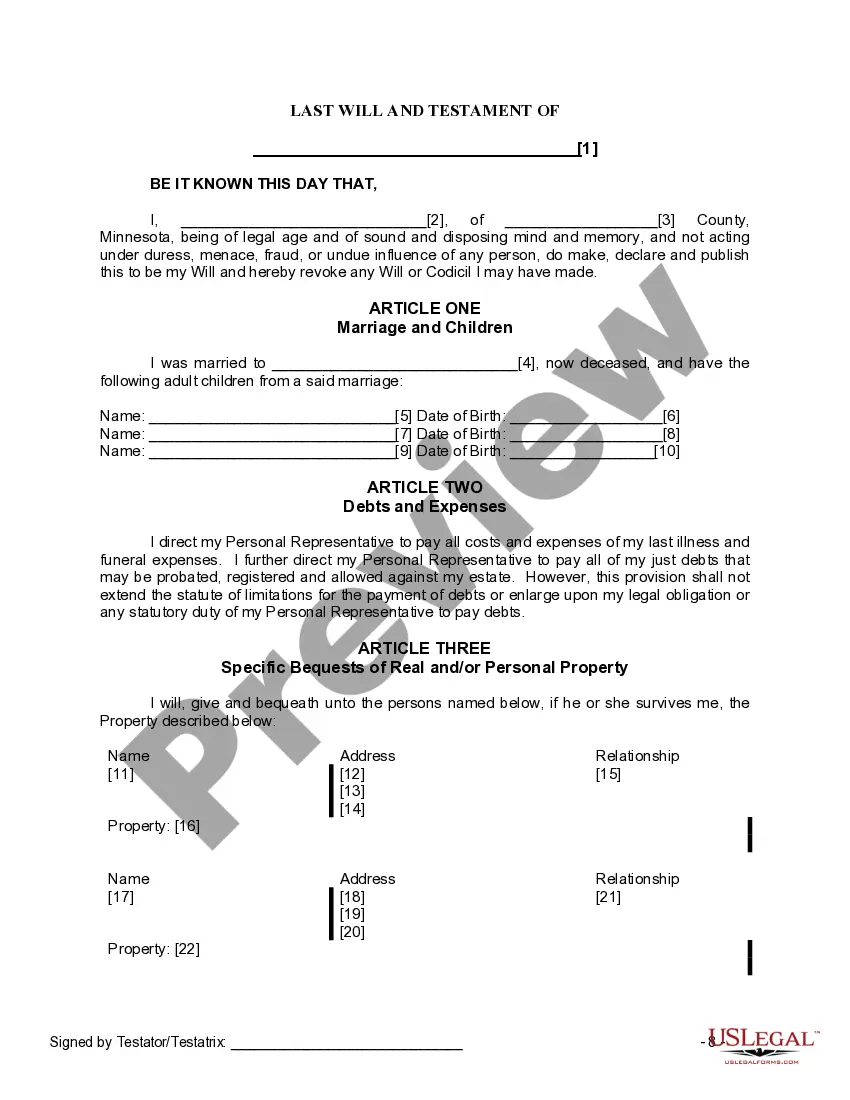

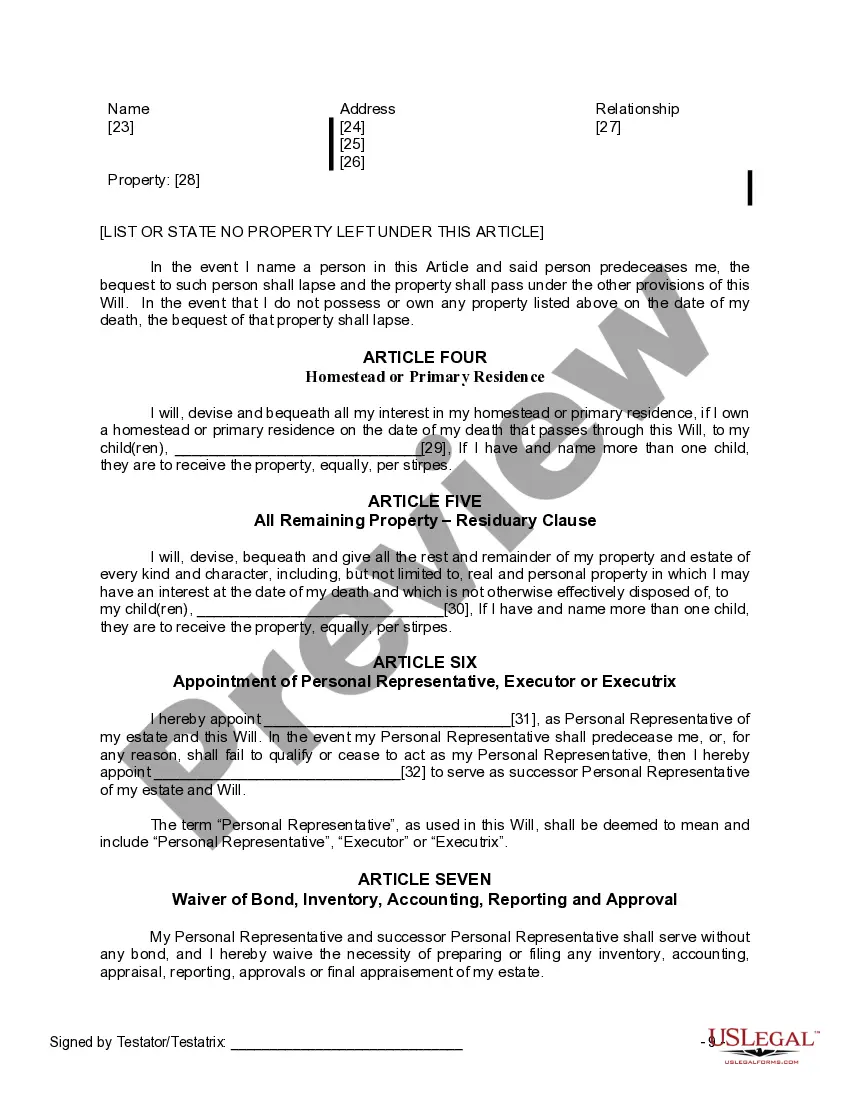

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Hennepin Minnesota Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a legal document that allows individuals who have lost their spouse and have adult children to outline their final wishes and distribute their assets after their passing. This comprehensive form ensures that their estate is managed according to their specific instructions and helps avoid any potential disputes or complications among surviving family members. The primary purpose of this legal form is to designate the beneficiaries who will inherit the deceased individual's assets and possessions. It allows the widow or widower to determine how their property, bank accounts, investments, real estate, and personal belongings will be distributed among their adult children. The Hennepin Minnesota Legal Last Will and Testament Form for a Widow or Widower with Adult Children typically includes provisions related to guardianship of any minor children, if applicable, and the appointment of an executor. The executor is responsible for administering the estate, paying any outstanding debts, and ensuring that the deceased's wishes are carried out according to the provisions outlined in the will. In addition, this legal form may include provisions for charitable donations, specifying any specific organizations or causes the widowed individual wishes to support through their estate. It is important to note that there may be variations or specialized versions of the Hennepin Minnesota Legal Last Will and Testament Form for a Widow or Widower with Adult Children, depending on the individual's unique circumstances or preferences. Some of these variations may include: 1. Hennepin Minnesota Legal Last Will and Testament Form with Trust: This variation incorporates trusts as a means to protect and manage assets for the benefit of the surviving children or other beneficiaries. Trusts can offer advantages such as reducing estate taxes, providing for long-term financial security, and controlling the timing of asset distributions. 2. Hennepin Minnesota Legal Last Will and Testament Form with Specific Bequests: This version allows the widow or widower to make specific bequests to certain individuals or organizations. Specific bequests can include sentimental items or larger monetary gifts to loved ones, close friends, or charities that hold significant meaning to the deceased. 3. Hennepin Minnesota Legal Last Will and Testament Form for Blended Families: In cases where the widow or widower has children from a previous marriage and wishes to ensure they are adequately provided for, a specialized form for blended families may be used. This form addresses the unique complexities that arise when balancing the interests and needs of both the surviving spouse and adult children from different relationships. By utilizing the appropriate Hennepin Minnesota Legal Last Will and Testament Form for a Widow or Widower with Adult Children, individuals can have peace of mind, knowing that their final wishes are legally documented and their loved ones are cared for according to their intentions. It is advised to consult with an attorney or legal professional to ensure that the form is completed correctly and in accordance with Minnesota state laws.

