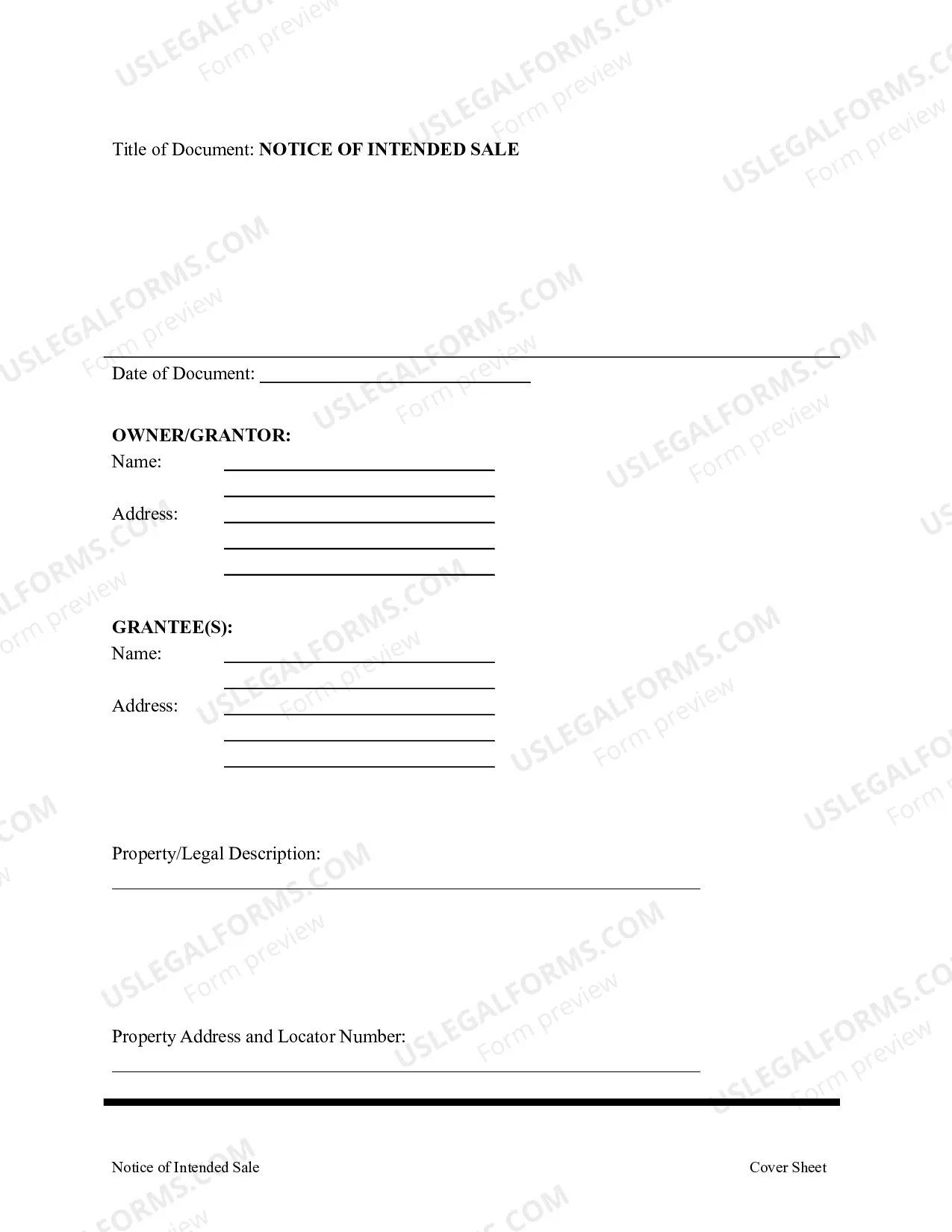

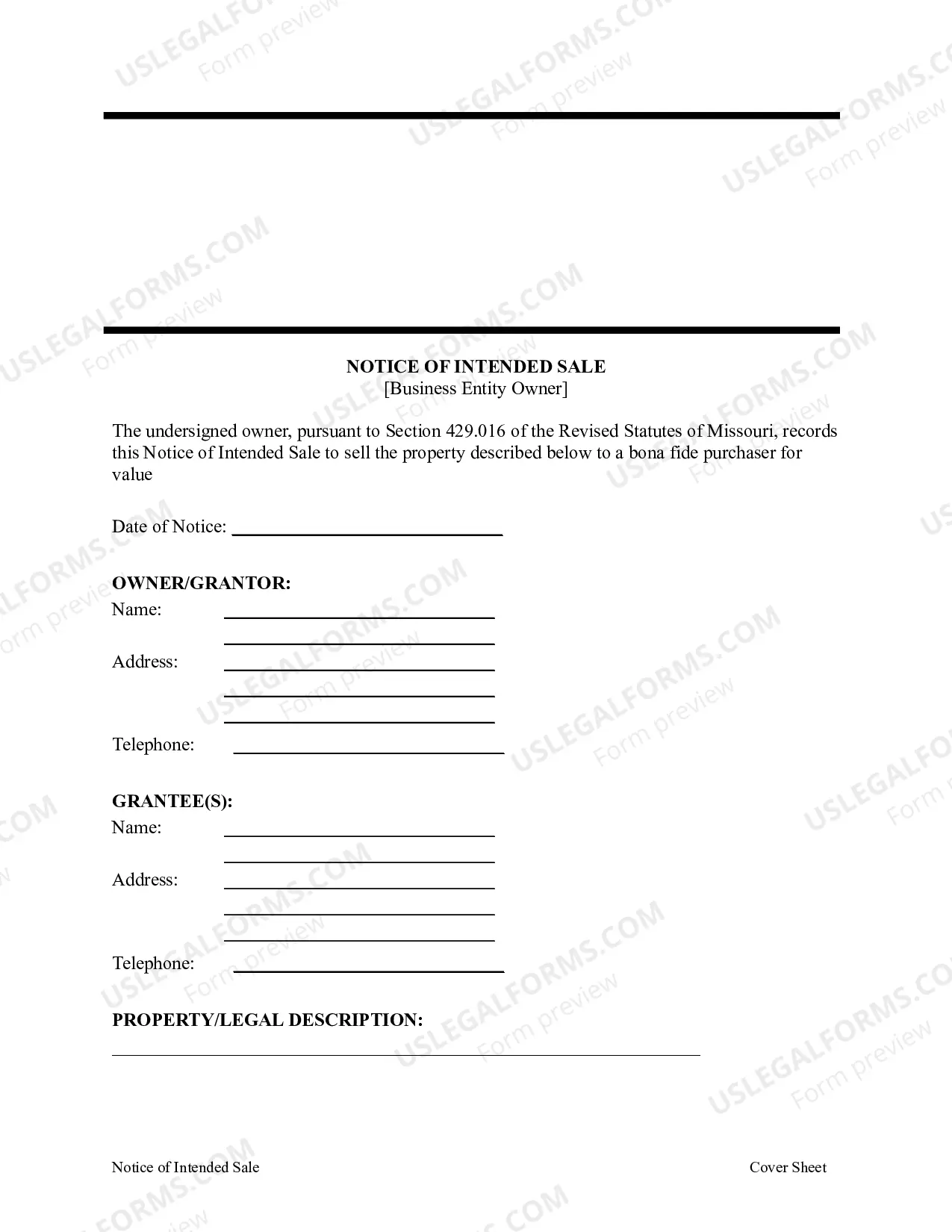

Kansas City Missouri Notice of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016

Description

How to fill out Missouri Notice Of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016?

We consistently aspire to diminish or avert legal complications when navigating intricate legal or financial issues.

To achieve this, we engage in legal services that are typically quite expensive.

However, not every legal concern is equally intricate; many can be resolved independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to the document. If you happen to misplace it, you can always download it again from the My documents section. The process remains equally simple even if you are unfamiliar with the website! You can create your account in just a few minutes. Ensure to verify that the Kansas City Missouri Notice of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016 adheres to the laws and regulations of your state and locale. Furthermore, it is crucial to review the form's outline (if accessible), and if you find any inconsistencies with your initial expectations, seek a different template. After confirming that the Kansas City Missouri Notice of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016 is appropriate for you, select a subscription plan and proceed with payment. You can then download the document in any available format. For over 24 years, we have assisted millions by offering customizable and current legal documents. Optimize your experience with US Legal Forms now to conserve time and resources!

- Our collection empowers you to manage your affairs without needing an attorney.

- We provide access to legal form templates that are not always readily available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you require to obtain and download the Kansas City Missouri Notice of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016 or any other form swiftly and securely.

Form popularity

FAQ

A mechanic's lien must be filed with the Circuit Court in the county where the real property is located. Once a mechanic's lien is filed, the contractor, subcontractor, or supplier must then file a petition to enforce the mechanic's lien in the proper court within six months after the filing of the lien.

