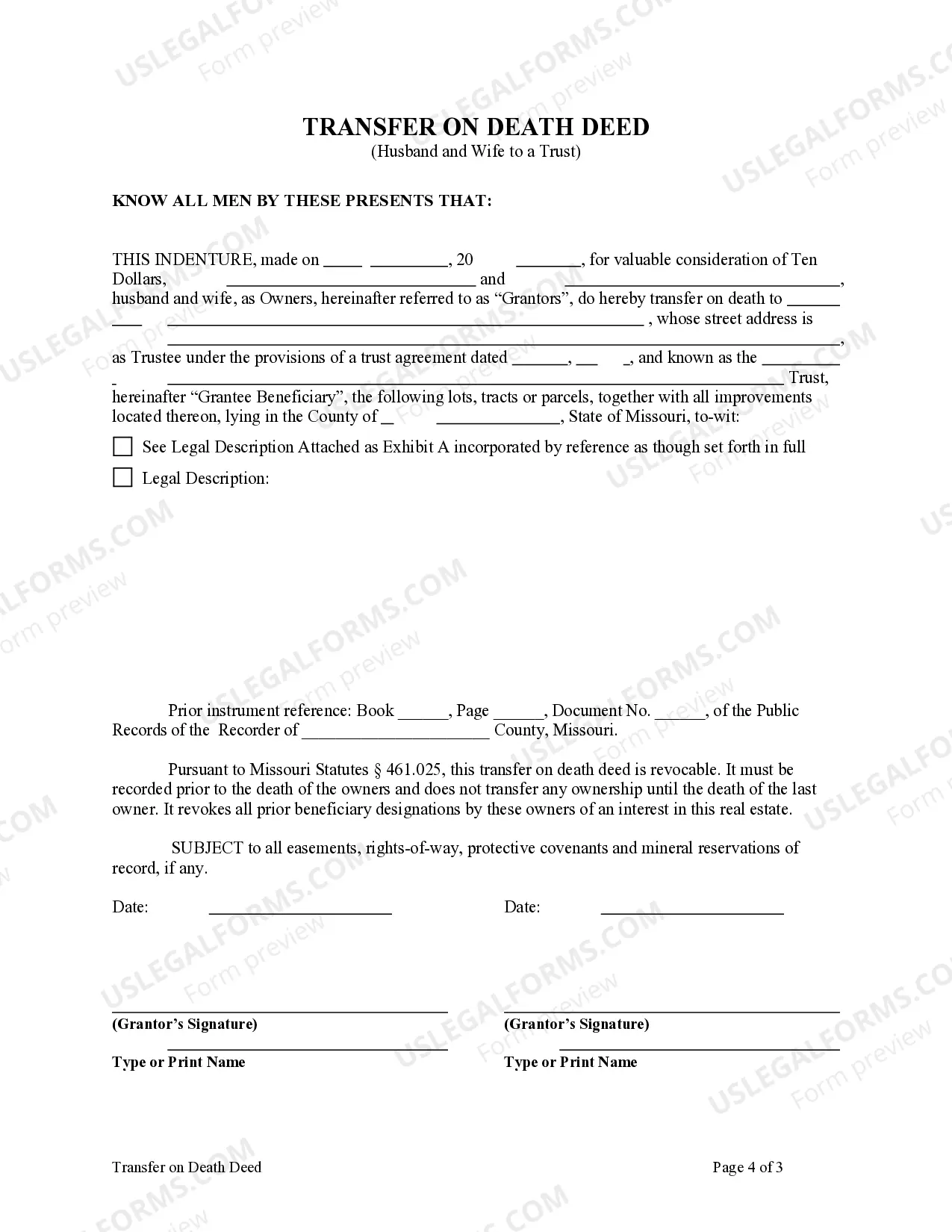

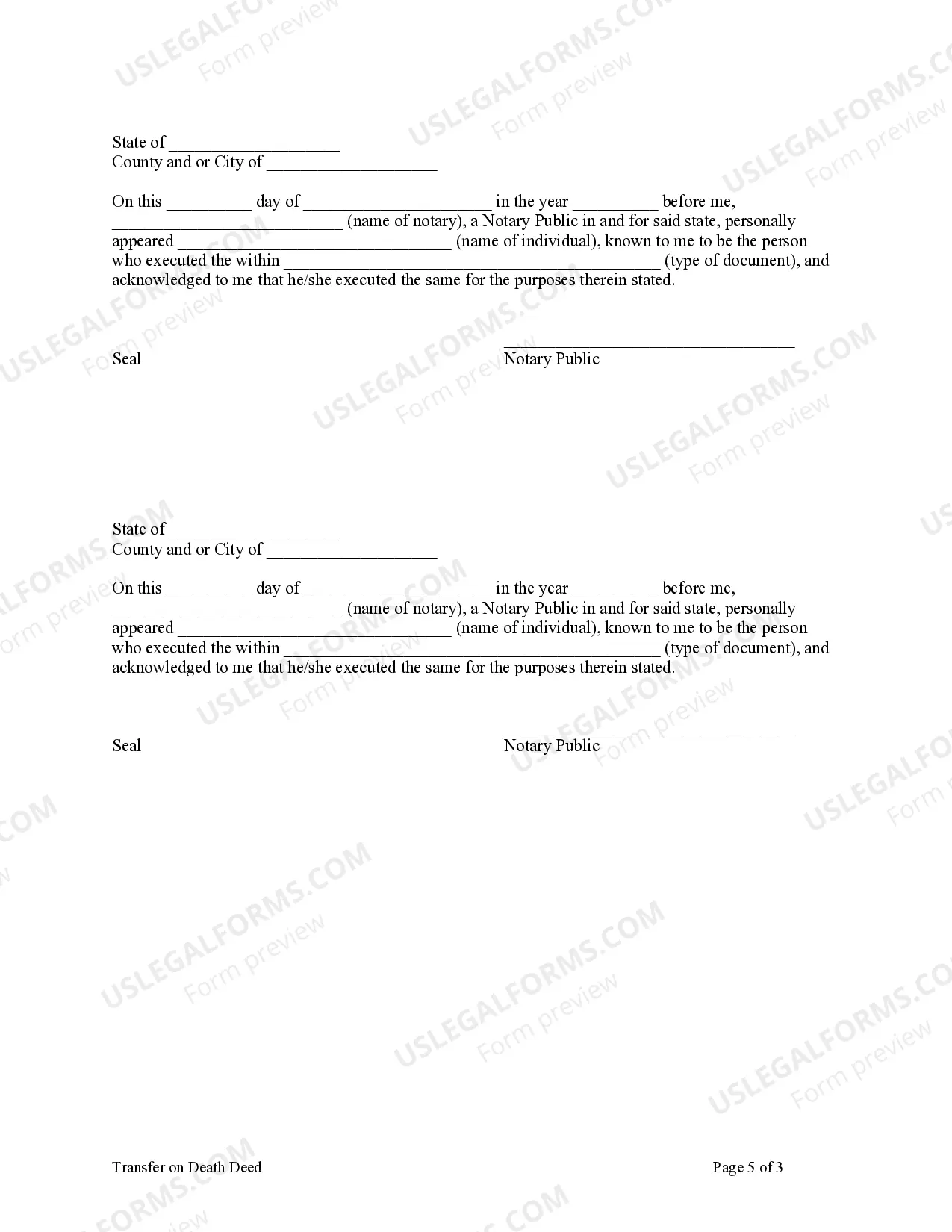

Transfer on Death Deed - Beneficiary Deed Missouri - Husband and Wife to a Trust: This deed is used to transfer the title of a parcel of land, upon the death of the Grantors to the Grantee beneficiary. It is revocable until the death of the last surviving Grantor and it must be recorded prior to the death of the last surviving Grantor.

A Kansas City Missouri Transfer on Death Deed (TOD) or Beneficiary Deed is a legal instrument utilized by individuals who wish to transfer their real estate property to a trust upon their death. This type of deed is specifically designed for married couples who own property jointly and desire it to be passed on to a trust rather than going through probate. The TOD — Beneficiary Deed offers several benefits for couples looking to establish a seamless transfer of property. It allows the husband and wife to retain complete control and ownership of the property during their lifetime, while simultaneously designating a trust as the beneficiary upon their death. This unique deed ensures that the property efficiently passes to the designated trust without the need for probate proceedings. There are different variations of the Kansas City Missouri Transfer on Death Deed or TOD — Beneficiary Deed available to couples based on their specific preferences and circumstances. Some commonly utilized versions include: 1. Joint Tenancy with Right of Survivorship TOD-Beneficiary Deed: This type of deed ensures that if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property. However, upon the death of the second spouse, the property is transferred to the designated trust. 2. Tenants in Common TOD-Beneficiary Deed: This deed establishes ownership where both spouses have an equal undivided interest in the property. If one spouse passes away, their interest in the property transfers to the trust, while the surviving spouse retains their portion of ownership. 3. Community Property with Right of Survivorship TOD-Beneficiary Deed: Available only in states that recognize community property laws, this deed creates joint ownership of property between spouses. In the event of a spouse's death, the surviving spouse automatically inherits the deceased spouse's share, and upon the second spouse's passing, the property is transferred to the trust. By utilizing a Kansas City Missouri Transfer on Death Deed or TOD — Beneficiary Deed, married couples can streamline their estate planning process, avoid probate, and ensure their property is effectively transferred to their desired trust upon their