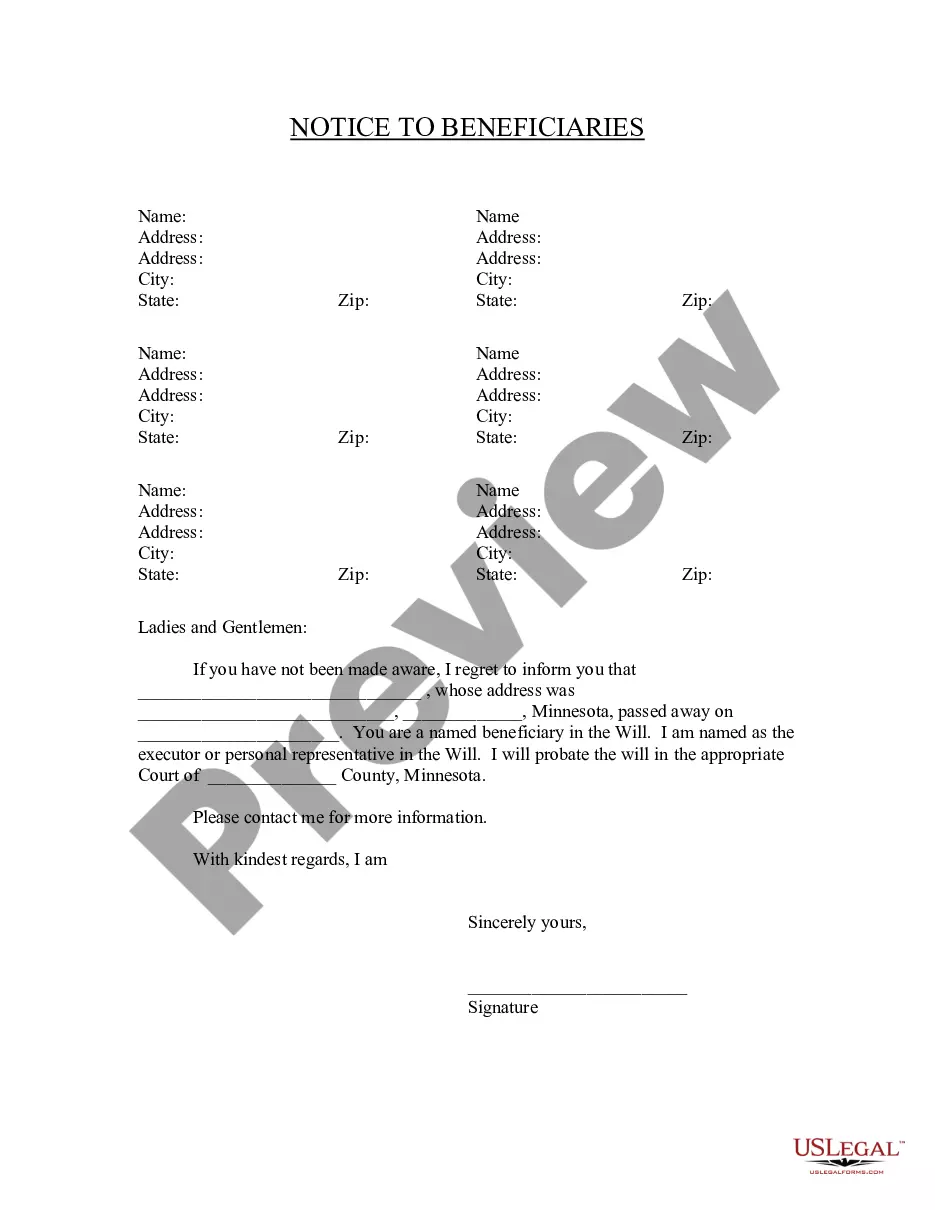

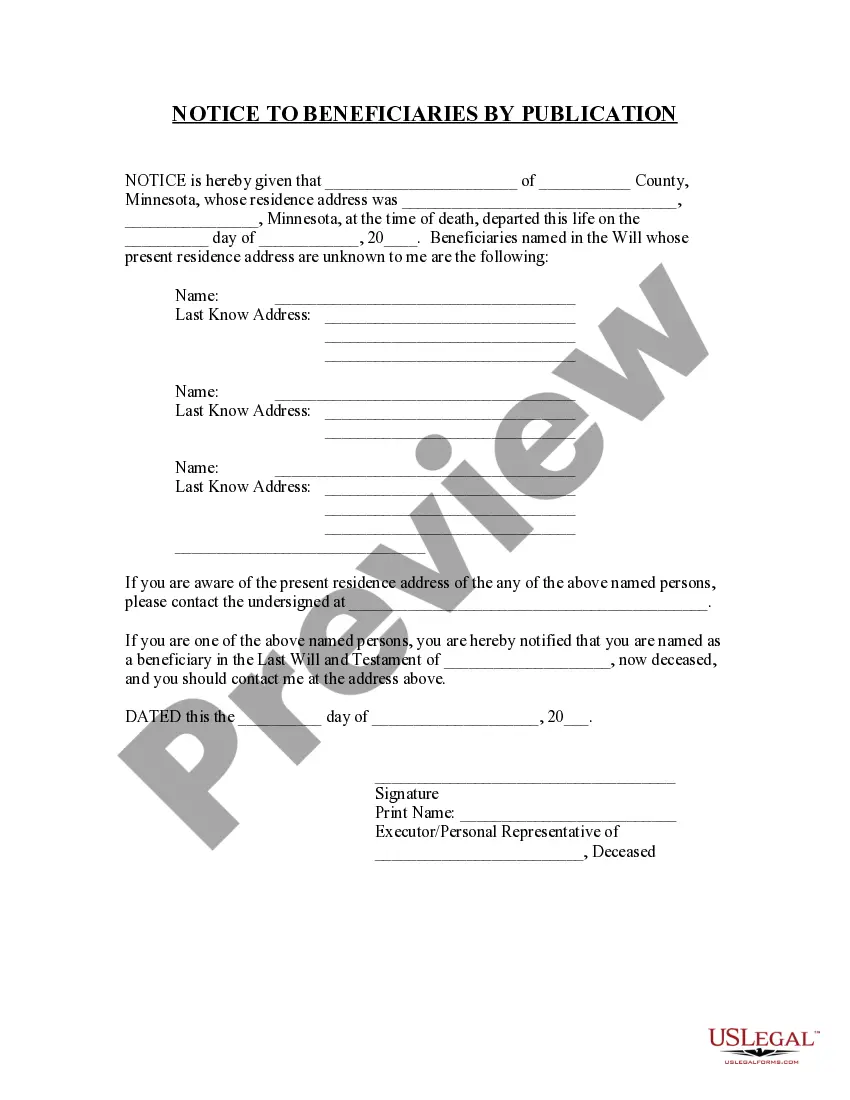

Title: Comprehensive Guide to Saint Paul Minnesota Notice to Beneficiaries of Being Named in a Will Keywords: Saint Paul Minnesota, Notice to Beneficiaries, Will, Probate, Estate planning, Testamentary document, Inheritance, Legal process Introduction: In Saint Paul, Minnesota, when a person passes away and their assets are distributed according to their will, beneficiaries play a crucial role in this process. As per Minnesota law, beneficiaries named in a will must receive a formal Notice to Beneficiaries, notifying them of their inclusion in the will and their entitlement to certain assets. In this article, we will delve into the various aspects of the Saint Paul Minnesota Notice to Beneficiaries of being named in a will, exploring its purpose, types, delivery methods, and necessary legal procedures. I. Understanding the Saint Paul Minnesota Notice to Beneficiaries: A. Purpose: The primary objective of the notice is to inform beneficiaries that they have been mentioned in a will, in order to safeguard their interests and provide an opportunity to claim their rightful inheritance. B. Legal requirement: Minnesota law considers the Notice to Beneficiaries an essential step in probate proceedings, ensuring transparency throughout the distribution process. II. Types of Saint Paul Minnesota Notice to Beneficiaries: A. Standard Notice: In straightforward cases without complications, a standard Notice to Beneficiaries is employed, providing a concise but comprehensive description of the beneficiary's inclusion and detailing the subsequent steps they may need to take. B. Specialized Notice: In certain situations, such as contested wills or complex estates, a specialized Notice to Beneficiaries may be necessary. These notices often contain additional legal information and instructions tailored to address