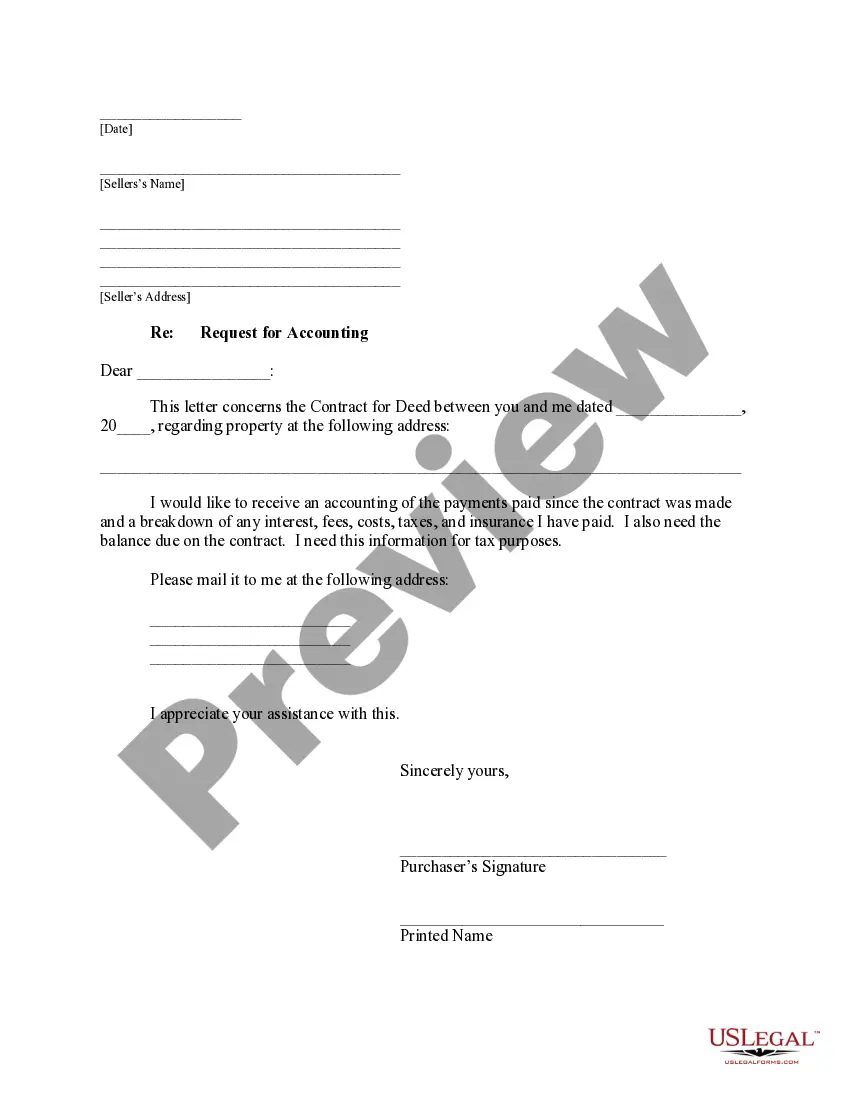

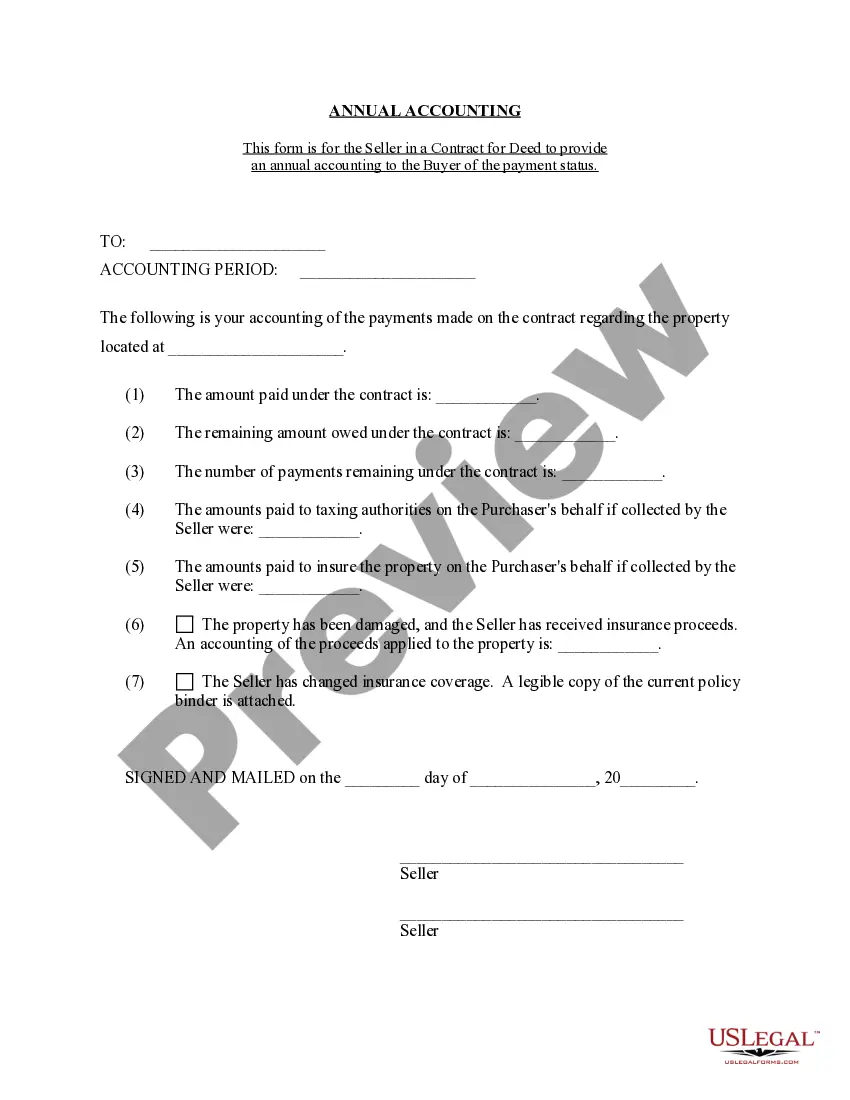

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

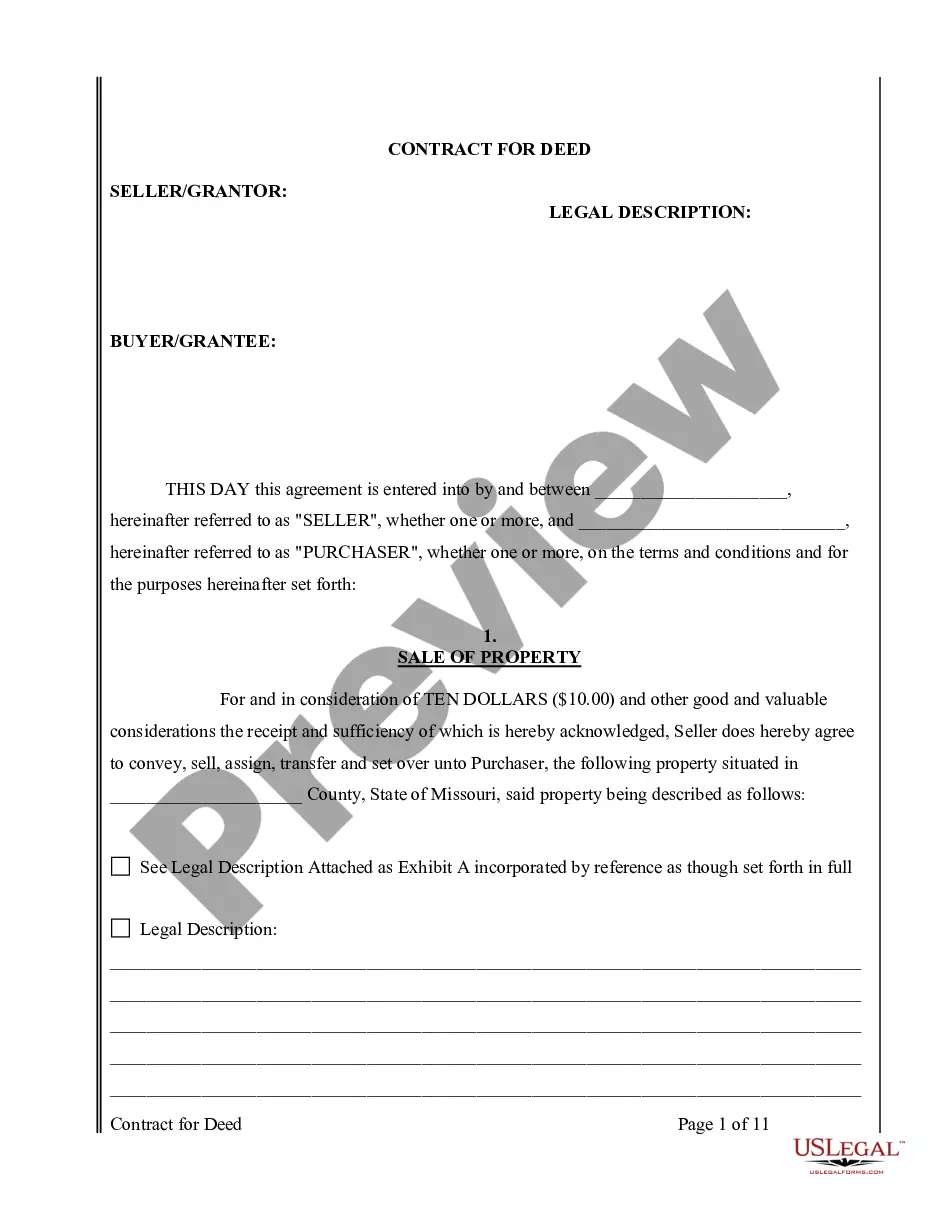

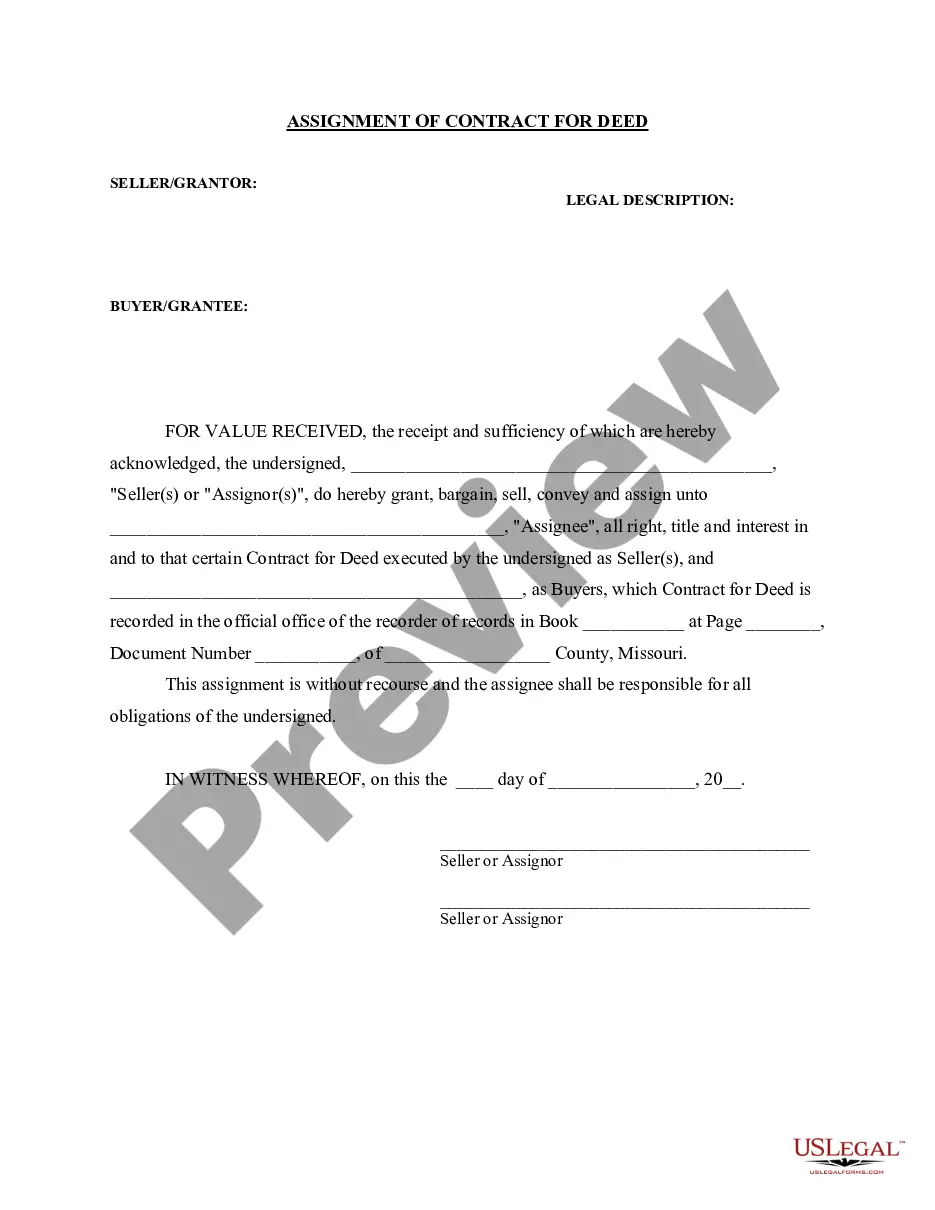

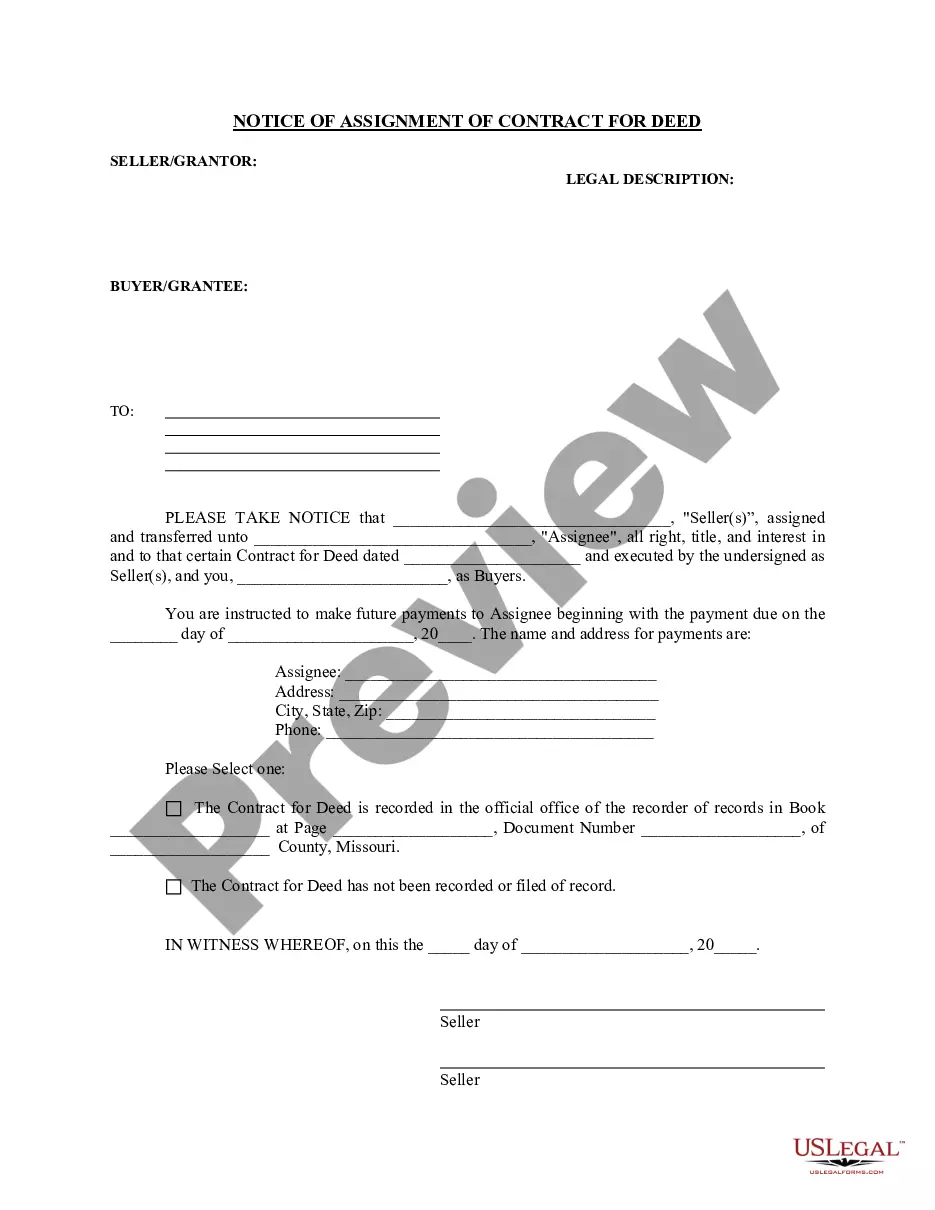

A Springfield, Missouri Contract for Deed Seller's Annual Accounting Statement is a document that sellers of properties utilizing a contract for deed in Springfield, Missouri, must provide to the buyer on an annual basis. This accounting statement serves as a detailed record of the financial transactions