The Hennepin Minnesota Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a legal document that allows individuals who have lost their spouse and have adult children to outline their final wishes and distribute their assets after their passing. This comprehensive form ensures that their estate is managed according to their specific instructions and helps avoid any potential disputes or complications among surviving family members. The primary purpose of this legal form is to designate the beneficiaries who will inherit the deceased individual's assets and possessions. It allows the widow or widower to determine how their property, bank accounts, investments, real estate, and personal belongings will be distributed among their adult children. The Hennepin Minnesota Legal Last Will and Testament Form for a Widow or Widower with Adult Children typically includes provisions related to guardianship of any minor children, if applicable, and the appointment of an executor. The executor is responsible for administering the estate, paying any outstanding debts, and ensuring that the deceased's wishes are carried out according to the provisions outlined in the will. In addition, this legal form may include provisions for charitable donations, specifying any specific organizations or causes the widowed individual wishes to support through their estate. It is important to note that there may be variations or specialized versions of the Hennepin Minnesota Legal Last Will and Testament Form for a Widow or Widower with Adult Children, depending on the individual's unique circumstances or preferences. Some of these variations may include: 1. Hennepin Minnesota Legal Last Will and Testament Form with Trust: This variation incorporates trusts as a means to protect and manage assets for the benefit of the surviving children or other beneficiaries. Trusts can offer advantages such as reducing estate taxes, providing for long-term financial security, and controlling the timing of asset distributions. 2. Hennepin Minnesota Legal Last Will and Testament Form with Specific Bequests: This version allows the widow or widower to make specific bequests to certain individuals or organizations. Specific bequests can include sentimental items or larger monetary gifts to loved ones, close friends, or charities that hold significant meaning to the deceased. 3. Hennepin Minnesota Legal Last Will and Testament Form for Blended Families: In cases where the widow or widower has children from a previous marriage and wishes to ensure they are adequately provided for, a specialized form for blended families may be used. This form addresses the unique complexities that arise when balancing the interests and needs of both the surviving spouse and adult children from different relationships. By utilizing the appropriate Hennepin Minnesota Legal Last Will and Testament Form for a Widow or Widower with Adult Children, individuals can have peace of mind, knowing that their final wishes are legally documented and their loved ones are cared for according to their intentions. It is advised to consult with an attorney or legal professional to ensure that the form is completed correctly and in accordance with Minnesota state laws.