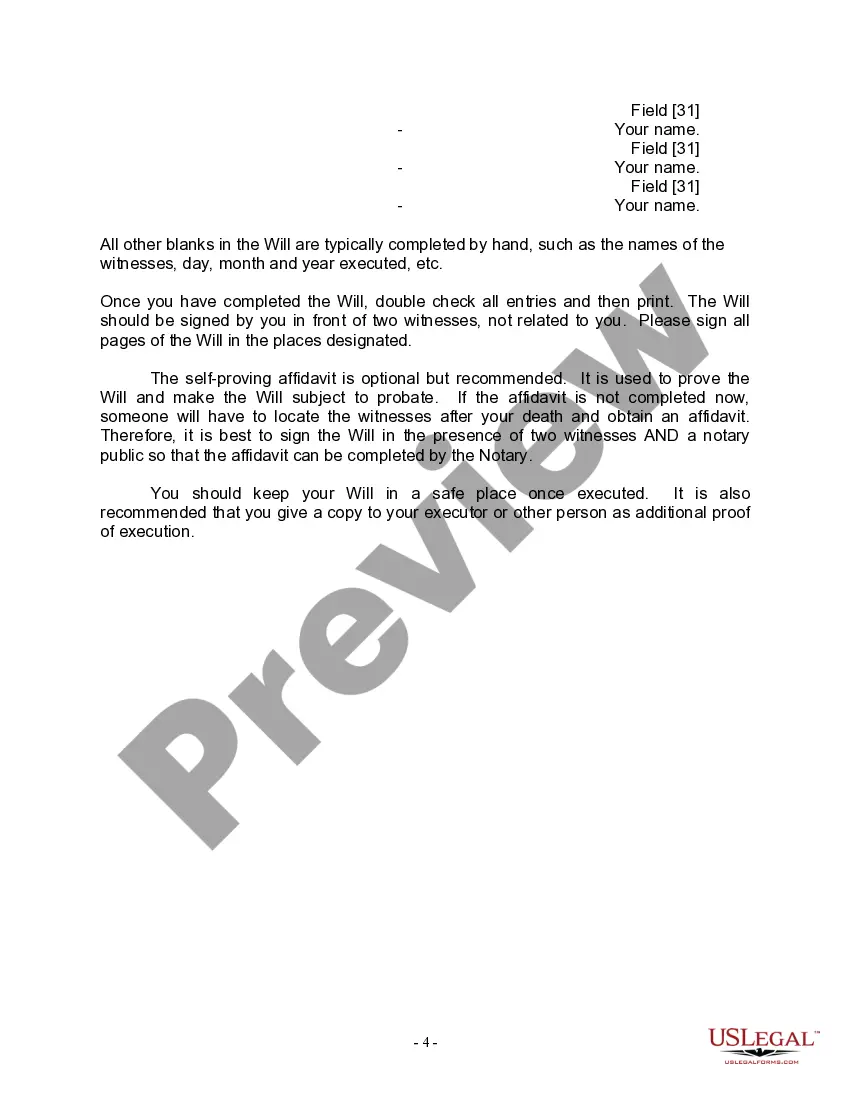

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

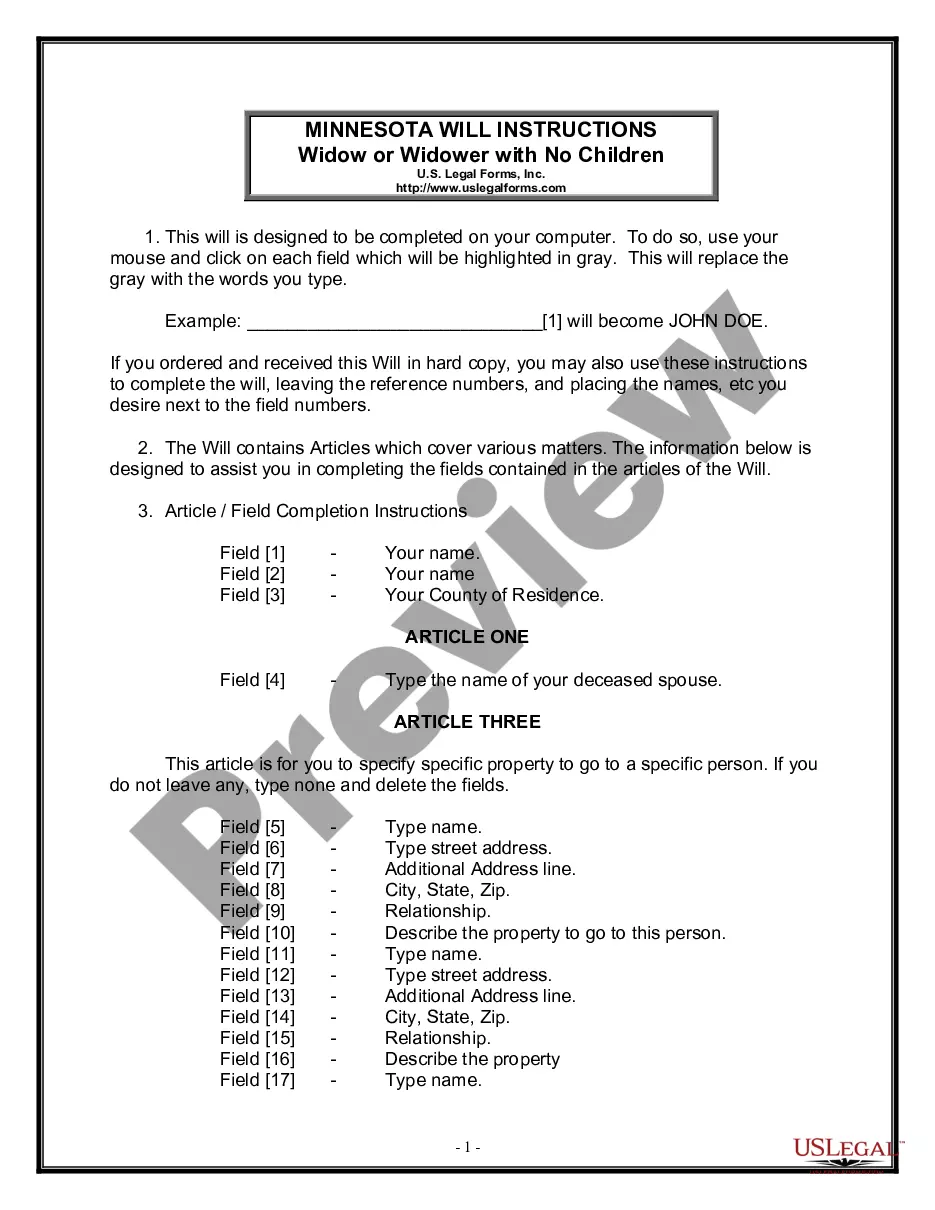

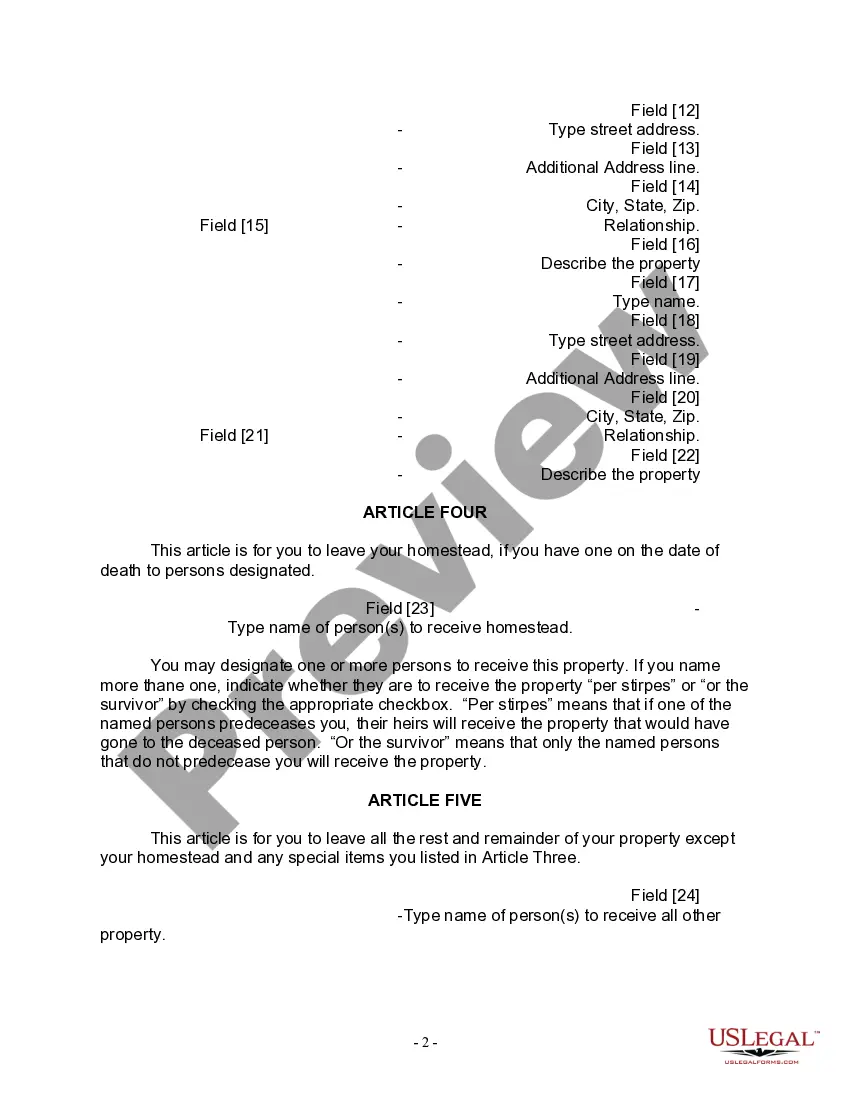

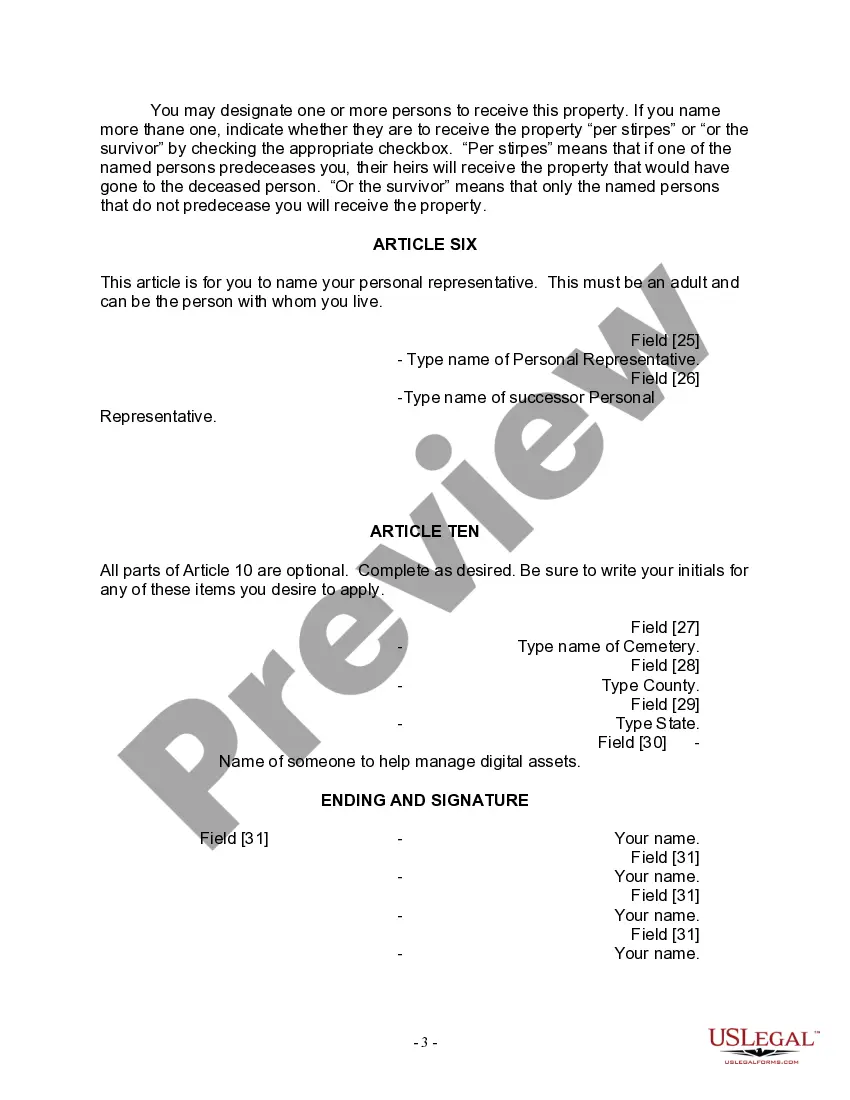

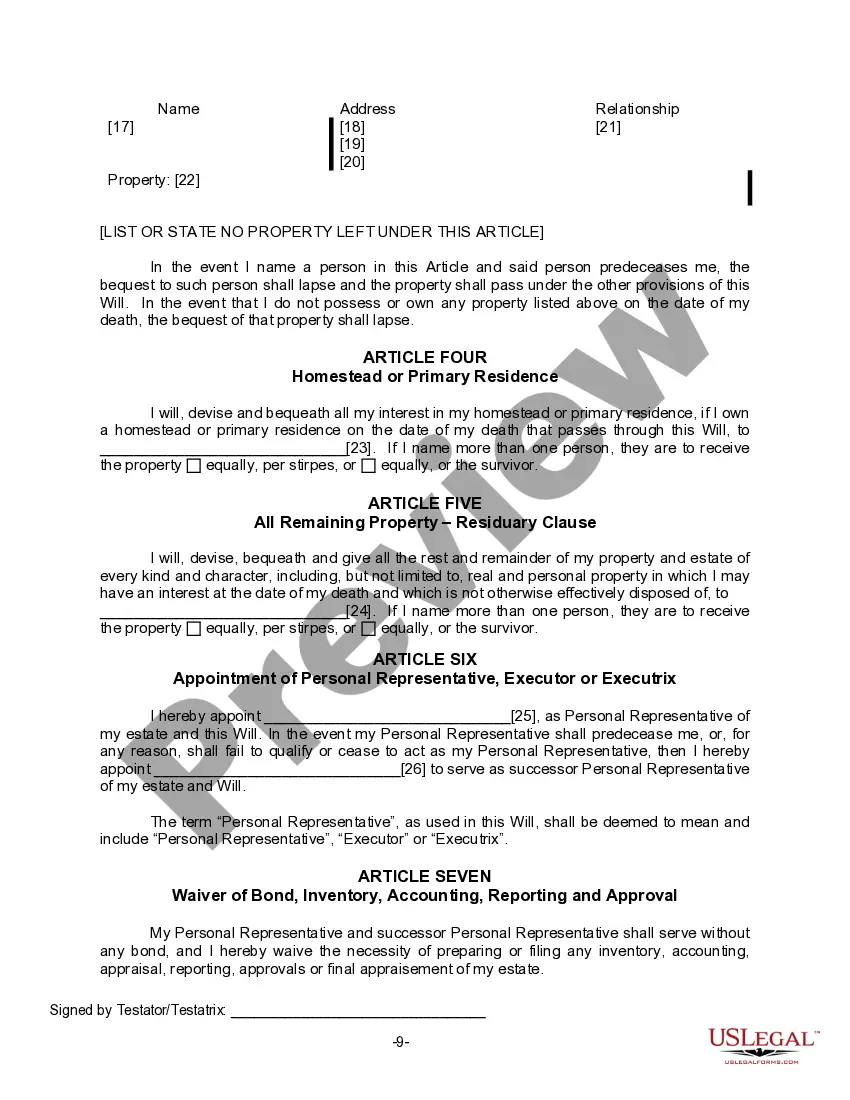

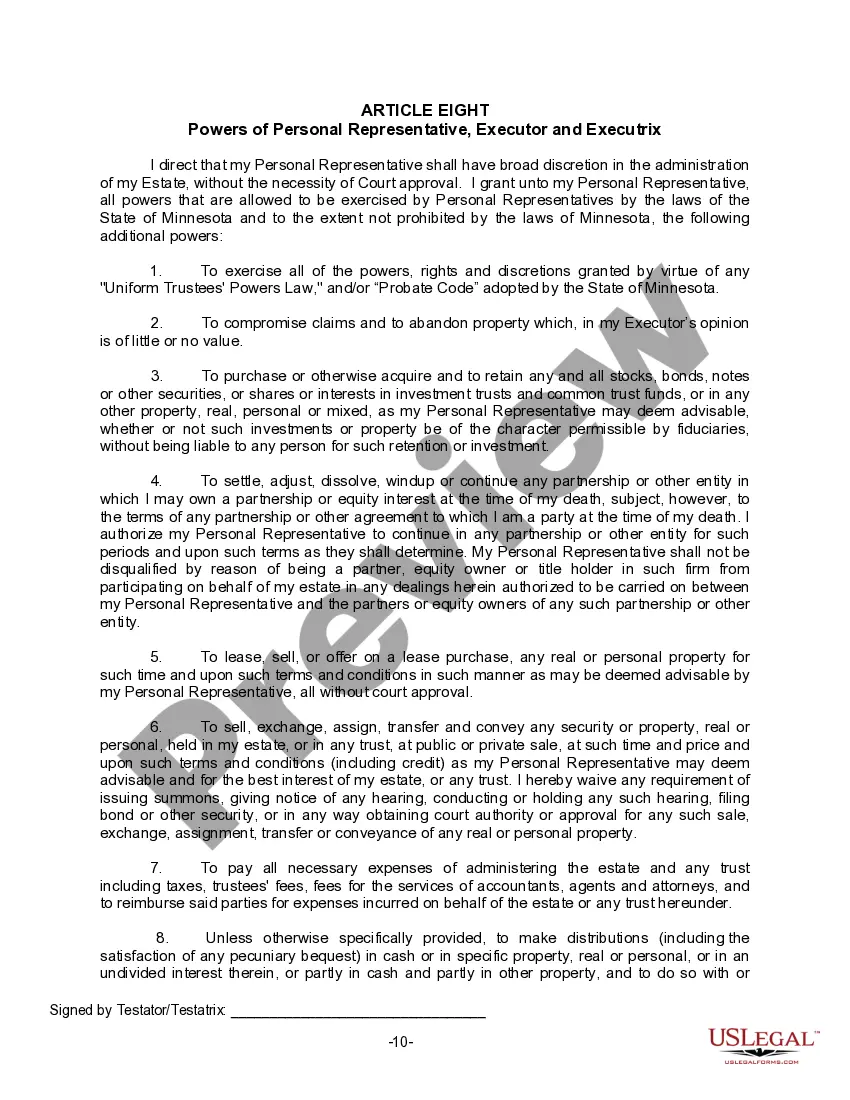

Description: A Saint Paul Minnesota Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals who have lost their spouse and do not have any children to dictate their final wishes for their assets, property, and estate. This comprehensive form serves as a critical tool in ensuring that the deceased