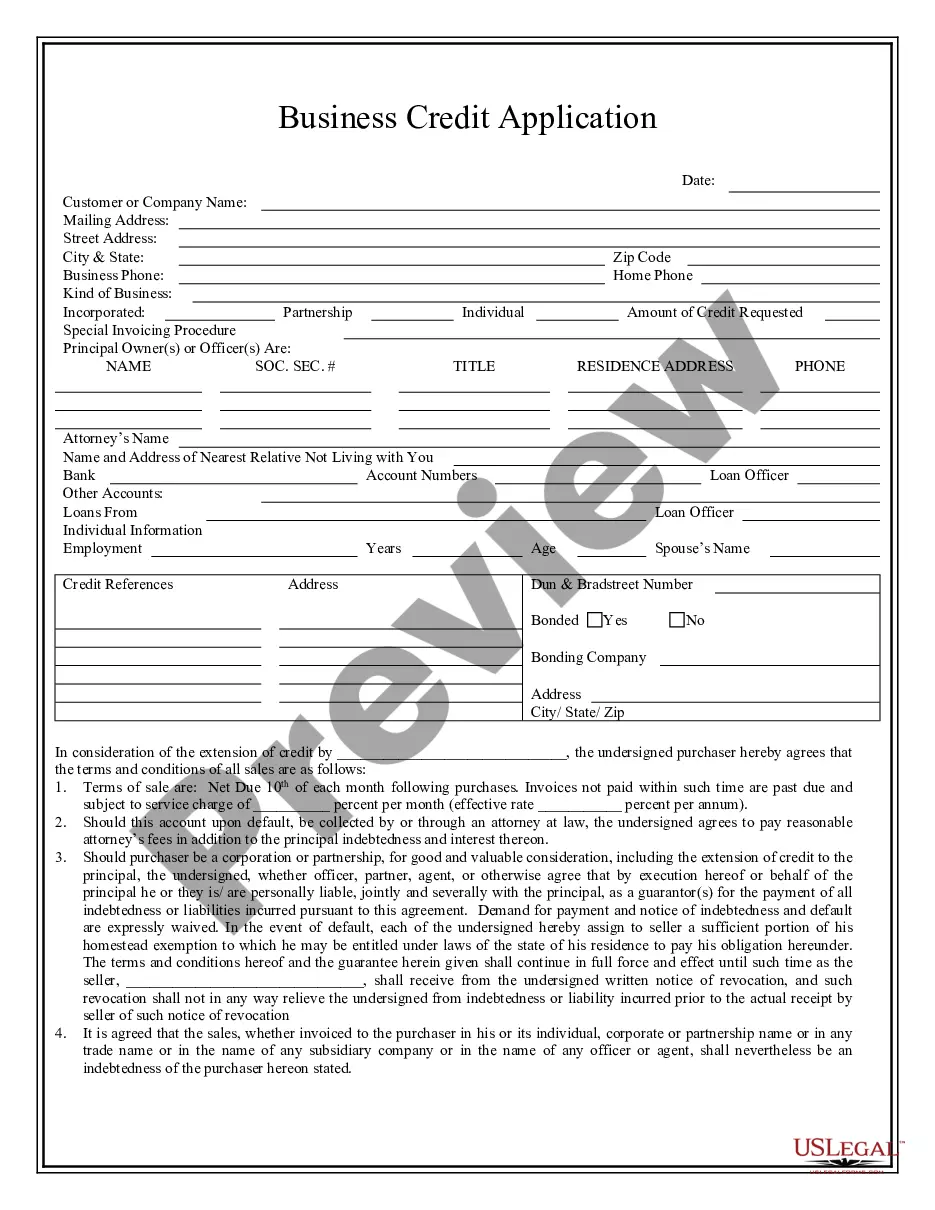

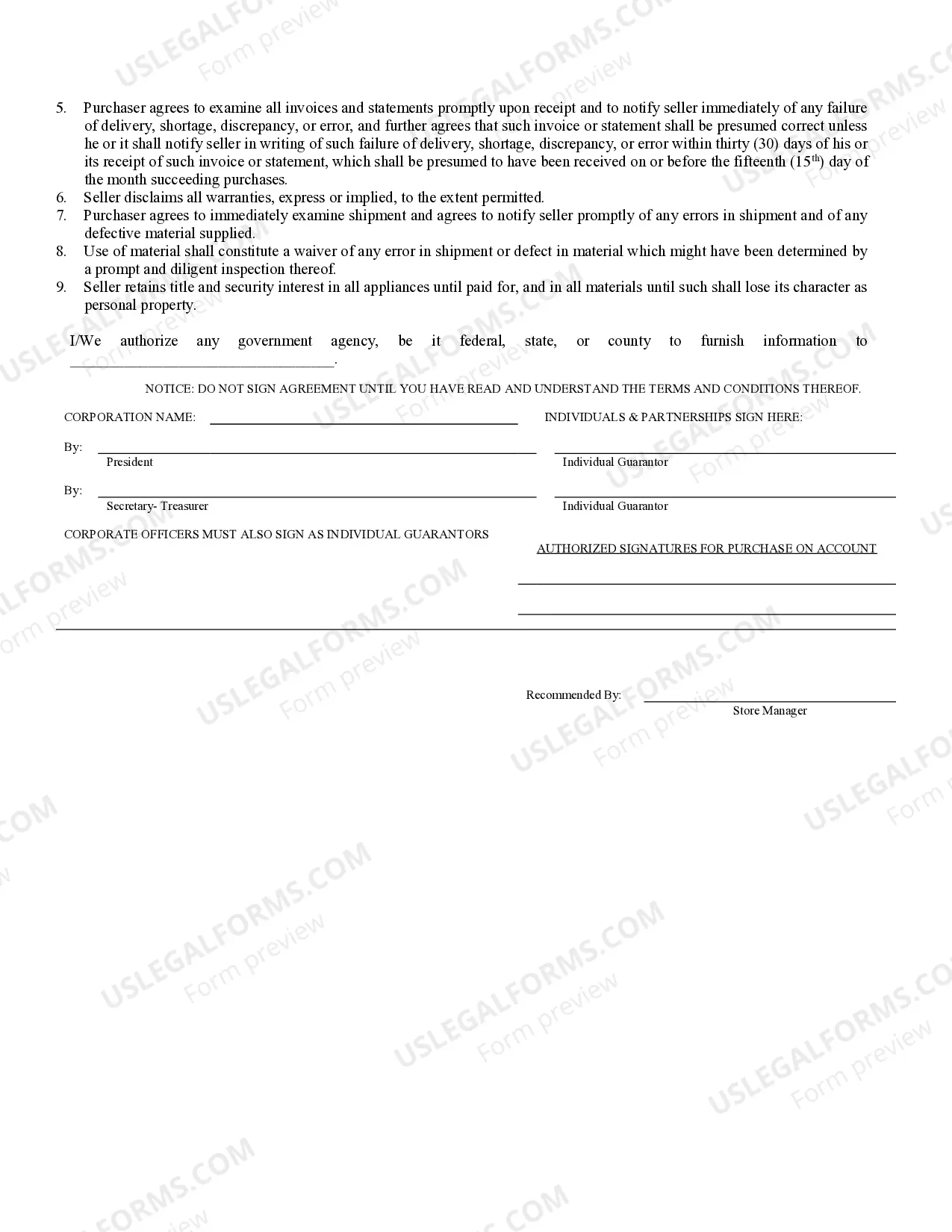

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Kansas City Missouri Business Credit Application is a comprehensive and essential document that allows businesses in the Kansas City, Missouri area to apply for credit and establish financial partnerships with lenders and vendors. This application is designed to gather crucial information about the business and its financial standing to evaluate its creditworthiness and determine the terms and conditions under which credit may be extended. The Kansas City Missouri Business Credit Application typically includes several sections to capture vital business information. Firstly, it requires the business's legal name, address, phone number, and other contact details for effective communication. It also requests necessary identification information such as the company's Employer Identification Number (EIN) or Social Security Number (SSN) if a sole proprietorship. Furthermore, the Kansas City Missouri Business Credit Application entails a thorough analysis of the business's financial history and current status. This may involve providing details about the company's annual revenue, assets, liabilities, and other financial statements to assess its capacity to handle credit responsibilities. Furthermore, the application may inquire about the ownership structure of the business, including information about partners, shareholders, or members. To evaluate creditworthiness, the Kansas City Missouri Business Credit Application often requires the disclosure of the business's banking relationships. This includes the name and address of the primary bank, account numbers, and contact information for verification purposes. Additionally, the application may ask for trade references, where businesses provide the names and contact information of their regular suppliers or creditors. In case there are different types of Kansas City Missouri Business Credit Application, they may vary based on the industry or the specific financial institution providing the credit. For instance, a Retail Business Credit Application may focus on the company's inventory turnover and experience in the retail sector. Conversely, a Service Business Credit Application might emphasize contract stability and client relationships. Regardless of the type, the primary goal of the Kansas City Missouri Business Credit Application remains constant — to assess a business's creditworthiness, evaluate its financial stability, and establish credit relationships. By providing accurate and comprehensive information, businesses can increase their chances of obtaining credit and securing favorable