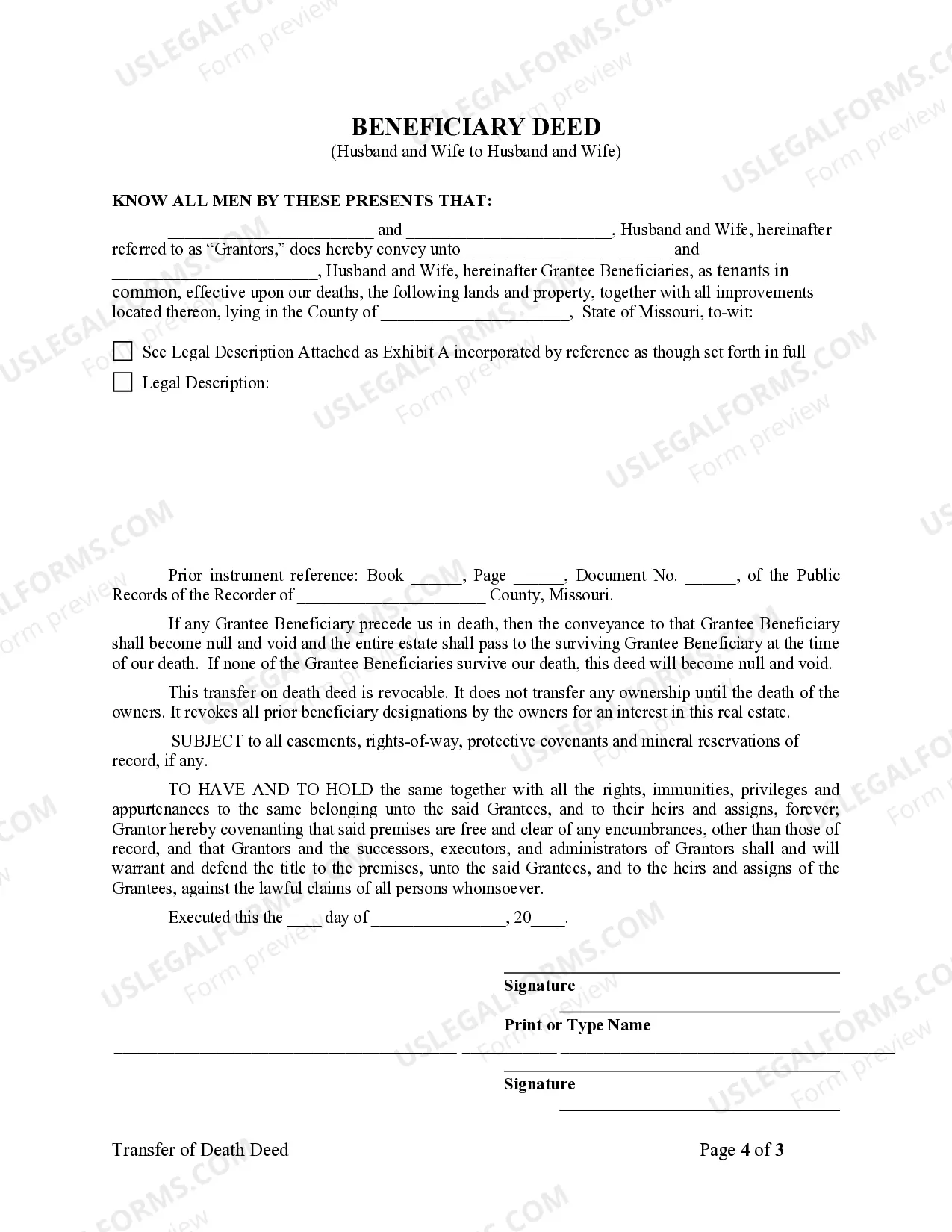

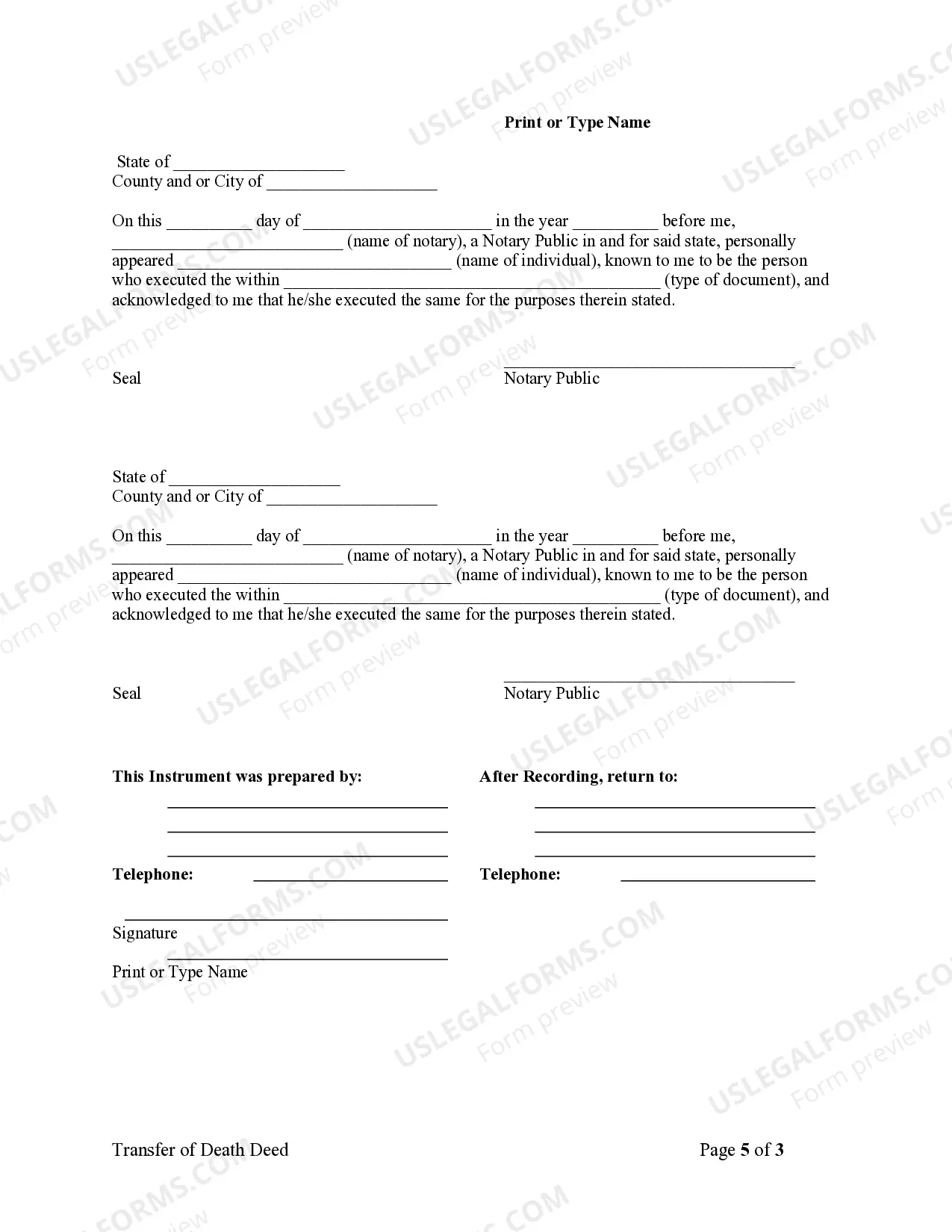

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantee Beneficiaries are Husband and Wife. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. If both Grantee Beneficiaries survive the Grantors, the Grantees take the property as tenants in common, joint tenants with the right of survivorship or as tenants by the entirety. This deed complies with all state statutory laws.

