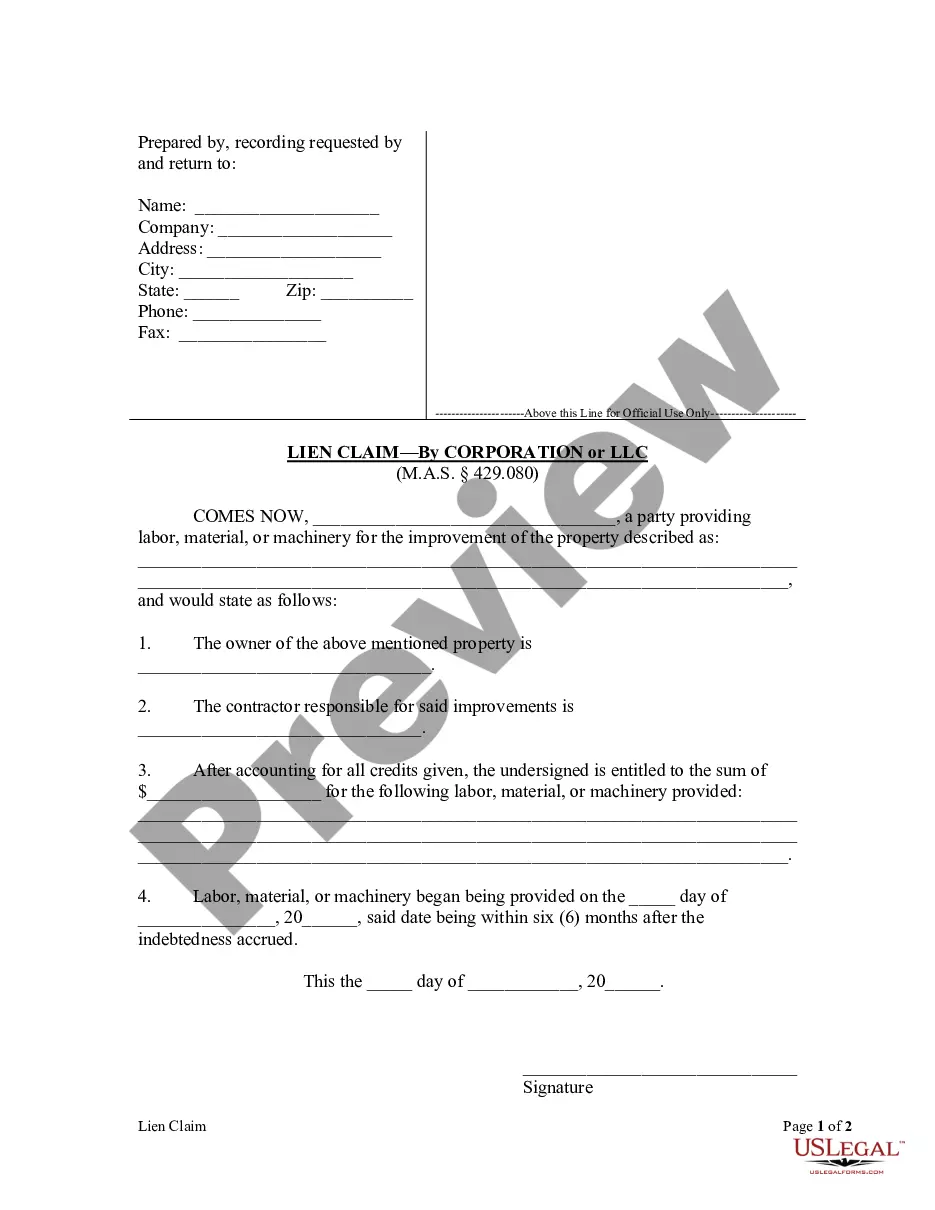

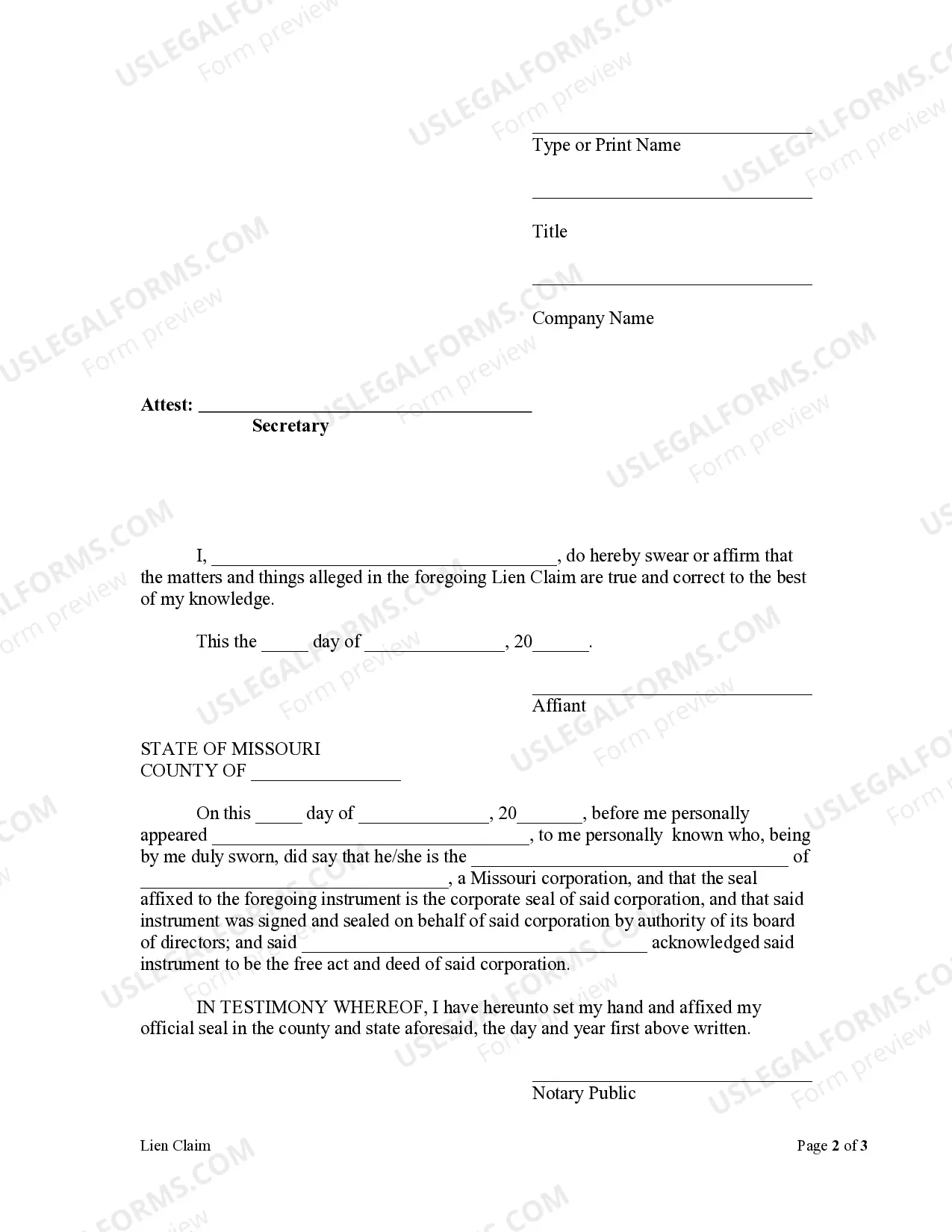

According to Missouri statutes, "It shall be the duty of every contractor... within six months after the indebtedness shall have accrued to file with the clerk of the circuit court of the proper county a just and true account of the demand due him or them after all just credits have been given..." The Lien Claim filing must be verified by the oath of the lien claimant or some credible person for him.

Springfield Missouri Lien Claim - Corporation

Description

How to fill out Missouri Lien Claim - Corporation?

Acquiring verified templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents catering to both personal and professional requirements as well as various real-life situations.

All the files are accurately categorized by their usage area and jurisdiction, making the search for the Springfield Missouri Lien Claim - Corporation or LLC as straightforward as one, two, three.

Maintaining documentation orderly and in accordance with legal standards holds great significance. Leverage the US Legal Forms library to always have vital document templates available for any requirements right at your fingertips!

- Review the Preview mode and form description.

- Ensure you’ve selected the correct one that aligns with your needs and fully complies with your regional jurisdiction rules.

- Search for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the accurate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

