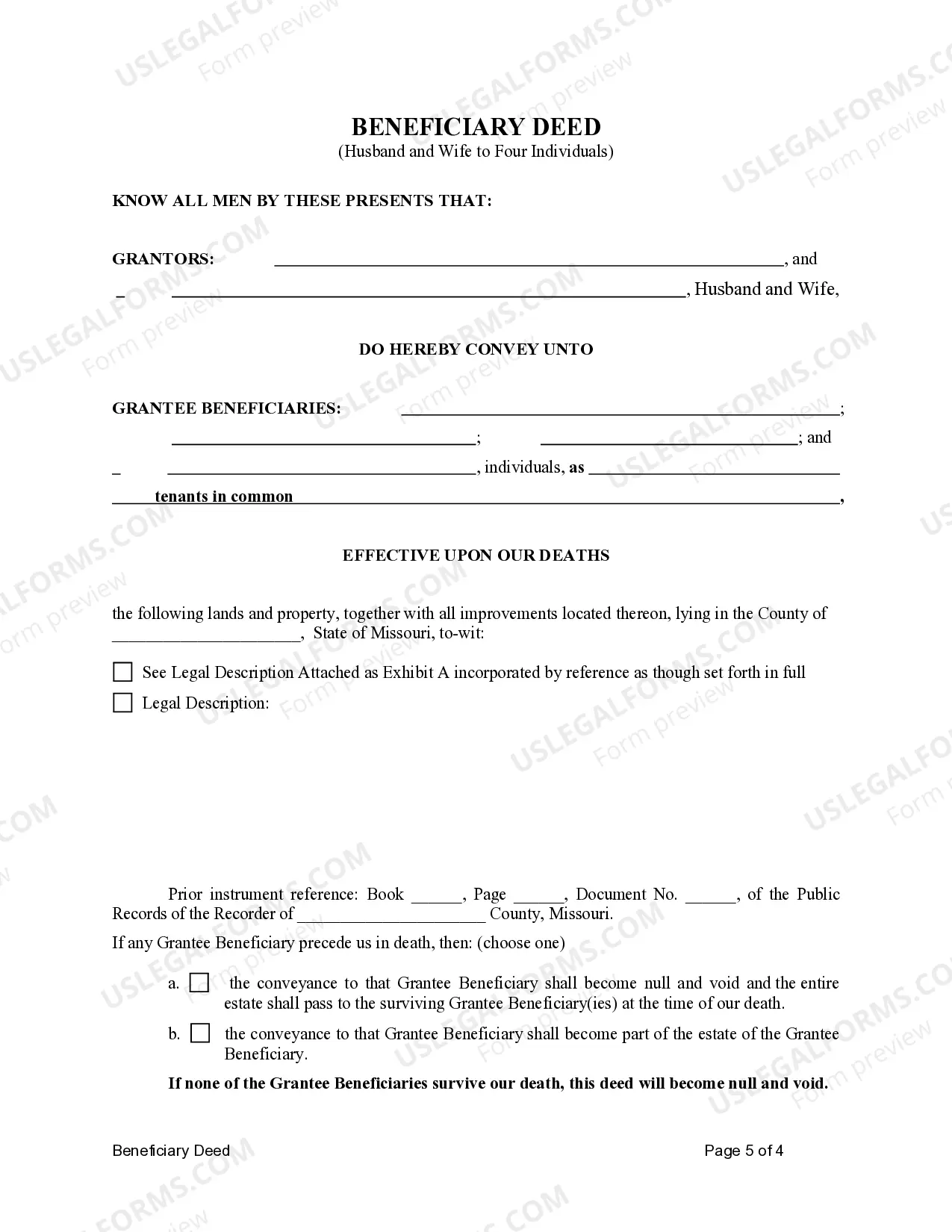

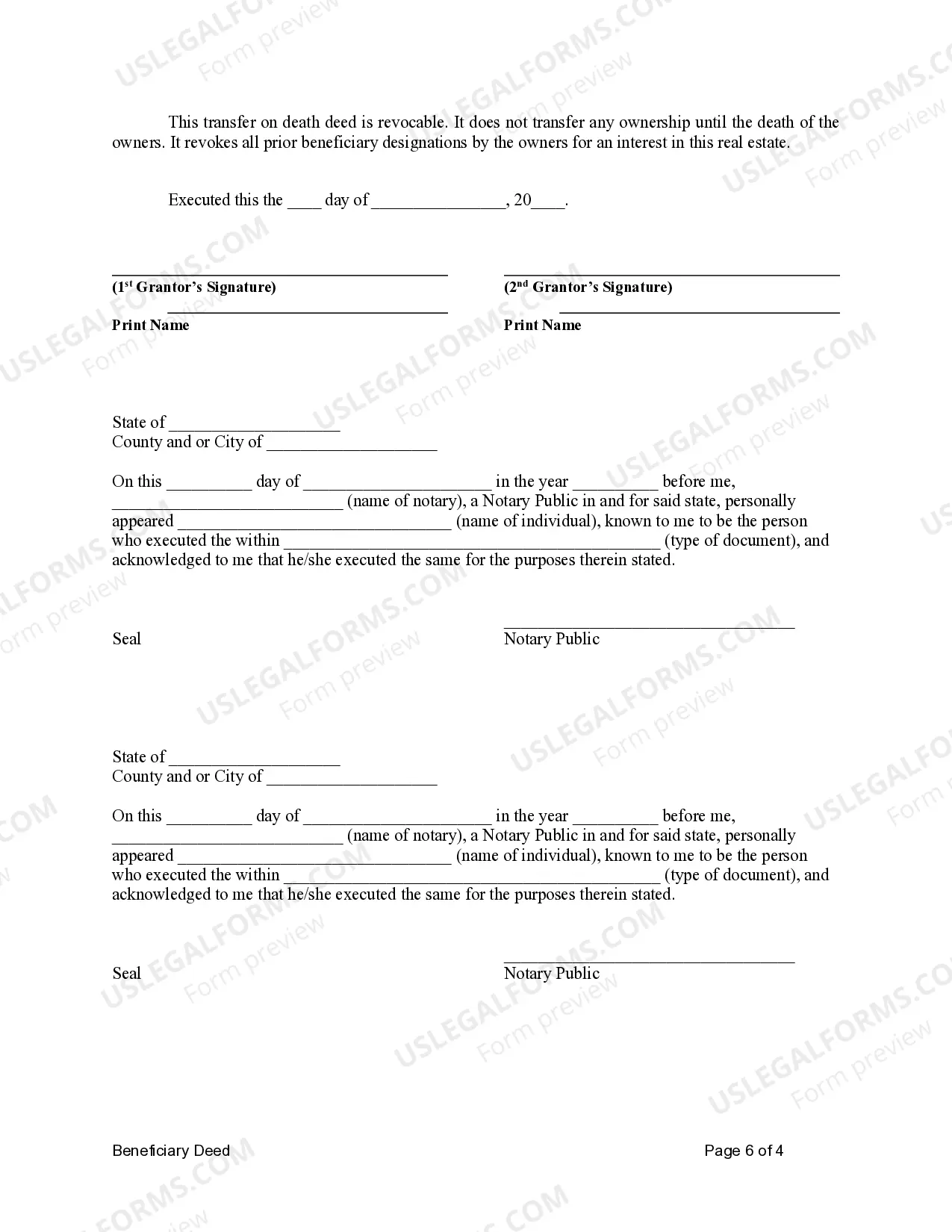

This form is a Transfer on Death Deed where the grantors are husband and wife and the grantees are four individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common. This deed complies with all state statutory laws.

