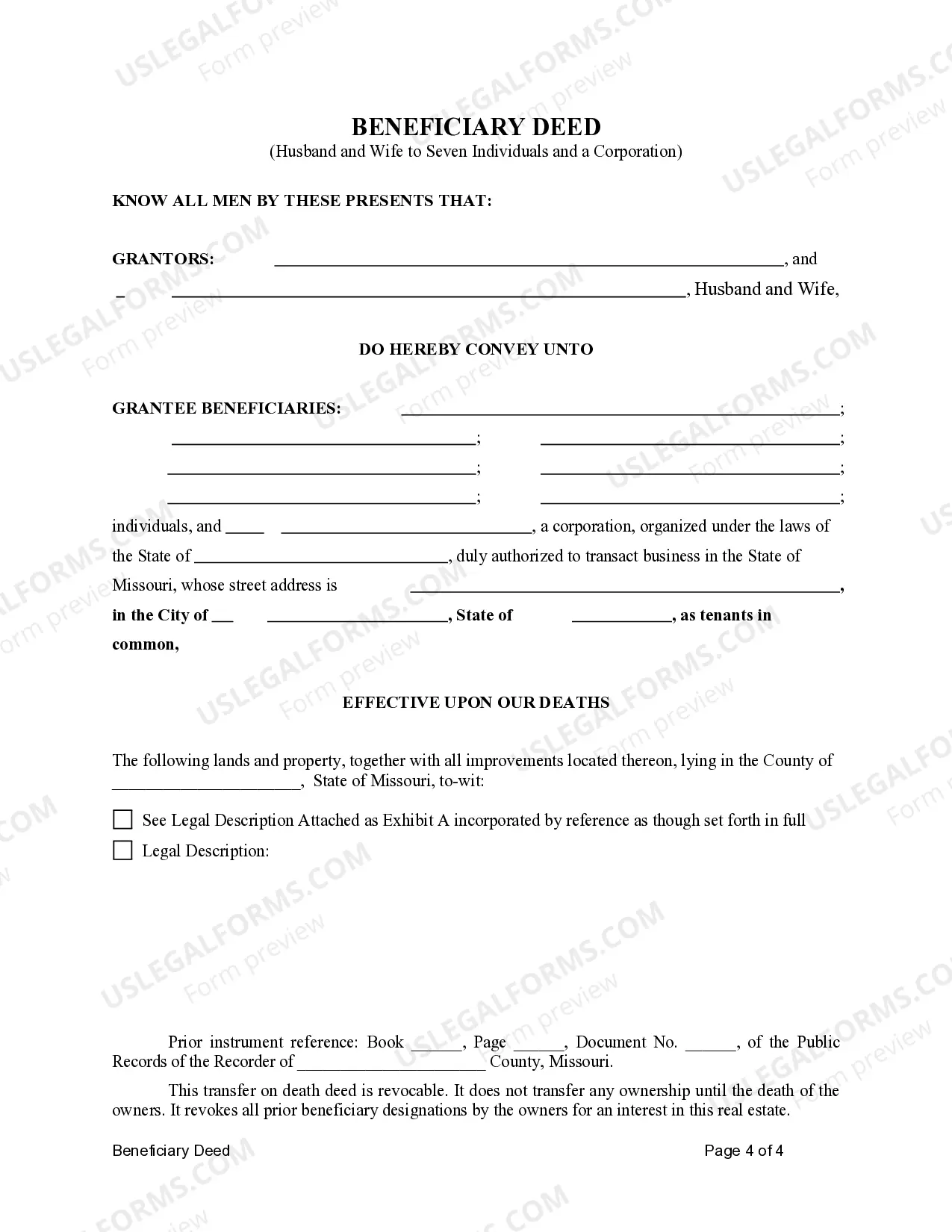

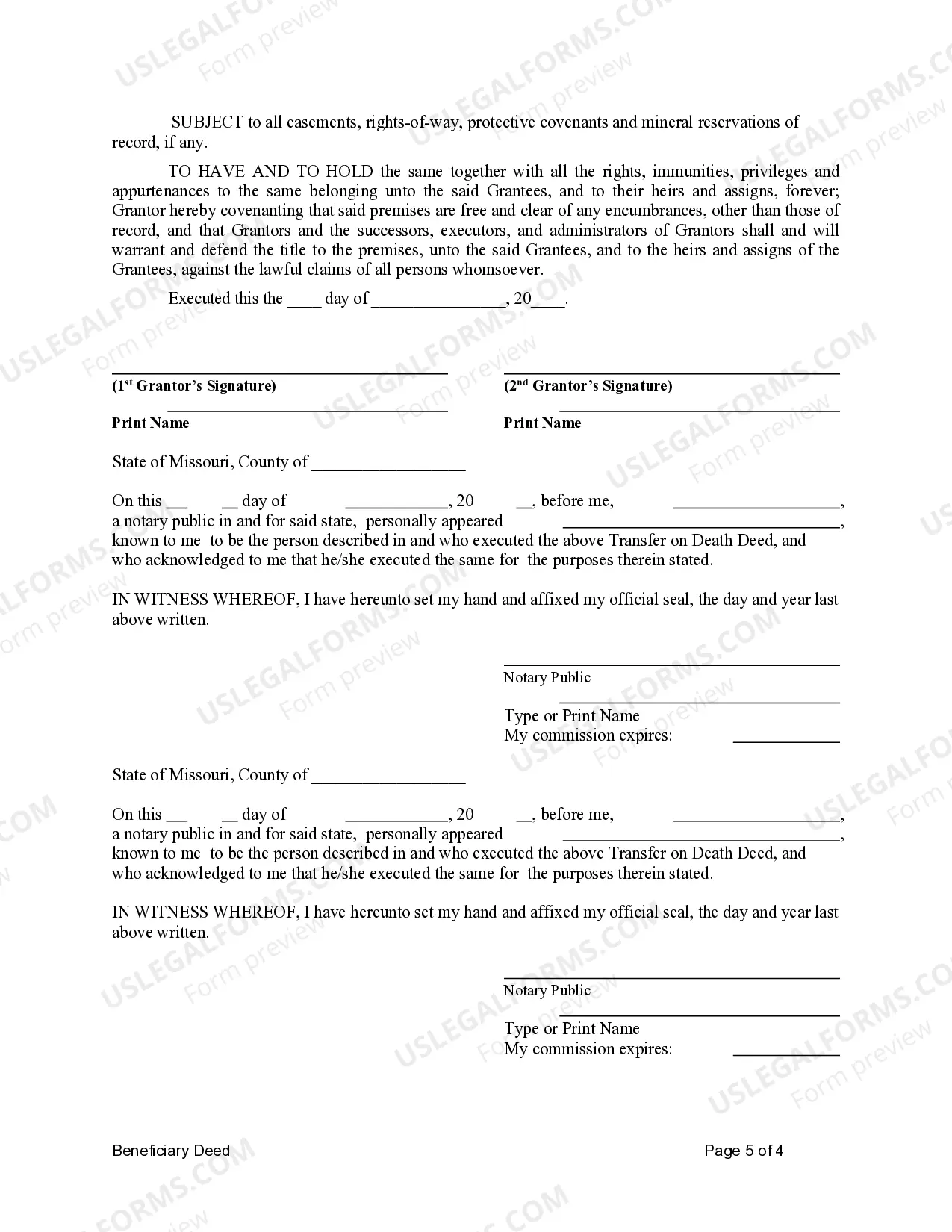

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantees are seven individuals and one corporate beneficiary. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. The Grantees take the property as tenants in common. This deed complies with all state statutory laws.

Kansas City Missouri Transfer on Death Deed (TOD) or Beneficiary Deed is a legal document that allows a property owner in Kansas City, Missouri to transfer their real estate to designated beneficiaries upon their death, bypassing the probate process. This type of deed offers several benefits, including the ability to avoid probate, streamline the transfer of assets, and provide a clear plan for property distribution. In the case of a Transfer on Death Deed or Beneficiary Deed for Husband and Wife to Seven Individual Beneficiaries and a Corporate Beneficiary, the property owner (husband and wife) can designate seven individuals and one corporate entity as beneficiaries to receive ownership rights after their passing. This allows for a diverse distribution of the property, accommodating personal preferences and ensuring a smooth transition of ownership. There are various types of Transfer on Death Deeds or TOD — Beneficiary Deeds available in Kansas City, Missouri, each with its own specific features: 1. Traditional Transfer on Death Deed: This deed allows the property owner to name specific beneficiaries who will receive ownership rights without going through probate. 2. Joint Tenancy with Rights of Survivorship: This option involves joint ownership of the property between husband and wife, with the right of survivorship. It means that when one spouse passes away, the other automatically becomes the sole owner of the property. 3. Tenancy by the Entirety: Similar to joint tenancy, this type of ownership is exclusive to married couples and offers protection against individual spouse's creditors. 4. Life Estate Deed: This deed grants one or both spouses the right to live on the property until their death, after which ownership passes to the named beneficiaries. By utilizing a Kansas City Missouri Transfer on Death Deed or Beneficiary Deed, married couples can ensure their property is transferred smoothly to multiple individual beneficiaries and a corporate entity as desired, without the need for probate. This efficient planning tool allows for the efficient distribution of assets, bypassing the expensive and time-consuming probate process.