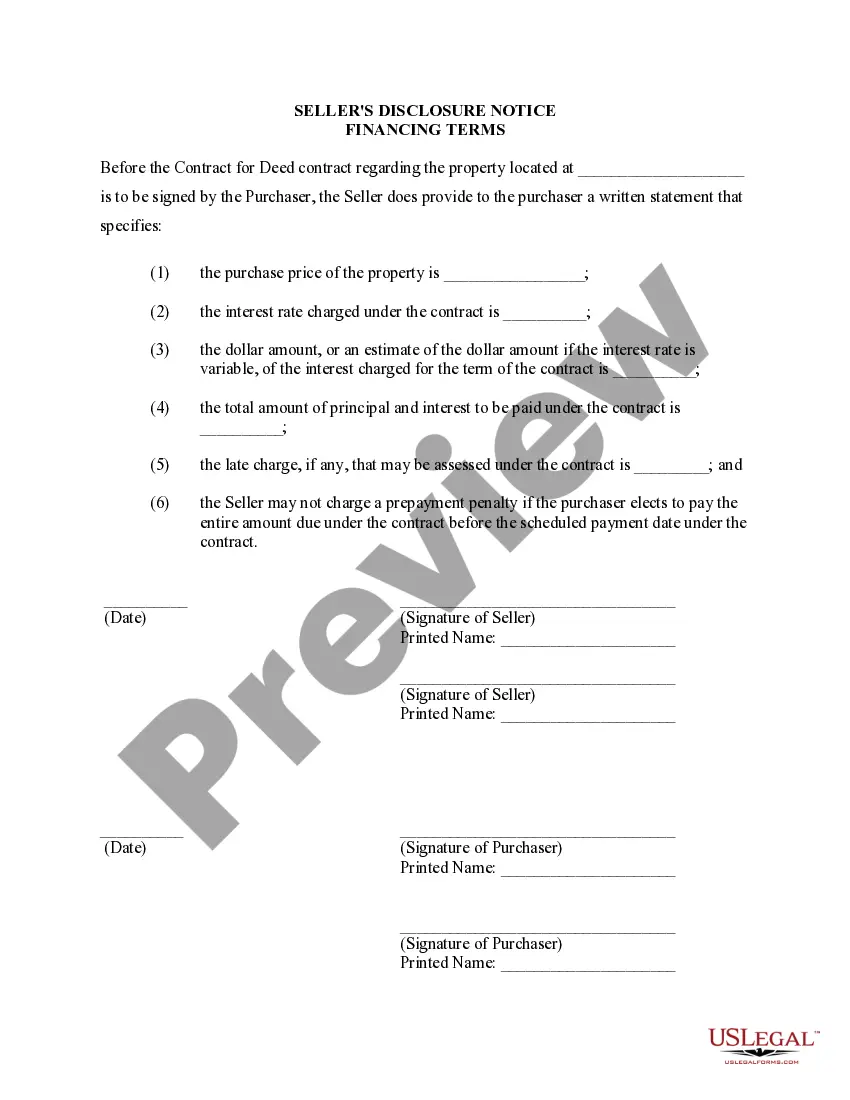

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Kansas City Missouri Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the financing terms and conditions for buying a residential property. This disclosure provides crucial information for the buyer regarding the financial obligations and responsibilities associated with the purchase. The content of the Kansas City Missouri Seller's Disclosure of Financing Terms for Residential Property may vary depending on specific agreements or terms negotiated between the parties involved. However, there are several key components that are typically included in this disclosure: 1. Purchase Price: The disclosure will specify the agreed-upon purchase price for the property. This is the amount that the buyer will pay to the seller over time, following the terms of the contract. 2. Down Payment: The document will outline whether a down payment is required and, if so, the amount or percentage that needs to be paid upfront. The disclosure may also address whether the down payment is refundable or non-refundable. 3. Installment Payments: The financing terms will include details about the installment payments the buyer is required to make. This information typically includes the due date, frequency (monthly, quarterly, etc.), and the amount of each payment. 4. Interest Rate: If applicable, the disclosure will indicate the interest rate that applies to the financing arrangement. This rate determines the cost of borrowing the money and is often expressed as an annual percentage. 5. Amortization Period: The amortization period refers to the length of time over which the buyer is expected to repay the loan. This period is usually stated in years and influences the total interest paid over time. 6. Balloon Payment (if applicable): In some cases, land contracts include a balloon payment, which is a larger payment due at the end of the term. The disclosure will clarify if a balloon payment is required and the amount. 7. Late Payment Penalties: The disclosure will detail any penalties or fees incurred by the buyer for late or missed payments. This might also include information on grace periods and how late payments could potentially affect the contract. It's important to note that specific terms and language may differ from one agreement to another. Different types of Kansas City Missouri Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract might include variations in the above-mentioned components based on the specific negotiated terms between the buyer and seller. It is crucial for both parties to thoroughly review and understand the contents of the disclosure to ensure a clear understanding of their rights and obligations in the transaction.Kansas City Missouri Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the financing terms and conditions for buying a residential property. This disclosure provides crucial information for the buyer regarding the financial obligations and responsibilities associated with the purchase. The content of the Kansas City Missouri Seller's Disclosure of Financing Terms for Residential Property may vary depending on specific agreements or terms negotiated between the parties involved. However, there are several key components that are typically included in this disclosure: 1. Purchase Price: The disclosure will specify the agreed-upon purchase price for the property. This is the amount that the buyer will pay to the seller over time, following the terms of the contract. 2. Down Payment: The document will outline whether a down payment is required and, if so, the amount or percentage that needs to be paid upfront. The disclosure may also address whether the down payment is refundable or non-refundable. 3. Installment Payments: The financing terms will include details about the installment payments the buyer is required to make. This information typically includes the due date, frequency (monthly, quarterly, etc.), and the amount of each payment. 4. Interest Rate: If applicable, the disclosure will indicate the interest rate that applies to the financing arrangement. This rate determines the cost of borrowing the money and is often expressed as an annual percentage. 5. Amortization Period: The amortization period refers to the length of time over which the buyer is expected to repay the loan. This period is usually stated in years and influences the total interest paid over time. 6. Balloon Payment (if applicable): In some cases, land contracts include a balloon payment, which is a larger payment due at the end of the term. The disclosure will clarify if a balloon payment is required and the amount. 7. Late Payment Penalties: The disclosure will detail any penalties or fees incurred by the buyer for late or missed payments. This might also include information on grace periods and how late payments could potentially affect the contract. It's important to note that specific terms and language may differ from one agreement to another. Different types of Kansas City Missouri Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract might include variations in the above-mentioned components based on the specific negotiated terms between the buyer and seller. It is crucial for both parties to thoroughly review and understand the contents of the disclosure to ensure a clear understanding of their rights and obligations in the transaction.