the specific circumstances of each case. III. Key Elements of the Saint Paul Minnesota Notice to Beneficiaries: A. Identification: The notice should clearly identify the decedent, the beneficiaries, and any personal representatives involved in the probate process. B. Asset description: The beneficiaries must be informed about the nature and extent of the assets they are entitled to under the will. C. Timeframe for action: The notice should specify any deadlines or timeframes within which beneficiaries should act or claim their inheritance. D. Legal representative information: Contact details for the personal representative or the attorney assigned to the case should be provided, offering beneficiaries an avenue for seeking clarification or proceeding with any necessary legal actions. IV. Delivery Methods and Compliance: A. Postal mail or hand delivery: The notice may be mailed or personally delivered to the known addresses of the beneficiaries. B. Proof of delivery: To ensure compliance with legal regulations, it is crucial to maintain records of the delivery, such as certified mail receipts or signed acknowledgments by the beneficiaries. C. Compliance with timelines: It is essential to adhere to specific timeframes for serving the notice to beneficiaries according to Minnesota probate laws. Conclusion: The Saint Paul Minnesota Notice to Beneficiaries is a legally required document that serves as a crucial mechanism for communicating a person's inclusion in a will and their entitlement to inheritances. Whether utilizing standard or specialized notices, it is essential to ensure compliance with relevant procedures and timelines to maintain transparency and fairness throughout the probate process. By fulfilling their obligations in this regard, personal representatives can significantly contribute to the smooth distribution of assets and the realization of the testator's wishes.

