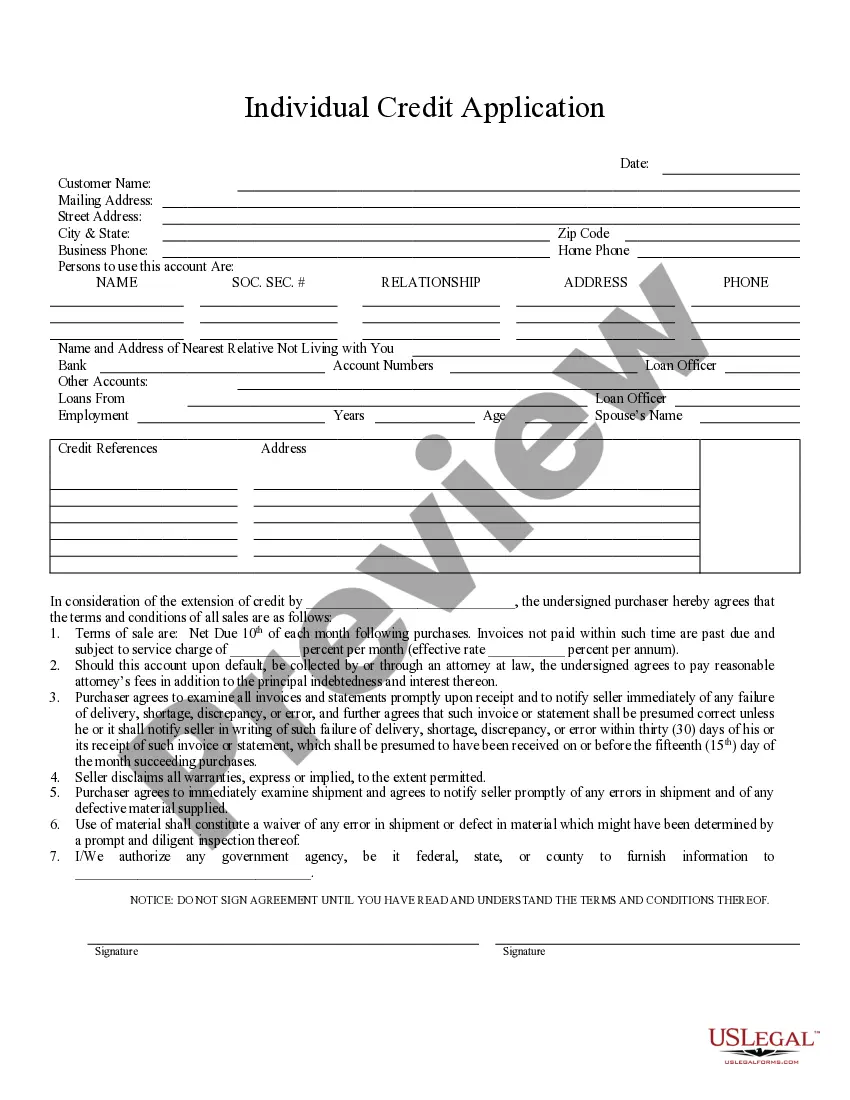

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Lee's Summit Missouri Individual Credit Application is a vital document required for individuals who are seeking credit facilities in Lee's Summit, Missouri. This comprehensive application form collects crucial personal and financial information to evaluate the creditworthiness of the applicant. The Lee's Summit Missouri Individual Credit Application gathers key details such as the applicant's full name, contact information, residential address, social security number, date of birth, and driver's license number. These details help identify the applicant and ensure accurate processing of the credit application. Additionally, this credit application form requires detailed employment information of the applicant. This includes the name and address of the current employer, job title, length of employment, and income details. This employment information helps assess the applicant's stability and ability to repay the credit if approved. Furthermore, the Lee's Summit Missouri Individual Credit Application asks for an itemized list of current debts and obligations, including credit cards, loans, mortgages, and any other financial commitments. This section provides a comprehensive overview of the applicant's existing financial obligations and helps evaluate their debt-to-income ratio. The application also includes a section for the applicant to list personal references, such as family members or close friends, who can provide additional insight into the applicant's character and reliability. These references assist in assessing the applicant's credibility and trustworthiness. It is important to note that different types of credit applications may exist within Lee's Summit, Missouri. Some of these might include: 1. Auto Loan Credit Application: Specifically tailored for individuals seeking credit for purchasing a vehicle in Lee's Summit. This application may include additional details related to the vehicle, such as make, model, year, and VIN. 2. Mortgage Credit Application: Designed for individuals applying for a home loan or mortgage in Lee's Summit. This application may gather more extensive financial information, including proof of income, assets, and details about the property being purchased. 3. Personal Loan Credit Application: Geared towards individuals looking for unsecured loans in Lee's Summit. This application may require less collateral information and focus more on the applicant's credit history and financial stability. The Lee's Summit Missouri Individual Credit Application, along with its various types, plays a crucial role in the credit evaluation process. Lenders rely on accurately completed applications to make informed decisions regarding an individual's creditworthiness.Lee's Summit Missouri Individual Credit Application is a vital document required for individuals who are seeking credit facilities in Lee's Summit, Missouri. This comprehensive application form collects crucial personal and financial information to evaluate the creditworthiness of the applicant. The Lee's Summit Missouri Individual Credit Application gathers key details such as the applicant's full name, contact information, residential address, social security number, date of birth, and driver's license number. These details help identify the applicant and ensure accurate processing of the credit application. Additionally, this credit application form requires detailed employment information of the applicant. This includes the name and address of the current employer, job title, length of employment, and income details. This employment information helps assess the applicant's stability and ability to repay the credit if approved. Furthermore, the Lee's Summit Missouri Individual Credit Application asks for an itemized list of current debts and obligations, including credit cards, loans, mortgages, and any other financial commitments. This section provides a comprehensive overview of the applicant's existing financial obligations and helps evaluate their debt-to-income ratio. The application also includes a section for the applicant to list personal references, such as family members or close friends, who can provide additional insight into the applicant's character and reliability. These references assist in assessing the applicant's credibility and trustworthiness. It is important to note that different types of credit applications may exist within Lee's Summit, Missouri. Some of these might include: 1. Auto Loan Credit Application: Specifically tailored for individuals seeking credit for purchasing a vehicle in Lee's Summit. This application may include additional details related to the vehicle, such as make, model, year, and VIN. 2. Mortgage Credit Application: Designed for individuals applying for a home loan or mortgage in Lee's Summit. This application may gather more extensive financial information, including proof of income, assets, and details about the property being purchased. 3. Personal Loan Credit Application: Geared towards individuals looking for unsecured loans in Lee's Summit. This application may require less collateral information and focus more on the applicant's credit history and financial stability. The Lee's Summit Missouri Individual Credit Application, along with its various types, plays a crucial role in the credit evaluation process. Lenders rely on accurately completed applications to make informed decisions regarding an individual's creditworthiness.