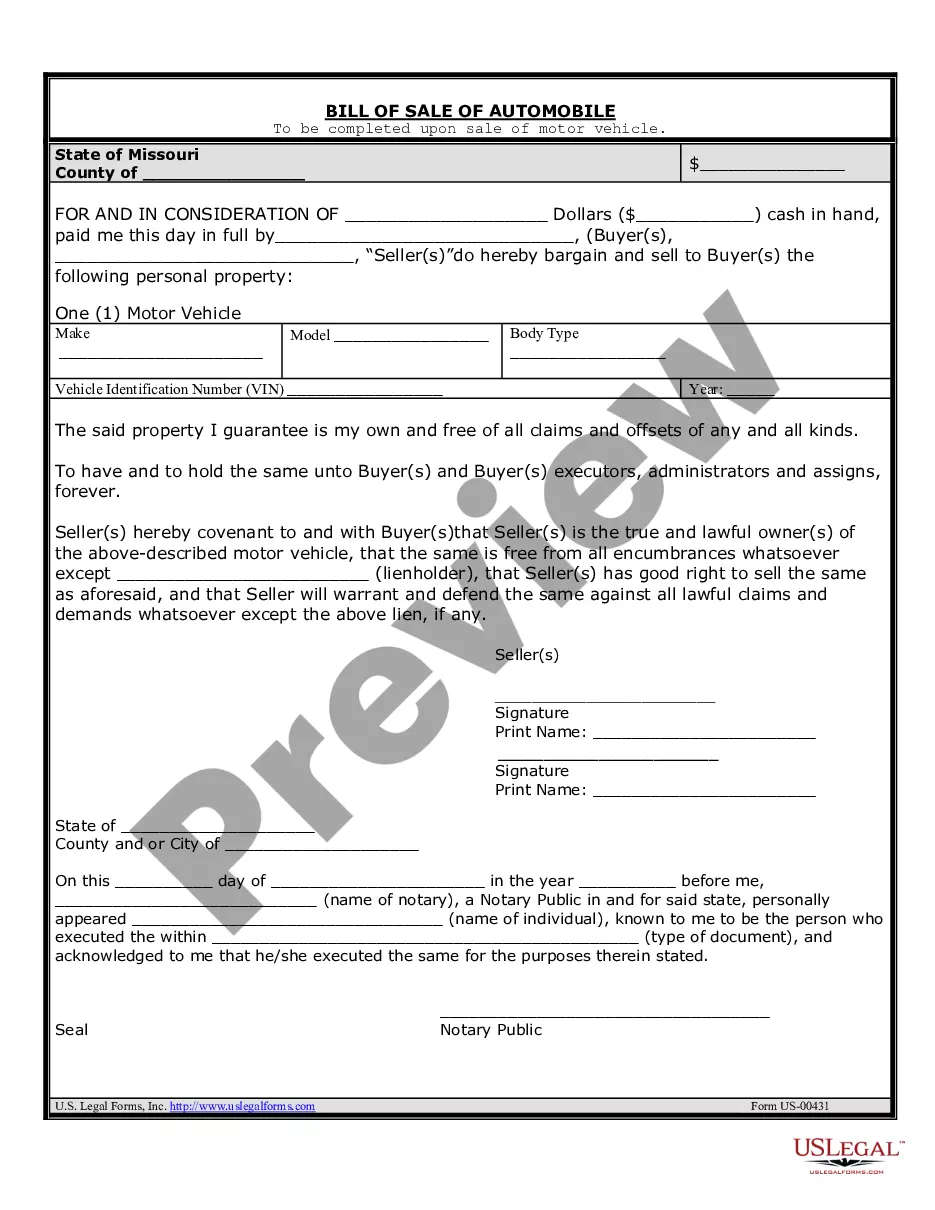

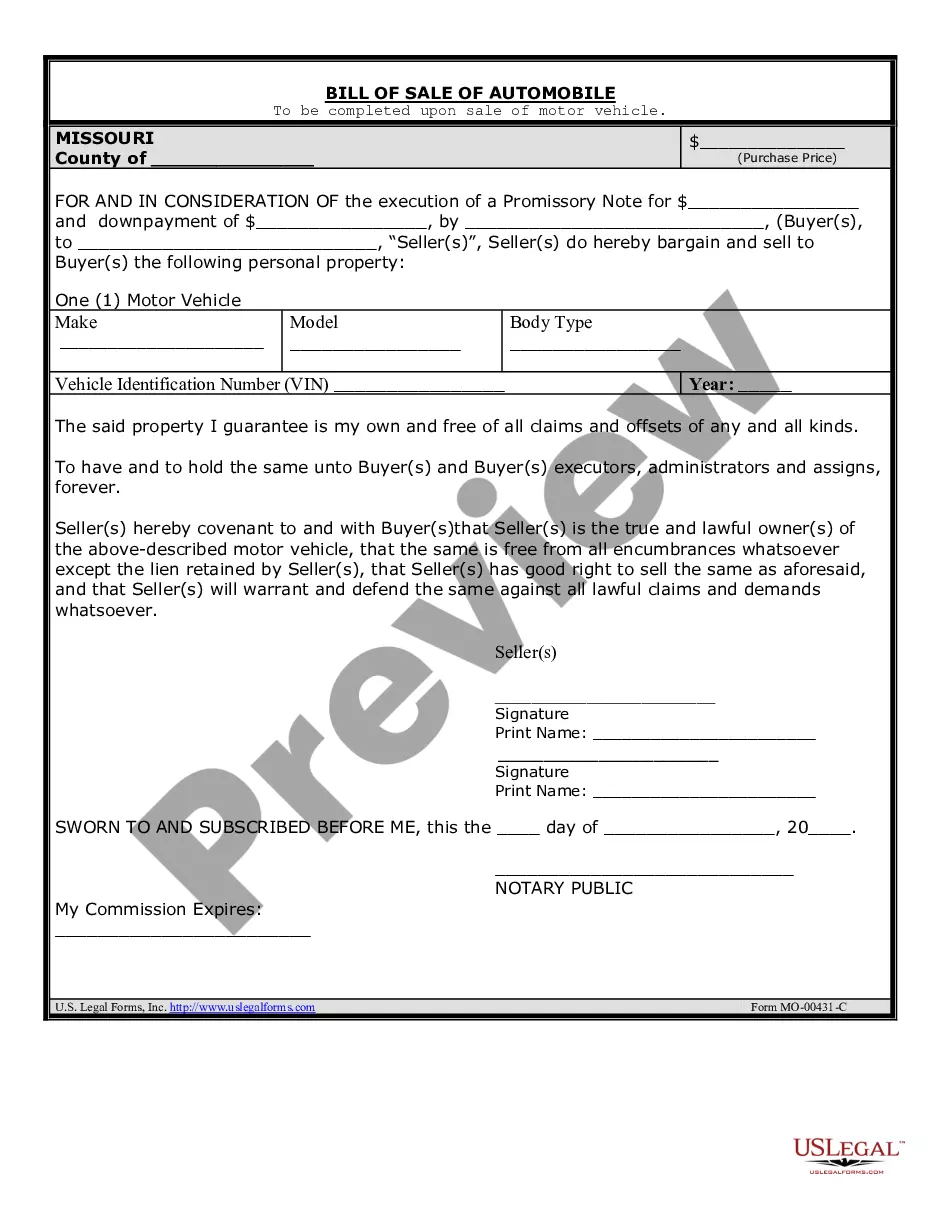

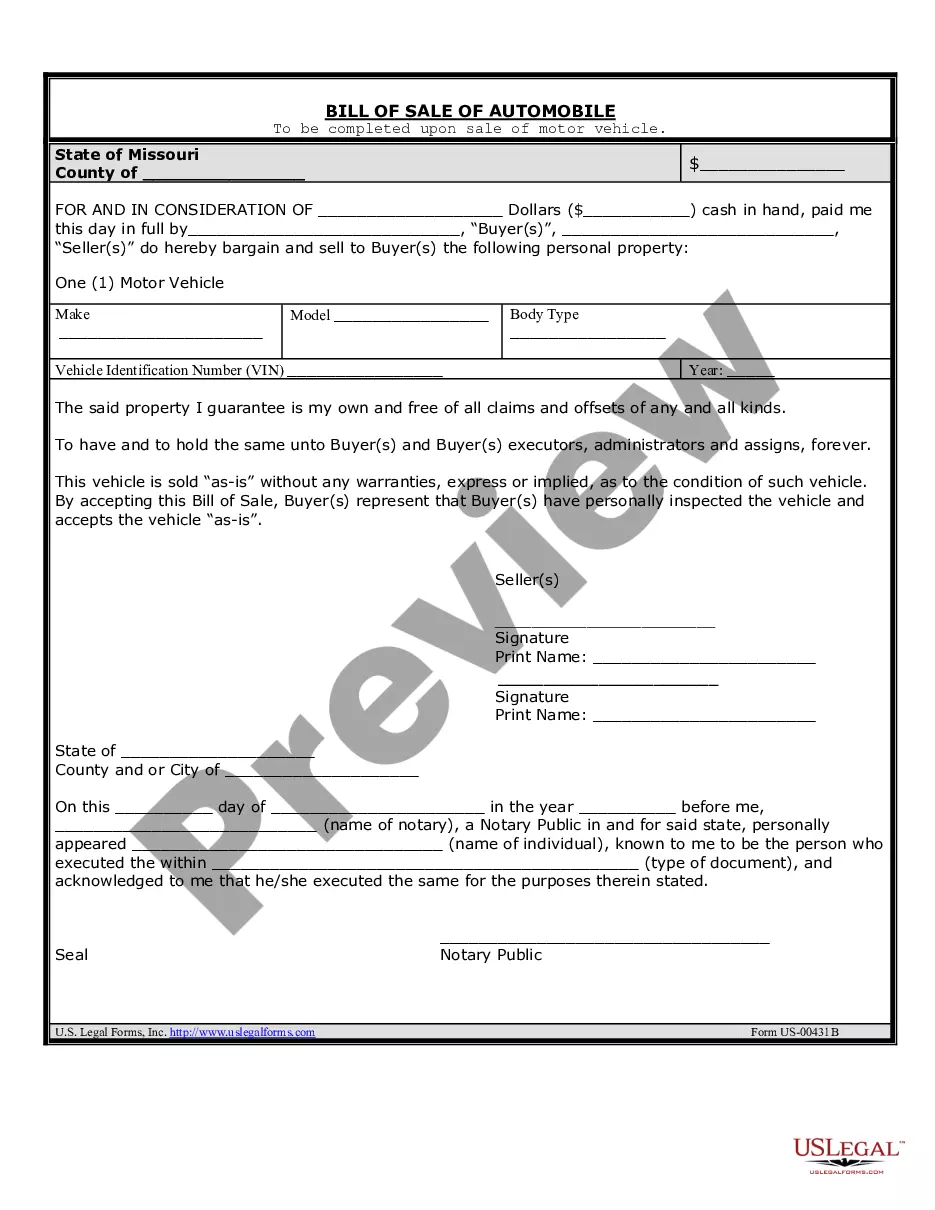

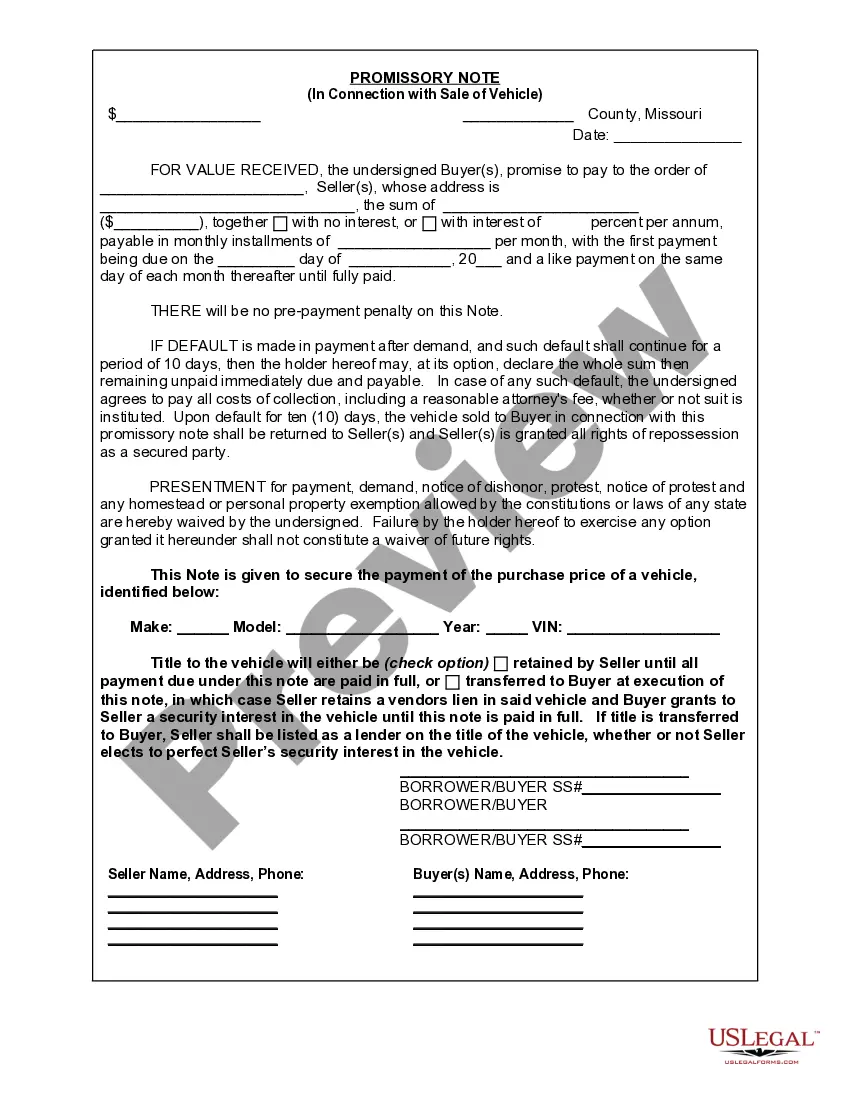

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Lee's Summit Missouri Promissory Note in connection with the sale of a vehicle or automobile is a legally binding agreement between a buyer and seller that outlines the terms and conditions of a loan used to purchase a vehicle. This document serves as proof of the transaction, acknowledging the amount borrowed, the repayment schedule, and any other relevant details agreed upon by the parties involved. Keywords: Lee's Summit Missouri, Promissory Note, sale of vehicle, sale of automobile, terms and conditions, legally binding agreement, loan, purchase, repayment schedule, transaction. There are several types of Lee's Summit Missouri Promissory Notes in connection with the sale of a vehicle or automobile, which can be categorized based on specific attributes or purposes. Here are some common types: 1. Installment Promissory Note: This type of promissory note specifies that the buyer will repay the borrowed amount through a series of regular installments over a predetermined period. The note includes details such as the interest rate, payment due dates, and consequences for default. 