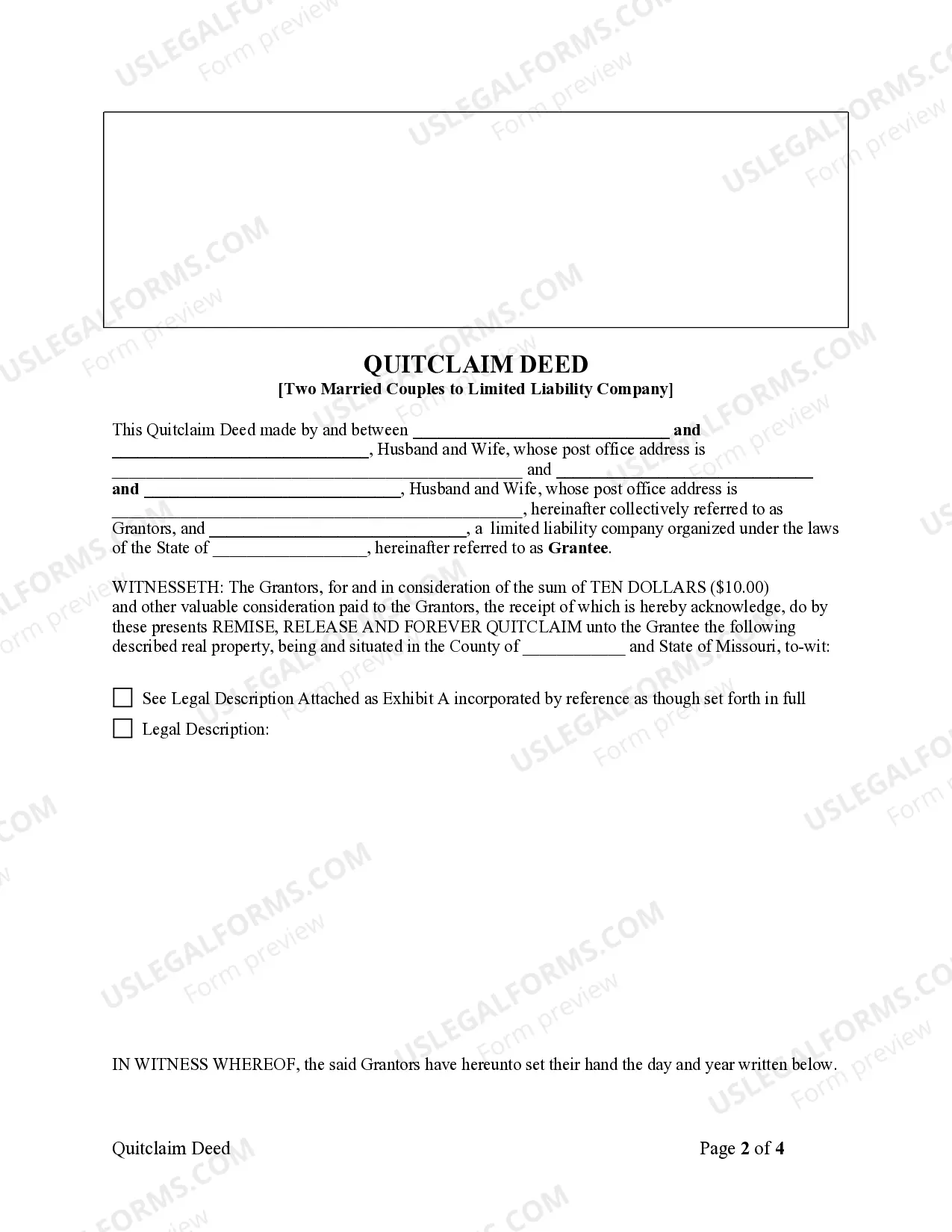

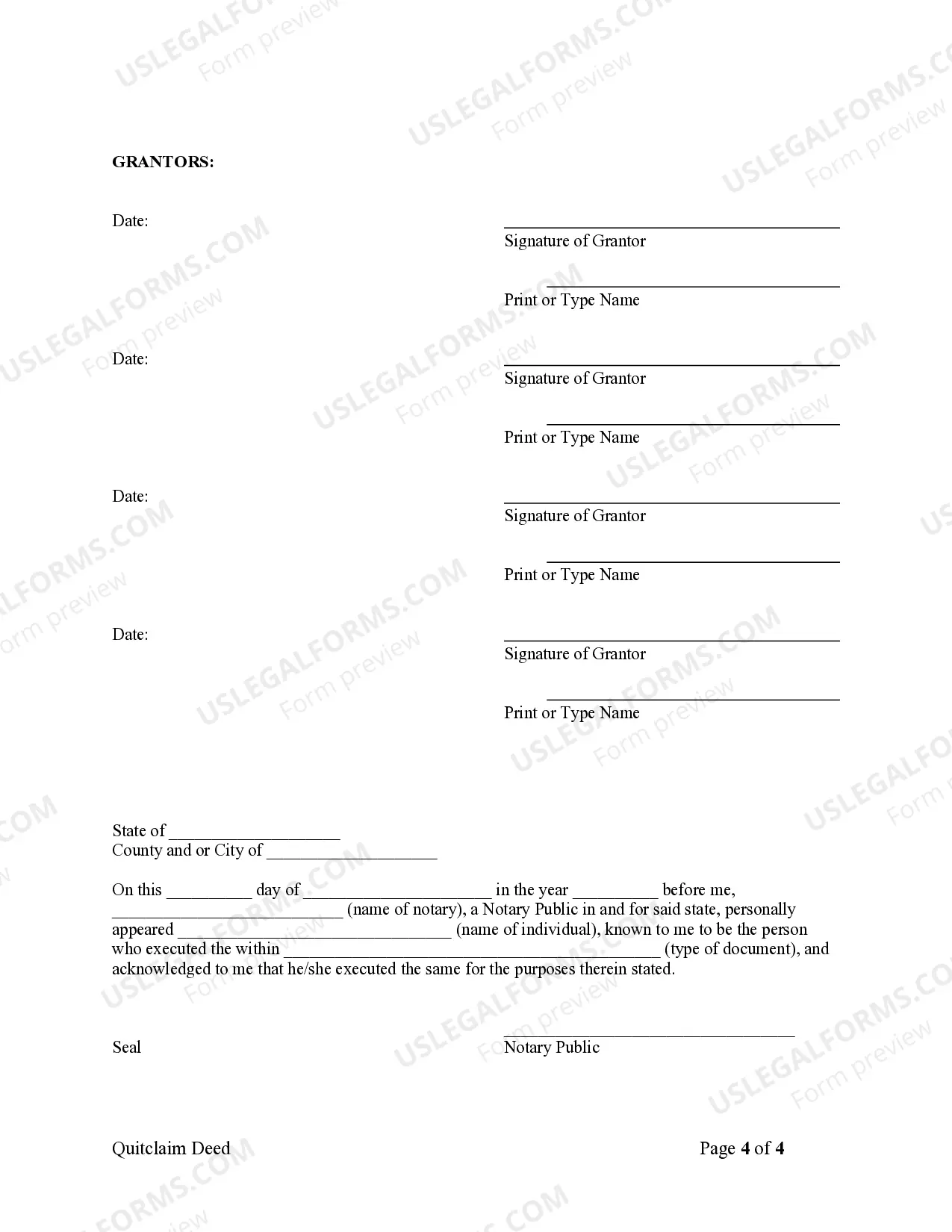

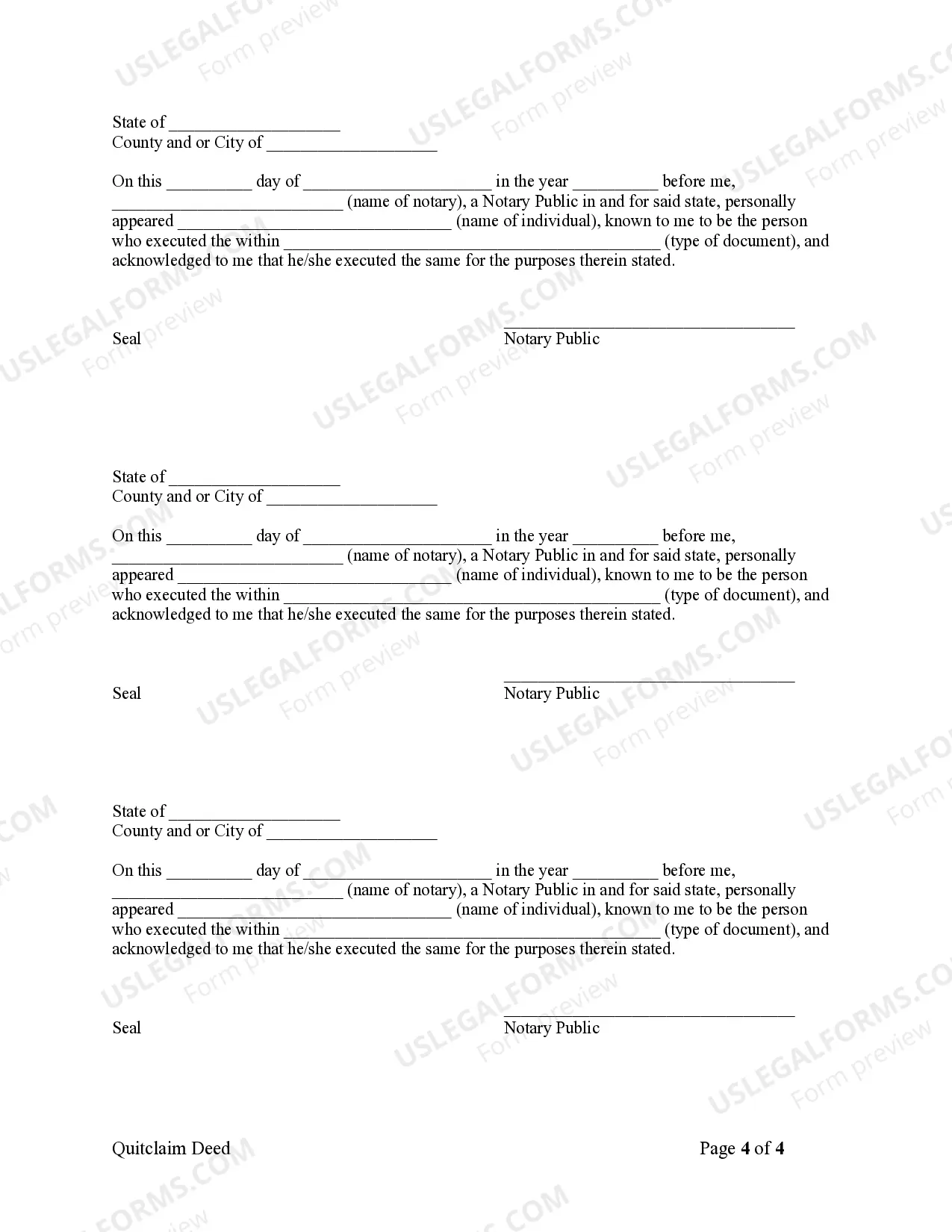

This form is a Quitclaim Deed where the grantors are two sets of husbands and wifes and the grantee is a limited liability company. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

A Springfield Missouri Quitclaim Deed — Two Married Couples to a Limited Liability Company is a legal document used to transfer property ownership from two married couples to a Limited Liability Company (LLC). This type of deed allows for the property to be jointly owned by the LLC, rather than the individual couples. This can be useful for various reasons, such as asset protection, centralized property management, or tax advantages. Here are some relevant keywords and variations to provide a detailed description: 1. Springfield Missouri Quitclaim Deed: This refers to the specific type of deed used in Springfield, Missouri, to legally transfer property. 2. Married Couples: The deed involves the joint ownership of the property by two married couples, indicating their consent to transfer ownership. 3. Limited Liability Company (LLC): The LLC in this context serves as the recipient of the property ownership, acting as a legal entity separate from the couples. This structure offers liability protection for the owners and potentially provides tax benefits. 4. Property Transfer: The quitclaim deed facilitates the transfer of property ownership rights from the couples to the LLC, making the company the new legal owner. 5. Asset Protection: By transferring property ownership to an LLC, the couples can shield their personal assets from potential liabilities or legal issues relating to the property. 6. Centralized Property Management: By using an LLC, the couples can consolidate the management of their property under a single legal entity, streamlining decision-making and administration. 7. Tax Advantages: Depending on the specific circumstances and tax regulations, utilizing an LLC for property ownership can potentially offer tax benefits or deductions. Different types of Springfield Missouri Quitclaim Deed — Two Married Couples to a Limited Liability Company may include variations based on the specific purpose of the transfer, property usage (residential, commercial, rental), or the involvement of additional parties (such as investors or family members). It is essential to consult a qualified attorney or real estate professional to determine the best type of quitclaim deed that suits individual circumstances and objectives.