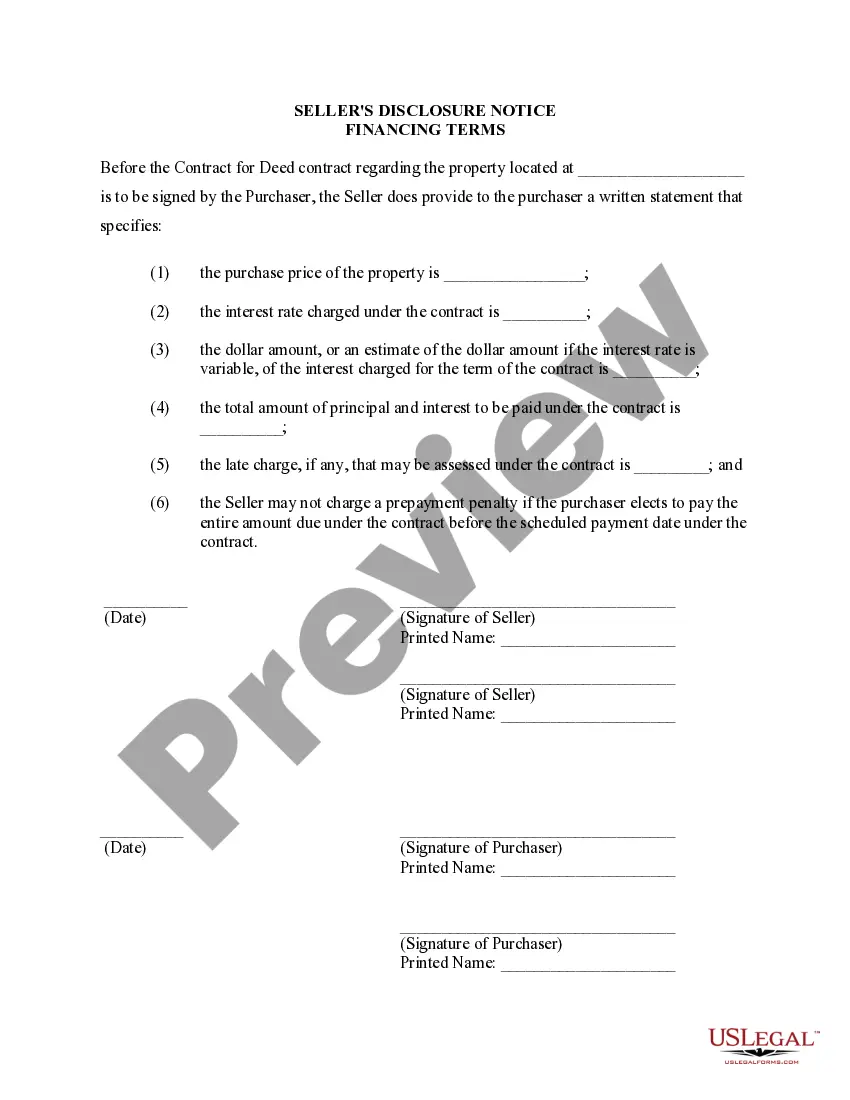

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Lee's Summit Missouri Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, aka Land Contract, is a crucial document that provides important information to both buyers and sellers of residential properties in Lee's Summit, Missouri. This disclosure outlines the terms and conditions regarding the financing arrangements related to the sale of a property through a land contract. Keywords: Lee's Summit Missouri, seller's disclosure, financing terms, residential property, contract for deed, agreement for deed, land contract. The Lee's Summit Missouri Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed is designed to inform potential buyers about the financial aspects of the property sale. It ensures transparency and avoids any misunderstandings or disputes regarding the financing terms. The disclosure includes essential information such as: 1. Purchase Price: The document specifies the agreed-upon purchase price of the property. This amount is usually mentioned both as the total purchase price and the amount to be paid as a down payment. 2. Interest Rate: The disclosure outlines the interest rate applicable to the financing provided by the seller. It ensures that the buyer is aware of the interest rate they will be paying throughout the duration of the land contract. 3. Payment Terms: It describes the frequency and method of payment, including whether it is monthly, quarterly, or yearly. Additionally, it may include details about penalties for late payments. 4. Length of Contract: This section specifies the duration of the contract or agreement for deed. It provides information about the length of time the buyer has to pay off the remaining balance of the purchase price. 5. Balloon Payment: A balloon payment refers to a lump sum payment made at the end of a specified period. The disclosure identifies whether a balloon payment is required and, if so, the amount and due date. 6. Default and Remedies: The document clarifies the consequences of default by the buyer, such as potential penalties, foreclosure procedures, and the seller's rights. It is important to note that the disclosure may have variations depending on the specific terms agreed upon between the buyer and seller. Therefore, it is crucial to review the exact document provided by the seller to ensure accuracy and completeness. Different types of Lee's Summit Missouri Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed include variations in terms, such as the interest rate, payment schedule, and balloon payment requirements. These variations cater to the unique financial arrangements agreed upon between individual buyers and sellers.Lee's Summit Missouri Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, aka Land Contract, is a crucial document that provides important information to both buyers and sellers of residential properties in Lee's Summit, Missouri. This disclosure outlines the terms and conditions regarding the financing arrangements related to the sale of a property through a land contract. Keywords: Lee's Summit Missouri, seller's disclosure, financing terms, residential property, contract for deed, agreement for deed, land contract. The Lee's Summit Missouri Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed is designed to inform potential buyers about the financial aspects of the property sale. It ensures transparency and avoids any misunderstandings or disputes regarding the financing terms. The disclosure includes essential information such as: 1. Purchase Price: The document specifies the agreed-upon purchase price of the property. This amount is usually mentioned both as the total purchase price and the amount to be paid as a down payment. 2. Interest Rate: The disclosure outlines the interest rate applicable to the financing provided by the seller. It ensures that the buyer is aware of the interest rate they will be paying throughout the duration of the land contract. 3. Payment Terms: It describes the frequency and method of payment, including whether it is monthly, quarterly, or yearly. Additionally, it may include details about penalties for late payments. 4. Length of Contract: This section specifies the duration of the contract or agreement for deed. It provides information about the length of time the buyer has to pay off the remaining balance of the purchase price. 5. Balloon Payment: A balloon payment refers to a lump sum payment made at the end of a specified period. The disclosure identifies whether a balloon payment is required and, if so, the amount and due date. 6. Default and Remedies: The document clarifies the consequences of default by the buyer, such as potential penalties, foreclosure procedures, and the seller's rights. It is important to note that the disclosure may have variations depending on the specific terms agreed upon between the buyer and seller. Therefore, it is crucial to review the exact document provided by the seller to ensure accuracy and completeness. Different types of Lee's Summit Missouri Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed include variations in terms, such as the interest rate, payment schedule, and balloon payment requirements. These variations cater to the unique financial arrangements agreed upon between individual buyers and sellers.