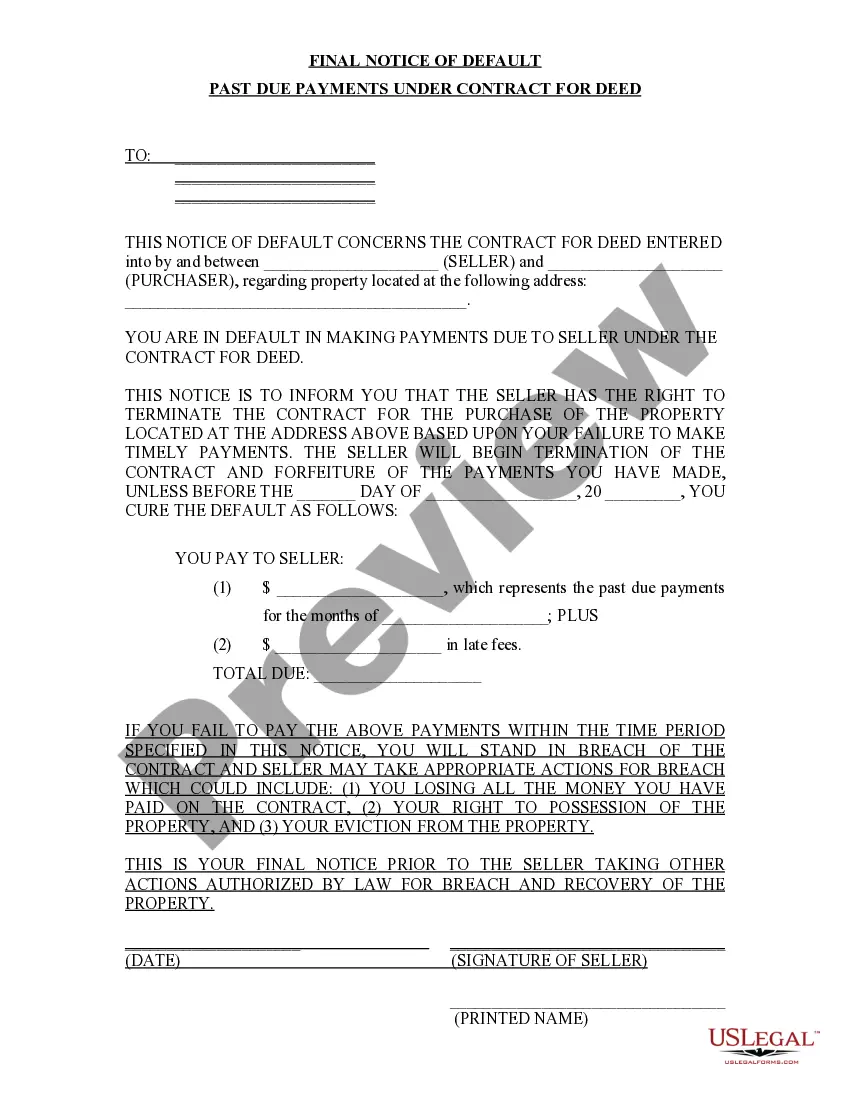

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Understanding the Springfield, Missouri Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Springfield, Missouri, final notice of default, past due payments, contract for deed Introduction: In Springfield, Missouri, a final notice of default for past due payments in connection with a contract for deed is a formal notification sent to a buyer who has failed to fulfill their financial obligations stated in the contract. This document serves as a legal last warning to prompt the buyer to rectify the overdue payments and prevent further legal consequences. Understanding the implications and potential variations of these notices is crucial for both buyers and sellers involved in contract for deed transactions. Types of Springfield, Missouri Final Notice of Default for Past Due Payments in Connection with Contract for Deed: 1. Standard Final Notice of Default: A standard final notice of default is typically issued when a buyer has fully defaulted on their financial obligations, such as missed or late payments, violating the terms of the contract for deed. This notification notifies the buyer of the imminent consequences if timely payment or other satisfactory remedies are not made. 2. Final Notice with Cure Period: This type of notice is sent to buyers who have fallen behind on their payments but are still within their allotted grace period known as the cure period. With this notice, the seller provides an additional opportunity to rectify the past due payments within a specified timeframe before considering further legal actions. 3. Final Notice of Default and Intent to Accelerate: This notice is issued as a final warning to buyers who have consistently failed to make timely payments beyond the cure period. The notice states the seller's intent to accelerate the contract, requiring full payment of the remaining balance within a specified period, failing which the seller may initiate foreclosure proceedings. 4. Final Notice of Default and Foreclosure Proceedings: If the buyer fails to respond to previous notices or cure their default, the seller might issue a final notice of default stating their intention to begin foreclosure proceedings. This notice explains the steps the seller will take to proceed with foreclosure, including legal proceedings that may ultimately result in the loss of the buyer's rights to the property. Conclusion: The Springfield, Missouri final notice of default for past due payments in connection with a contract for deed encompasses various types, each designed to address specific situations based on the level of default and compliance with the contract's terms. Recognizing and responding promptly to these notices can help buyers in resolving their financial obligations and potentially avoiding severe legal consequences. Likewise, sellers can ensure their rights are protected by utilizing appropriate notice types and following relevant legal procedures.Title: Understanding the Springfield, Missouri Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Springfield, Missouri, final notice of default, past due payments, contract for deed Introduction: In Springfield, Missouri, a final notice of default for past due payments in connection with a contract for deed is a formal notification sent to a buyer who has failed to fulfill their financial obligations stated in the contract. This document serves as a legal last warning to prompt the buyer to rectify the overdue payments and prevent further legal consequences. Understanding the implications and potential variations of these notices is crucial for both buyers and sellers involved in contract for deed transactions. Types of Springfield, Missouri Final Notice of Default for Past Due Payments in Connection with Contract for Deed: 1. Standard Final Notice of Default: A standard final notice of default is typically issued when a buyer has fully defaulted on their financial obligations, such as missed or late payments, violating the terms of the contract for deed. This notification notifies the buyer of the imminent consequences if timely payment or other satisfactory remedies are not made. 2. Final Notice with Cure Period: This type of notice is sent to buyers who have fallen behind on their payments but are still within their allotted grace period known as the cure period. With this notice, the seller provides an additional opportunity to rectify the past due payments within a specified timeframe before considering further legal actions. 3. Final Notice of Default and Intent to Accelerate: This notice is issued as a final warning to buyers who have consistently failed to make timely payments beyond the cure period. The notice states the seller's intent to accelerate the contract, requiring full payment of the remaining balance within a specified period, failing which the seller may initiate foreclosure proceedings. 4. Final Notice of Default and Foreclosure Proceedings: If the buyer fails to respond to previous notices or cure their default, the seller might issue a final notice of default stating their intention to begin foreclosure proceedings. This notice explains the steps the seller will take to proceed with foreclosure, including legal proceedings that may ultimately result in the loss of the buyer's rights to the property. Conclusion: The Springfield, Missouri final notice of default for past due payments in connection with a contract for deed encompasses various types, each designed to address specific situations based on the level of default and compliance with the contract's terms. Recognizing and responding promptly to these notices can help buyers in resolving their financial obligations and potentially avoiding severe legal consequences. Likewise, sellers can ensure their rights are protected by utilizing appropriate notice types and following relevant legal procedures.