person's estate is distributed according to their wishes and prevents any potential disputes or confusion among family members. Key Features: 1. Clear Identification: The form begins by requiring the individual's full legal name, date of birth, and current address. This ensures that the will accurately identifies the person creating it and leaves no doubts about their intentions. 2. Appointment of an Executor: Selecting an executor is a crucial step in the will creation process. The form allows the widow or widower to appoint a trusted individual, often a close relative or friend, to carry out their final wishes, distribute assets, and settle any outstanding debts or expenses. 3. Asset Distribution: The form provides a section for the widow or widower to list their assets, including real estate, investments, bank accounts, personal belongings, and any other valuable items. They can specify how they want these assets distributed, whether it be to specific individuals, charities, or organizations. 4. Alternate Beneficiaries: In case the primary beneficiaries are unable to inherit or decline their inheritance, the widow or widower can designate alternate beneficiaries. This ensures that their intentions are still upheld if any unforeseen circumstances arise. 5. Digital Assets and Online Accounts: Given the rise in digital presence, the form acknowledges the importance of addressing digital assets like social media accounts, online banking, and email accounts. The widow or widower has the option to provide instructions on how they want these assets managed or transferred. 6. Guardian for Dependents: Although the specific will form is designed for individuals with no children, it may also include a provision to appoint a guardian for any dependent minors or individuals who may rely on the widower or widow for care or support. Different Types: While there may not be multiple types of Saint Paul Minnesota Legal Last Will Forms specifically for widows or widowers with no children, variations may exist based on personal circumstances and preferences. These variations could include specific bequests, special requests, or additional instructions tailored to the individual's unique situation. It is recommended to consult an attorney familiar with Minnesota estate laws to ensure all legal requirements are met and the will accurately reflects the widow or widower's intentions.