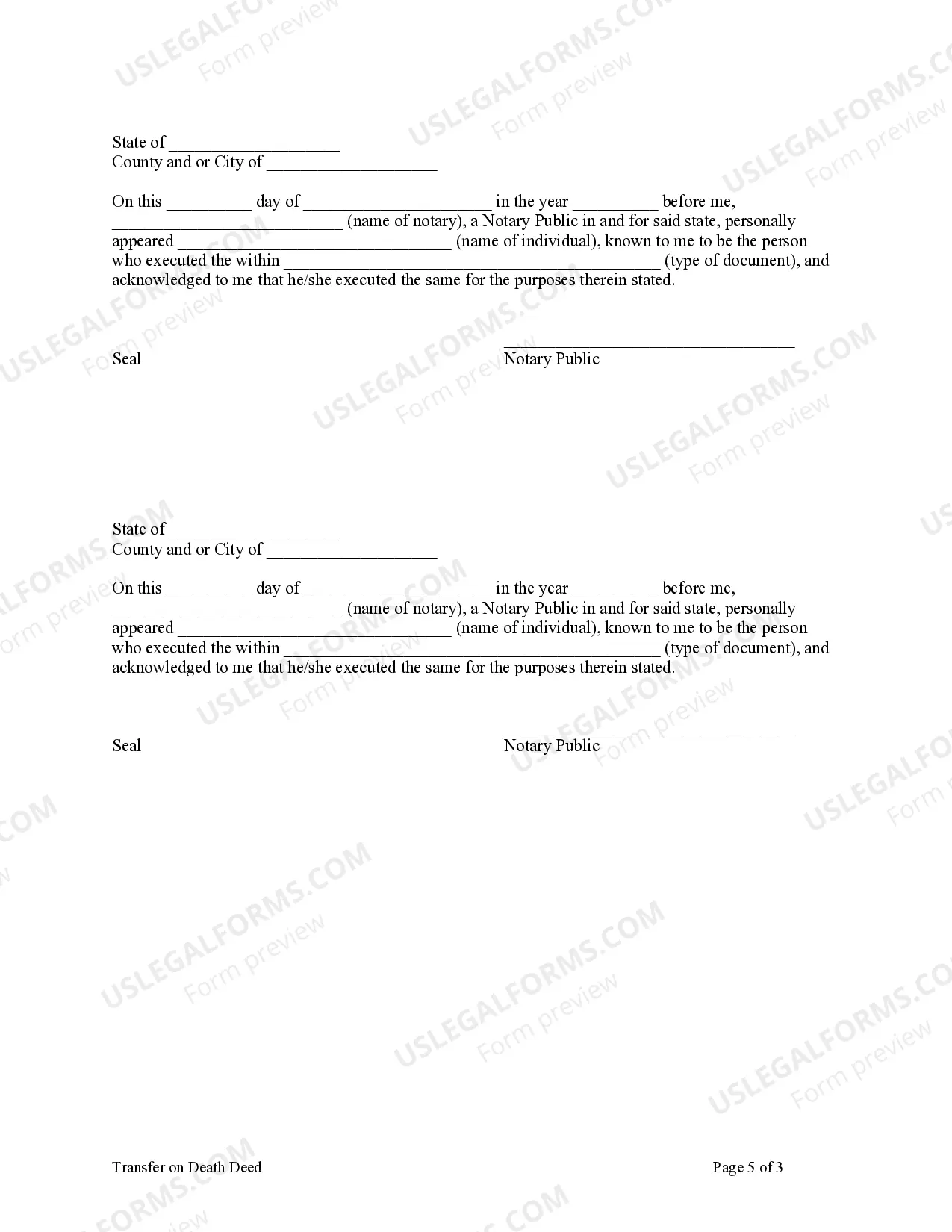

Transfer on Death Deed - Beneficiary Deed Missouri - Husband and Wife to a Trust: This deed is used to transfer the title of a parcel of land, upon the death of the Grantors to the Grantee beneficiary. It is revocable until the death of the last surviving Grantor and it must be recorded prior to the death of the last surviving Grantor.

Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to a Trust

Description

How to fill out Missouri Transfer On Death Deed Or TOD - Beneficiary Deed - Husband And Wife To A Trust?

If you are looking for a legitimate form template, it’s hard to select a more suitable service than the US Legal Forms website – likely the most extensive collections online.

With this collection, you can discover a vast array of templates for business and personal uses by categories and states, or keywords.

Utilizing our advanced search feature, acquiring the latest Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to a Trust is as straightforward as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Receive the template. Select the file format and store it on your device.

- Moreover, the accuracy of each document is verified by a team of experienced attorneys who routinely review the templates on our site and update them according to the latest state and county regulations.

- If you are familiar with our platform and possess a registered account, all you need to do to obtain the Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to a Trust is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions outlined below.

- Ensure you have located the form you need. Review its details and utilize the Preview option to examine its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to find the appropriate document.

- Validate your choice. Click the Buy now button. Next, choose your desired pricing plan and provide information to create an account.

Form popularity

FAQ

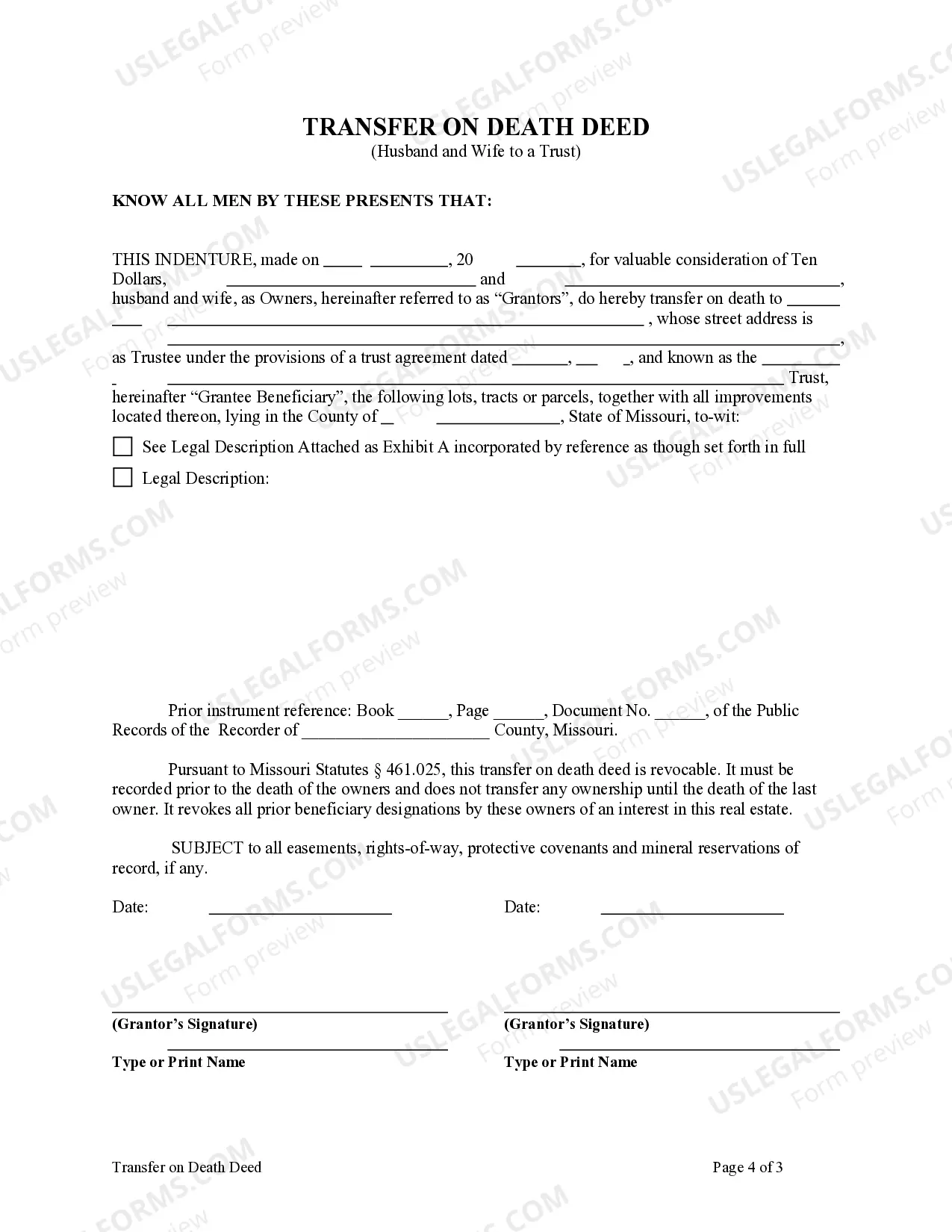

To fill out a Missouri beneficiary deed, start by providing the property's address and a clear description of the property. Include your name as the property owner and the names of the beneficiaries. After filling in all relevant details, you must sign the deed before a notary and record it with the county clerk. For templates and further assistance, consider using UsLegalForms to ensure you follow all legal requirements.

In most cases, you do not need an attorney to create a transfer on death deed. However, having legal advice can be beneficial, especially if your estate is complex. A qualified attorney can help you understand your options and ensure that your Springfield Missouri transfer on death deed is executed correctly. If you prefer handling it yourself, check UsLegalForms for reliable guidance.

While it is not mandatory to hire an attorney for a transfer on death deed, consulting one can provide valuable guidance. An attorney can ensure that the deed complies with Springfield Missouri laws and that all necessary details are included. If you prefer handling the process independently, resources like UsLegalForms offer templates and instructions to assist you in completing the deed accurately.