Transfer on Death Deed (TOD) or Beneficiary Deed is a legal document that allows property owners in Springfield, Missouri to transfer their property to designated individuals upon their death, without the need for probate. This type of deed is specifically designed for couples, allowing both spouses to name four individuals as beneficiaries. Springfield Missouri TOD — Transfer on Death Deed or Beneficiary Deed — Husband and Wife to Four Individuals is a popular estate planning tool that provides a straightforward and efficient way to pass on real estate to chosen beneficiaries. By establishing this type of deed, the property owners ensure a smooth transfer of ownership upon their demise, without the involvement of the court. The Springfield Missouri TOD — Transfer on Death Deed or Beneficiary Deed — Husband and Wife to Four Individuals offers the following benefits: 1. Avoidance of Probate: By using this deed, the property is automatically transferred to the designated beneficiaries upon the death of both spouses, bypassing the expensive and time-consuming probate process. This allows for quicker distribution of assets to the intended recipients. 2. Retained Control: Despite naming beneficiaries, the property owners retain control over the property during their lifetime. They can sell, mortgage, or even revoke the deed if circumstances change, providing flexibility and security. 3. No Interference with Other Estate Planning Documents: This type of deed does not affect other estate planning documents such as wills or trusts. It works independently and does not interfere with any other provisions outlined in the overall estate plan. 4. Potential Tax Benefits: Utilizing a TOD or Beneficiary Deed may offer certain tax advantages depending on the specific circumstances and applicable tax laws. It is advisable to consult with an attorney or tax professional for personalized advice in this regard. Different types of Springfield Missouri TOD — Transfer on Death Deed or Beneficiary Deed — Husband and Wife to Four Individuals may include variations in the number of beneficiaries. While the example provided outlines the transfer of property to four individuals, it is possible to designate a different number of beneficiaries according to the individual's wishes and circumstances. In conclusion, the Springfield Missouri TOD — Transfer on Death Deed or Beneficiary Deed — Husband and Wife to Four Individuals provides a useful estate planning tool for couples in Springfield. By using this deed, they can ensure the smooth transfer of property without probate, retain control during their lifetime, and potentially benefit from tax advantages. It is important to consult with a legal professional to ensure the deed is prepared correctly and in accordance with the applicable laws and regulations.Transfer on Death Deed (TOD) or Beneficiary Deed is a legal document that allows property owners in Springfield, Missouri to transfer their property to designated individuals upon their death, without the need for probate. This type of deed is specifically designed for couples, allowing both spouses to name four individuals as beneficiaries. Springfield Missouri TOD — Transfer on Death Deed or Beneficiary Deed — Husband and Wife to Four Individuals is a popular estate planning tool that provides a straightforward and efficient way to pass on real estate to chosen beneficiaries. By establishing this type of deed, the property owners ensure a smooth transfer of ownership upon their demise, without the involvement of the court. The Springfield Missouri TOD — Transfer on Death Deed or Beneficiary Deed — Husband and Wife to Four Individuals offers the following benefits: 1. Avoidance of Probate: By using this deed, the property is automatically transferred to the designated beneficiaries upon the death of both spouses, bypassing the expensive and time-consuming probate process. This allows for quicker distribution of assets to the intended recipients. 2. Retained Control: Despite naming beneficiaries, the property owners retain control over the property during their lifetime. They can sell, mortgage, or even revoke the deed if circumstances change, providing flexibility and security. 3. No Interference with Other Estate Planning Documents: This type of deed does not affect other estate planning documents such as wills or trusts. It works independently and does not interfere with any other provisions outlined in the overall estate plan. 4. Potential Tax Benefits: Utilizing a TOD or Beneficiary Deed may offer certain tax advantages depending on the specific circumstances and applicable tax laws. It is advisable to consult with an attorney or tax professional for personalized advice in this regard. Different types of Springfield Missouri TOD — Transfer on Death Deed or Beneficiary Deed — Husband and Wife to Four Individuals may include variations in the number of beneficiaries. While the example provided outlines the transfer of property to four individuals, it is possible to designate a different number of beneficiaries according to the individual's wishes and circumstances. In conclusion, the Springfield Missouri TOD — Transfer on Death Deed or Beneficiary Deed — Husband and Wife to Four Individuals provides a useful estate planning tool for couples in Springfield. By using this deed, they can ensure the smooth transfer of property without probate, retain control during their lifetime, and potentially benefit from tax advantages. It is important to consult with a legal professional to ensure the deed is prepared correctly and in accordance with the applicable laws and regulations.