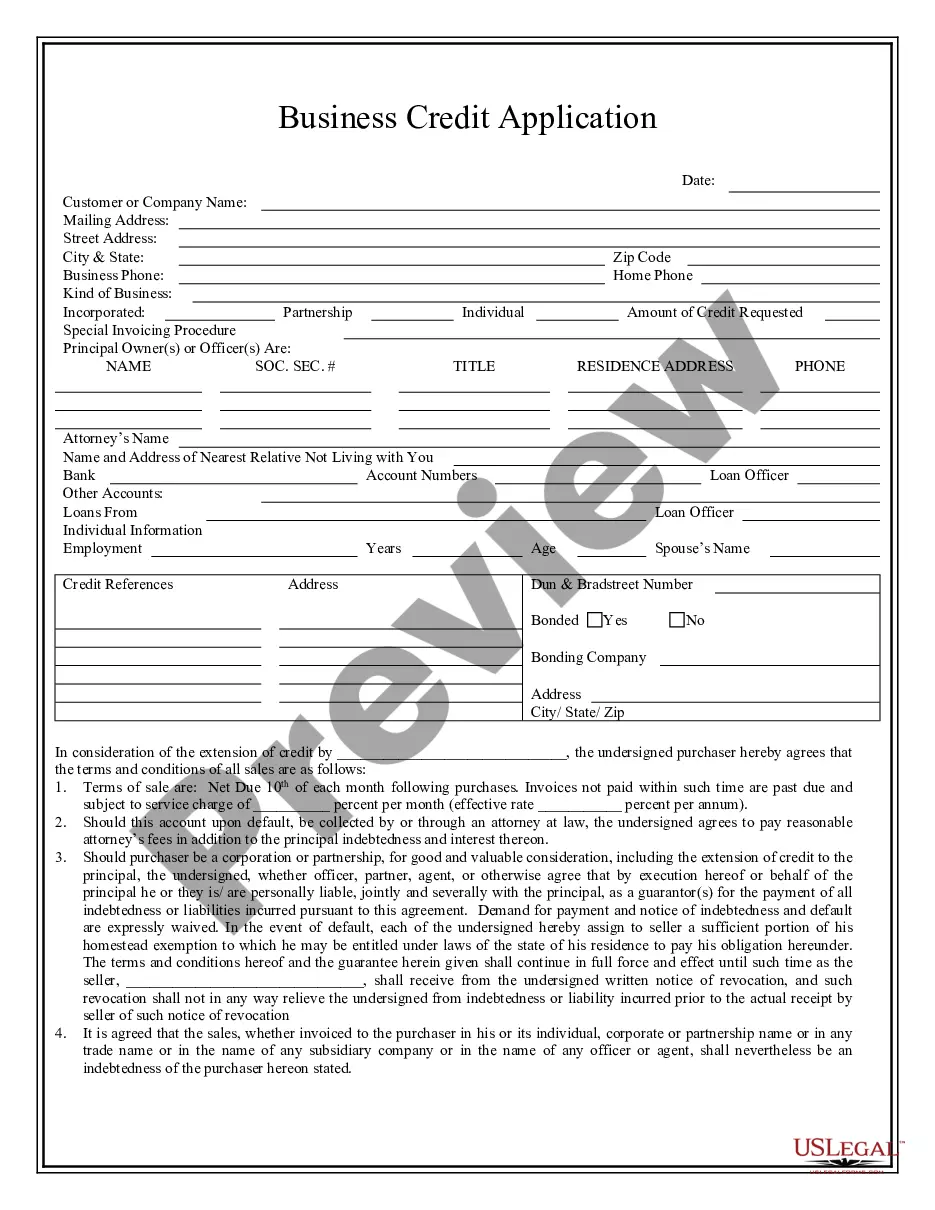

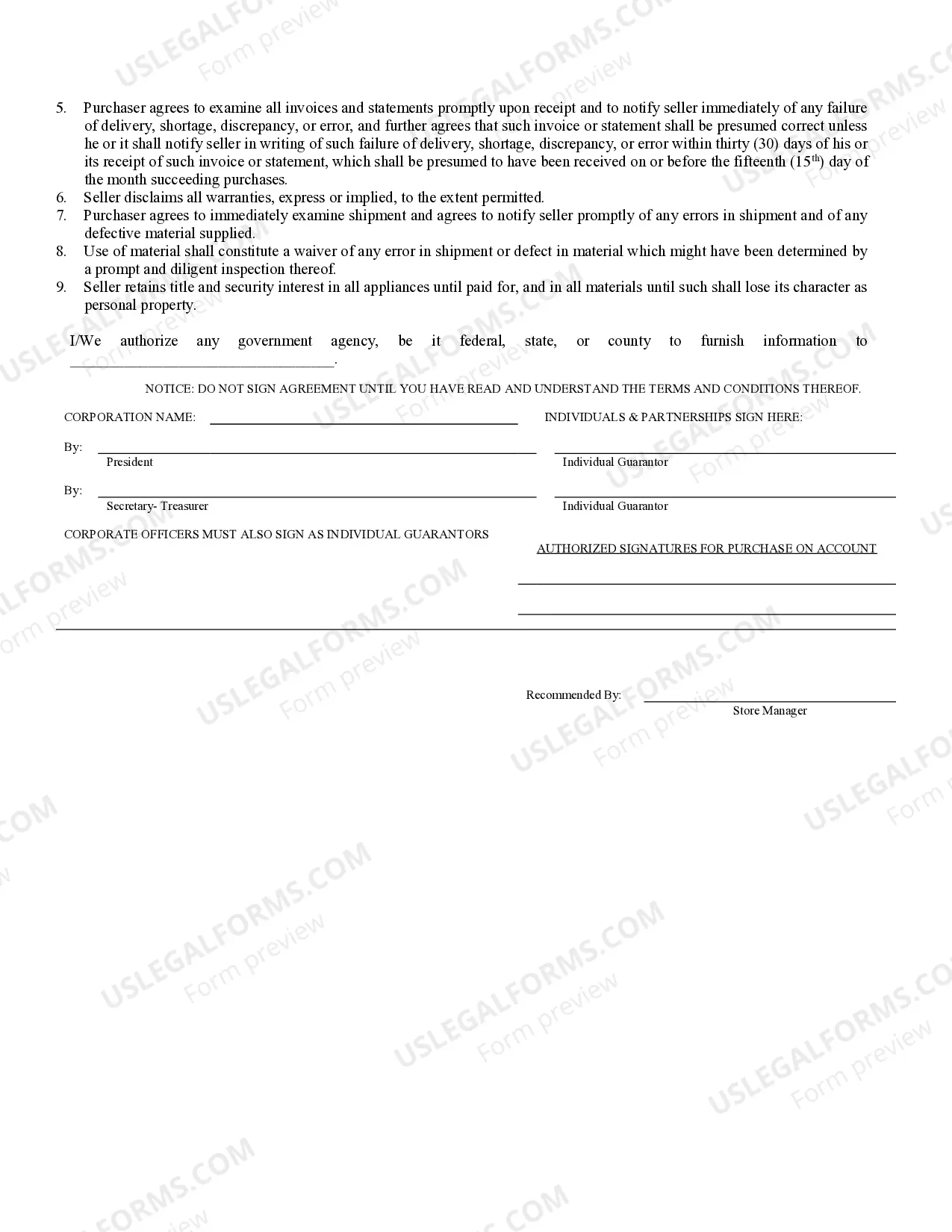

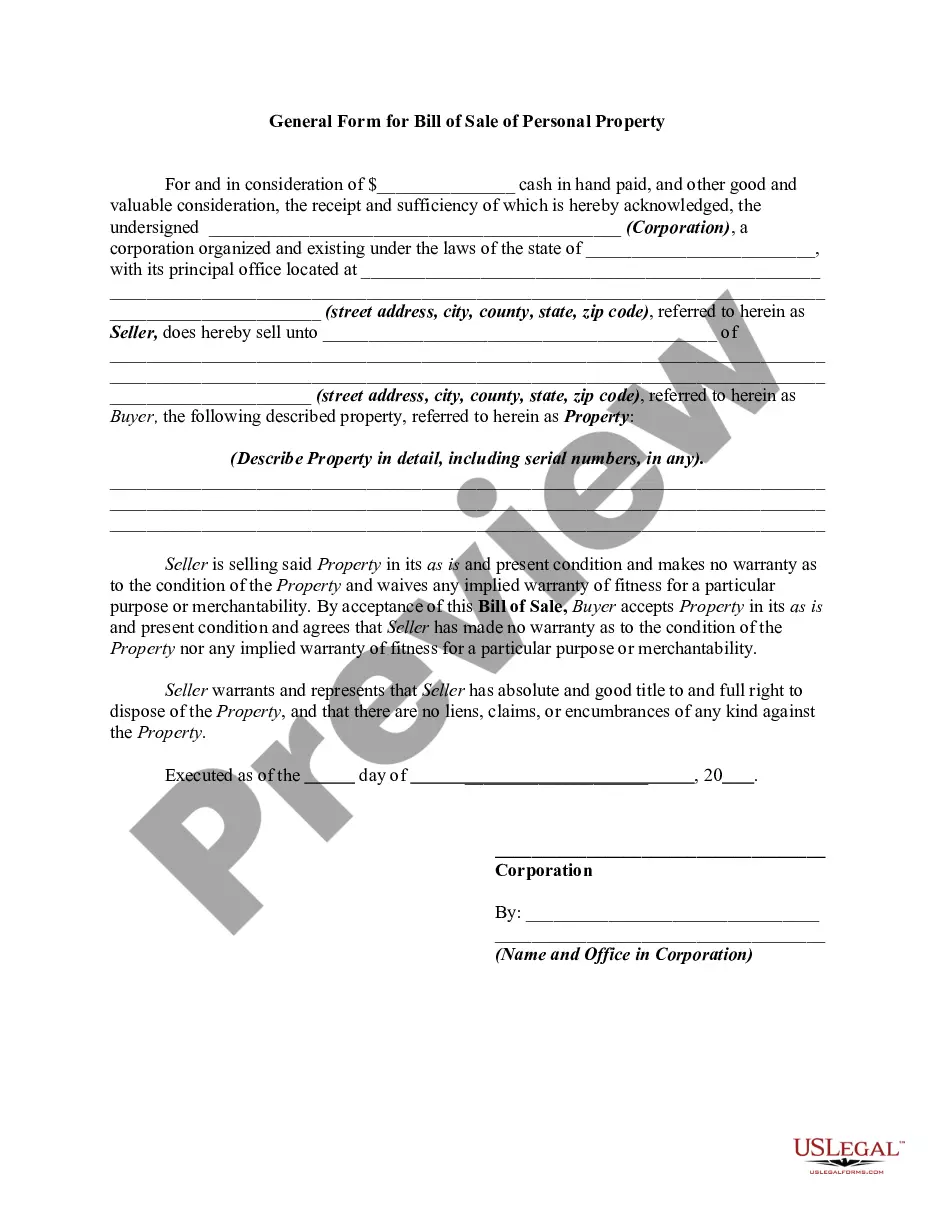

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Lee's Summit, Missouri, offers a variety of business credit applications to support local businesses in their growth and financial endeavors. These applications serve as a crucial tool for entrepreneurs and business owners to access lines of credit, loans, and other financial resources necessary for expansion, purchasing inventory, or meeting operational expenses. Here, we will provide a detailed description of what Lee's Summit Missouri Business Credit Application entails, highlighting its significance and benefits for businesses in the area. A Lee's Summit Missouri Business Credit Application is a standardized form designed by financial institutions, such as banks or credit unions, specific to the Lee's Summit business community. This application serves as a comprehensive document that businesses fill out when applying for credit or financial assistance. It gathers essential information about the business's financial status, history, and future projections, allowing lenders to assess the creditworthiness and eligibility of the applicant. The Lee's Summit Missouri Business Credit Application typically consists of several sections, including: 1. Business Information: This section collects basic details about the business, such as its legal name, address, contact information, and the