Saint Paul Minnesota Notice to Beneficiaries of being Named in Will

Description

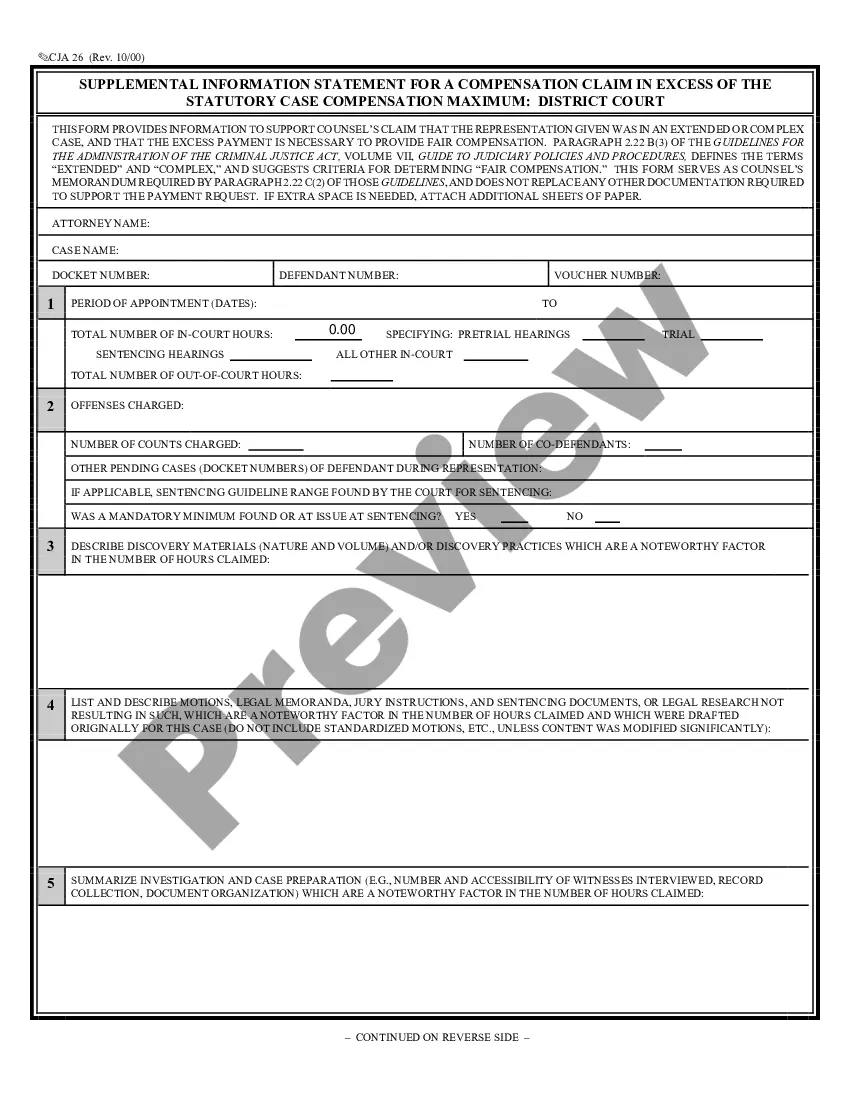

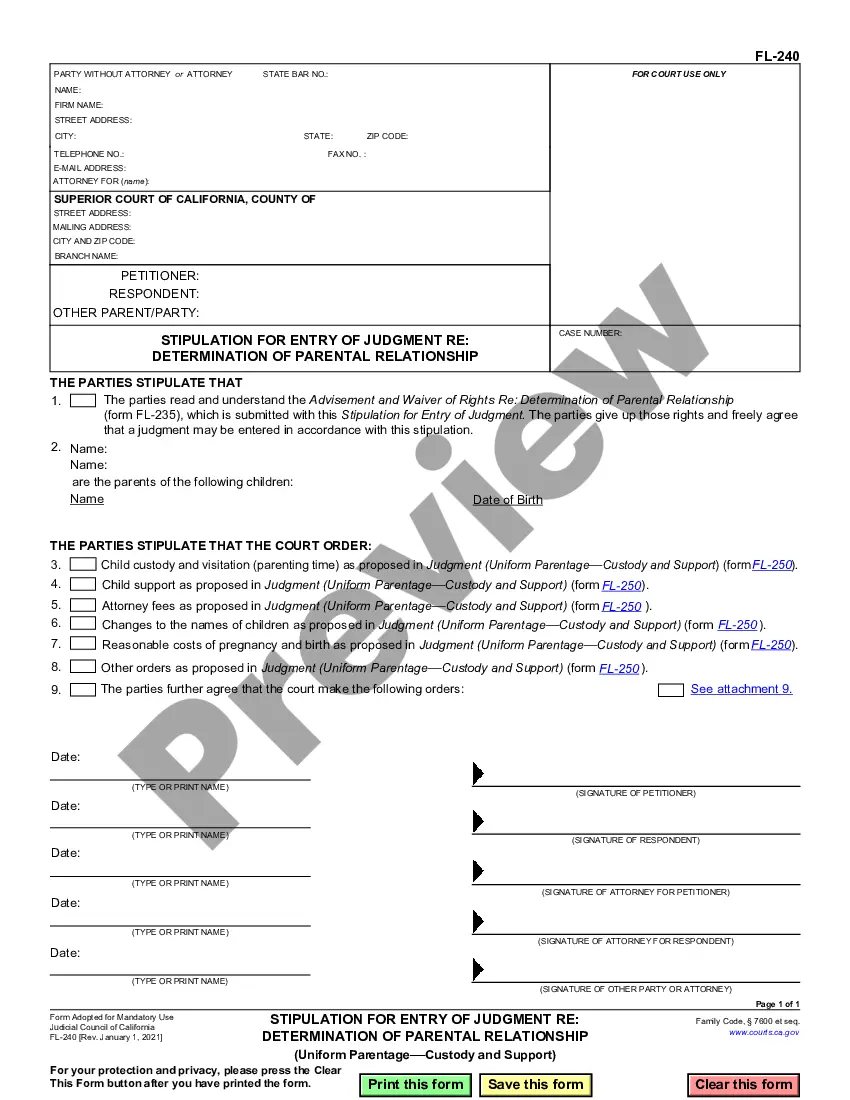

How to fill out Saint Paul Minnesota Notice To Beneficiaries Of Being Named In Will?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents for both personal and professional requirements and various real-world scenarios.

All the forms are appropriately categorized by usage area and jurisdiction regions, making it easy and quick to find the Saint Paul Minnesota Notice to Beneficiaries of being Named in Will.

Maintaining documentation organized and compliant with legal standards is critically important. Utilize the US Legal Forms library to always have crucial document templates readily available for any requirements!

- For those familiar with our catalog and who have utilized it previously, acquiring the Saint Paul Minnesota Notice to Beneficiaries of being Named in Will only requires a few clicks.

- Simply Log In to your account, select the document, and click Download to save it on your device.

- The process will involve just a few additional steps for new users.

- Follow the steps below to begin with the most comprehensive online form collection.

- Check the Preview mode and form description. Ensure you’ve chosen the correct one that satisfies your needs and completely aligns with your local jurisdiction requirements.

Form popularity

FAQ

Helen: If someone has left a will and you are a beneficiary of an estate, you would usually be contacted by the executor, or the solicitor the executor has instructed, to notify you that you are a beneficiary.

You might want to contact the National Association of Insurance Commissioners (NAIC) for their free Life Insurance Policy Locator Service, which looks for policies on the databases of many insurance companies. Another great resource could be your state's Department of Insurance (DOI).