terms from lenders and vendors in the Kansas City, Missouri area.Kansas City Missouri Business Credit Application is a comprehensive and essential document that allows businesses in the Kansas City, Missouri area to apply for credit and establish financial partnerships with lenders and vendors. This application is designed to gather crucial information about the business and its financial standing to evaluate its creditworthiness and determine the terms and conditions under which credit may be extended. The Kansas City Missouri Business Credit Application typically includes several sections to capture vital business information. Firstly, it requires the business's legal name, address, phone number, and other contact details for effective communication. It also requests necessary identification information such as the company's Employer Identification Number (EIN) or Social Security Number (SSN) if a sole proprietorship. Furthermore, the Kansas City Missouri Business Credit Application entails a thorough analysis of the business's financial history and current status. This may involve providing details about the company's annual revenue, assets, liabilities, and other financial statements to assess its capacity to handle credit responsibilities. Furthermore, the application may inquire about the ownership structure of the business, including information about partners, shareholders, or members. To evaluate creditworthiness, the Kansas City Missouri Business Credit Application often requires the disclosure of the business's banking relationships. This includes the name and address of the primary bank, account numbers, and contact information for verification purposes. Additionally, the application may ask for trade references, where businesses provide the names and contact information of their regular suppliers or creditors. In case there are different types of Kansas City Missouri Business Credit Application, they may vary based on the industry or the specific financial institution providing the credit. For instance, a Retail Business Credit Application may focus on the company's inventory turnover and experience in the retail sector. Conversely, a Service Business Credit Application might emphasize contract stability and client relationships. Regardless of the type, the primary goal of the Kansas City Missouri Business Credit Application remains constant — to assess a business's creditworthiness, evaluate its financial stability, and establish credit relationships. By providing accurate and comprehensive information, businesses can increase their chances of obtaining credit and securing favorable terms from lenders and vendors in the Kansas City, Missouri area.