The process of bonding off a mechanics lien starts after a claimant has filed a mechanics lien. After the claim is made, a general contractor or a property owner can contact a surety bond company to purchase a surety bond that replaces the value of the lien that was filed against the property.

In Missouri, mechanics liens are valid for 6 months after filing. Unless you extend the lien, you have this 6 month window to enforce your lien claim if you need to. If you go unpaid for a long time, you can always file a notice of intent to foreclose to spur payment.

Even if the debt exceeds the property value, you can still sell a house with a lien on it. First, start with an expert who can contact the lien holder to negotiate for a partial or full release of the lien. Judgments from creditors are rarely set in stone.

Missouri Statute 429.005 et seq. grants general contractors, subcontractors, suppliers, and laborers the ability to assert a mechanic's lien for labor and materials provided to or incorporated into a property if the lien is properly filed within six months of the last date of work by the contractor/subcontractor.

The notice of intended sale shall state the calendar date on which the owner intends to close on the sale of such property to such purchaser.

For owner-occupied residential projects of 4 units or less, only parties with a direct contract with the owner-occupier may assert a mechanics lien, unless the owner has signed a Consent of Owner document which allows mechanics liens by unpaid subs and suppliers.

Missouri law (R.S.Mo. 429.005. 1, et seq.) grants general contractors, subcontractors, suppliers, and laborers the ability to assert a mechanic's lien for labor and materials provided to a property, provided the lien is properly filed within six months of the last date of work (excluding warranty and corrective work).

A judgment lien is one way to ensure that the person who won the judgment (the creditor) gets what he or she is owed. A judgment lien gives the creditor the right to be paid a certain amount of money from proceeds from the sale of the debtor's property.