Who Notifies Me That I Am a Beneficiary of a Will? Typically, executors should notify beneficiaries of the estate within three months after the will has been filed in probate court. Items listed will become a part of the public record once admitted to probate.

Beneficiaries have a right to be notified that they are entitled to an inheritance from the estate. It is up to the executor to decide when is an appropriate time to inform the beneficiaries. Often executors will inform beneficiaries at the beginning of the administration of the estate.

While it is often beneficial to communicate with beneficiaries regarding the estate administration, executors are not required to comply with every single request for information. Beneficiaries are often surprised to discover that in reality they have a right to very little information regarding an estate.

If the executor probates the will, they must provide notice, with a copy of the relevant portions of the will, to each beneficiary. If a potential beneficiary hasn't received a notice, then either the executor has not filed for probate or the individual isn't actually a beneficiary.

To find out if you're the beneficiary of an inheritance, contact the probate court in the county where the decedent lived. If a probate estate has been opened, you can do a records search by the decedent's name.

Executors have a duty to communicate with beneficiaries. If they are not doing so, you are entitled to take action.

There are three main ways to find out if someone left you money after their death. Reach out to their personal representative (executor) or attorney. This is the fastest way to find out.Contact the Court Clerk's Office.Learn your state's Intestacy Laws.

More info

It is not an FS form and does not count toward MinnesotaCare coverage. Find out if you qualify for Caregiver's Allowance.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.