Springfield Missouri Quitclaim Deed from LLC to an Individual

Description

How to fill out Missouri Quitclaim Deed From LLC To An Individual?

Regardless of social or professional standing, filling out legal-related documentation is a regrettable requirement in the contemporary world.

Frequently, it's nearly unfeasible for an individual lacking legal training to create such documents from scratch, largely due to the intricate language and legal nuances they entail.

This is where US Legal Forms can be a game-changer.

Verify the form you have located is tailored to your locality, as the laws of one state or area are not applicable to another.

Review the form and read through a brief description (if available) of the situations for which the document can be utilized.

- Our platform presents an extensive assortment with more than 85,000 ready-to-use state-specific forms applicable to nearly any legal circumstance.

- US Legal Forms also serves as a valuable tool for paralegals or legal advisors seeking greater efficiency with our DIY documents.

- Regardless of whether you need the Springfield Missouri Quitclaim Deed from LLC to an Individual or any other documentation suitable for your state or locality, US Legal Forms has everything readily available.

- Here's how to swiftly obtain the Springfield Missouri Quitclaim Deed from LLC to an Individual using our reliable platform.

- If you are already a registered user, you can proceed to Log In to your account to access the relevant form.

- However, if you are new to our library, make sure to adhere to these steps before downloading the Springfield Missouri Quitclaim Deed from LLC to an Individual.

Form popularity

FAQ

The primary issue with a Springfield Missouri Quitclaim Deed from LLC to an Individual is that it does not guarantee clear title to the property. This means that if there are any liens or encumbrances, the individual assumes those risks. Unlike a warranty deed, a quitclaim deed provides no protection or assurance about the property’s title status. If you're considering using this type of deed, it’s wise to review any potential title issues first, and platforms like uslegalforms can help simplify this process.

To transfer property in Virginia, start by preparing a deed that accurately describes the property. If using a Springfield Missouri Quitclaim Deed from LLC to an Individual in a different state, consider how state laws may vary. It’s essential to consult with a local attorney or a property professional to navigate the legal requirements and ensure that everything is executed correctly. Platforms like uslegalforms can provide valuable resources and templates to simplify this process.