industry it operates in. 2. Ownership and Management: Here, businesses outline the structure of their ownership, including names, contact information, and percentage of ownership for each involved party. Additionally, details about key individuals involved in management positions, such as CEOs or presidents, are provided. 3. Business History: This segment delves into the business's background, including its founding date, number of employees, annual revenue, and any significant milestones or accomplishments. 4. Financial Statements: Lenders require businesses to submit financial statements, including income statements, balance sheets, and cash flow statements. These documents provide an overview of the business's financial health, profitability, and liquidity. 5. Credit Requested: In this section, businesses specify the type and amount of credit they are seeking. It could be a line of credit, equipment loan, or a commercial mortgage. The intended purpose of the credit is also typically mentioned, whether for inventory purchases, expanding production, or debt consolidation. 6. Collateral: If the credit request requires collateral, businesses need to provide details regarding the assets they plan to pledge, such as real estate, inventory, or equipment. 7. Personal Guarantees: If applicable, businesses may need to disclose individuals offering personal guarantees for the credit request. This provides an additional level of assurance to the lender if the business fails to repay the credit. Upon completing and submitting the Lee's Summit Missouri Business Credit Application, the lender rigorously reviews all provided information, running credit checks and conducting thorough assessments to determine the applicant's creditworthiness. The lender's decision may depend on factors such as the business's financial stability, credit history, and repayment ability. Different types of credit applications available in Lee's Summit, Missouri, include: 1. Small Business Loans: These applications are tailored specifically for small businesses seeking financing options to fuel their growth, purchase equipment, or expand their operations. 2. Commercial Lines of Credit: Designed for businesses requiring convenient access to funds for daily operations, a line of credit application allows qualified businesses to withdraw funds as needed, up to a predetermined credit limit. 3. Equipment Financing Application: Specific to businesses seeking financing for purchasing or leasing equipment, this application enables companies to obtain the necessary machinery or technology without hefty upfront costs. Lee's Summit Missouri Business Credit Applications play a vital role in providing businesses with the financial resources they need to thrive. By accurately completing these applications, entrepreneurs can optimize their chances of securing credit facilities that assist in achieving their business goals and propelling the local economy forward.