Kansas City Missouri Transfer on Death Deed (TOD) or Beneficiary Deed from Husband and Wife to Husband and Wife is a legal instrument that allows married couples in Kansas City, Missouri, to transfer real estate property to each other upon the death of one spouse without the need for probate. This type of deed ensures a seamless transfer of property rights and streamlines the estate planning process. One type of Transfer on Death Deed from Husband and Wife to Husband and Wife is the Joint Tenancy with Right of Survivorship Deed. This type of deed provides ownership rights to both spouses during their lifetime, and upon the death of one spouse, the surviving spouse automatically becomes the sole owner of the property without the need for probate. Another type is the Tenancy by the Entirety Deed, which is only available for married couples. This deed provides similar rights as Joint Tenancy with Right of Survivorship, but it includes additional benefits, such as protection from individual creditors and the inability of one spouse to unilaterally sever the tenancy. It is important to note that the specific language and requirements for these types of Transfer on Death Deeds may vary, so it is crucial for individuals to consult with an experienced attorney to ensure compliance with the laws and regulations in Kansas City, Missouri. The process of creating a Transfer on Death Deed or Beneficiary Deed from Husband and Wife to Husband and Wife usually involves the following steps: 1. Determine eligibility: Confirm that you meet the eligibility criteria for creating this type of deed, including being married, owning the property jointly, and being of sound mind. 2. Obtain the necessary forms: Contact the appropriate local authority or consult with an attorney to obtain the specific forms required for creating a Transfer on Death Deed or Beneficiary Deed from Husband and Wife to Husband and Wife in Kansas City, Missouri. 3. Fill out the forms: Carefully complete the required forms, ensuring accuracy and compliance with local laws. Include relevant information such as the full legal names of both spouses, a thorough description of the property, and any special provisions or conditions. 4. Sign and notarize the deed: Both spouses must sign the deed in the presence of a notary public. Notarization is crucial to validate the document and make it legally binding. 5. Record the deed: File the completed and notarized Transfer on Death Deed or Beneficiary Deed with the appropriate local government office, usually the county recorder's office. This step ensures the public record reflects the transfer of property rights. By utilizing a Kansas City Missouri Transfer on Death Deed or TOD — Beneficiary Deed from Husband and Wife to Husband and Wife, married couples can ensure a smooth transfer of real estate property upon the death of one spouse. This type of deed offers convenience, privacy, and often reduces the need for costly and time-consuming probate procedures. However, it is advisable to consult with a knowledgeable attorney to navigate the intricacies of estate planning and to ensure compliance with relevant laws and regulations.Kansas City Missouri Transfer on Death Deed (TOD) or Beneficiary Deed from Husband and Wife to Husband and Wife is a legal instrument that allows married couples in Kansas City, Missouri, to transfer real estate property to each other upon the death of one spouse without the need for probate. This type of deed ensures a seamless transfer of property rights and streamlines the estate planning process. One type of Transfer on Death Deed from Husband and Wife to Husband and Wife is the Joint Tenancy with Right of Survivorship Deed. This type of deed provides ownership rights to both spouses during their lifetime, and upon the death of one spouse, the surviving spouse automatically becomes the sole owner of the property without the need for probate. Another type is the Tenancy by the Entirety Deed, which is only available for married couples. This deed provides similar rights as Joint Tenancy with Right of Survivorship, but it includes additional benefits, such as protection from individual creditors and the inability of one spouse to unilaterally sever the tenancy. It is important to note that the specific language and requirements for these types of Transfer on Death Deeds may vary, so it is crucial for individuals to consult with an experienced attorney to ensure compliance with the laws and regulations in Kansas City, Missouri. The process of creating a Transfer on Death Deed or Beneficiary Deed from Husband and Wife to Husband and Wife usually involves the following steps: 1. Determine eligibility: Confirm that you meet the eligibility criteria for creating this type of deed, including being married, owning the property jointly, and being of sound mind. 2. Obtain the necessary forms: Contact the appropriate local authority or consult with an attorney to obtain the specific forms required for creating a Transfer on Death Deed or Beneficiary Deed from Husband and Wife to Husband and Wife in Kansas City, Missouri. 3. Fill out the forms: Carefully complete the required forms, ensuring accuracy and compliance with local laws. Include relevant information such as the full legal names of both spouses, a thorough description of the property, and any special provisions or conditions. 4. Sign and notarize the deed: Both spouses must sign the deed in the presence of a notary public. Notarization is crucial to validate the document and make it legally binding. 5. Record the deed: File the completed and notarized Transfer on Death Deed or Beneficiary Deed with the appropriate local government office, usually the county recorder's office. This step ensures the public record reflects the transfer of property rights. By utilizing a Kansas City Missouri Transfer on Death Deed or TOD — Beneficiary Deed from Husband and Wife to Husband and Wife, married couples can ensure a smooth transfer of real estate property upon the death of one spouse. This type of deed offers convenience, privacy, and often reduces the need for costly and time-consuming probate procedures. However, it is advisable to consult with a knowledgeable attorney to navigate the intricacies of estate planning and to ensure compliance with relevant laws and regulations.