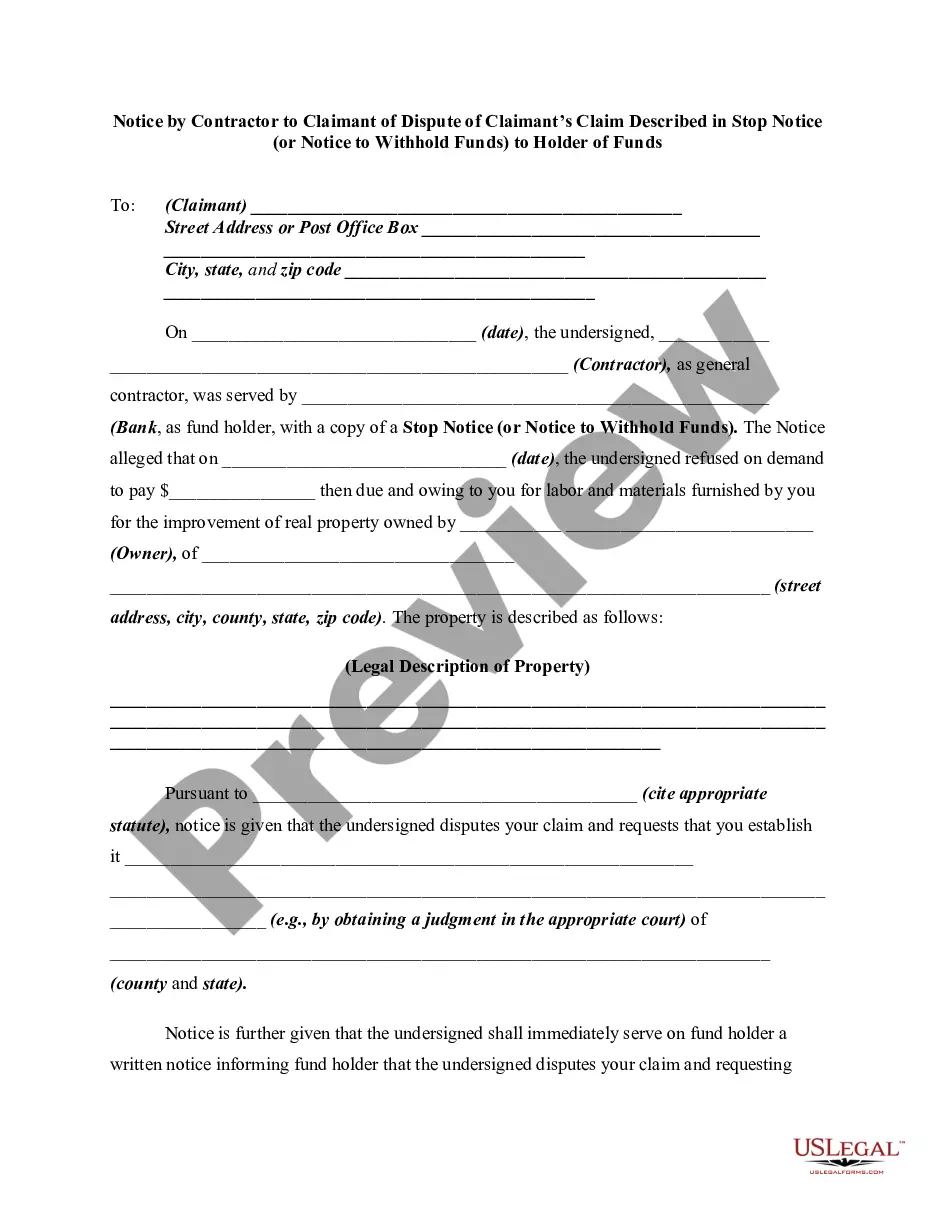

To place a lien, specific conditions must be met, such as having a legal judgment or an agreement that establishes valid debt. The lien must also comply with state laws, including proper filing procedures. If you are experiencing issues with a corporation, understanding these conditions is vital for successfully initiating a Springfield Missouri lien claim. Engaging with US Legal Forms can provide guidance on these requirements and assist you in preparing your claim efficiently.

Yes, you can place a lien on a corporation under certain circumstances, usually when there is a valid debt owed to you. This legal action involves filing the appropriate paperwork and often requires proof of the debt. If you decide to pursue a Springfield Missouri lien claim against a corporation, understanding the legal procedures can help you navigate the complexities. US Legal Forms offers resources that simplify this process, giving you access to the necessary tools and information.

To look up property liens in Missouri, you can start by checking the online databases provided by the Missouri Secretary of State or your local county recorder's office. These records typically include information on property ownership and any associated liens. This step is essential if you intend to make a Springfield Missouri lien claim against a corporation, as it ensures you have accurate and comprehensive information. Utilizing US Legal Forms can also provide tools for accessing these public records easily.

In Missouri, a lien typically remains on your property for five years, but it can be extended through legal actions or if the lien is renewed. Once the lien period expires, the lien should be released. It's crucial to maintain records to ensure your property remains clear of unnecessary liens. If you're dealing with a Springfield Missouri lien claim against a corporation, understanding these details could help in resolving any disputes effectively.

To file a lawsuit against a corporation, you first need to gather the necessary documentation, including any evidence supporting your claim. Then, draft a complaint outlining the reasons for your lawsuit. You can file your lawsuit in the appropriate court, usually where the corporation conducts business. To streamline this process, consider using US Legal Forms to access templates and resources aimed at filing Springfield Missouri lien claims against corporations.