2. Balloon Promissory Note: This note is structured so that the buyer makes small, regular payments over the loan term, but a large "balloon" payment is due at the end. These notes are suitable for individuals who expect a lump sum of money or plan to refinance the loan before the final payment. 3. Secured Promissory Note: This type of note includes collateral, such as the vehicle itself, to secure the loan. In case of default, the seller has the right to repossess the vehicle to recover the outstanding balance. 4. Unsecured Promissory Note: Unlike a secured note, this type does not require any collateral. It solely relies on the buyer's creditworthiness and personal guarantee to ensure repayment. 5. Acceleration Promissory Note: This note grants the seller the right to accelerate the repayment schedule in case of default or violation of the terms. This means the entire balance becomes due immediately, instead of following the agreed-upon repayment schedule. 6. Co-Signer Promissory Note: In situations where the buyer's creditworthiness is not strong enough, a co-signer may be required. This note includes the co-signer's liability to repay the loan if the buyer defaults. When executing a Lee's Summit Missouri Promissory Note in connection with the sale of a vehicle or automobile, it is crucial to consult with a legal professional to ensure compliance with local laws and regulations and to accurately draft the agreement to protect the rights and interests of both the buyer and seller.A Lee's Summit Missouri Promissory Note in connection with the sale of a vehicle or automobile is a legally binding agreement between a buyer and seller that outlines the terms and conditions of a loan used to purchase a vehicle. This document serves as proof of the transaction, acknowledging the amount borrowed, the repayment schedule, and any other relevant details agreed upon by the parties involved. Keywords: Lee's Summit Missouri, Promissory Note, sale of vehicle, sale of automobile, terms and conditions, legally binding agreement, loan, purchase, repayment schedule, transaction. There are several types of Lee's Summit Missouri Promissory Notes in connection with the sale of a vehicle or automobile, which can be categorized based on specific attributes or purposes. Here are some common types: 1. Installment Promissory Note: This type of promissory note specifies that the buyer will repay the borrowed amount through a series of regular installments over a predetermined period. The note includes details such as the interest rate, payment due dates, and consequences for default. 2. Balloon Promissory Note: This note is structured so that the buyer makes small, regular payments over the loan term, but a large "balloon" payment is due at the end. These notes are suitable for individuals who expect a lump sum of money or plan to refinance the loan before the final payment. 3. Secured Promissory Note: This type of note includes collateral, such as the vehicle itself, to secure the loan. In case of default, the seller has the right to repossess the vehicle to recover the outstanding balance. 4. Unsecured Promissory Note: Unlike a secured note, this type does not require any collateral. It solely relies on the buyer's creditworthiness and personal guarantee to ensure repayment. 5. Acceleration Promissory Note: This note grants the seller the right to accelerate the repayment schedule in case of default or violation of the terms. This means the entire balance becomes due immediately, instead of following the agreed-upon repayment schedule. 6. Co-Signer Promissory Note: In situations where the buyer's creditworthiness is not strong enough, a co-signer may be required. This note includes the co-signer's liability to repay the loan if the buyer defaults. When executing a Lee's Summit Missouri Promissory Note in connection with the sale of a vehicle or automobile, it is crucial to consult with a legal professional to ensure compliance with local laws and regulations and to accurately draft the agreement to protect the rights and interests of both the buyer and seller.