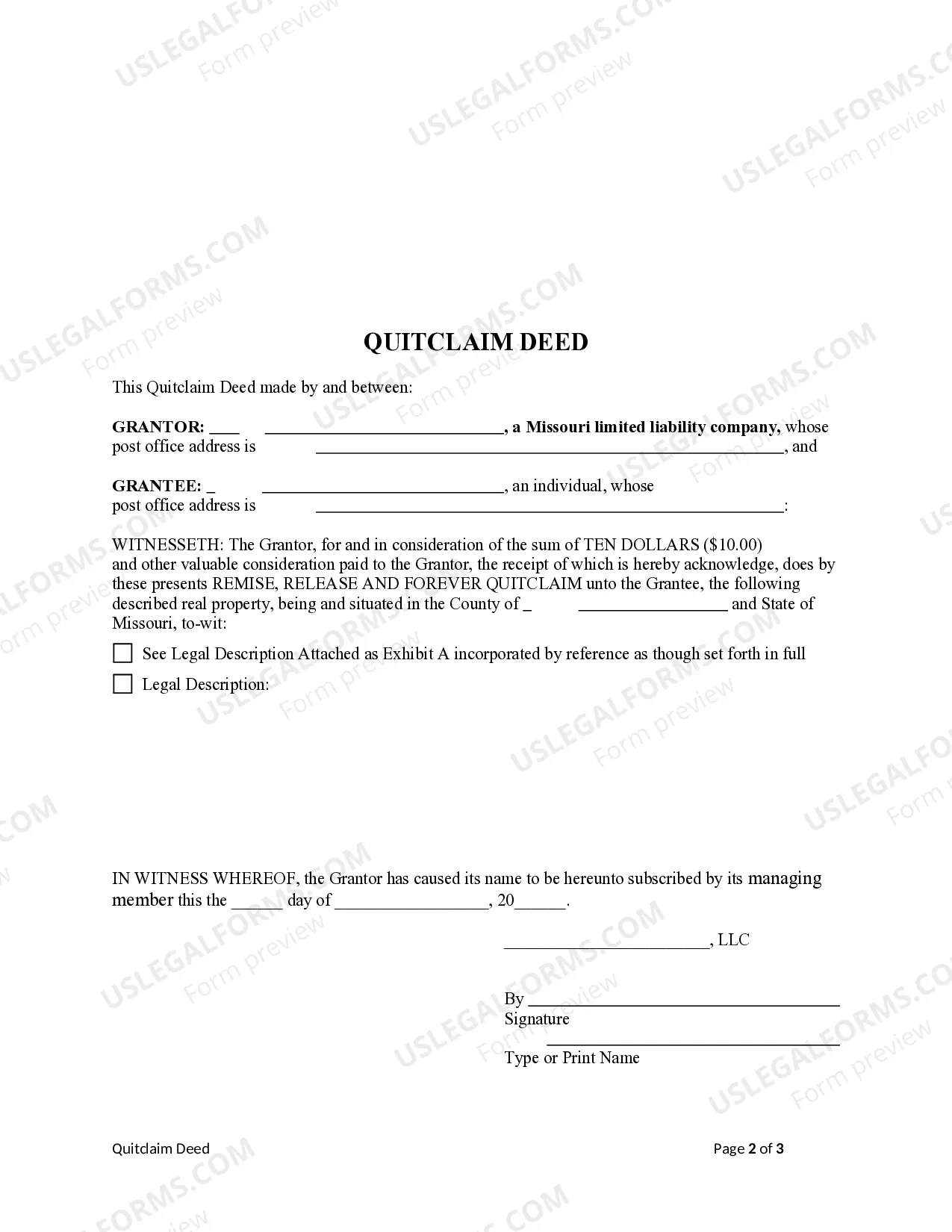

In Missouri, a quitclaim deed requires specific elements to be valid, especially when transferring property through a Springfield Missouri Quitclaim Deed from LLC to an Individual. First, you need the names of both the grantor (the LLC) and the grantee (the individual). The deed must be signed by the grantor in front of a notary, and it should include a legal description of the property. Moreover, it’s wise to ensure that any tax obligations associated with the transfer are addressed.

Yes, you can transfer property from an LLC to an individual using a Springfield Missouri Quitclaim Deed from LLC to an Individual. This deed allows the LLC to relinquish any claim it holds over the property to the individual. It is a straightforward process that typically requires the LLC to execute the deed and then the individual to accept it. Always ensure that you follow local regulations to complete this transfer properly.

The individual receiving the property often benefits the most from a quitclaim deed, as they gain full ownership without the need for a lengthy legal process. This is particularly true for a Springfield Missouri Quitclaim Deed from LLC to an Individual, where the transfer is straightforward and efficient. Additionally, the LLC may benefit by simplifying its asset management. Assess your particular situation to determine how a quitclaim deed aligns with your property goals.

To quitclaim an LLC deed, start by preparing a Springfield Missouri Quitclaim Deed from LLC to an Individual. Ensure you include accurate property details and the names of the individuals involved in the transfer. After drafting, sign the document in front of a notary and submit it to your local county office for recording. It's beneficial to seek assistance from legal platforms like uslegalforms to guide you through the process.

Transferring property to an LLC in California can have various tax implications, including reassessment of property taxes. While this question primarily targets California law, understanding the tax consequences is important for your Springfield Missouri Quitclaim Deed from LLC to an Individual. Consulting with a tax professional can provide clarity on how such transfers might affect your tax situation.

Filing a quitclaim deed in Missouri involves preparing the document with all required information about the property and the parties involved. After drafting your Springfield Missouri Quitclaim Deed from LLC to an Individual, you must sign it in the presence of a notary. Once notarized, file the deed with the appropriate county recorder’s office to officially complete the transfer.

To remove property from an LLC, you should draft a Springfield Missouri Quitclaim Deed from LLC to an Individual. This document allows the LLC to transfer ownership of the property to an individual. It's important to follow all state-specific rules during the process. Consider consulting with a legal professional to ensure that all forms are correctly filled out and filed.