Conducting a lien search in Missouri is straightforward. You will need to visit the county recorder's office where the property is located to access public records. Many counties also offer online resources for easier access to lien information. Utilizing US Legal Forms can simplify the search process, helping you obtain the necessary information quickly and efficiently.

In Missouri, a lien typically lasts for five years from the date it is filed. However, it may be renewed by re-filing before it expires. It's essential to monitor your lien and understand its duration, as this impacts your legal rights regarding the indebted property. US Legal Forms can help you stay informed about renewal procedures for your Springfield Missouri Lien Claim - Corporation.

Filing a lien in Missouri involves several clear steps. First, ensure you gather all necessary information about the debt and the property. Next, you will need to complete the relevant lien form and submit it to the appropriate county recorder's office. For assistance in this procedure, US Legal Forms provides templates that can streamline your filing process for a Springfield Missouri Lien Claim - Corporation.

Yes, you can put a lien against your own property in Springfield, Missouri. A lien serves as a legal claim, ensuring payment for a debt or obligation. However, this process often requires careful documentation and adherence to state laws to ensure its validity. Consider using US Legal Forms to navigate the necessary forms and procedures efficiently.

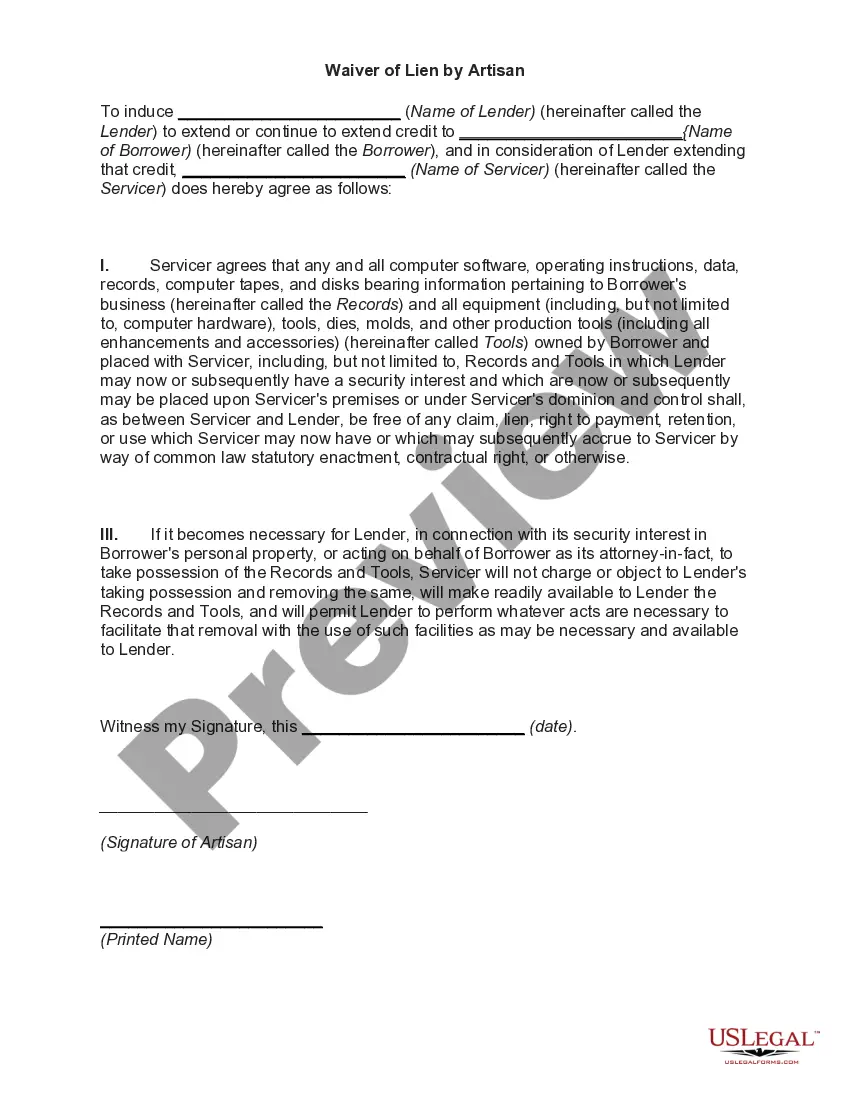

The requirements for notarized lien waivers vary by state, with certain states mandating notarization to enhance enforceability. If you're managing Springfield Missouri lien claims relating to corporations, it is essential to check Missouri regulations and compare them to other states' requirements. Resources like US Legal Forms can provide state-specific guidelines to assist you.