and obligations related to the contract for deed agreement. Keywords: Springfield, Missouri, Contract for Deed, Seller's Annual Accounting Statement, properties, buyer, financial transactions, obligations. There are various types of Springfield, Missouri Contract for Deed Seller's Annual Accounting Statements, including: 1. Standard Seller's Annual Accounting Statement: This is the most common type of accounting statement provided by sellers to buyers. It includes a comprehensive breakdown of all financial transactions and obligations for the year, such as principal and interest payments, property taxes, insurance premiums, and any additional charges. 2. Detailed Transaction Statement: This type of accounting statement provides a more in-depth breakdown of each individual financial transaction throughout the year. It includes specific dates, amounts, and descriptions of all payments made and received, allowing for a thorough understanding of the financial history of the contract for deed. 3. Tax Summary Statement: This accounting statement focuses primarily on the tax-related aspects of the contract for deed. It includes details about property tax payments made by the seller, any tax credits or deductions applied, and the buyer's responsibilities regarding tax obligations. 4. Insurance Statement: In cases where the seller is responsible for maintaining the property's insurance coverage, an Insurance Statement is provided as part of the Seller's Annual Accounting Statement. This document outlines the insurance premiums paid, coverage details, and any claims filed throughout the year. 5. Escrow Account Statement: If an escrow account is established for the contract for deed, the seller must provide an Escrow Account Statement along with the annual accounting statement. This statement includes details of all funds held in escrow, including any interest earned or disbursements made. By providing a detailed and accurate Seller's Annual Accounting Statement, sellers ensure transparency and maintain a clear record of all financial transactions pertaining to the contract for deed agreement. It allows buyers to review and verify the financial aspects of their investment, supporting a mutually beneficial and trustworthy relationship between the parties involved.