passing. It is essential to consult with an experienced estate planning attorney to ensure a proper understanding of the various deed options available and select the most suitable one for your specific needs.A Kansas City Missouri Transfer on Death Deed (TOD) or Beneficiary Deed is a legal instrument utilized by individuals who wish to transfer their real estate property to a trust upon their death. This type of deed is specifically designed for married couples who own property jointly and desire it to be passed on to a trust rather than going through probate. The TOD — Beneficiary Deed offers several benefits for couples looking to establish a seamless transfer of property. It allows the husband and wife to retain complete control and ownership of the property during their lifetime, while simultaneously designating a trust as the beneficiary upon their death. This unique deed ensures that the property efficiently passes to the designated trust without the need for probate proceedings. There are different variations of the Kansas City Missouri Transfer on Death Deed or TOD — Beneficiary Deed available to couples based on their specific preferences and circumstances. Some commonly utilized versions include: 1. Joint Tenancy with Right of Survivorship TOD-Beneficiary Deed: This type of deed ensures that if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property. However, upon the death of the second spouse, the property is transferred to the designated trust. 2. Tenants in Common TOD-Beneficiary Deed: This deed establishes ownership where both spouses have an equal undivided interest in the property. If one spouse passes away, their interest in the property transfers to the trust, while the surviving spouse retains their portion of ownership. 3. Community Property with Right of Survivorship TOD-Beneficiary Deed: Available only in states that recognize community property laws, this deed creates joint ownership of property between spouses. In the event of a spouse's death, the surviving spouse automatically inherits the deceased spouse's share, and upon the second spouse's passing, the property is transferred to the trust. By utilizing a Kansas City Missouri Transfer on Death Deed or TOD — Beneficiary Deed, married couples can streamline their estate planning process, avoid probate, and ensure their property is effectively transferred to their desired trust upon their passing. It is essential to consult with an experienced estate planning attorney to ensure a proper understanding of the various deed options available and select the most suitable one for your specific needs.