Filling out a transfer-on-death designation affidavit involves listing the property details, including the owner's name and the designated beneficiaries. Clearly express your intent to transfer the property upon your death. Once you have completed the form, it’s crucial to sign it in front of a notary for verification. For sample forms and easy-to-follow instructions, UsLegalForms can be a helpful resource.

To complete an affidavit of death and heirship, collect information such as the decedent’s name, date of death, and a list of heirs. Clearly state the relationship of each heir to the deceased. After filling in the correct details, ensure that the affidavit is signed in front of a notary. For comprehensive templates and support, consider visiting UsLegalForms to streamline this process regarding your Springfield Missouri transfer on death deed.

The requirements for a transfer-on-death deed in Missouri include the property owner's full name, a legal description of the property, and the names of the beneficiaries. You must also sign and date the deed before a notary. It is essential to file this deed with the county recorder of deeds to make it effective. Understanding these requirements can facilitate the process for your Springfield Missouri transfer on death deed.

To fill out a transfer on death designation affidavit in Ohio, start by gathering necessary information such as the property owner's name, address, and the designated beneficiary's details. It is important to clearly state your intention to transfer property upon your death. Additionally, you must sign the affidavit in front of a notary public. For more guidance on properly completing this document, consider exploring the resources available on the UsLegalForms platform.

The Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to a Trust has some disadvantages worth noting. For instance, it does not provide protection against creditors, meaning individuals can claim against the property if you have outstanding debts. Furthermore, it also lacks the control mechanisms found in trusts, which can limit your flexibility in estate planning. Understanding these limitations will help you make informed decisions about your estate.

You might wonder if you need a lawyer for a Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to a Trust. While it is possible to prepare this deed without legal assistance, consulting with a professional can help ensure it meets all necessary requirements. A lawyer can guide you through the process and address any specific concerns related to your situation, making your estate planning smoother.

While the Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to a Trust offers benefits, there are some disadvantages to consider. One significant issue is that it may not effectively manage complex situations such as debts or taxes. Additionally, if your beneficiary predeceases you, the deed can become void. It's essential to weigh these factors carefully and consider your overall estate planning needs.